Flame Detector Market Scope & Overview:

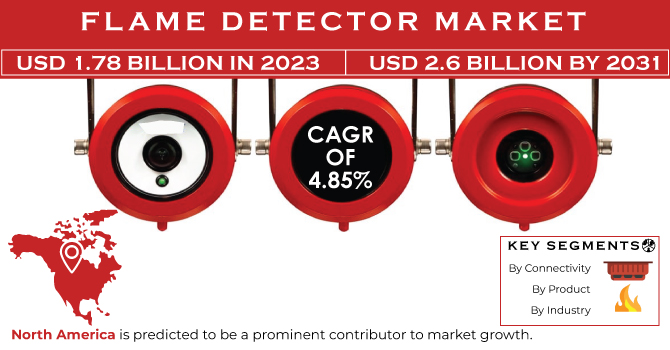

The Flame Detector Market size was estimated at USD 1.78 billion in 2023 and is expected to reach USD 2.6 billion by 2031 at a CAGR of 4.85% during the forecast period of 2024-2031.

Flame detectors are being used in a wide range of situations, including industrial heating and drying systems, industrial gas turbines, and petrochemical oil and gas plants. They lessen risk in a particular setting by recognizing an unwelcome flame soon. Increasing safety awareness across several industrial verticals, including manufacturing, oil and gas, and mining, among others, is driving the expansion of the flame detector market. The increasing discovery of new mining locations increases the demand for flame detectors. Furthermore, newly developed safety laws for hazardous regions are more strict, and the requirement for comprehensive flame detector solutions across varied sectors is projected to drive market expansion. Communication, video image processing, and data storage technology have all advanced in recent years. have emerged quickly, are widely available, and are simple to deploy. Over the forecast period, they are likely to contribute to the development of the next generation of flame detection systems and products.

To get more information on Flame Detector Market - Request Free Sample Report

MARKET DYNAMICS

DRIVERS

-

Government policies, rules, and initiatives

Flame detection is a risk avoidance and management method that aids in the reduction and avoidance of fire risk in both public and private facilities. It requires the collaboration of government custodians and renters, private building owners, and local fire departments. Fire safety and protection policies and regulations are often country-specific and differ from one another. They are, nevertheless, intended to increase asset and human safety. The National Fire Protection Association's Standard 86, for example, indicates that flame detectors are not suitable for up to 1400 degrees Fahrenheit. This is because, because the air/fuel mixture is combustible, it will burn above that temperature, and the combustor temperature will be high enough to detect the radiation flame.

As a result of growing fire threats, governments around the world are eager to implement steps to decrease fire-related losses. As a result, higher installations of flame safety systems contribute to the growth of the flame detector market.

RESTRAIN

-

High initial costs, false alarms, and a lack of awareness

Advanced flame detection systems can be costly to buy, install, and maintain, especially for small and medium-sized businesses. Certain conditions, like dust, dampness, or other non-hazardous causes, might cause false alerts, undermining the systems' confidence. In some industries, there may be a lack of understanding regarding the benefits of flame detectors, resulting in slower adoption rates.

OPPORTUNITY

-

Technological Advances, Emerging Markets

-

Integration of flame detectors with the Internet of Things (IoT) can provide real-time monitoring and remote control, broadening their potential uses.

CHALLENGES

-

Harsh environments and maintenance needs

Flame detectors are frequently used in hazardous locations such as offshore oil rigs and chemical facilities, where severe temperatures, corrosive compounds, and other conditions might affect their operation. The efficient operation of flame detectors necessitates frequent maintenance and calibration, which can be costly.

IMPACT OF RUSSIA-UKRAINE WAR

Uncertainty in the Market Geopolitical conflicts can create an uncertain environment, influencing investment decisions and company planning. Companies may postpone or scale back initiatives, particularly those involving safety equipment such as flame detectors, until the situation is clarified. Changes in Demand Demand for flame detectors may fluctuate depending on the specific industries and regions affected by the war. For example, if specific businesses or locations are more vulnerable to fires as a result of the conflict or its aftermath, the demand for flame detectors in those areas may rise.

IMPACT OF ONGOING RECESSION

Capital Spending Cuts During a recession, firms frequently lower capital expenditures and tighten their budgets. This could result in postponed or reduced investments in safety equipment such as flame detectors. Businesses may prioritize necessary expenditures above new safety improvements. Effects vary by industry. The impact of a recession varies by industry. Some industries that are more vulnerable to economic downturns may reduce non-essential spending, such as safety modifications. Despite economic constraints, industries with significant safety demands, such as oil and gas, chemicals, and manufacturing, may continue to invest in safety equipment.

Delays in Project Completion Project delays and cancellations can occur during a recession. Due to economic uncertainties, construction projects, facility expansions, and other operations involving the installation of flame detectors may be delayed.

KEY MARKET SEGMENTATION

By Product

-

Single UV

-

Single IR

-

Dual UVIR

-

Triple IR

-

Multi IR

By Connectivity

-

Wired

-

Wireless

By Industry

-

Oil & Gas

-

Energy & Power

-

Chemicals

-

Aerospace & Defense

-

Logistics

-

Mining

-

Automotive

-

Pharmaceuticals

-

Marine

-

Other Industries

REGIONAL COVERAGE

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

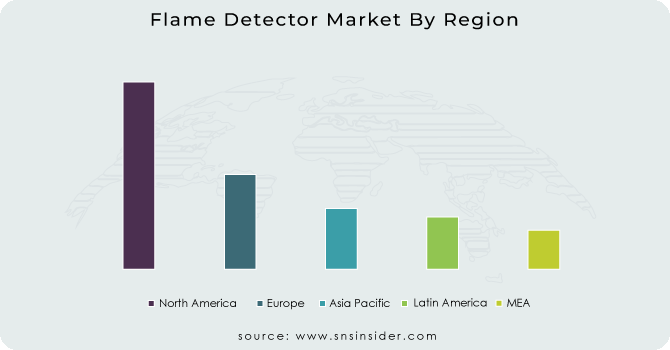

REGIONAL ANALYSES

North America is predicted to be a prominent contributor to market growth. In comparison to Canada, the United States plays a significant role in expanding regional demand. The country is seeing increased demand from practically all Industry categories, particularly the oil and gas, energy, and power sectors. Furthermore, some of the market's key vendors are located in the region, which assists the market's expansion. Honeywell International Inc., Emerson Electric Co., United Technologies Corporation, and Spectrex Inc. are among them.

Additionally, the country boasts one of the world's most active mining industries. According to the Mining Association of Canada, Canada ranks among the top five members in the world in terms of the production of 13 main minerals and metals, including potash, uranium, nickel, cobalt, aluminum, diamonds, titanium, and gold. All of the aforesaid changes in both countries are projected to support regional market growth.

Need any customization research on Flame Detector Market - Enquiry Now

Key Players

The major key players are Johnson Controls, SiemensMSA, Honeywell, Halma, Hochiki, Carrier Global, Emerson Electric, Robert BoschDraeger, Teledyne Technologies, Nohmi Bosai and other players

Johnson Controls-Company Financial Analysis

RECENT DEVELOPMENT

Bosch: In August 2022, Bosch unveiled the AVENAR all-in-one 4000, which combines alarm and detection in a single device. The new AVENAR all-in-one 4000 is suitable for interior use and may be mounted on the wall or ceiling, with surface and flush cabling options. Furthermore, the fire alarm panel software sounder and flasher can be installed separately.

Siemens Smart Infrastructure: In June 2021, Siemens Smart Infrastructure debuted the Siemens R-type Fire Detection System 2.0, which provides faster and more precise fire detection. Siemens plans to expand its presence in the domestic fire detection market with the new SRF 2.0, which was developed and built in Korea. SRF 2.0 also includes a positively adjustable and integrated offering of fire alarm panels and transponder panels, as well as analog smoke and heat detectors, transponder modules, built-in isolators, and automatic self-diagnostic functions that can be efficiently programmed via smartphone software.

| Report Attributes | Details |

| Market Size in 2023 | US$ 1.78 Bn |

| Market Size by 2031 | US$ 2.6 Bn |

| CAGR | CAGR of 4.85% From 20234 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Single UV, Single IR, Dual UVIR, Triple IR, Multi IR) • By Connectivity (Wired, Wireless) • By Industry (Oil & Gas, Energy & Power, Chemicals, Aerospace & Defense, Logistics, Mining, Automotive, Pharmaceuticals, Marine, Other Industries) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Johnson Controls, SiemensMSA, Honeywell, Halma, Hochiki, Carrier Global, Emerson Electric, Robert BoschDraeger, Teledyne Technologies, Nohmi Bosai |

| Key Drivers | • Government policies, rules, and initiatives |

| Market Restraints | • High initial costs, false alarms, and a lack of awareness |