Nickel Metal Hydride (NiMH) Battery Market Size:

To get more information on Nickel Metal Hydride (NiMH) Battery Market - Request Free Sample Report

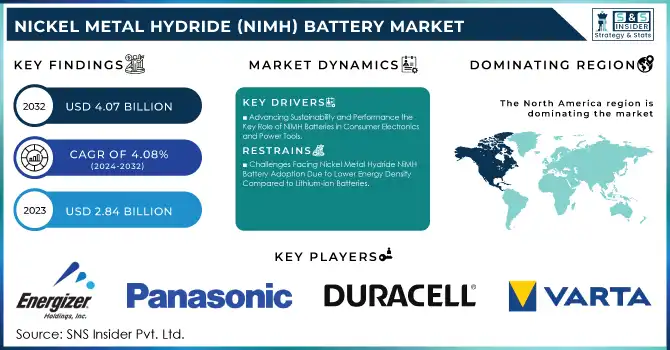

The Nickel Metal Hydride (NiMH) Battery Market Size was valued at USD 2.84 billion in 2023 and is expected to grow to USD 4.07 billion by 2032 and grow at a CAGR of 4.08% over the forecast period of 2024-2032.

The Nickel Metal Hydride (NiMH) battery market is experiencing significant growth, driven by its increasing use in renewable energy storage, electric vehicles (EVs), and portable electronics. NiMH batteries are gaining popularity due to their superior safety features, longer cycle life, and efficient high power output, making them suitable for large-scale energy storage systems essential for grid integration of renewable energy sources like solar and wind. As renewable energy capacity expands, the demand for reliable energy storage solutions to manage intermittency and ensure grid stability grows, further boosting the NiMH battery market. The International Energy Agency (IEA) predicts a substantial rise in global renewable energy capacity by 2030, increasing the need for advanced storage systems. In the automotive sector, NiMH batteries are widely used in hybrid electric vehicles (HEVs), especially in markets like Japan with established hybrid vehicle infrastructure, despite lithium-ion batteries dominating the electric vehicle market. Government regulations and policies promoting clean energy and sustainability are accelerating the adoption of technologies such as electric vehicles and renewable energy systems, benefiting the NiMH battery market. The sector is further supported by the rise of electric vehicle charging infrastructure, with EVs expected to account for 45% of global vehicle sales by 2030. This growth is aligned with national energy transition policies, which emphasize renewable energy adoption and clean technology, as seen in countries like Brazil, Germany, and the United States. Renewable energy targets continue to be raised globally, and by 2030, renewable energy is expected to account for nearly 20% of final energy consumption, with a significant portion of growth coming from electricity generation and renewable fuels like hydrogen and bioenergy. These trends are expected to drive sustained demand for NiMH batteries.

Market Dynamics

Drivers

-

Advancing Sustainability and Performance the Key Role of NiMH Batteries in Consumer Electronics and Power Tools

The Nickel Metal Hydride (NiMH) battery market is flourishing, driven by its extensive adoption in consumer electronics and power tools. Known for their balance between energy density, environmental safety, and cost-effectiveness, NiMH batteries power a wide range of applications, including cameras, toys, cordless devices, drills, and lawnmowers. Their energy density, typically ranging from 60-120 Wh/kg, surpasses that of nickel-cadmium (NiCd) batteries while offering a safer, cadmium-free solution, making them an environmentally sustainable alternative. Furthermore, their robust power density enables them to deliver high current outputs, essential for demanding applications like power tools and hybrid vehicles. With an efficiency rate of 70-80%, NiMH batteries convert a significant portion of stored energy into usable electricity, ensuring reliability and durability in diverse use cases. Their eco-friendly design aligns with global sustainability initiatives, enhancing their market appeal in regions with growing demand for green technologies. Power tool manufacturers increasingly integrate NiMH batteries into heavy-duty products, leveraging their high-energy output and longer cycle life. Similarly, consumer electronics companies favor NiMH technology for its rechargeable and affordable characteristics, catering to cost-conscious consumers. Technological advancements are further elevating their performance, with innovations in material science and battery design improving energy density and durability. This evolution positions NiMH batteries as an indispensable choice in applications requiring moderate energy storage and consistent performance. As global demand for portable and cordless devices rises, particularly in regions with high consumer goods production, the strategic importance of NiMH batteries in powering sustainable and efficient technologies continues to grow, cementing their role as a key driver in the battery market's expansion.

Restraints

-

Challenges Facing Nickel Metal Hydride NiMH Battery Adoption Due to Lower Energy Density Compared to Lithium-ion Batteries

The Nickel Metal Hydride (NiMH) battery market faces significant challenges due to its comparatively lower energy density than Lithium-ion (Li-ion) batteries, which remains a critical limitation in various high-demand applications. NiMH batteries typically offer an energy density range of 60-120 Wh/kg, falling short of the 150-250 Wh/kg provided by Li-ion alternatives. This disparity makes Li-ion batteries a more attractive option for energy-intensive applications such as electric vehicles (EVs), advanced consumer electronics, and renewable energy storage systems. With EVs leading the global push for sustainable mobility, the demand for high-capacity and lightweight batteries places NiMH technology at a competitive disadvantage, especially when weight and energy efficiency are paramount. The rapid evolution of portable devices like smartphones, laptops, and wearables has heightened the preference for Li-ion batteries due to their superior energy density, faster charging times, and smaller form factors. This technological shift has relegated NiMH batteries to less demanding applications, such as toys, cordless devices, and power tools, limiting their market scope. The growing focus on lithium-ion innovation, backed by substantial R&D investments, exacerbates the market challenge for NiMH batteries. Emerging technologies, such as solid-state lithium-ion and lithium-sulfur batteries, further dilute the market share of NiMH by offering even higher energy densities and enhanced safety profiles.While NiMH batteries maintain their relevance in certain niches due to their cost-effectiveness, safety, and environmental advantages, their inability to meet the energy storage requirements of modern applications hampers market expansion.

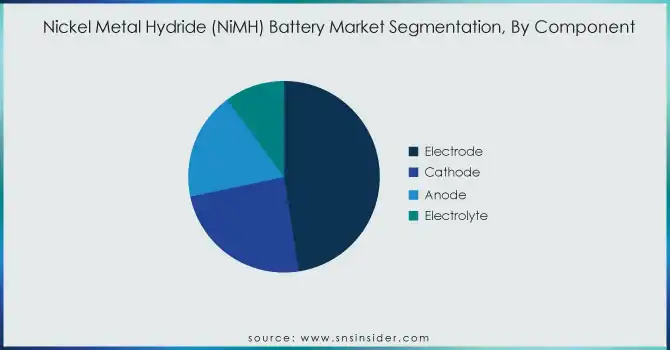

Segment Analysis

By Component

The electrode segment led the Nickel Metal Hydride (NiMH) battery market with a 48% share in 2023, driven by its vital role in battery performance and efficiency. Comprising nickel hydroxide (positive electrode) and metal hydride (negative electrode), electrodes facilitate the core energy storage and release processes in NiMH batteries. Their importance spans diverse applications, from consumer electronics like cameras and toys to power tools and hybrid vehicles, where energy density, stability, and output are crucial. Technological advancements, such as rare-earth alloys enhancing hydrogen storage and improved nickel-based compounds, have significantly boosted electrode performance. Additionally, the eco-friendly nature of NiMH batteries, free from toxic cadmium, aligns with sustainability goals, reinforcing the demand for advanced electrode materials and sustaining their market dominance.

By Size

In 2023, small-sized Nickel Metal Hydride (NiMH) batteries dominated the market, accounting for approximately 59% of the revenue share. Their widespread adoption is attributed to their versatility, compact design, and suitability for consumer electronics, medical devices, and small household appliances. These batteries offer a reliable energy source for cameras, toys, remote controls, and hearing aids, balancing energy density, safety, and cost-effectiveness. Small NiMH batteries are preferred for their Rechargeability, long cycle life, and eco-friendly attributes, as they avoid the toxic cadmium found in older technologies. Technological advancements, such as improved electrode materials and energy density, have further enhanced their performance, cementing their dominance. Their compatibility with global sustainability trends and broad application range make small-sized NiMH batteries a critical driver of growth in this market segment.

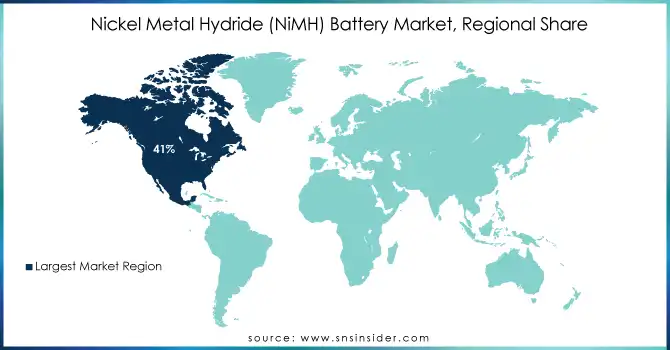

REGIONAL ANALYSIS

In 2023, North America held the largest revenue share of around 41% in the Nickel Metal Hydride (NiMH) battery market, driven by robust demand across various sectors, including consumer electronics, automotive, and renewable energy. The region's dominance can be attributed to its advanced technological infrastructure, significant investments in electric vehicle (EV) production, and a growing emphasis on renewable energy solutions. The U.S. and Canada are key players, with the U.S. leading the charge in battery manufacturing, research and development, and adoption of sustainable technologies. The U.S. has also seen a surge in electric vehicle production, further boosting the demand for NiMH batteries, especially in hybrid vehicles. Additionally, North America's focus on environmental sustainability and energy efficiency has fueled the need for eco-friendly battery alternatives, enhancing NiMH’s appeal. The presence of key manufacturers and supportive government policies also bolsters the region's market growth.

The Asia-Pacific region is the fastest-growing market for Nickel Metal Hydride (NiMH) batteries from 2024 to 2032, driven by rapid industrialization, technological advancements, and increasing demand for consumer electronics and electric vehicles (EVs). China, the largest producer of electronics and EVs, leads the region in NiMH battery adoption, particularly in hybrid vehicle manufacturing. Japan, a key player in battery technology, continues to push innovations and expand applications for NiMH batteries in various industries. South Korea is enhancing its energy storage systems, further driving the demand for these batteries. India’s growing investments in electric mobility and consumer electronics also contribute to the regional market expansion. With government incentives, favorable regulations, and large-scale manufacturing capabilities, Asia-Pacific is set to maintain its leadership in the NiMH battery market over the forecast period.

Get Customized Report as per Your Business Requirement - Enquiry Now

KEY PLAYERS

Some of the major players in Nickel Metal Hydride (NiMH) Battery Market along wirth their product:

-

Energizer Holdings, Inc. (Energizer Rechargeable Batteries)

-

Panasonic Holdings Corporation (Eneloop NiMH Rechargeable Batteries)

-

Duracell (Duracell Rechargeable NiMH Batteries)

-

VARTA AG (VARTA Rechargeable NiMH Batteries)

-

FDK Corporation (FDK NiMH Rechargeable Batteries)

-

BYD Company Limited (BYD NiMH Battery Packs)

-

Primearth EV Energy Co., Ltd. (Primearth EV Energy NiMH Batteries)

-

GP Batteries International Limited (GP ReCyko+ NiMH Rechargeable Batteries)

-

Toshiba Corporation (Toshiba NiMH Rechargeable Batteries)

-

Sanyo Electric Co. Ltd. (Sanyo Eneloop NiMH Batteries)

-

Panasonic Energy (Panasonic NiMH Battery Cells)

-

ATL (Advanced Technology & Materials) (ATL NiMH Battery Cells)

-

Hitachi Maxell, Ltd. (Maxell NiMH Rechargeable Batteries)

-

Saft Group (Saft NiMH Rechargeable Batteries)

-

NEC Corporation (NEC NiMH Battery Cells)

-

Sony Corporation (Sony NiMH Rechargeable Batteries)

-

Samsung SDI (Samsung NiMH Rechargeable Batteries)

-

Shenzhen BAK Battery Co., Ltd. (BAK NiMH Rechargeable Batteries)

-

CALB (China Aviation Lithium Battery Co., Ltd.) (CALB NiMH Batteries)

-

LG Chem (LG NiMH Battery Cells)

List of key suppliers in the NiMH battery market that supply raw materials and components

-

Umicore

-

Glencore

-

Sherritt International

-

Sumitomo Metal Mining Co., Ltd.

-

Xiamen Tungsten Co., Ltd.

-

Norilsk Nickel

-

Jinchuan Group International Resources Co. Ltd.

-

BASF

-

Mitsubishi Materials Corporation

-

Tesla, Inc.

-

Shaanxi J&R Optimum Energy Co. Ltd.

-

Advanced Battery Concepts

-

SMM (Sumitomo Metal Mining)

-

Hitachi Chemical Co. Ltd.

-

China Northern Rare Earth Group High-Tech Co. Ltd.

-

Votorantim Metals

-

Livent Corporation

-

Furukawa Electric Co. Ltd.

-

Molycorp

-

Samsung SDI

RECENT DEVELOPMENT

-

November 29, 2024 – Toshiba's SCiB Energy Storage System has recently been integrated into critical infrastructure, offering faster power restoration and enhanced reliability. With rapid charging capabilities, it ensures data centers and healthcare facilities maintain uninterrupted operations during power outages, driving both sustainability and cost efficiency.

-

June 19, 2024 – SAMSUNG SDI unveiled the upgraded SAMSUNG Battery Box (SBB) 1.5 at Inter Battery Europe 2024, showcasing its advanced direct injection system for enhanced anti-propagation. The company aims to lead the global ESS market by offering diverse product lineups, including high-power cells for UPS systems to meet growing data center demands.

| Report Attributes | Details |

| Market Size in 2023 | USD 2.84 Billion |

| Market Size by 2032 | USD 4.07 Billion |

| CAGR | CAGR of 4.08% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Electrode, Cathode, Anode, Electrolyte) • By Battery Type (A, AA, AAA, C, D, 9V, Others) • By Size (Small, Large, By Sales Channel) • By Sales Channel (OEM, Aftermarket) • By Vertical (Automotive, Consumer Electronics, Healthcare, Industrial, Residential, Commercial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Energizer Holdings, Inc., Panasonic Holdings Corporation, Duracell, VARTA AG, FDK Corporation, BYD Company Limited, Primearth EV Energy Co., Ltd., GP Batteries International Limited, Toshiba Corporation, Sanyo Electric Co. Ltd., Panasonic Energy, ATL (Advanced Technology & Materials), Hitachi Maxell, Ltd., Saft Group, NEC Corporation, Sony Corporation, Samsung SDI, Shenzhen BAK Battery Co., Ltd., CALB (China Aviation Lithium Battery Co., Ltd.), and LG Chem are key players in the NiMH battery market. |

| Key Drivers | • Advancing Sustainability and Performance the Key Role of NiMH Batteries in Consumer Electronics and Power Tools. |

| Restraints | • Challenges Facing Nickel Metal Hydride NiMH Battery Adoption Due to Lower Energy Density Compared to Lithium-ion Batteries. |