Rugged Servers Market Report Scope and Overview:

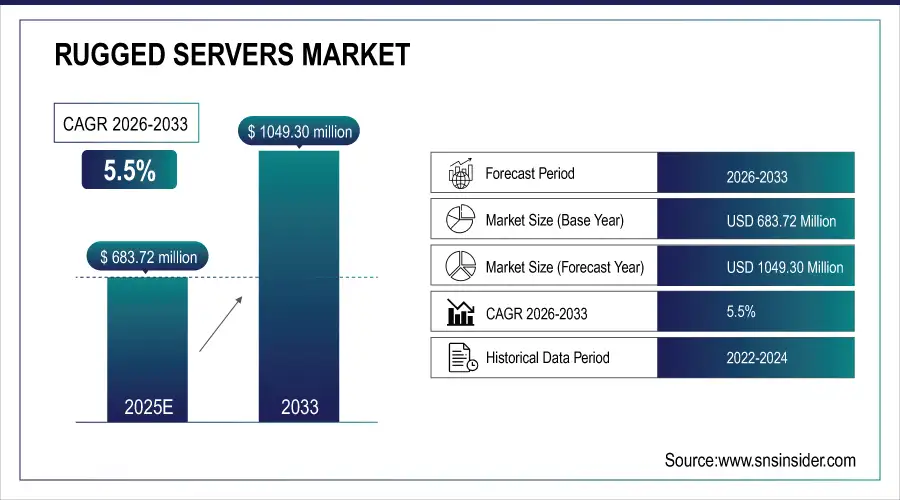

The Rugged Servers Market Size was valued at USD 683.72 million in 2025E and is expected to reach USD 1049.30 Million by 2033 and grow at a CAGR of 5.5% over the forecast period 2026-2033.

The Rugged Servers market has experienced notable expansion due to the increasing demand for durable computing solutions that can function in harsh environments. Rugged Servers are essential in industries like military, industrial automation, and transportation, where regular servers may not withstand vibrations, humidity, dust, and heat. Their ability to withstand challenges is confirmed through strict testing criteria, which includes Ingress Protection (IP), ATEX, IECEx, and military specifications. These servers are necessary for real-time data processing applications in Machine Learning (ML), Artificial Intelligence (AI), and unmanned systems, frequently utilizing specialized wide-temperature Solid State Disks (SSDs) to improve data security.

The growing use of IoT devices and automation in sectors such as manufacturing, oil & gas, and transportation is also driving the need for durable servers. The significance of Cubic Corporation's M3X and M3-SE Rugged Servers in critical infrastructure is highlighted by government regulations like Do DIN APL certification for product safety and quality. The pandemic exposed weaknesses in supply chains, but the market's rebound and expected increase show a positive direction, with a prediction of faster growth in the future as industries adopt advanced rugged computing solutions.

Rugged Servers Market Size and Forecast:

-

Market Size in 2025E: USD 683.72 Million

-

Market Size by 2033: USD 1,049.30 Million

-

CAGR: 5.5% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Get more information on Rugged Servers Market - Request Sample Report

Rugged Servers Market Highlights

-

The Rugged Servers market is expanding rapidly due to rising demand for durable computing solutions in military, aerospace, industrial automation, oil & gas, and transportation sectors.

-

These servers are designed to withstand vibrations, extreme temperatures, dust, humidity, and pressure, with compliance to certifications such as Ingress Protection (IP), ATEX, IECEx, and MIL-STD standards.

-

Increasing adoption of AI, Machine Learning (ML), IoT, and unmanned systems drives demand for rugged servers, especially for real-time data processing.

-

Cubic Corporation’s M3X and M3-SE Rugged Servers gained Do DIN APL certification in 2022, marking their approval for U.S. Department of Defense operations.

-

Rising global military spending (USD 773 billion in U.S. DoD 2023 budget) is fueling higher adoption of rugged servers with advanced features like Intel Xeon processors, SSD storage, and modular scalability.

-

Privacy and cybersecurity risks remain key restraints, especially in remote deployments (oil rigs, military bases, industrial facilities), where compliance with frameworks like CMMC (U.S. DoD) and GDPR (EU) is mandatory.

-

Growing emphasis on safety, compliance, and data security makes rugged servers indispensable for industries requiring reliable performance in harsh environments.

Rugged Servers Market Drivers

- Increased safety and adherence to regulations are fueling the growth of the rugged server market.

Strict regulations in sectors such as military, aerospace, marine, and power drive the high demand for durable servers. These industries must adhere to strict requirements for the excellence and safety of their products, requiring strong computing solutions that can operate dependably in challenging environments. Rugged Servers are specially built to withstand tough conditions like extreme temperatures, heavy vibrations, and high pressures, making them essential in industries where regular servers would struggle. In industries like food and beverages and pharmaceuticals, specific manufacturing processes happen under harsh conditions that regular servers cannot handle. Deploying Rugged Servers ensures smooth operations in compliance with regulations, improving safety and efficiency. The need for durable servers is also highlighted by their capacity to manage expenses and quality effectively while adhering to strict regulatory requirements. Industries are increasingly focusing on safety and compliance, leading to a projected increase in the use of Rugged Servers, which aligns with a larger trend of investing in durable, high-performance computing options that can function effectively in harsh environments. The increasing focus on compliance with regulations and the importance of strong, reliable computing environments are main factors driving market expansion for Rugged Servers.

- Rugged Servers Market Growth Driven by Advanced Military Certifications

The Rugged Servers Market is experiencing considerable expansion due to rising need for powerful computing solutions that can function in harsh conditions, especially in military and defense fields. One main reason driving this expansion is the strict certification procedures that robust servers must go through to satisfy the demanding criteria needed for military purposes. In June 2022, Cubic Corporation's M3X and M3-SE Rugged Servers were granted Do DIN APL certification, indicating they are secure, trusted, and authorized for use in the U.S. Department of Defense's technology system. This certification emphasizes the crucial importance of durable servers in military activities, where reliability and security are of utmost significance. The M3-SE servers, equipped with Intel Xeon processors, provide 10-gigabit networking and SSD storage, making them perfect for compact command post locations needing advanced computing capabilities. Moreover, the M3X-APP server module, equipped with a 16-core processor from Intel Xeon and 128GB of DDR4 RAM, is specifically crafted for handling intensive virtual workloads, guaranteeing smooth functioning even in challenging settings. These servers meet MIL-STD-810G and MIL-STD-461 standards, demonstrating the durability necessary for military purposes, offering unmatched performance at the frontline. The M3-SE and M3X servers feature a modular design that enables simple upgrades and seamless integration with current systems, providing adaptability and scalability to meet changing mission requirements.

Rugged Servers Market Restraints

- Privacy and Security Issues for Robust Servers in Distant Areas

Rugged Servers, commonly used in challenging conditions like military bases, oil rigs, and industrial facilities, are essential for handling and safeguarding confidential information. Nonetheless, the protection and safety of the information managed by these servers are notable worries, particularly considering their placement in remote and frequently unprotected areas. These servers are commonly utilized for important tasks such as real-time data processing for military communications, monitoring industrial equipment, and conducting remote sensing in dangerous environments. The servers in these areas are susceptible to cyber-attacks, physical tampering, and unauthorized access, putting the data integrity at risk. The government has become stricter with data privacy and security regulations due to growing concerns. An example is the implementation of the Cybersecurity Maturity Model Certification (CMMC) framework by the U.S. Department of Defense (DoD), mandating contractors, including users of Rugged Servers, to adhere to cybersecurity standards in safeguarding sensitive data on DoD networks. Furthermore, the General Data Protection Regulation (GDPR) in the European Union enforces stringent rules on data protection that are also relevant for businesses utilizing Rugged Servers within European territories. It is necessary to follow these regulations, as not protecting data properly can result in significant consequences such as penalties and harm to one's reputation.

Rugged Servers Market Segment Analysis

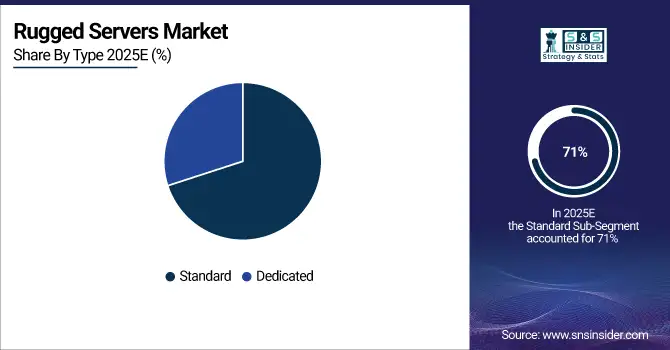

By Type, Standard Rugged Servers Capture Largest Market Share in 2025 Due to Versatility and Durability

Standard is captured the largest share in Rugged Servers Market with 71% of share in 2025. This prevalent of these servers is due to their adaptability and wide range of uses in various industries, such as industrial automation, transportation, telecommunications, and others. Regular durable servers are created to provide a well-rounded mix of toughness and versatile functionality, making them perfect for a variety of uses needing strong performance and flexibility to different operating conditions. The rising need for trustworthy computer systems able to withstand tough environmental elements like extreme temperatures, vibrations, dust, and moisture has greatly fueled the expansion of this sector. Companies such as Cisco Systems have been leading the way in innovation by introducing new Rugged Servers that adhere to strict industrial and military standards while providing improved processing power and connectivity choices. For example, Cisco's UCS E-Series servers are designed to function effectively in difficult conditions while delivering the necessary computing power for essential applications. In the same way, HPE has launched the HPE Edge line EL8000 Converged Edge System, blending durability with powerful computing, ideal for edge installations in challenging environments like distant oil and gas sites or military facilities.

By Offering, Hardware Segment Dominates Rugged Servers Market in 2025, Driven by Extreme-Condition Performance Needs

In 2025, the Hardware Segment dominated the revenue in the Rugged Servers Market with a 62% share. Considering the crucial importance of strong and efficient parts in meeting the tough needs of challenging conditions. Continuous technological advances and increasing demand for durable servers capable of withstanding extreme conditions like temperature variations, physical impacts, dust, and moisture are driving the growth of this sector. Companies in the Rugged Servers sector are making significant investments in R&D to improve the durability and performance of their hardware products. An example is Trenton Systems, a top provider of durable computing solutions, who has released high-tech durable server platforms made to adhere to military standards like MIL-STD-810G. Their servers come with shock-mounted components and advanced cooling systems to guarantee top performance in the toughest conditions. In the same way, Dell Technologies has broadened its rugged server selection by launching the PowerEdge XR11 and XR12, specifically made for edge deployments in harsh environments. These servers are perfect for remote military outposts, oil rigs, and industrial sites due to their strong chassis, sealed connectors, and advanced thermal management systems. The hardware industry is also profiting from the growing complexity of applications in defense, aerospace, and industrial automation industries, which require more processing power, increased storage capacity, and improved connectivity choices.

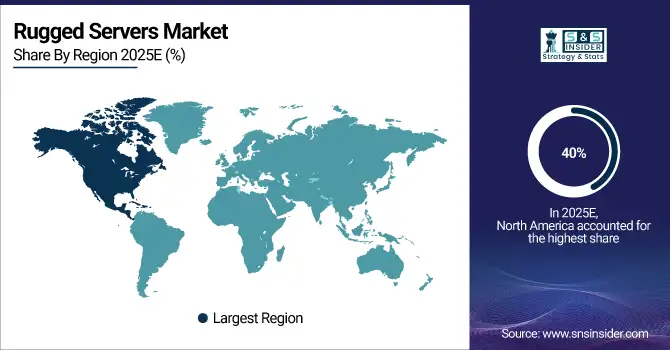

Rugged Servers Market Regional Analysis

North America Rugged Servers Market Trends:

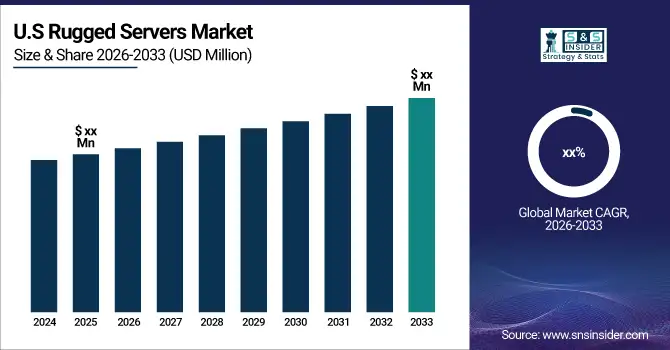

North America held the largest portion of revenue in the Rugged Servers market in 2025, accounting for 40% of the market share. Primarily fueled by growing demand from the defense and aerospace industries. Investments in ruggedized computing solutions have increased due to the U.S. government's emphasis on modernizing military infrastructure and improving cyber defense capabilities. The U.S. Department of Defense is making substantial investments in upgrading command and control systems, incorporating advanced technologies like artificial intelligence and machine learning into defense operations. These efforts play a crucial role in driving the demand for robust and dependable servers in the area, as they need servers that can endure harsh conditions and still deliver top performance. Moreover, the increased use of IoT and Industry 4.0 technologies in industries like manufacturing, oil and gas, and transportation is driving the need for durable servers that can function effectively in tough conditions. Many top companies in North America are leading the way in innovation within this industry. One instance is the introduction of Dell Technologies' durable server line, which includes the Dell EMC PowerEdge XR2 model, built to adhere to military standards for shock, vibration, and extreme temperatures.

Need any customization research on Rugged Servers Market - Enquiry Now

Europe and Asia-Pacific Rugged Servers Market Trends and Forecast

The Rugged Servers market in Europe & Asia-Pacific is growing significantly at a CAGR of 5.5% from 2026 to 2033. The growth of the market in Europe is driven by the rising need for reliable and secure computer solutions in defense and critical infrastructure sectors. European nations are making investments in cutting-edge military technologies and strengthening their defense capabilities, such as the deployment of durable servers. Moreover, the growth of smart city initiatives and implementation of digital transformation strategies in different sectors offer new possibilities for rugged server deployments. In Asia-Pacific, market growth is being driven by quick industrialization and substantial investments in defense. Nations such as China, India, and Japan are updating their military capabilities and improving their industrial automation processes, leading to a growing need for durable computing solutions. The varied weather and tough working conditions in the area demand durable servers to guarantee dependable performance.

Latin America (LATAM) and Middle East & Africa (MEA) Rugged Servers Market Insights

The Latin America and Middle East & Africa rugged servers market is witnessing steady growth, fueled by increasing defense and security investments, demand for reliable systems in harsh industrial environments, and infrastructure development projects. In Latin America, industries like oil & gas and mining drive adoption, while in MEA, military modernization and smart city initiatives accelerate demand. However, limited budgets and uneven technological infrastructure remain key challenges to widespread rugged server deployment across these regions.

Rugged Servers Market Key Players:

-

Dell Technologies

-

Siemens AG

-

Crystal Group, Inc.

-

Core Systems

-

CP Technologies

-

Portwell, Inc.

-

Symmatrix

-

Mercury Systems

-

Trenton Systems

-

One Stop Systems

-

ADLINK Technology Inc.

-

Advantech Co., Ltd.

-

General Micro Systems, Inc.

-

GETAC

-

Kontron

-

Westek Technology

-

Moxa

-

Systel

-

Shenzhen Lexic Technology

-

Octagon Systems

Rugged Servers Market Competitve Landscape:

Advantech Co., Ltd. is a leading global provider of industrial computing and embedded solutions, headquartered in Taipei, Taiwan. Established in 1983, the company plays a pivotal role in the rugged servers and industrial automation market, delivering high-performance, reliable, and durable computing systems for critical applications. Advantech’s rugged server portfolio is designed to operate in harsh environments, making it a preferred choice for industries such as defense, aerospace, oil & gas, transportation, and manufacturing. With continuous investment in IoT, AI, and edge computing technologies, Advantech strengthens its position as a key innovator, supporting digital transformation and mission-critical infrastructure worldwide.

-

In April 2024, Advantech Co., Ltd., a leader in industrial computing, unveiled a new range of industrial solutions and servers utilizing the 14th Generation Intel Core processors. This series includes the ASMB-610V3, ASMB-788, ASMB-588, and the Edge Accelerator Server HPC-6120 + ASMB-610V3. These servers are created to greatly improve industrial and edge computing applications.

Crystal Group Inc. is a U.S.-based company specializing in rugged computing solutions, including rugged servers, embedded computers, storage systems, and network devices. Headquartered in Hiawatha, Iowa, the company is a trusted supplier to defense, aerospace, industrial, and automotive sectors that require high-performance systems capable of withstanding extreme environments. Its rugged servers are widely deployed in military operations, intelligence gathering, autonomous vehicles, and mission-critical applications where reliability and durability are essential. With a strong focus on innovation, compliance with military standards, and integration of advanced technologies such as AI and cybersecurity, Crystal Group plays a vital role in the rugged computing market.

-

In May 2024, Crystal Group Inc., a company that designs and produces durable high-performance edge computing solutions, signed a multi-million dollar deal with an important defense contractor to provide durable, cybersecurity-enabled servers for use in advanced radar systems by the U.S. Army.

Getac is a leading provider of rugged computing solutions, headquartered in Taiwan, and a subsidiary of MiTAC-Synnex Group. The company specializes in rugged laptops, tablets, and mobile video solutions designed to operate in extreme conditions such as defense, public safety, utilities, manufacturing, and field services. Its rugged devices are built to military-grade standards, offering resistance to water, dust, shock, and extreme temperatures. Getac has established a strong global presence with partnerships across defense agencies, law enforcement, and industrial enterprises. With continuous innovation in connectivity, AI integration, and advanced display technology, Getac remains a key player in the rugged computing market.

-

In February 2023: GETAC introduced enhancements to its X600 mobile workstation line by unveiling the X600 Pro-PCI and X600 Server models. These servers are tailored to meet the specific requirements of professionals operating in challenging environments, including those in the oil & gas, manufacturing, and defense sectors.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 683.72 Million |

| Market Size by 2033 | USD 1049.30 Million |

| CAGR | CAGR of 5.5% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Offering (Hardware, Software, Services) • By Type (Standard, Dedicated) • By Memory Size (<256>512 GB−1 TB, >1TB) • By Application (Military And Aerospace, Industrial, Marine, IT And Telecommunication, Energy & Power, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Dell Technologies, Siemens AG, Crystal Group, Inc., Core Systems, CP Technologies, Portwell, Inc., Symmatrix, Mercury Systems, Trenton Systems, One Stop Systems, ADLINK Technology Inc., Advantech Co., Ltd., General Micro Systems, Inc., GETAC, Kontron, Westek Technology, Moxa, Systel, Shenzhen Lexic Technology, Octagon Systems. |