In Vehicle Payment Services Market Report Scope & Overview:

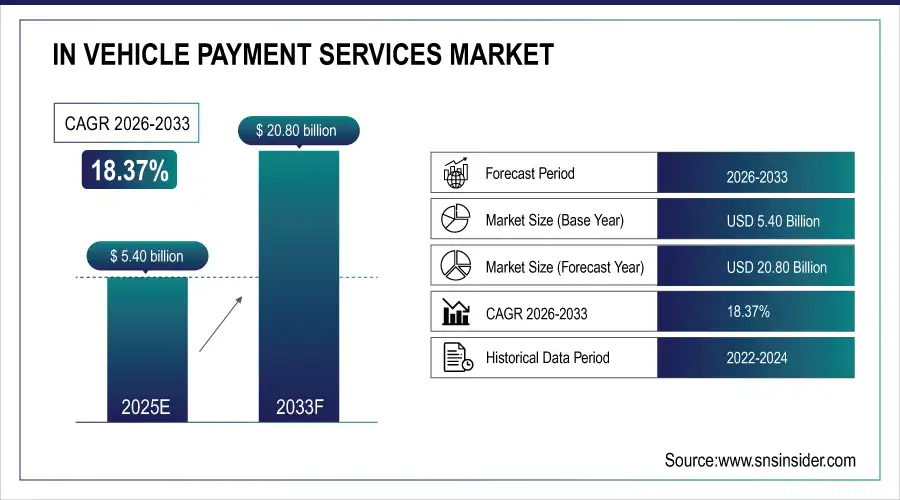

The In Vehicle Payment Services Market size was valued at USD 5.40 Billion in 2025E and is projected to reach USD 20.80 Billion by 2033, growing at a CAGR of 18.37% during 2026–2033.

The In-Vehicle Payment Services market is rapidly evolving, driven by increasing adoption of connected cars, digital payment solutions, and the growing preference for contactless transactions. Key offerings include solutions, services, professional, and managed models, catering to light and heavy-duty vehicles across applications such as shopping, fuel, parking, and toll payments. North America leads the market in revenue, while Asia-Pacific emerges as the fastest-growing region, fueled by rising automotive digitization. Dominant payment modes include credit/debit cards, with app/e-wallets and NFC witnessing the fastest growth. Innovations from automakers and tech companies continue to enhance convenience, security, and user experience in digital in-car transactions.

Aug 20, 2025 – Honda launches Honda Finance India Private Ltd. to offer retail financing services, including loans and leases, strengthening its presence in India’s growing automotive and motorcycle markets.

In Vehicle Payment Services Market Size and Forecast:

Market Size in 2025: USD 5.40 Billion

Market Size by 2033: USD 20.80 Billion

CAGR: 18.37% from 2026 to 2033

Base Year: 2025E

Forecast Period: 2026–2033

Historical Data: 2022–2024

To Get more information On In Vehicle Payment Services Market - Request Free Sample Report

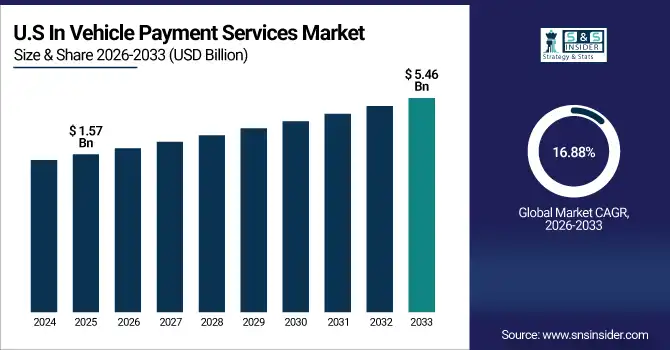

The U.S. In Vehicle Payment Services Market size was valued at USD 1.57Billion in 2025E and is projected to reach USD 5.46Billion by 2033, growing at a CAGR of 16.88% during 2026–2033. This growth is driven by increasing consumer demand for seamless and convenient payment solutions within vehicles, rapid adoption of connected car technologies, expansion of digital and contactless payment infrastructure, and growing integration of smart mobility services. Automakers and fintech providers are leveraging these trends to offer real-time, secure, and user-friendly in-car payment experiences, enhancing driver convenience and creating new revenue streams in the evolving automotive ecosystem.

In Vehicle Payment Services Market Highlights:

-

Rising adoption of in-vehicle payments with connected car technologies and EV integration driving demand for seamless, cashless transactions

-

Enhanced user experience through mobile wallets, NFC, QR codes, and secure financial platforms improving reliability and convenience

-

Automaker and fintech partnerships accelerating innovation and deployment of in-vehicle payment solutions globally

-

High costs and security concerns including implementation expenses, privacy risks, and platform fragmentation limiting adoption

-

Regulatory challenges due to inconsistent frameworks across regions creating barriers to widespread integration

-

Expansion opportunities from increasing global preference for contactless and real-time payments driving growth in automotive payment platforms

In Vehicle Payment Services Market Drivers:

-

Rising Adoption of Seamless In-Vehicle Payment Services Drives Market Growth

The In Vehicle Payment Services market is being propelled by the rapid integration of connected car technologies and smart vehicle solutions. Consumers increasingly demand seamless, cashless transactions for parking, fuel, tolls, and other services directly from their vehicles. Rising adoption of electric vehicles (EVs) further supports in-car payment solutions, as drivers seek convenient access to charging networks. Additionally, advancements in mobile wallets, NFC, QR code payments, and secure financial platforms enhance user experience, making in-vehicle payments more reliable. Automotive manufacturers and fintech partnerships continue to innovate, driving widespread deployment and adoption globally.

April 9, 2025 – German regulator ends probe into Google’s in-car services after company agrees to modify automotive services and maps platform, ensuring compliance across Europe.

In Vehicle Payment Services Market Restraints:

-

High Costs and Security Concerns Hamper Adoption of In-Vehicle Payment Services

The In-Vehicle Payment Services market faces several challenges that could hinder its growth. High implementation costs and the need for advanced in-car technology limit adoption, especially among smaller automakers. Security and privacy concerns, including risks of data breaches and unauthorized transactions, create user hesitation. Fragmentation across payment platforms and inconsistent regulatory frameworks across regions further complicate deployment. Additionally, consumer unfamiliarity with in-car payment systems and the slow adoption of digital wallets in certain regions reduce market penetration. These factors collectively affect the seamless integration of in-vehicle payment solutions, slowing overall market growth.

In Vehicle Payment Services Market Opportunities:

-

Expanding Digital Payments Create Growth Opportunities in In-Vehicle Payment Services

The increasing adoption of digital and contactless payments worldwide presents significant opportunities for the In-Vehicle Payment Services market. Automakers and service providers can integrate seamless payment solutions into vehicles, enabling drivers to pay for parking, fuel, tolls, and other services directly from the car. Growing consumer preference for convenient, real-time transactions encourages innovation in connected vehicle platforms. This trend allows companies to enhance user experience, drive customer loyalty, and expand monetization avenues within the automotive ecosystem, positioning in-vehicle payments as a key driver of future mobility and smart transportation solutions.

In September 2025 – UnionPay International expands its payment network to cover over 90% of Europe, enabling seamless transactions for residents and travelers across major merchants and transport services.

In Vehicle Payment Services Market Segment Highlights:

-

By Mode of Payment: Dominant – Credit/Debit Card (38.75% in 2025E → 31.25% in 2033); Fastest-Growing – App/E-wallet & NFC (CAGR 20.39%)

-

By Offering: Dominant – Solution (34.25% in 2025E → 29.75% in 2033); Fastest-Growing – Service (CAGR 19.62%)

-

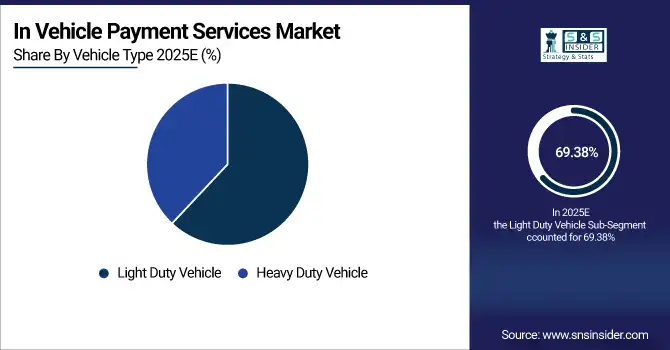

By Vehicle Type: Dominant – Light Duty Vehicle (69.38% in 2025E → 65.63% in 2033); Fastest-Growing – Heavy Duty Vehicle (CAGR 20.08%)

-

By Application: Dominant – Shopping (29.75% in 2025E → 28.25% in 2033); Fastest-Growing – Gas/Charging Stations (CAGR 22.83%)

In Vehicle Payment Services Market Segment Analysis:

By Mode of Payment: Dominance of Credit/Debit Cards and Rapid Rise of App/E-wallets & NFC

The Credit/Debit Card segment is dominant, holding the largest share, while App/E-wallets and NFC are the fastest-growing segments, driven by increasing demand for convenient, contactless, and integrated in-car payment solutions across vehicles and regions.

By Offering: Dominance of Solution and Rapid Rise of Service

The Solution segment dominates, accounting for the largest share of offerings, while the Service segment is the fastest-growing, driven by increasing demand for comprehensive, integrated, and customer-focused in-car payment and mobility solutions.

By Vehicle Type: Dominance of Light Duty Vehicles and Rapid Rise of Heavy Duty Vehicles

The Light Duty Vehicle segment dominates the In-Vehicle Payment Services market with the largest share, while Heavy Duty Vehicles are the fastest-growing segment, driven by rising adoption of digital payment solutions in commercial fleets and logistics operations.

By Application: Dominance of Shopping and Rapid Rise of Gas/Charging Stations

Shopping leads the market as the dominant segment, whereas Gas/Charging Stations are the fastest-growing, fueled by increasing demand for seamless, in-car payment solutions at fuel and EV charging points.

In Vehicle Payment Services Market Regional Highlights:

-

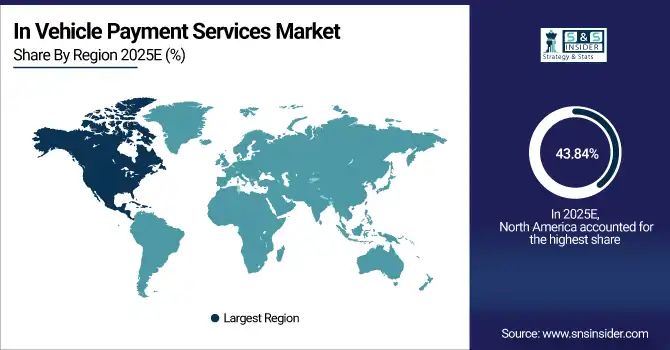

By Region – Dominating: North America (43.84% in 2025E → 42.52% in 2033, CAGR 17.92%)

-

Fastest-Growing Region: Asia-Pacific (26.76% in 2025E → 28.63% in 2033, CAGR 19.37%)

-

Europe: 19.33% → 19.72% (CAGR 18.67%)

-

South America: 5.71% → 5.30% (CAGR 17.26%, slowing growth)

-

Middle East & Africa: 4.35% → 3.82% (CAGR 16.43%)

In Vehicle Payment Services Market Regional Analysis:

North America In Vehicle Payment Services Market Insights:

North America leads the In Vehicle Payment Services market, holding the largest share due to advanced automotive infrastructure, high adoption of connected vehicles, and strong digital payment penetration. The region benefits from supportive regulations, growing EV adoption, and consumer demand for seamless in-car transactions, driving continuous innovation and market expansion through 2033.

Get Customized Report as per Your Business Requirement - Enquiry Now

-

U.S. In Vehicle Payment Services Market Insights:

The United States is the dominating country. This is due to its large automotive market, advanced digital payment adoption, widespread connected and electric vehicle integration, and supportive infrastructure for in-car payment services.

Asia-Pacific In Vehicle Payment Services Market Insights:

Asia-Pacific is the fastest-growing region in the In Vehicle Payment Services market, driven by rapid adoption of connected and electric vehicles, expanding digital payment infrastructure, and rising consumer demand for convenient in-car transactions. Key markets like China, Japan, and South Korea are leading growth, supported by government incentives, technological advancements, and increasing investment from automotive and fintech companies across the region.

-

China In Vehicle Payment Services Market Insights:

China is the dominating country. Its leadership is driven by the largest automotive market in the region, rapid EV adoption, advanced digital payment systems, and strong government support for smart mobility and connected vehicle technologies.

Europe In Vehicle Payment Services Market Insights:

The Europe In Vehicle Payment Services market is witnessing steady growth, supported by increasing adoption of connected and electric vehicles, advanced digital payment infrastructure, and government initiatives promoting smart mobility. Key markets such as Germany, the UK, and France are driving demand, while automotive manufacturers continue to integrate seamless in-car payment solutions to enhance customer convenience and experience.

-

Germany In Vehicle Payment Services Market Insights:

Germany is the dominating country. This is due to its strong automotive industry, high adoption of connected and electric vehicles, advanced digital payment infrastructure, and leadership of major OEMs integrating in-car payment solutions.

Latin America In Vehicle Payment Services Market Insights:

The Latin America In-Vehicle Payment Services market is steadily expanding, driven by increasing adoption of connected vehicles, digital payment solutions, and government initiatives supporting smart mobility. Brazil and Mexico lead the region, with growing urbanization and rising consumer demand for convenient in-car transactions encouraging automotive manufacturers to integrate seamless payment technologies.

-

Brazil In Vehicle Payment Services Market Insights:

Brazil is the dominating country in the In-Vehicle Payment Services market, owing to its large automotive sector, growing adoption of connected vehicles, and increasing demand for convenient digital in-car payment solutions.

Middle East & Africa In Vehicle Payment Services Market Insights:

The Middle East and Africa In-Vehicle Payment Services market is experiencing moderate growth, supported by gradual adoption of connected and electric vehicles, expanding digital payment infrastructure, and government initiatives promoting smart mobility. Key markets like the UAE and South Africa are driving demand for seamless in-car payment solutions.

-

United Arab Emirates (UAE) In Vehicle Payment Services Market Insights:

The United Arab Emirates (UAE) is the dominating country in the In Vehicle Payment Services market, driven by advanced automotive infrastructure, high adoption of connected vehicles, and strong digital payment integration.

In Vehicle Payment Services Market Competitive Landscape:

BMW AG – Established in 1916, BMW AG is a German luxury automobile and motorcycle manufacturer renowned for innovation, performance, and premium vehicles. The company offers advanced mobility solutions, including in-vehicle technologies and digital services, aiming to enhance driving experiences globally while maintaining leadership in sustainable mobility and connected vehicle ecosystems.

-

In September 2024, BMW launches In-Car Payment in Germany, enabling drivers to pay for fuel and parking digitally from their vehicles; rollout to other countries planned.

Daimler AG – Established in 1926, Daimler AG is a German multinational automotive corporation specializing in premium cars, commercial vehicles, and financial services. Through subsidiaries like Daimler Truck Financial Services, the company provides innovative mobility solutions, including e-mobility financing, leasing, and digital services, supporting sustainable transport and fleet electrification worldwide.

-

In August 2025, Daimler Truck Financial Services launches eService Leasing in Germany, offering bundled leasing, service contracts, and optional services to simplify electric truck adoption for fleet operators.

Ford Motor Company – Established in 1903, Ford Motor Company is a global automotive leader headquartered in Dearborn, Michigan. The company designs, manufactures, and sells cars, trucks, SUVs, and electric vehicles, while offering connected services and financial solutions. Ford emphasizes innovation, sustainability, and customer-centric mobility through its Ford+, Model e, and Pro divisions.

-

In September 2025, Ford partners with Octopus Electroverse to offer seamless public EV charging across Europe, providing one app and card for over one million chargers with in-car support and integrated billing options.

In Vehicle Payment Services Market Key Players:

-

BMW AG

-

Daimler AG

-

Ford Motor Co.

-

General Motors Co.

-

Honda Motor Co. Ltd.

-

Hyundai Motor Co.

-

Jaguar Land Rover Automotive PLC

-

Volkswagen AG

-

ZF Friedrichshafen AG

-

Qualcomm

-

Amazon

-

Visa

-

MasterCard

-

PayPal

-

Tesla Inc.

-

Google

-

Intel Corporation

-

Apple Inc.

-

Continental AG

-

IBM Corporation

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 5.40 Billion |

| Market Size by 2033 | USD 20.80 Billion |

| CAGR | CAGR of 18.37% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Mode of Payment(App/e-wallet, Credit/Debit card, NFC, QR Code/RFID) • By Offering(Solution, Service, Professional, Managed) • By Vehicle Type(Light Duty Vehicle AND Heavy Duty Vehicle) • By Application(Shopping, Food/Coffee, Parking, Gas/charging stations, Toll Collection and Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | BMW AG, Daimler AG, Ford Motor Co., General Motors Co., Honda Motor Co. Ltd., Hyundai Motor Co., Jaguar Land Rover Automotive PLC, Volkswagen AG, ZF Friedrichshafen AG, Qualcomm, Amazon, Visa, MasterCard, PayPal, Tesla Inc., Google, Intel Corporation, Apple Inc., Continental AG, IBM Corporation |