Industrial Cooking Fire Protection System Market Overview:

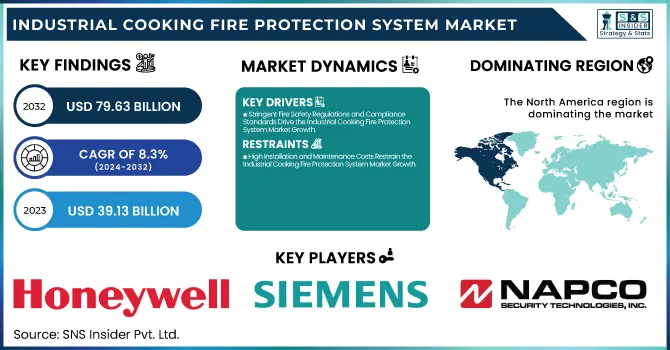

The Industrial Cooking Fire Protection System Market Size was valued at USD 39.13 Billion in 2023 and is expected to reach USD 79.63 Billion by 2032 and grow at a CAGR of 8.3% over the forecast period 2024-2032. The Market is growing due to rising fire safety concerns in commercial kitchens. Stringent regulations like NFPA 96, along with increasing restaurant and food processing units, drive demand for advanced fire suppression technologies. Innovations in automatic suppression systems, smart detectors, and eco-friendly extinguishing agents enhance safety and efficiency. Government initiatives and IoT-enabled solutions further boost adoption. Leading players invest in R&D for cost-effective solutions, ensuring compliance and reliability. While North America and Europe dominate the market, Asia-Pacific is rapidly expanding due to the booming food service sector and growing awareness of fire safety.

To Get more information on Industrial Cooking Fire Protection System Market - Request Free Sample Report

Industrial Cooking Fire Protection System Market Dynamics

Key Drivers:

-

Stringent Fire Safety Regulations and Compliance Standards Drive the Industrial Cooking Fire Protection System Market Growth

Governments and regulatory bodies worldwide enforce strict fire safety standards, such as NFPA 96, OSHA, and UL 300, to minimize fire hazards in commercial kitchens. Compliance with these regulations is mandatory for restaurants, hotels, and food processing facilities, leading to a significant demand for advanced fire suppression and detection systems. Authorities impose severe penalties for non-compliance, pushing businesses to adopt automatic fire suppression solutions, flame detectors, and IoT-enabled monitoring systems.

Additionally, insurance companies often mandate fire protection measures, further encouraging market adoption. The increasing frequency of kitchen fires due to high-temperature cooking, oil-based equipment, and electrical faults reinforces the need for fire protection measures. As a result, manufacturers continue investing in R&D to enhance the reliability and cost-effectiveness of these systems. While North America and Europe lead due to strict regulatory enforcement, emerging markets in Asia-Pacific are rapidly adopting fire safety measures, driven by urbanization and a growing food service sector.

Restrain:

-

High Installation and Maintenance Costs Restrain the Industrial Cooking Fire Protection System Market Growth

The Industrial Cooking Fire Protection System Market is a high initial cost of installation and ongoing maintenance expenses. Advanced fire suppression systems, including automatic wet chemical extinguishers, gas-based suppression solutions, and intelligent fire alarm systems, require significant capital investment. Small and medium-sized enterprises (SMEs) in the food service industry often struggle to afford these systems, leading to lower adoption rates.

Additionally, periodic inspections, maintenance, and refilling of fire suppression agents add to operational costs. Many commercial kitchens operate on tight budgets and prioritize cost-cutting measures, delaying or avoiding investment in comprehensive fire protection solutions. The need for skilled professionals to install, test, and maintain these systems further increases expenses, particularly in developing regions where fire safety awareness and regulatory enforcement are still evolving. Retrofitting existing kitchens with modern fire protection equipment can be complex and costly, discouraging businesses from upgrading.

Opportunities:

-

Advancements in IoT-Enabled Smart Fire Detection and Suppression Systems Create Growth Opportunities in the Market

The integration of IoT-enabled fire protection solutions is emerging as a major growth opportunity in the Industrial Cooking Fire Protection System Market. Smart fire suppression systems equipped with real-time monitoring, AI-driven analytics, and wireless connectivity enhance safety and efficiency by providing instant alerts, predictive maintenance, and remote-control capabilities. IoT-based fire alarms and detectors can transmit data to centralized platforms, allowing facility managers to analyze fire risks, track system performance, and receive early warnings before incidents occur. Cloud-based fire safety solutions further enable remote access and automatic system diagnostics, improving operational reliability.

Many leading manufacturers are investing in smart sensors, automated fire suppression units, and AI-based risk assessment tools to modernize fire protection systems. The increasing adoption of cloud computing, machine learning, and advanced data analytics is expected to revolutionize fire safety management in commercial kitchens. Additionally, government initiatives promoting smart building technologies and digital transformation in fire safety regulations are further driving market adoption.

Challenge:

-

Complex Retrofitting of Existing Kitchen Facilities Poses a Major Challenge to Market Expansion

The retrofitting of existing commercial kitchens with modern fire protection systems presents a significant challenge in the Industrial Cooking Fire Protection System Market. Many food service establishments, especially older restaurants, hotels, and food processing units, were built without considering advanced fire suppression technologies, making the installation of modern fire safety systems complicated and costly. The structural constraints of older buildings, limited space, and outdated electrical systems make it difficult to integrate automatic suppression solutions, high-tech fire alarms, and smart detection devices without major modifications.

Additionally, compliance with evolving fire safety regulations often requires businesses to upgrade their ventilation systems, cooking equipment, and exhaust hoods, further increasing costs and complexity. Downtime during retrofitting also affects business operations, discouraging many owners from adopting modern solutions. In many developing markets, a lack of technical expertise and awareness regarding advanced fire protection systems further hampers retrofitting efforts. Overcoming this challenge requires flexible, space-efficient fire suppression solutions that can be seamlessly integrated into existing kitchen setups.

Industrial Cooking Fire Protection System Market Segments Analysis

By Product Type

The Detector Type segment held the largest market share of 42% in 2023, driven by the increasing demand for advanced fire detection technologies in commercial kitchens, restaurants, and food processing facilities. Fire detectors, including heat detectors, flame detectors, and smoke sensors, play a crucial role in preventing fire hazards by providing early warnings and rapid response mechanisms. Several leading companies have launched innovative fire detection solutions to enhance fire safety in industrial cooking environments.

For instance, Honeywell International Inc. introduced its VESDA-E VEP aspirating smoke detector, designed to offer high-sensitivity smoke detection in kitchen exhaust ducts and cooking areas, reducing fire risks significantly. Similarly, Siemens AG launched the Cerberus PRO fire detection system, incorporating intelligent multi-criteria sensors to detect both heat and smoke variations, improving detection accuracy.

The Fire Alarm Type segment is projected to witness the highest CAGR of 9.33% during the forecasted period, fueled by technological advancements, increasing fire incidents, and regulatory compliance mandates in the foodservice industry. Fire alarms play a critical role in industrial kitchens by promptly alerting staff and triggering automatic suppression systems, minimizing fire damage and enhancing safety. The growing adoption of wireless, addressable, and AI-enabled fire alarms is revolutionizing fire protection in commercial kitchens

For example, Johnson Controls International plc launched the Simplex 4100ES fire alarm system, featuring networked monitoring and advanced voice evacuation functions, ensuring faster emergency response. Likewise, Carrier Global Corporation introduced the Edwards EST4 intelligent fire alarm system, offering enhanced scalability and IoT integration for improved kitchen safety. The integration of AI-driven analytics and cloud-based alarm monitoring has significantly improved fire safety in industrial cooking facilities.

By Connectivity

The Wired segment held the largest market share of 52% in 2023, driven by its reliability, stability, and compliance with industrial safety standards in commercial kitchens, restaurants, and food processing facilities. Wired fire protection systems, including fire alarms, smoke detectors, and suppression control units, are preferred for their consistent power supply, minimal signal interference, and long-term durability in high-risk environments. Leading manufacturers are continuously innovating wired fire protection solutions to enhance operational safety.

For instance, Robert Bosch GmbH introduced the AVENAR fire detection system, a hardwired, networked solution featuring advanced multi-criteria sensors and high-speed communication protocols for seamless fire detection in commercial kitchens. Similarly, Eaton Corporation Plc launched its FX Series wired fire alarm system, designed to offer real-time monitoring, rapid response capabilities, and compliance with stringent fire safety regulations like NFPA 96.

The Wireless segment is expected to grow at the highest CAGR of 8.9% during the forecast period, fueled by technological advancements, ease of installation, and growing adoption of smart fire safety solutions. Wireless fire protection systems, including wireless fire alarms, IoT-enabled smoke detectors, and remote-controlled suppression systems, are gaining traction in the food service industry due to their flexibility, scalability, and cost-effectiveness.

For example, Siemens AG launched the Cerberus PRO Wireless Fire Detection System, offering battery-powered detectors with encrypted wireless communication, ensuring seamless integration into modern commercial kitchens. Likewise, Halma plc introduced its Apollo XPander wireless fire alarm system, designed for fast deployment in food service facilities where wired installations are challenging.

By End-Use

The Restaurants and Hotels segment accounted for the largest market share of 49% in 2023, driven by the rising number of commercial kitchens, stringent fire safety regulations, and increasing awareness of fire protection measures. Restaurants and hotels operate high-temperature cooking equipment, deep fryers, and open flames, making them highly vulnerable to kitchen fires caused by grease buildup, electrical faults, or human error. To address these risks, industry leaders are introducing advanced fire suppression solutions tailored for the hospitality sector.

For example, Johnson Controls International plc launched its ANSUL R-102 Restaurant Fire Suppression System, designed to detect and extinguish grease fires using wet chemical agents while meeting NFPA 96 and UL 300 standards. Similarly, Kidde Fire Systems introduced the WHDR Wet Chemical Suppression System, specifically engineered to protect hotel kitchens, ventilation ducts, and exhaust hoods from fire hazards.

The Food and Beverage segment is projected to grow at the highest CAGR of 8.88% during the forecast period, driven by the expansion of food processing plants, stringent hygiene and fire safety regulations, and automation in food production facilities. Large-scale food production involves high-risk processes such as frying, baking, roasting, and packaging, which increase the likelihood of fire incidents due to oil ignition, overheating equipment, and combustible dust accumulation. To mitigate these risks, companies are adopting advanced fire suppression technologies that integrate with automated food processing equipment.

Additionally, Eaton Corporation Plc introduced its xDetect Multi-Sensor Fire Alarm System, which uses AI-driven analytics and heat mapping to identify potential fire hazards in food processing facilities. The increasing adoption of wireless fire alarms, smart fire suppression systems, and cloud-based monitoring solutions is revolutionizing fire safety in the food and beverage industry.

Industrial Cooking Fire Protection System Market Regional Landscape

In 2023, North America emerged as the dominant region in the Industrial Cooking Fire Protection System Market, accounting for an estimated 35% market share. This dominance is attributed to stringent fire safety regulations, increasing adoption of smart fire protection technologies, and the presence of leading fire safety solution providers. Regulatory bodies such as the National Fire Protection Association (NFPA) and Occupational Safety and Health Administration (OSHA) have implemented strict guidelines like NFPA 96, which mandates the use of fire suppression systems, exhaust hood protection, and grease removal mechanisms in commercial kitchens.

For instance, Honeywell International Inc. launched its Xtralis VESDA-E VEP aspirating smoke detection system, designed for early fire detection in high-risk cooking environments.

The Asia-Pacific region is projected to be the fastest-growing market, with an estimated CAGR of 9.8% during the forecast period. This growth is driven by rapid urbanization, increasing food service industry expansion, and growing awareness of fire safety regulations in emerging economies like China, India, and Southeast Asian countries. The rising number of commercial kitchens, cloud kitchens, and food processing plants has heightened the need for advanced fire suppression systems to mitigate fire hazards. Governments in the region are also tightening fire safety norms to ensure compliance with international standards.

For example, China has enforced GB 50016-2014, a national fire protection standard that mandates stringent fire safety measures in commercial kitchens and food manufacturing plants. Several companies are capitalizing on this growing market by introducing cost-effective and technologically advanced fire protection systems.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Some of the major players in the Industrial Cooking Fire Protection System Market are:

-

Honeywell International Inc. (Honeywell Notifier Fire Alarm Systems, Honeywell Xtralis Aspirating Smoke Detection)

-

Siemens AG (Siemens Cerberus PRO Fire Detection System, Siemens Sinorix Gas Suppression System)

-

Napco Security Technologies, Inc. (Napco FireLink Fire Alarm Control Panel, Napco StarLink Fire Communicators)

-

Robert Bosch GmbH (Bosch AVENAR Fire Alarm Systems, Bosch Fire Detection Cameras)

-

Johnson Controls International plc (ANSUL R-102 Restaurant Fire Suppression System, TYCO Sprinkler Systems)

-

Hochiki Corporation (Hochiki Fire Alarm Panels, Hochiki Flame Detectors)

-

Carrier Global Corporation (Kidde Fire Suppression Systems, Edwards Fire Alarm Systems)

-

Eaton Corporation Plc (Eaton Fire Alarm Systems, Eaton Emergency Lighting Systems)

-

Nittan Company, Limited (Nittan Evolution Fire Detectors, Nittan Fire Alarm Control Panels)

-

Halma plc (Apollo Fire Detectors, FFE Fireray Beam Smoke Detectors)

-

Rotarex (Rotarex FireDETEC Automatic Fire Suppression, Rotarex Inert Gas Fire Suppression Systems)

-

Clarke (Clarke Fire Protection Diesel Pump Systems, Clarke Fire Pump Controllers)

-

Evenbound (Evenbound Fire Protection Monitoring Software, Evenbound Smart Suppression Solutions)

-

M I Fire Protection Services Ltd (M I Fire Restaurant Fire Suppression Systems, M I Fire Alarm Maintenance Services)

-

Chubb Fire & Security (Chubb Fire Extinguishing Systems, Chubb Alarm and Detection Systems)

-

Kidde Fire Systems (Kidde WHDR Wet Chemical Suppression System, Kidde FM-200 Clean Agent Fire Suppression)

Recent Trends

-

In February 2024, Siemens integrated Generative Artificial Intelligence (AI) into its predictive maintenance solutions, enhancing the efficiency of industrial fire protection systems. The AI-driven approach improved real-time monitoring, fault detection, and system diagnostics, reducing fire hazards in industrial cooking environments.

-

In March 2024, Hochiki Europe introduced advanced fire detectors designed to meet UL268 7th Edition compliance, strengthening fire safety measures in industrial kitchens. The new detectors featured enhanced smoke and heat detection capabilities, reducing false alarms in high-heat environments such as commercial cooking spaces.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 39.13 Billion |

| Market Size by 2032 | USD 79.63 Billion |

| CAGR | CAGR of 8.3% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Fire Alarm Type, Detector Type, icon_6) • By Connectivity (Wired, Wireless, icon_7) • By End Use (Restaurants and Hotels, Food and Beverage, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Honeywell International Inc., Siemens AG, Napco Security Technologies, Inc., Robert Bosch GmbH, Johnson Controls International plc, Hochiki Corporation, Carrier Global Corporation, Eaton Corporation Plc, Nittan Company, Limited, Halma plc, Rotarex, Clarke, Evenbound, M I Fire Protection Services Ltd, Chubb Fire & Security, Kidde Fire Systems |