Counterfeit Money Detection Market Size & Growth Trends:

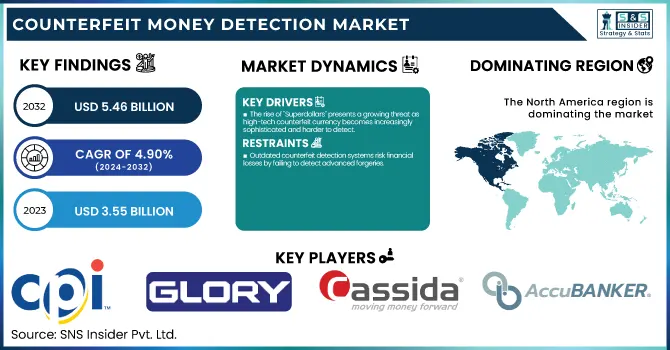

The Counterfeit Money Detection Market was valued at USD 3.55 billion in 2023 and is expected to reach USD 5.46 billion by 2032, growing at a CAGR of 4.90% from 2024 to 2032. Rising counterfeit currency circulation, especially in high-denomination banknotes, is driving demand for advanced detection technologies. Law enforcement reports increasing seizures of fake notes, while financial losses due to counterfeiting continue to impact retailers and banks.

To Get more information on Counterfeit Money Detection Market - Request Free Sample Report

In the U.S., the market was valued at USD 0.98 billion in 2023 and is expected to reach USD 1.33 billion by 2032, with a CAGR of 3.44%.AI-powered multi-layered detection systems (UV, IR, magnetic, and watermark analysis) are replacing traditional counterfeit detectors. Regulatory bodies are mandating stricter compliance, with redesigned high-security banknotes being introduced. USD, Euro, and Chinese Yuan remain the most counterfeited currencies, with Southeast Asia and Latin America identified as hotspots. Increasing digital counterfeiting and fraud are also shifting industry focus toward AI-driven security solutions.

Counterfeit Money Detection Market Dynamics:

Drivers:

-

The rise of "Superdollars" presents a growing threat as high-tech counterfeit currency becomes increasingly sophisticated and harder to detect.

The Counterfeit Money Detection Market is significantly influenced by the evolution of counterfeit techniques, particularly the emergence of "superdollars"—high-quality counterfeit U.S. banknotes that closely mimic genuine currency. These sophisticated fakes are produced using advanced technologies such as high-resolution 3D printing and AI-driven image manipulation, making detection increasingly challenging. Law enforcement agencies worldwide have reported a surge in the circulation of such counterfeit notes, especially in high-denomination bills like the USD 100 note. For instance, in February 2025, counterfeit USD 100 bills featuring President Trump's image began circulating on social media, highlighting the audacity and technological prowess of modern counterfeiters. This trend underscores the urgent need for financial institutions and businesses to adopt advanced detection technologies, including AI-powered scanners and multi-layered verification systems, to effectively combat the growing threat posed by these highly sophisticated counterfeit currencies.

Restraints:

-

Outdated counterfeit detection systems risk financial losses by failing to detect advanced forgeries.

Many financial institutions and retailers continue to rely on outdated authentication equipment, leaving them vulnerable to increasingly sophisticated counterfeit currency. These legacy systems struggle to process modern security features such as color-shifting ink, microprinting, holograms, and UV-reactive elements, which are now standard in new banknotes. As counterfeiters leverage AI-driven printing techniques, 3D replication, and high-resolution digital forgeries, older machines fail to detect fraudulent bills, increasing the risk of counterfeit circulation. Additionally, outdated systems may reject genuine banknotes due to incompatibility with enhanced security elements, leading to transaction delays, financial losses, and customer dissatisfaction. Businesses that fail to upgrade risk regulatory non-compliance, as many governments mandate the adoption of advanced counterfeit detection solutions. Without investment in modern detection technologies, banks and retailers face mounting threats, making them easy targets for fraudsters who exploit these weaknesses to circulate counterfeit currency undetected.

Opportunities:

-

AI-driven fraud evolution is transforming counterfeit detection with advanced technologies to combat increasingly sophisticated threats.

The circulation of fake USD 100 bills featuring President Trump underscores the evolving tactics of fraudsters, who now leverage AI to create synthetic identities, deepfake scams, and phishing attacks. Global losses from digital fraud exceeded USD 47.8 billion this year, with synthetic identity fraud surging by 31% and check fraud incidents rising by 28%, according to the U.S. Federal Trade Commission. As fraud prevention shifts towards AI-driven detection, the market must embrace holistic systems that integrate biometric identity verification, real-time intelligence, and interoperability across digital security platforms. Advanced fraud mitigation will not only enhance accuracy but also reshape identity verification to balance security with user experience. With the rise of deepfake-driven scams, AI-powered behavioral analytics and privacy-enhancing technologies will be critical to safeguarding financial institutions, businesses, and consumers.

Challenges:

-

Counterfeit detection faces challenges due to varying security features on banknotes worldwide, making it difficult to develop a universal solution.

The lack of standardization in banknote security features presents a major challenge for counterfeit money detection solutions. Each country implements unique design elements, watermarks, holograms, and security threads to prevent counterfeiting, making it difficult to develop a single, universally effective detection system. As financial institutions and businesses operate across international markets, they must invest in multiple authentication technologies to handle different currencies, increasing operational costs and complexity. Additionally, periodic updates in banknote designs, such as the introduction of polymer notes or new security features, require constant system upgrades, which may not be feasible for smaller businesses. This inconsistency also complicates counterfeit detection training, as employees need to be familiar with various national and regional authentication techniques. Without a standardized global framework, counterfeiters exploit the gaps in detection capabilities, targeting weaker or outdated systems to introduce fake currency into circulation, thereby increasing financial risks for businesses and economies worldwide.

Counterfeit Money Detection Market Key Segments:

By Product Type

The currency detectors segment dominated the Counterfeit Money Detection Market, accounting for approximately 54% of total revenue in 2023. This dominance is driven by the widespread adoption of automated banknote authentication systems in banks, retail stores, casinos, and other cash-intensive businesses. Currency detectors use advanced technologies such as ultraviolet (UV), magnetic, infrared (IR), and watermark detection to identify counterfeit notes efficiently. With the increasing circulation of high-value counterfeit banknotes, financial institutions and retailers are investing in sophisticated detection devices to minimize fraud risks. Additionally, governments and regulatory bodies are enforcing stricter compliance measures, further fueling demand for currency detectors. The segment is expected to continue growing as businesses upgrade legacy systems to enhance security and transaction accuracy.

The coin currency counters segment is witnessing rapid growth in the Counterfeit Money Detection Market and is expected to expand significantly from 2024 to 2032. This growth is driven by increasing demand for efficient cash-handling solutions in banks, retail stores, casinos, and vending machine operations. Businesses are investing in advanced coin counters equipped with counterfeit detection features, such as magnetic and weight-based authentication, to enhance accuracy and security. The rise of automated cash management in financial institutions and commercial establishments is further fueling adoption. Additionally, emerging markets with high cash dependency are increasingly integrating coin counting solutions to streamline operations and reduce manual errors. As technological advancements improve detection capabilities, the segment is poised for continued expansion.

By Technology

The ultraviolet (UV) segment dominated the Counterfeit Money Detection Market with a revenue share of approximately 30% in 2023. UV detection technology is widely used due to its effectiveness in identifying counterfeit banknotes by highlighting embedded security features such as watermarks, fluorescent threads, and invisible ink patterns. Financial institutions, retail businesses, and government agencies rely on UV counterfeit detectors to enhance transaction security and prevent fraud. The affordability and ease of integration of UV detection systems into existing cash-handling equipment contribute to their widespread adoption. Additionally, with the increasing sophistication of counterfeit techniques, continuous advancements in UV detection technology are further driving its demand across various industries.

The infrared (IR) segment is the fastest-growing in the Counterfeit Money Detection Market from 2024 to 2032, driven by its high accuracy in detecting counterfeit banknotes. Infrared detection technology identifies security features such as special inks, embedded patterns, and heat-sensitive markings that are invisible to the human eye but present in genuine currency. Financial institutions, retail chains, and cash-intensive businesses are increasingly adopting IR-based detection systems due to their reliability against advanced counterfeiting methods. The rising prevalence of sophisticated fake currency, combined with the demand for automated, high-speed verification systems, is fueling the growth of this segment. Continuous advancements in IR technology, including integration with AI and machine learning for enhanced detection, further support its expanding adoption across global markets.

By Application

The kiosks segment dominated the Counterfeit Money Detection Market with approximately 25% revenue share in 2023, driven by increasing demand for automated self-service solutions in banks, retail stores, and public spaces. These kiosks integrate advanced counterfeit detection technologies such as ultraviolet (UV), infrared (IR), and magnetic ink verification, ensuring efficient and accurate currency authentication. The growing adoption of self-checkout systems, ticketing machines, and ATMs equipped with counterfeit detection capabilities is fueling market expansion. Additionally, the rise of digital transactions has not diminished the need for secure cash-handling solutions, as kiosks provide a seamless way to verify banknotes in high-traffic locations. Continuous technological advancements, including AI-powered verification and cloud-based monitoring, are further enhancing the efficiency and reliability of these systems, supporting sustained market growth.

The self-checkout machines segment is expected to be the fastest-growing in the Counterfeit Money Detection Market from 2024 to 2032, a trend that is being driven by the increasing adoption of automated retail solutions. This has led retailers to spend more on self-checkout systems high on counterfeit detection technology such as ultraviolet (UV), infrared (IR) and artificial intelligence (AI) based image recognition, to stop fraudulent transactions. With consumers demanding less cumbersome and faster shopping experiences, businesses are adopting such systems to simplify processes at workplaces along with ensuring safe cash transactions. The increasing number of supermarkets, convenience stores, and fast-food chains adopting self-service payment methods contributes to the market's growth. Machine learning and cloud-based monitoring are improving counterfeit detection in self-checkout machines, making them an important part of any modern retail environment.

By End Use Industry

The retail and e-commerce segment dominated the largest share of revenue in the Counterfeit Money Detection Market, accounting for approximately 32% in 2023, and is expected to witness substantial growth from 2024 to 2032. The increasing volume of cash transactions in physical retail stores, combined with the surge in digital payments for e-commerce, has heightened the need for advanced counterfeit detection solutions. Brick-and-mortar retailers rely on sophisticated banknote authentication technologies such as ultraviolet (UV), infrared (IR), and magnetic ink detection to prevent fraudulent transactions. Meanwhile, e-commerce platforms are integrating AI-driven verification tools to enhance payment security and detect counterfeit transactions. The rise of omnichannel retailing and cross-border trade further fuels demand for counterfeit detection systems, as businesses seek to safeguard their financial operations. Additionally, government regulations and increasing counterfeit threats are pushing retailers to adopt cutting-edge fraud prevention technologies to ensure consumer trust and secure financial transactions.

Counterfeit Money Detection Market Regional Outlook:

North America dominated the largest share of revenue in the Counterfeit Money Detection Market, accounting for approximately 40% in 2023, driven by the region's strong regulatory framework, advanced financial infrastructure, and high adoption of counterfeit detection technologies. The presence of major financial institutions, retail chains, and law enforcement agencies has fueled the demand for sophisticated authentication systems, including ultraviolet (UV) and infrared (IR) detectors, currency validators, and AI-powered fraud detection solutions. The increasing circulation of counterfeit banknotes and rising digital fraud cases have prompted businesses and banks to invest in advanced security measures. Additionally, government initiatives to enhance banknote security features and combat financial fraud contribute to the market’s growth. The expansion of e-commerce and self-checkout kiosks further accelerates the demand for counterfeit detection solutions, ensuring transaction security. With continuous technological advancements and growing awareness, North America is expected to maintain its leading position in the counterfeit money detection market through 2032.

The Asia-Pacific segment is the fastest-growing in the Counterfeit Money Detection Market over the forecast period 2024-2032, driven by rapid economic growth, increasing cash transactions, and rising concerns over counterfeit currency circulation. Countries such as China, India, and Indonesia experience high cash dependency, making them prime targets for counterfeiters. Governments in the region are implementing stricter regulations and introducing enhanced security features in banknotes to combat counterfeiting. Additionally, the growing adoption of digital payment systems and self-checkout machines in retail and e-commerce sectors is increasing the demand for counterfeit detection solutions. The expansion of banking networks and financial institutions across emerging markets further fuels investments in advanced currency authentication technologies, including ultraviolet (UV), infrared (IR), and AI-based systems. With continuous technological advancements and increased awareness, Asia-Pacific is expected to witness significant growth in counterfeit money detection solutions throughout the forecast period.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

Some of the Major Players in Counterfeit Money Detection Market along with Products:

-

Crane Payment Innovations (USA) – Currency validation and cash management solutions

-

Glory Ltd. (Japan) – Cash automation technologies, banknote counters, and sorters

-

Cassida Corporation (USA) – Currency counters, counterfeit detectors, and cash handling solutions

-

Japan Cash Machine Co., Ltd. (Japan) – Banknote recyclers, coin sorters, and counterfeit detection systems

-

Accubanker (USA) – UV, IR, and multi-currency counterfeit detection machines

-

DRI Mark Products Inc. (USA) – Counterfeit detection pens, UV detectors, and authentication tools

-

Innovative Technology Ltd. (UK) – Banknote validators, coin recyclers, and cash-handling equipment

-

Cummins Allison Corp. (USA) – Currency counters, coin sorters, and counterfeit detection systems

-

Semacon Business Machines, Inc. (USA) – Banknote counters, coin sorters, and counterfeit detection solutions

-

Fraud Fighter (USA) – Security marking solutions and forensic counterfeit detection devices

-

Royal Sovereign International Inc. (South Korea) – Currency counters, counterfeit detectors, and cash handling machines

-

Magner International (USA) – Bill counters, sorters, and counterfeit detection devices

-

Giesecke+Devrient (Germany) – Banknote processing and counterfeit detection systems

-

Kisan Electronics (South Korea) – Banknote fitness sorters, counterfeit detectors, and counting machines

List of Suppliers who provide raw material and component in Counterfeit Money Detection Market

-

Zhejiang Nanxing Technology Co., Ltd. (China)

-

Easycount Group Co., Limited (China)

-

Suzhou Kobotech Trading Co., Ltd. (China)

-

Zhejiang Chuanwei Electronic Technology Co., Ltd. (China)

-

EB International Group Limited (China)

-

Crane Payment Innovations (USA)

-

Glory Ltd. (Japan)

-

Cassida Corporation (USA)

-

Japan Cash Machine Co., Ltd. (Japan)

-

Accubanker (USA)

-

DRI Mark Products Inc. (USA)

-

Innovative Technology Ltd. (UK)

-

Semacon Business Machines, Inc. (USA)

-

Royal Sovereign International Inc. (South Korea)

-

Fraud Fighter (USA)

Recent Development:

-

On November 26, 2024, Crane Payment Innovations (CPI) announced the grand opening of its first Depot Service Center in Mt. Prospect, IL, allowing customers to send CPI components and Cummins Allison products for servicing. This milestone enhances service flexibility by offering centralized repairs, maintenance, and expert support from CPI’s skilled technicians and engineers.

-

On January 9, 2025, Glory was confirmed as the global leader in retail cash recycling solutions by RBR Data Services, holding a 44% market share globally (excluding Japan) and 68% including Japan. The company continues to enhance retail cash automation with its CASHINFINITY recyclers and UBIQULAR digital services.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 3.55 Billion |

| Market Size by 2032 | USD 5.46 Billion |

| CAGR | CAGR of 4.90% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Coin Currency Counters, Currency Sorters, Currency Detectors, Pens) • By Technology(Ultraviolet, Infrared, Magnetic, Watermark, Microprint) • By Application(Kiosks, Self-checkout Machines, Gaming Machines, Vehicle Parking Machines, Automatic Fare Collection Machines, Vending Machines) • By End Use Industry(Retail & e-commerce, BFSI, Gaming, Transportation, Hospitality and tourism, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Crane Payment Innovations (USA), Glory Ltd. (Japan), Cassida Corporation (USA), Japan Cash Machine Co., Ltd. (Japan), Accubanker (USA), DRI Mark Products Inc. (USA), Innovative Technology Ltd. (UK), Cummins Allison Corp. (USA), Semacon Business Machines, Inc. (USA), Fraud Fighter (USA), Royal Sovereign International Inc. (South Korea), Magner International (USA), Giesecke+Devrient (Germany), Kisan Electronics (South Korea). |