Industrial Control Systems Market Report Scope & Overview:

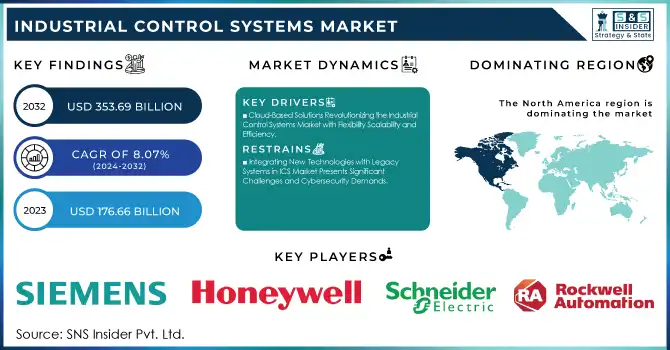

The Industrial Control Systems Market Size was valued at USD 176.66 Billion in 2023 and is expected to reach USD 353.69 Billion by 2032 and grow at a CAGR of 8.07% over the forecast period 2024-2032.

To get more information on Industrial Control Systems Market - Request Free Sample Report

The Industrial Control Systems (ICS) market seeing exponential growth with automation introduction in diverse sectors is also contributing to this. Manufacturers looking to use better control systems that allow them to minimize manual work and lower operational costs are increasingly investing in digital automation solutions. With the use of technologies such as the Internet of Things (IoT), artificial intelligence, and big data analytics, this trend has been fueled even further. According to a McKinsey report, leveraging AI-powered automation can increase productivity of up to 20% within manufacturing industries which brings us to the second aspect improving operational efficiency. Among other findings in a 2024 Deloitte survey, most manufacturing executives 58% said that they plan to purchase automation technologies to enhance productivity and reduce costs—further evidence of a strong shift toward digital systems that automate routine functions itertools.

Moreover, the rising focus on safety & compliance in various industries, such as oil & gas and health care and manufacturing, is fuelling the demand for strong ICS solutions. As organizations put greater emphasis on risk management and compliance, more advanced control systems are being required for monitoring activities to minimize incidents. In addition, booming smart manufacturing and Industry 4.0-related efforts encourage the development of integrated systems to manage complex manufacturing processes. Improved safety management systems have achieved a decrease or reduction of incidents by 40% across the oil and gas industry according to the International Association of Oil & Gas Producers (IOGP). At the same time, the World Economic Forum expects that by 2025, approximately 70% of manufacturers will embrace Industry 4.0 technologies — like IoT and AI. Moreover, enhanced management of risk contributes to the reduction of compliance costs by up to 20%, which further fuels the need for an advanced Industrial Control System (ICS).

Market Dynamics

Key Drivers:

-

Cloud-Based Solutions Revolutionizing the Industrial Control Systems Market with Flexibility Scalability and Efficiency

The transition of the Industrial Control Systems (ICS) market towards cloud-based solutions is one such trend. In the past, ICS consisted of on-premise systems that required high capital costs with continuous upkeep. That said, due to the cloud computing trend in recent years, a large number of firms are now adopting control systems within the cloud that allow for better flexibility, scalability, and cost savings. Remote monitoring and management can help make companies run more efficiently while having real-time data anywhere there is an Internet connection. A recent report by PwC found that 67% of manufacturers have adopted or plan to adopt cloud-based solutions to improve operating margin and reduce costs. According to a survey made by Frost & Sullivan, organizations with cloud-based monitoring systems experienced 40% less downtime simply because they had access to real-time data. Furthermore, Accenture estimated that as much as 30% of IT costs could be reduced by cloud technologies and be redirected back into other parts of the enterprise. Cloud also makes easy integration with other digital tools and it helps to share data among departments. This trend will continue to reshape the ICS landscape, as new businesses target systems used on the cloud for benefits typical of this technology.

-

Growing Cybersecurity Focus in Industrial Control Systems Protecting Operations Amid Rising Digital Threats

The growth of cybersecurity in industrial control systems is another trend. With the increasing interconnectivity and digital dependence of ICS, cyber threats have become more prevalent. Considering the possibilities of an attack on their systems, organizations understand how crucial it is to protect themselves from a situation where they would end up with operations being affected or even losing large amounts of money. Consequently, this has led to an increased focus on the deployment of strong cybersecurity solutions such as threat detection, real-time monitoring, and incident response plans. As a result, there is an increasing realization that ICS requires investing in security solutions tailored to meet the needs of these complex environments with additional regulatory scrutiny to ensure that they comply while securing critical national infrastructure. According to a report by IBM, organizations in the manufacturing sector are projected to spend an average of USD 7 million on cybersecurity measures in 2024. Additionally, a survey by Deloitte found that 87% of organizations are prioritizing compliance with cybersecurity regulations, emphasizing the need for robust security solutions in Industrial Control Systems (ICS) environments. As a result, the security of ICS is increasingly being regarded as a key component that must be incorporated into the digital transformation efforts of organizations that want to secure their operations in an ever more connected environment.

Restrain:

-

Integrating New Technologies with Legacy Systems in ICS Market Presents Significant Challenges and Cybersecurity Demands

Legacy A huge challenge in the Integrated Control Systems (ICS) market is integrating new technologies with legacy systems. For some industries, legacy control systems have long been employed that are not readily upgradable to more advanced offerings. All of this makes transitions longer which can create downtime and affect operations and productivity. Moreover, the growing demand for cybersecurity solutions is a challenge but also a restraint. Increased connectivity implies an increased threat of cyberattacks against ICS, emphasizing the need for strong security protocols. On the other hand, deploying such solutions on an enterprise scale can be expensive and demanding as it requires specialized skill sets, tools, and continuous personnel training. This necessitates a fine balance between the demand for resilience and security because organizations want to be able to decode new technologies while ensuring that operational efficiency is not lost, which becomes all the more pertinent in light of threats that evolve every day without fail.

Segment Analysis

By Technology

Distributed Control Systems (DCS) held over 32.6% of the overall Industrial Control Systems market in 2023 owing to their versatility and robustness in handling complex industrial processes. DCS is predominantly employed in industries like oil and gas, chemicals, as well as power generation, which necessitate continuous and reliable control. This enables a distributed control architecture that offers better reliability, fault tolerance, and scalability for handling larger systems. DCS is appealing to organizations wanting to enhance operational efficiency while ensuring safety because of its integration capabilities with other technologies and potential for scale.

SCADA systems, are expected to be the fastest-growing segment by CAGR between 2024 and 2032. The increasing demand for real-time data monitoring and control in different industries has been the key driver of this growth. SCADA systems enable the control and monitoring of processes from a distance, which makes them particularly useful in fields such as utilities, transportation, and manufacturing. With industrial profiling arrangements driving digital transformation, the requirement for SCADA systems is set to increase further with advances in IoT and data analytics supporting superior decision-making and operational efficiency.

By Component

The Remote Terminal Unit (RTU) accounted for the largest market share of 24.6% in 2023 as it is an important component of industrial automation and control systems RTUs play an important role in industrial sectors like oil and gas, water treatment, manufacturing, etc., for remote monitoring and control of processes. Field Devices collect data from field buses and propagate it to centralized control systems, enabling real-time decision-making, and increased operational efficiency. Moreover, RTUs can work in hostile environments, thus making them ideal for installation or deployment in remote areas with unsuitable conditions for regular control systems to function.

The Human-Machine Interface (HMI) is estimated to register the highest CAGR output from 2024-2032. The growth of this sector will be attributed to the growing interest in easy-to-use interfaces as a means to enhance operator engagement with industrial systems. Industries are adapting to the increasing complexity of automation solutions with highly sophisticated HMI that improve efficiency and reduce human error. With the development of new technology like touchscreen interfaces, advanced graphics, and data visualization tools, HMIs are becoming more user-friendly and powerful.

By End Use

In 2023, Manufacturing recorded the largest share of 16.6% of the Industrial Control Systems market owing to its contribution to industrial automation and efficiency enhancement among various end-use industries. Many manufacturing processes need accurate control and monitoring for quality assurance of products and efficiency of operation. From Industrial control systems like DCS, the SCADA system makes it easy for manufacturers to optimize production lines, decrease downtime, and ensure safety. .

The Healthcare segment is anticipated to have the highest CAGR growth between 2024 and 2032. The increasing adoption of automation and control systems in medical infrastructure to enhance patient care and operational performance is driving this growth. With mounting pressure on the healthcare sector to provide increased levels of service and ensure that complicated processes like remote patient monitoring, medication management, and surgical automation are more reliable than ever, robust and sophisticated control methods are needed.

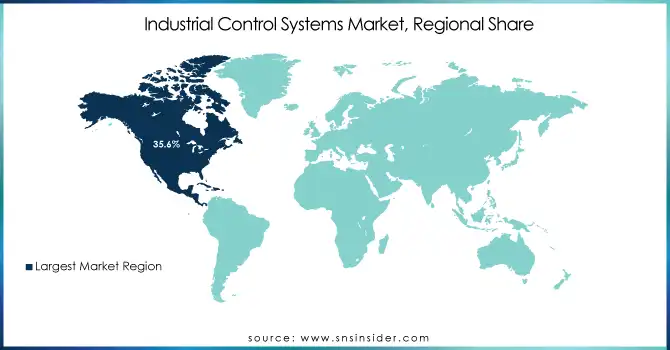

Regional Analysis

North America was the largest segment of the Industrial Control Systems market in 2023 accounting for 35.6% of the market share. Some of the key factors responsible for this domination are better manufacturing infrastructure, a high presence of core industry players, and significant investment in automation technologies in the region. For instance, the U.S. and Canada have been pioneers when it comes to smart manufacturing and also integrating technologies like IoT and AI into industrial processes. For instance, General Electric and Honeywell, as some of the leading developers in the industry, have started to seek to implement Industrial Control Systems within their organizations which benefits their operations across various sectors such as energy, manufacturing, and aerospace with a high level of operational efficiency and safety.

The Asia Pacific region will witness the highest CAGR growth of 2024-2032, due to industrialization, and several developing regions in countries like China & India are pushing for more automation. The Chinese government’s "Made in China 2025" plan seeks to turn the country into a world leader in advanced manufacturing and has made major investments in, among other things, industrial automation and control systems. As an example, Siemens and Mitsubishi Electric are increasing the level of their companies in the Asia Pacific region by offering regional businesses modern factory automation solutions. The industrial control systems market in this region is expected to witness substantial growth due to the rapid infrastructural development emerging economies are doing in the field of sophisticated industrial control systems, thus making the Asia Pacific one of the most significant regions for prospects of industrial automation.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key players

Some of the major players in the Industrial Control Systems Market are:

-

Siemens (SIMATIC S7, SINAMICS)

-

Honeywell (Experion PKS, Matrikon)

-

Schneider Electric (EcoStruxure, Modicon)

-

Rockwell Automation (PlantPAx, FactoryTalk)

-

Emerson (DeltaV, Ovation)

-

ABB (AC500, 800xA)

-

General Electric (PACSystems, Proficy)

-

Mitsubishi Electric (MELSEC, E-F@ctory)

-

Yokogawa (CENTUM, ProSafe)

-

Omron (Sysmac, E3NW)

-

Panasonic (FP0, FP7)

-

Beckhoff Automation (TwinCAT, EtherCAT)

-

FANUC (FANUC Robotics, iRVision)

-

B&R Industrial Automation (Automation Studio, APROL)

-

KUKA (KRC, KUKA.Sim)

-

Schneider Electric (Unity Pro, SoMachine)

-

Moxa (OnCell, EDS-510)

-

Hirschmann (BAT54, RSP-1)

-

Ametek (Solid State Controls, Programmable Controllers)

-

National Instruments (LabVIEW, CompactRIO)

Some of the Raw Material Suppliers for Industrial Control Systems Companies:

-

Texas Instruments

-

NXP Semiconductors

-

Analog Devices

-

Infineon Technologies

-

Microchip Technology

-

STMicroelectronics

-

Maxim Integrated

-

Broadcom

-

ON Semiconductor

-

Vishay Intertechnology

Recent Trends

-

In July 2024, Nozomi Networks launched Arc Embedded, a security sensor for Mitsubishi Electric PLCs. This innovation provides enhanced visibility into industrial automation processes, enabling teams to detect and address threats without disrupting operations, thereby improving resilience, uptime, and compliance.

-

In June 2024, The Cybersecurity and Infrastructure Security Agency (CISA) issued an advisory regarding a critical vulnerability in RAD Data Communications’ SecFlow-2 devices, the advisory warns that this flaw could be exploited remotely with low attack complexity.

-

In May 2024, A ransomware attack by the Ransomhub group compromised the Industrial Control Systems of a Spanish bioenergy plant. According to a report from Cyble Research & Intelligence Labs, the attack specifically targeted the SCADA system, crucial for managing operations at the facility.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 176.66 Billion |

| Market Size by 2032 | USD 353.69 Billion |

| CAGR | CAGR of 8.07% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Integrated Control and Monitoring System (ICMS), Manufacturing, Execution System (MES), Distributed Control System (DCS), Safety Instrumented System (SIS), Supervisory Control and Data Acquisition) • By Component (Remote Terminal Unit (RTU), Human-Machine Interface (HMI), Surge Protectors, Marking Systems, Modular Terminal Blocks, Others) • By End Use (Aerospace & Defence, Automotive, Chemical, Energy & Utilities, Food & Beverage, Healthcare, Manufacturing, Mining & Metal, Oil & Gas, Transportation, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Siemens, Honeywell, Schneider Electric, Rockwell Automation, Emerson, ABB, General Electric, Mitsubishi Electric, Yokogawa, Omron, Panasonic, Beckhoff Automation, FANUC, B&R Industrial Automation, KUKA, Moxa, Hirschmann, Ametek, National Instruments |

| Key Drivers | • Cloud-Based Solutions Revolutionizing the Industrial Control Systems Market with Flexibility Scalability and Efficiency • Growing Cybersecurity Focus in Industrial Control Systems Protecting Operations Amid Rising Digital Threats |

| RESTRAINTS | • Integrating New Technologies with Legacy Systems in ICS Market Presents Significant Challenges and Cybersecurity Demands |