Industrial Access Control Market Report Scope & Overview:

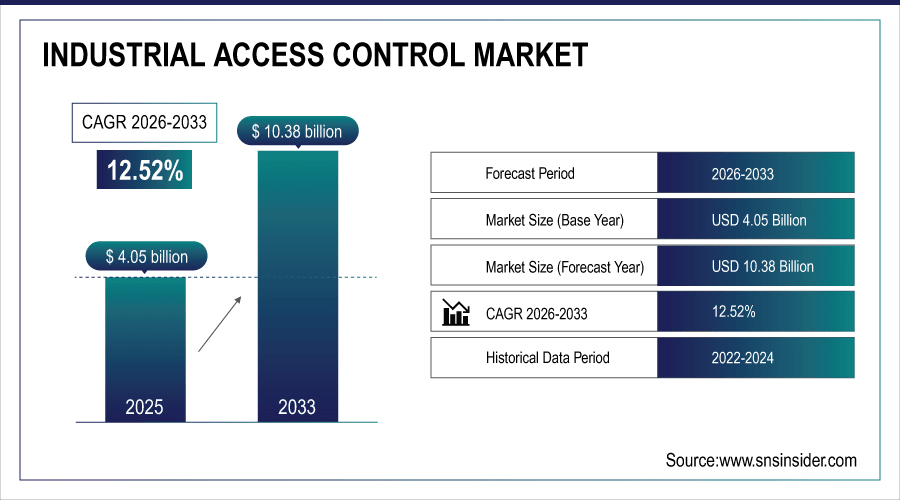

The Industrial Access Control Market size was valued at USD 4.05 Billion in 2025E and is projected to reach USD 10.38 Billion by 2033, growing at a CAGR of 12.52% during 2026-2033.

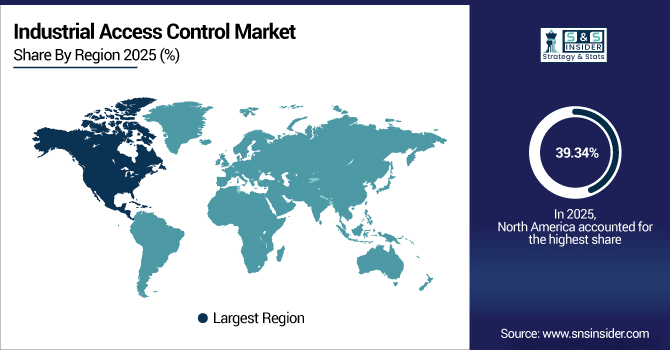

The Industrial Access Control Market analysis highlights the increasing industrial automation and smart infrastructural development. Hardware dominates the market because of its reliability and simplicity in field integration. Production facilities are the strongest end user segment and electronic and logical access control systems show the best growth. North America dominates the market, due to the strict safety and regulatory requirements. Increasing demand for cloud based services and adherence to the ISO, UL, EN standards market growth.

In new industrial facility builds, over 90% include integrated hardware-based access control at entry points, server rooms, and machinery zones as part of base security specifications

To Get More Information On Industrial Access Control Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2025: USD 4.05 Billion

-

Market Size by 2033: USD 10.38 Billion

-

CAGR: 12.52% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Industrial Access Control Market Trends

-

Global adoption of electronic and logical access control systems is motivated by industrial digitalization, IoT-connected devices, intelligent building automation and management solutions.

-

Businesses want cloud-based access control solutions to decentralize IT; lower infrastructure spend and support remote site security that is scalable across multiple locations.

-

Access control Access-control solutions are being more tightly integrated with IoT devices and enterprise resource planning (ERP) systems to enable centralized monitoring, analysis and better operational efficiency.

-

The use of ISO, UL and EN certified access control systems is growing as a result of strict safety code demands for workplaces.

-

Quickest industrialization emerging in Asia-Pacific, Latin America and the Middle East regions is generating demand for advanced access control systems; thereby boosting its utilization from operations such as manufacturing, oil & gas and utility.

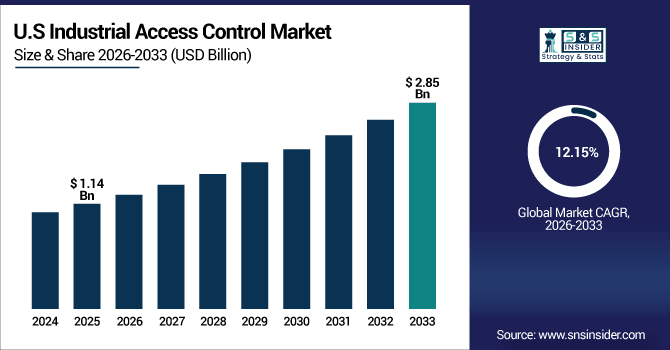

The U.S. Industrial Access Control Market size was valued at USD 1.14 Billion in 2025E and is projected to reach USD 2.85 Billion by 2033, growing at a CAGR of 12.15% during 2026-2033. Industrial Access Control Market growth is driven by growing need for ensuring safety and security at manufacturing plants, encouraging the implementation of access control systems in industries. The high acceptance for access control systems is being driven by strict safety and regulatory standards in North America such as UL and NEC. The primary end-users are factories, data centers and oil &gas plants. Digital transformation trends are favouring electronic and logical access control solution.

Industrial Access Control Market Growth Drivers:

-

Rising Industrial Automation and Smart Infrastructure Deployment Boosts Market Growth.

Rising adoption of industrial automation and smart infrastructure among manufacturing plants, oil & gas facilities, data centers is the major factor propelling the growth of Industrial Access Control market. Companies are combining electrical and logic controls with IoT/ERP platforms to secure, remotely monitor operations and increase production. Escalating levels of regulatory compliance and the requirement for secure access management continue to drive market demand worldwide.

Over 55% of large industrial facilities (500+ employees) globally have integrated access control systems with IoT sensor networks or ERP/MES platforms as of Q1 2024, enabling real-time personnel tracking and automated incident response

Industrial Access Control Market Restraints:

-

High Implementation Costs and Complexity Limit Widespread Adoption

There is a significant barrier to the deployment of industrial access control systems, such as hardware devices, software and system integration services are expensive. Adoption is limited, in particular by complex installations, training needs and the continuing cost of maintaining it particularly for small and medium-sized firms. Technical legacy compatibility issues and resistance to technology adoption also impede faster deployment. Together, these factors serve as constraints to the growth of the market despite growing security requirements and digital transformation initiatives.

Industrial Access Control Market Opportunities:

-

Expansion in Emerging Markets with Rapid Industrialization and Digitalization

Industrial Access Control Market is expected to gain traction in emerging APAC, Latin America, and the Middle East regions which have lucrative environments for the growth of market. Expeditious industrialization, infrastructure growth, and growing smart factory adoption are the major factors fueling access control demand. There is an opportunity for the companies to leverage the growing consciousness on work place safety and international standardized compliance. Growth opportunities are in cloud-based offers and cost sensitive access systems, which create driving end-user demand from the untapped sector as well as a higher increase in turnover.

Over 60% of industrial employers in Thailand, Malaysia, and the Philippines updated access control systems in 2023–2024 to meet new national occupational safety regulations aligned with ISO 45001

Industrial Access Control Market Segment Analysis

-

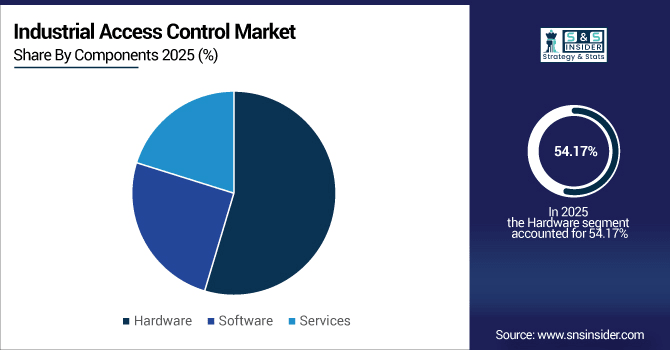

By Components: In 2025, hardware led the Industrial Access Control Market with a 54.17% share, while services emerged as the fastest-growing segment with a CAGR of 9.5%.

-

By Application: Manufacturing plants dominated the market in 2025 with a 36.20% share, whereas data centers are projected to grow fastest, registering a CAGR of 10.38%.

-

By Type: Physical access control accounted for the largest share of 45.32% in 2025, while electronic access control is expected to record the highest growth at a CAGR of 9.40%.

-

By End-User: The industrial segment led with a 42.65% market share in 2025, while the commercial segment is forecasted to expand fastest with a CAGR of 10.21%.

By Components, Hardware Leads Market While Services Registers Fastest Growth

Hardware continues leading the Industrial Access Control Market with the huge demand of card readers, biometric devices and control panels. Industries On Hardware continues to be the cornerstone for securing physical entry points in industries. Yet services are forecast to deliver the most growth, driven by increasing use of cloud integration, managed access and support services. The transition to security subscriptions also helps drive impressive growth in services.

By Application, Manufacturing Plants Dominate While Data Centers Shows Rapid Growth

Manufacturing Plants to dominate the Industrial Access Control Market in 2025, as production sites demand high security measures across supply chains and workforce safety. The rising automation and stringent government norms drive the demand of access control systems in manufacturing plants. Data centers are a rapidly growing end-user segment, driven by an increase in cyber‐ physical security threats, expansion of cloud infrastructure and stringent data protection laws leading to smart electronic and logical access control system applications.

By Type, Physical Access Control Lead While Electronic Access Control Registers Fastest Growth

The physical access control segment dominated the market in 2025, as certain industries nowadays are more tech dependent for protection of entry and gates to other restricted areas. Access systems connected via hardware options, like card readers, keypads and biometric scanners, are still in use throughout the world. Yet electronic access control is the fastest growing segment, driven by digital transformation, IoT connectivity and the move to cloud-based solutions. The growing demand for real-time monitoring and integrated control systems is driving the need for electronic solutions in various industrial sectors.

By End-User, Industrial Lead While Commercial Grow Fastest

The Industrial segment is leading contributor for the Industrial Access Control Market in 2025 and is also projected to have a major share owing to its high penetration in manufacturing, utilities and oil & gas plants. Park says that enforcement of regulations and need for safety, along with the growth of automation, are spurring continued growth. The commercial end user will be the fastest growing market, led by rising requirement to protect offices, retail outlets and corporate offices. The growing penetration of electronic access control systems is encouraging the rapid growth of this segment.

Industrial Access Control Market Regional Analysis:

North America Industrial Access Control Market Insights

In 2025E North America dominated the Industrial Access Control Market and accounted for 39.34% of revenue share, this leadership is due to the excellent industrial infrastructure and stringent government regulations for security. Focus on cybersecurity and merging physical security with information security in the region is an adoption driver for electronic and logical access systems market. Major application segments consist of manufacturing facilities, oil and gas business and data centers.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Industrial Access Control Market Insights

The U.S. continues to be the single largest market for the North American Industrial Access Control Market. Tight safety and regulation policies, especially in oil & gas, utilities and defense industries drives the adoption.

Asia-pacific Industrial Access Control Market Insights

Asia-pacific is expected to witness the fastest growth in the Industrial Access Control Market over 2026-2033, with a projected CAGR of 13.11% due to rapid industrialization, automation and infrastructure development in manufacturing and utilities are driving the growth of Asia-Pacific Industrial Access Control Market. Rising demand Growing use of bio-metric and electronic access systems are behind strong demand. In addition, government programs in support of industrial safety standards are also driving adoption.

China Industrial Access Control Market Insights

China owing to the large scale industrial production and fast urbanization. The nation is heavily focused on smart manufacturing and Industry 4.0, which influences the use of electronic access-control systems.

Europe Industrial Access Control Market Insights

Europe continues to grow at a stable rate in the Industrial Access Control Market, due to strong regulations on workplace safety as well as industrial automation trends. Integrated access solutions that provide physical, electronic and logical control are a key focus of the area. Adoption is already strong in manufacturing, utilities and critical infrastructure.

Germany Industrial Access Control Market Insights

Germany is the European leader in Industrial Access Control Market due to its industrial sector being quite advanced and having high focus on automation. Setting the Trend Manufacturers and Car manufacturers are leaders in security access systems.

Latin America (LATAM) and Middle East & Africa (MEA) Industrial Access Control Market Insights

The Industrial Access Control Market is experiencing moderate growth in the Latin America (LATAM) and Middle East & Africa (MEA) regions, due to the increasing pace of growth for industrial sector and increased attention on security at work places. Heavy usage is seen in the oil & gas, utilities and construction sectors. Safety regulations are getting more strict, which is forcing governments to implement it. Cost parity is still a challenge but cost-effective solutions are driving adoption in developing countries.

Industrial Access Control Market Competitive Landscape:

Honeywell International Inc., being one of the major players in the industrial access control market, provides sophisticated electronic and logical access systems. A leading company that brings IoT and AI technologies together to monitor, analyze in real-time, and predict for security solutions. Honeywell’s market leadership is strengthened by deep knowledge and expertise in manufacturing, oil & gas, utilities, Continuous innovation and global partnerships.

-

In June 2025, Honeywell launched the 50 Series CCTV camera portfolio, its first-ever line designed and produced in India, offering improved cybersecurity, analytics, and integration.

Johnson Controls International plc is the lead, and offers full-fledged industrial security with physical and electronic access control. The company uses smart building and automation technologies to unite access control with energy management and safety. The large product range and vast worldwide presence allow customized solutions for plants, data centers as well as critical infrastructures to meet all safety requirement.

-

In March 2025, Johnson Controls introduced the IQ Panel 5 at ISC West 2025, featuring a new Qualcomm-Dragon Wing processor, modular design, and enhanced wireless connectivity via PowerG +.

ASSA ABLOY AB is a worldwide leader in access control solutions, offering various cutting-edge physical and electronic access systems for industrial applications. Smart locks, biometric technology and cloud-based applications: Digi Lan provides ideal access to smarter services at work. Providing access solutions for a wide variety of applications, from versatile hardware to critical software, ASSA ABLOY is revolutionizing industrial access management and security through continual investment in R&D.

-

In January 2025, ASSA ABLOY absorbed U.S. firm 3millID Corporation and UK firm Third Millennium Systems Ltd. into its HID business unit to enhance its physical access control capabilities.

Bosch Security Systems is actively involved in with innovative electronic access control products. It provides biometric systems, card readers and integrated video surveillance as part of a complete security solution. Bosch focuses on intelligent, scalable and networked access-control systems for industrial & critical infrastructure applications. The innovation-based strategy and strong image in safety technologies make it more competitive globally.

-

In July 2025, the acquisition of Bosch’s security & communications product business by private equity firm Triton was finalized. The business will now operate under the new name KEENFINITY Group

Industrial Access Control Market Key Players:

Some of the Industrial Access Control Market Companies are:

-

Honeywell International Inc.

-

Johnson Controls International plc

-

ASSA ABLOY AB

-

Bosch Security Systems

-

Siemens AG

-

Schneider Electric SE

-

dormakaba Holding AG

-

HID Global Corporation

-

NEC Corporation

-

Allegion plc

-

Tyco International

-

Stanley Black & Decker

-

Gunnebo Group

-

Axis Communications AB

-

Vanderbilt Industries

-

Identiv, Inc.

-

Salto Systems

-

Kaba Group

-

LenelS2

-

Gallagher Group

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 4.05 Billion |

| Market Size by 2033 | USD 10.38 Billion |

| CAGR | CAGR of 12.52% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Hardware, Software, Services) • By Application (Manufacturing Plants, Data Centers, Oil & Gas, Utilities, Others) • By Type (Physical Access Control, Electronic Access Control, Logical Access Control) • By End-User (Industrial, Commercial, Government) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Honeywell International Inc., Johnson Controls International plc, ASSA ABLOY AB, Bosch Security Systems, Siemens AG, Schneider Electric SE, dormakaba Holding AG, HID Global Corporation, NEC Corporation, Allegion plc, Tyco International, Stanley Black & Decker, Gunnebo Group, Axis Communications AB, Vanderbilt Industries, Identiv, Inc., Salto Systems, Kaba Group, LenelS2, Gallagher Group |