Multilayer Ceramic Capacitor Market Size:

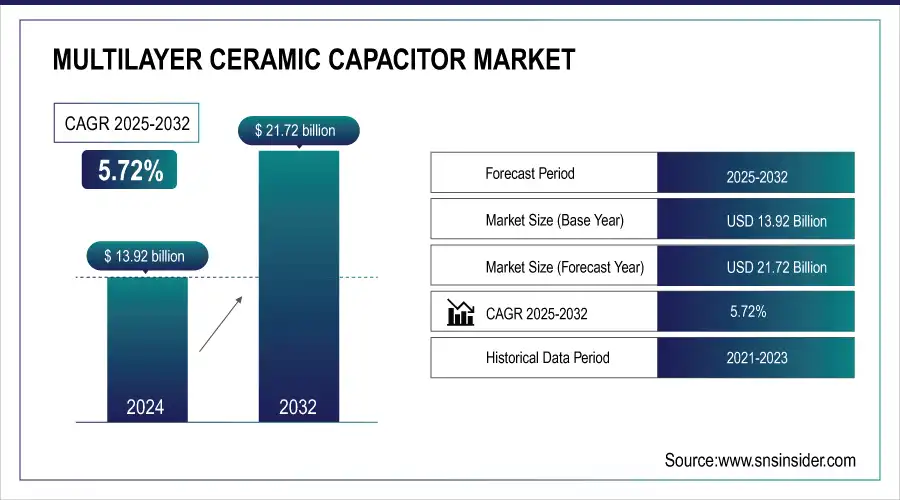

The Multilayer Ceramic Capacitor Market Size was valued at USD 13.92 Billion in 2024 and is expected to reach USD 21.72 Billion by 2032 and grow at a CAGR of 5.72% over the forecast period 2025-2032.

Get more information on Multilayer Ceramic Capacitor Market - Request Sample Report

The Multilayer Ceramic Capacitor Market continues to experience transformative growth, fuelled by technological advancements and shifts in government regulations. In 2023 and 2024, the United States, China, Japan, and South Korea launched significant initiatives to enhance the manufacturing and advancement of Multilayer Ceramic Capacitors. Governments globally are promoting the adoption of energy-efficient and eco-friendly electronic parts via subsidies and research funding. For instance, China's "Made in China 2025" initiative seeks to achieve self-reliance in manufacturing semiconductors and electronic parts, including Multilayer Ceramic Capacitors. In the United States, the CHIPS Act emphasizes enhancing domestic manufacturing capabilities while providing robust incentives for Multilayer Ceramic Capacitor producers.

Recent developments in Multilayer Ceramic Capacitor technology feature miniaturization, enhanced performance, and greater durability. The introduction of new products in 2023 and 2024, including high-capacity Multilayer Ceramic Capacitors for electric vehicles (EVs) and 5G base stations, indicates a trend in the market toward specialized applications. As of October 2024, there are almost 10 million 5G base stations globally, highlighting the demand for Multilayer Ceramic Capacitors. The automotive industry, particularly electric vehicles, has emerged as an essential segment, with over fifty percent of EV powertrains in 2023 employing advanced Multilayer Ceramic Capacitors. These elements are essential for improving energy efficiency and ensuring the dependability of intricate electronic systems. A further reason is the growing worldwide transition to renewable energy sources, like solar and wind power systems, which need Multilayer Ceramic Capacitors capable of enduring high voltages and severe environmental conditions.

Another element is the telecommunications industry, as 5G demands capacitors that offer high-frequency stability and minimal losses. As of 2023, approximately 50% of the newly installed 5G base stations employed advanced Multilayer Ceramic Capacitors to enhance performance and longevity. Consumer electronics remain a consistent demand hub, incorporating Multilayer Ceramic Capacitors in smartphones, laptops, and wearables because of their small size and excellent reliability.

Market Size and Forecast:

-

Market Size in 2024 USD 13.92 Billion

-

Market Size by 2032 USD 21.72 Billion

-

CAGR of 5.72% From 2025 to 2032

-

Base Year 2024

-

Forecast Period 2025-2032

-

Historical Data 2021-2023

Multilayer Ceramic Capacitor Market Trends:

-

Rising adoption of electric vehicles is boosting demand for advanced Multilayer Ceramic Capacitors in battery management and inverter systems.

-

Government incentives and emissions regulations are accelerating EV production, indirectly fueling capacitor usage.

-

Technological advancements in ultra-compact Multilayer Ceramic Capacitors align with manufacturers’ need for space efficiency and reliability.

-

Expansion of 5G infrastructure is driving demand for high-capacity capacitors in antennas, small cells, and signal processing equipment.

-

Growth of IoT devices reliant on 5G networks further strengthens the requirement for stable, high-frequency Multilayer Ceramic Capacitors.

Multilayer Ceramic Capacitor Market Growth Drivers:

-

The growing adoption of electric vehicles worldwide is driving Multilayer Ceramic Capacitor demand.

In 2023, nearly all electric vehicle manufacturers incorporated advanced Multilayer Ceramic Capacitors into their designs for battery management systems and inverters. Amid the surge in EV manufacturing in 2023, governments are providing incentives and regulations to encourage sustainability, including grants for EV purchasers and requirements for automakers to lower emissions.

Multilayer Ceramic Capacitors play a vital role in electric vehicles due to their small size, exceptional reliability, and thermal stability, all of which are essential for effective power conversion and energy storage solutions. Moreover, progress in Multilayer Ceramic Capacitor technology, including ultra-compact capacitors, coincides with electric vehicle manufacturers’ requirements to maximize space and efficiency, further enhancing demand.

-

The rollout of 5G technology requires advanced Multilayer Ceramic Capacitors for efficient network performance.

About 50% of the 5G base stations set up in 2023 employed high-capacity Multilayer Ceramic Capacitors. Governments and telecom firms are heavily investing in the rollout of 5G, with spending anticipated to rise in 2024. Multilayer Ceramic Capacitors are suitable for high frequencies and provide stability in signal processing, making them essential components of 5G infrastructure, such as antennas and small cells.

The increased data speeds and connectivity demands of 5G networks necessitate capacitors with enhanced capacitance and reliability, with Multilayer Ceramic Capacitors being essential components. This trend is also backed by the growth of IoT devices depending on 5G networks, increasing the need for Multilayer Ceramic Capacitors in the telecom industry.

Multilayer Ceramic Capacitor Market Restraints:

-

Fluctuating costs of raw materials like palladium and nickel pose challenges to Multilayer Ceramic Capacitor manufacturers.

Production of Multilayer Ceramic Capacitor depends heavily on the use of precious and rare-earth metals, whose prices are extremely sensitive to supply chain disruptions, geopolitical tensions, and fluctuating demand. In 2023, palladium price surged, leaving a significant footprint on the cost of production.

These increasing costs are further heightened by limited supplies and export controls from the principal producing countries such as Russia and South Africa accounting for 44% and 38% of global palladium supply respectively. Manufacturers are finding it tough to maintain profitability with increasing demand for Multilayer Ceramic Capacitors in various industries.

However, alternative materials and recycling methods are under development. Still, due to this situation, they seem not to be available. The uncertainty is caused by this reliance on expensive raw materials to peg prices as certain implications may hamper market growth and profitability.

Multilayer Ceramic Capacitor Market Segment Analysis:

By Case Size

In 2024, the 0603-1206 Inches segment accounted for the largest share, at 56%, as this size is most widely used in consumer electronics, such as smartphones and laptops. These sizes have balanced performance and miniaturization, making them ideal for space-constrained devices.

The Less Than 0603 Inches segment is expected to grow at the fastest CAGR of 6.29% from 2025 to 2032, driven by the increasing demand for ultra-miniature components in IoT devices and wearable technologies. As manufacturers focus on reducing device footprints while maintaining high capacitance, smaller Multilayer Ceramic Capacitors are gaining traction. For instance, Murata released its Super Small Multilayer Ceramic Capacitor. This is a capacitor of size 0.16mm x 0.08mm, the new smallest, having a volume ratio approximately 75% smaller than Murata's current smallest product.

This trend is supported by innovations in dielectric materials, enabling higher reliability and performance in compact sizes. The various applications from the automotive, telecommunication, and healthcare industries ensure continued demand for both standard and ultra-miniature Multilayer Ceramic Capacitors.

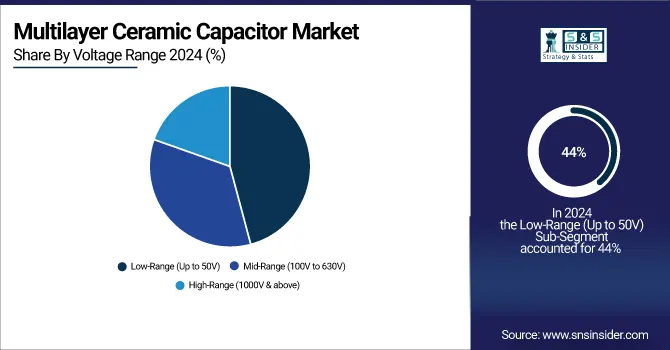

By Voltage Range

In 2024, the market was dominated by the Low Range (up to 50 V) segment that accounted for 44% share. These capacitors are very widely used in consumer electronics, such as smartphones and tablets that are operated at lower voltages.

The High Range (1000 V & above) segment is anticipated to expand with the highest CAGR of 6.47% in the estimated period from 2025 to 2032. This growth is mainly due to the increased adoption of Multilayer Ceramic Capacitors in high voltage applications that include EV powertrain, industrial machinery, and renewable energy systems. Critical applications are impossible without high-range Multilayer Ceramic Capacitors since they can support extreme conditions and consistently deliver performance.

In the same manner, advancements in technologies such as increases in energy density and thermal stability push the Multilayer Ceramic Capacitor market even more, meaning it will definitely follow a stable growth curve during the next five years.

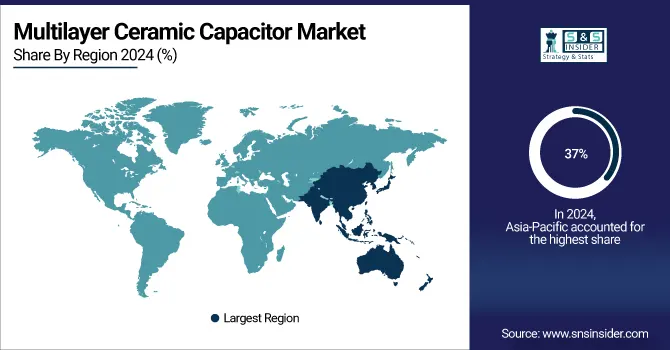

Multilayer Ceramic Capacitor Market Regional Analysis:

Asia Pacific Multilayer Ceramic Capacitor Market Insights

In 2024, the Asia-Pacific region captured 37% of the market share. This region is strong in electronics manufacturing, supported by countries like China, Japan, and South Korea. In addition, the government has policies that provide tax incentives and subsidies for local production, further enhancing Asia-Pacific's position.

Get a Customized Report as per your Business Requirement - Request For Customized Report

The Asia-Pacific region is expected to expand at the highest CAGR of 5.98% from 2025 to 2032. This growth can be attributed to the expansion in industrialization, increasing investments in EV production, and the 5G infrastructure rollout. Additionally, the cost-effective manufacturing capabilities in the region are complemented by the presence of major Multilayer Ceramic Capacitor producers. With increasing demands for advanced electronics worldwide, the Asia-Pacific region is certain to be one of the very important production centers and innovation ground for Multilayer Ceramic Capacitors.

North America Multilayer Ceramic Capacitor Market Insights

North America’s market is driven by strong adoption of electric vehicles, advanced consumer electronics, and expanding 5G infrastructure. Government incentives for EVs, coupled with heavy investment in telecom upgrades, are fueling capacitor demand. The region benefits from robust R&D activities and strong presence of leading technology and automotive manufacturers.

Europe Multilayer Ceramic Capacitor Market Insights

Europe shows significant growth in the multilayer ceramic capacitor market, supported by strict environmental regulations and rising electric vehicle adoption. Strong demand from renewable energy, automotive, and industrial applications boosts market expansion. Regional manufacturers emphasize sustainability and innovation, while 5G rollout and IoT integration further enhance capacitor consumption across key industries.

Latin America (LATAM) and Middle East & Africa (MEA) Multilayer Ceramic Capacitor Market Insights

LATAM and MEA are emerging markets, experiencing rising demand for multilayer ceramic capacitors due to growing mobile connectivity, telecom upgrades, and industrial automation. Increasing adoption of consumer electronics and gradual electric vehicle penetration support growth. Government-backed digitalization programs and infrastructure development further contribute to capacitor demand in these regions.

Multilayer Ceramic Capacitor Market Key Players:

Some of the Multilayer Ceramic Capacitor Market Companies are

-

Murata Manufacturing Co., Ltd. (Monolithic ceramic capacitors, SAW filters)

-

Samsung Electro-Mechanics (Multilayer Ceramic Capacitors with high bending strength, chip resistors)

-

Taiyo Yuden Co., Ltd. (High-frequency multilayer ceramic capacitors, inductors)

-

TDK Corporation (Multilayer ceramic chip capacitors, ferrite products)

-

Yageo Corporation (Multilayer ceramic capacitors, chip resistors)

-

Walsin Technology Corporation (Multilayer ceramic capacitors, RF components)

-

Kyocera AVX Components Corporation (Multilayer ceramic capacitors, tantalum capacitors)

-

KEMET Corporation (Tantalum capacitors, aluminum electrolytic capacitors)

-

Vishay Intertechnology Inc. (Ceramic capacitors, film capacitors)

-

Nippon Chemi-Con Corporation (Aluminum electrolytic capacitors, multilayer ceramic capacitors)

-

Samwha Capacitor Group (Multilayer ceramic capacitors, film capacitors)

-

Fenghua Advanced Technology (Multilayer ceramic capacitors, chip inductors)

-

Chaozhou Three-Circle (Group) Co., Ltd. (Multilayer ceramic capacitors, ceramic substrates)

-

Shenzhen Yuyang (Multilayer ceramic capacitors, ceramic filters)

-

Johanson Dielectrics, Inc. (High-voltage ceramic capacitors, RF capacitors)

-

Knowles Capacitors (Multilayer ceramic capacitors, EMI filters)

-

NIC Components Corp. (Multilayer ceramic capacitors, tantalum capacitors)

-

Würth Elektronik GmbH & Co. KG (Ceramic capacitors, inductors)

-

CalRamic Technologies (High-voltage ceramic capacitors, custom capacitors)

-

Frontier Electronics Corp. (Multilayer ceramic capacitors, surface-mount inductors)

Competitive Landscape for Multilayer Ceramic Capacitor Market:

Murata Manufacturing Co., Ltd., headquartered in Japan, is a global leader in the multilayer ceramic capacitor market. The company develops high-performance capacitors known for miniaturization, reliability, and thermal stability. Widely used in automotive, consumer electronics, and 5G infrastructure, Murata drives innovation with advanced capacitor technologies supporting energy efficiency and connectivity.

-

July 2024: Murata Manufacturing Co., Ltd. is expanding its portfolio of multilayer ceramic capacitors (MLCC) with the innovative new GRM188C80E107M and GRM188R60E107M. The new product has been designed to meet the ever-increasing requirements for miniaturization in servers, data centers, and IT applications. It is the world's first MLCC to offer a capacitance of 100μF in a 0603-inch (1608mm) size package.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 13.92 Billion |

| Market Size by 2032 | USD 21.72 Billion |

| CAGR | CAGR of 5.72% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (General Capacitor, Array, Serial Construction, Mega Cap, Others), • By Voltage Range (Low-Range (Up to 50V), Mid-Range (100V to 630V), High-Range (1000V & above)), • By Dielectric Type (X7R, X5R, C0G, Y5V, Others), • By End-User (Consumer Electronics, Automotive, Manufacturing, Healthcare, Telecommunication, and Others), • By Case Size (Less than 0603 Inches, 0603-1206 Inches, More than 1206 Inches) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Murata Manufacturing Co., Ltd., Samsung Electro-Mechanics, Taiyo Yuden Co., Ltd., TDK Corporation, Yageo Corporation, Walsin Technology Corporation, Kyocera AVX Components Corporation, KEMET Corporation, Vishay Intertechnology Inc., Nippon Chemi-Con Corporation, Samwha Capacitor Group, Fenghua Advanced Technology, Chaozhou Three-Circle (Group) Co., Ltd., Shenzhen Yuyang, Johanson Dielectrics, Inc., Knowles Capacitors, NIC Components Corp., Würth Elektronik GmbH & Co. KG, CalRamic Technologies, Frontier Electronics Corp. |