Industrial Diesel Turbocharger Market Report Scope & Overview:

Get More Information on Industrial Diesel Turbocharger Market - Request Sample Report

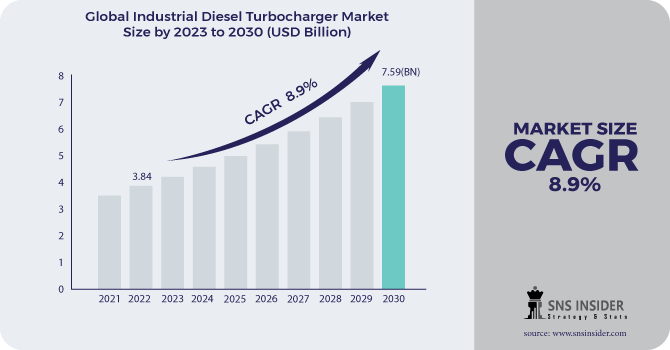

The Industrial Diesel Turbocharger Market Size was valued at USD 3.80 Billion in 2023 and is expected to reach USD 7.16 Billion by 2032 and grow at a CAGR of 7.3% over the forecast period 2024-2032.

The Industrial Diesel Turbocharger Market has been steady over the past few years and is expected to gain significant growth in the decade ahead. Turbochargers play a vital role in enhancing engine efficiency and performance. They are increasingly important in meeting strict environmental standards and addressing the rising demand for fuel-efficient diesel engines across various industries.

The industrial diesel turbocharger market is growing as demand worldwide for fuel-efficient diesel engines increases globally, especially within the Asia-Pacific region which held up to 45% or more of global market shares in 2023, and this number is on the rise since emerging nations embraced new technology. North America and Europe are also expected to grow steadily, driven by regulatory norms such as Euro VI that demand up to 55% NOx emission reduction. Technological improvements such as VGT adaptation to improve efficiency under changing loads will also add to the momentum. Low-pressure EGR systems, that save 10% in fuel consumption, are gaining acceptance. Turbochargers are becoming increasingly popular in light and heavy-duty vehicles. Over the next decade, turbocharged units are expected to grow by 25%. They offer 15%-20 % fuel efficiency improvements and 10% CO2 emission reductions.

Industrial Diesel Turbocharger Market Dynamics

Key Drivers:

-

Growing Demand for Fuel-Efficient Diesel Engines Across Industries Boosts the Industrial Diesel Turbocharger Market Growth

The rising global emphasis on fuel efficiency is significantly driving the growth of the industrial diesel turbocharger market. Turbochargers play a pivotal role in enhancing the performance and efficiency of diesel engines by optimizing air intake, resulting in reduced fuel consumption and emissions. Industries such as automotive, construction, and marine are witnessing a surge in the adoption of turbocharged diesel engines to comply with stringent emission regulations and reduce operational costs. For instance, advancements like variable geometry turbochargers (VGT) and low-pressure Exhaust Gas Recirculation (EGR) systems enable diesel engines to achieve fuel consumption reductions of up to 10%, meeting the increasing demand for cost-effective and eco-friendly solutions.

Additionally, as emerging economies in Asia-Pacific and Latin America industrialize, the demand for efficient engines to power heavy-duty equipment is expanding rapidly, contributing to the growing market adoption of diesel turbochargers.

-

Stringent Emission Regulations Drive Innovation and Adoption of Advanced Turbocharger Technologies in Diesel Engines

The implementation of stringent global emission standards is a critical driver for the adoption of advanced turbocharger technologies in diesel engines. Regulations like the Euro VI in Europe and Tier 4 in the United States mandate substantial reductions in harmful pollutants such as nitrogen oxides (NOx) and particulate matter. These standards have necessitated the development and deployment of high-performance turbochargers capable of optimizing engine combustion and reducing emissions. Technologies such as VGT and twin-scroll turbochargers have become integral to meeting these stringent requirements by improving engine airflow and efficiency. Furthermore, the integration of turbochargers with low-pressure EGR systems has emerged as a popular solution, enabling diesel engines to maintain performance while lowering NOx emissions by up to 55%. This regulatory push is compelling industries to invest in turbocharged diesel engines, spurring innovation and growth in the turbocharger market.

Restrain:

-

High Initial Costs and Complexity of Turbocharger Systems Limit Widespread Market Adoption

The high initial costs and technological complexity of turbocharger systems pose a significant restraint to the industrial diesel turbocharger market. Advanced turbocharger technologies, such as variable geometry turbochargers (VGT) and twin-scroll systems, require high-grade materials and precise engineering to ensure durability and performance under extreme conditions. These factors contribute to elevated production and procurement costs, making turbocharged diesel engines less accessible for small and medium enterprises, particularly in cost-sensitive markets.

High initial costs and technological complexity limit the adoption of industrial diesel turbochargers. Advanced systems like Variable Geometry Turbochargers (VGT) increase production costs by up to 30% compared to traditional models. Maintenance requires specialized tools, further raising operational expenses. Smaller enterprises, especially in emerging markets, face financial barriers due to upfront costs 15%-20% higher than conventional systems. Cost sensitivity in these regions often prioritizes traditional technologies over fuel-efficient options.

Additionally, compliance with stringent regulations like Euro VI, which demand significant nitrogen oxide emission reductions, escalates implementation and operational costs, slowing the widespread adoption of advanced turbocharger technologies.

Industrial Diesel Turbocharger Market Segments Analysis

By Sales Channel

In 2023, the OEM segment accounted for a dominant 69.00% market share in the industrial diesel turbocharger market. OEMs play a crucial role in integrating turbochargers into diesel engines during production, ensuring performance optimization and compliance with stringent emission standards like Euro VI and Tier 4. Companies such as Garrett Motion and BorgWarner have been at the forefront of product innovation in this segment. For instance, Garrett's advancements in variable geometry turbochargers (VGT) have been tailored for heavy-duty applications, enhancing fuel efficiency and reducing NOx emissions.

The Aftermarket segment is projected to grow at the fastest CAGR of 8.92% during the forecast period, driven by increasing replacement and retrofit demands. As global diesel engine fleets age, the need for cost-effective maintenance solutions has surged. Companies like Cummins and Honeywell are expanding their aftermarket portfolios with retrofit-ready turbochargers and rebuild kits designed for extended engine life and improved efficiency. Cummins, for example, launched a line of aftermarket VGTs in 2023 to cater to diverse engine models, enabling older diesel engines to comply with new emission regulations.

By End-User

The Marine segment accounted for the largest market share, 27% in 2023, within the industrial diesel turbocharger market due to the need of maritime industries for heavy-duty, power-efficient propulsion systems. Turbochargers are very essential in the marine engines because they have high power output and high fuel efficiency, which are indispensable in long-haul shipping and large vessels. Innovative leaders in this space have been ABB and MAN Energy Solutions. ABB's TPL-C turbochargers, aimed at low-speed two-stroke marine engines, will be long-lasting and energy-efficient for long periods of operational hours. MAN, Energy Solutions has introduced the TCT series, featuring high-pressure turbochargers designed for ecological compliance with IMO Tier III rules.

The Agricultural Equipment segment is expected to grow at the fastest CAGR of 9.22%, fuelled by the modernization of farming machinery in the pursuit of productivity and environmental demands. Turbocharged engines in tractors, harvesters, and other agricultural vehicles improve performance and lower fuel consumption, which fits into the requirements of farmers looking for cheaper alternatives. John Deere and Mahindra & Mahindra are examples of companies that have innovated in this field. Recently, John Deere unveiled its turbocharged Power Tech engines that boast increased torque and fuel efficiency for heavy-duty agricultural applications. Mahindra also brought turbo-integrated solutions for its Arjun NOVO tractors to the emerging markets, which were advanced but affordable systems.

Industrial Diesel Turbocharger Market Regional Overview

The Asia Pacific region dominated the industrial diesel turbocharger market in 2023, holding approximately 40% of the market share. This dominance is driven by rapid industrialization, urbanization, and infrastructure development in countries like China, India, and Southeast Asia. The need for fuel-efficient and emission-compliant engines in the construction, mining, and shipping sectors provides added impetus for further growth. China also follows up on advanced turbocharging due to the regulation on the manufacture and export of heavy-duty, while India utilizes turbochargers for agricultural machinery efficiency. Several other global automotive suppliers such as Garrett Motion and BorgWarner are also growing their operations in the area. Governments have also been shoving through laws and policies, as in the case of “Make in India” the initiative that promotes the adoption of sustainable technologies.

In 2023, North America emerged as the fastest-growing region in the industrial diesel turbocharger market, with an estimated CAGR of 9.18% from 2024 to 2032, shifting towards advanced diesel engines for energy production, investments in shipbuilding, and marine industries. The U.S., Canada, and Mexico are in a unique position to lead that growth, driven by a demand for clean and efficient technologies for industries ranging from construction to mining to transportation. Leading organizations like Garrett Motion and BorgWarner are augmenting their product range with novel turbocharging technologies for heavy-duty applications. In addition, stringent government regulations to decrease emissions are driving the demand for turbochargers.

.png)

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players in Industrial Diesel Turbocharger Market

Some of the major players in the Industrial Diesel Turbocharger Market are:

-

Honeywell International Inc. (Honeywell Turbocharger GTDI, Honeywell Garrett Turbochargers)

-

BorgWarner Inc. (BorgWarner EFR Turbocharger, BorgWarner VTT Turbochargers)

-

Cummins Inc. (Cummins Turbocharger ISX, Cummins Holset Turbocharger)

-

Mitsubishi Heavy Industries Ltd. (Mitsubishi TD Series Turbochargers, Mitsubishi MHI Turbochargers)

-

IHI Corporation (IHI Turbochargers for Diesel Engines, IHI Marine Turbocharger)

-

Continental AG (Continental Turbocharger Solutions, Continental Wastegate Turbochargers)

-

Garrett Motion Inc. (Garrett GT Series Turbochargers, Garrett Turbo for Diesel Engines)

-

Bosch Mahle Turbo Systems GmbH & Co. KG (Bosch Mahle Diesel Turbocharger, Bosch Mahle Dual-Stage Turbo)

-

Turbo Energy Private Limited (Turbo Energy Diesel Turbochargers, Turbo Energy Turbochargers for Industrial Applications)

-

Precision Turbo & Engine Inc. (Precision Turbochargers for Diesel Engines, Precision Turbo & Engine T4 Turbocharger)

-

Rotomaster International (Rotomaster Turbochargers for Diesel Engines, Rotomaster Industrial Turbochargers)

-

Weifang Fuyuan Turbocharger Co., Ltd. (Fuyuan Turbochargers for Diesel Engines, Fuyuan High-Performance Turbochargers)

-

Hunan Tyen Machinery Co., Ltd. (Tyen Turbochargers for Diesel Engines, Tyen Marine Turbochargers)

-

Komatsu Ltd. (Komatsu Turbochargers for Construction Equipment, Komatsu Diesel Turbochargers)

-

ABB Ltd. (ABB Turbocharging for Diesel Engines, ABB Marine Turbochargers)

-

Caterpillar Inc. (Caterpillar 3400 Series Turbochargers, Caterpillar Diesel Turbochargers)

-

MTU Friedrichshafen GmbH (MTU Diesel Turbocharger, MTU Turbocharging Solutions)

-

MAN Energy Solutions SE (MAN Diesel Turbochargers, MAN TCR Turbochargers)

-

Wabtec Corporation (Wabtec Turbochargers for Railways, Wabtec Diesel Engine Turbochargers)

-

Cummins Turbo Technologies Ltd. (Cummins Holset Turbochargers, Cummins Turbochargers for Industrial Engines)

Suppliers

-

ArcelorMittal

-

ThyssenKrupp Steel

-

Shaanxi Yanchang Petroleum Group

-

Nippon Steel Corporation

-

United States Steel Corporation

-

Alcoa Corporation

-

POSCO

-

Daewoo International Corporation

-

Sumitomo Metal Mining Co., Ltd.

-

Vallourec

Recent Trends

-

In September 2024, A Cummins-powered Ram had on display a 2700 HP triple-turbo setup in a high-performance demo accompanied by a slow explosion that underlined the immense capabilities of industrial diesel turbochargers. It gave credence to the awesome capacity and efficiency of today's turbocharging systems- much more so for that designed by Cummins.

-

In May 2023, Mitsubishi Heavy Industries (MHI) introduced MGS3100R, a turbocharger for high efficiency in the diesel engine. It marked a monumental technological advancement in turbochargers in increasing fuel efficiency and further cutting industrial emission levels.

-

In April 2023, Garrett Motion launched new products during the Auto Shanghai 2023 event, focusing on the latest turbocharging solutions both for gasoline and diesel engines. These innovations target better performance and efficiency of industrial diesel turbochargers supporting industries requiring high-powered engine solutions.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 3.80 Billion |

| Market Size by 2032 | US$ 7.16 Billion |

| CAGR | CAGR of 7.3 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By End-User (Marine, Power Generation, Agricultural Equipment, Construction Equipment, Railways, Mining Equipment, Others) • By Sales Channel (OEM, Aftermarket) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Honeywell International Inc., BorgWarner Inc., Cummins Inc., Mitsubishi Heavy Industries Ltd., IHI Corporation, Continental AG, Garrett Motion Inc., Bosch Mahle Turbo Systems GmbH & Co. KG, Turbo Energy Private Limited, Precision Turbo & Engine Inc., Rotomaster International, Weifang Fuyuan Turbocharger Co., Ltd., Hunan Tyen Machinery Co., Ltd., Komatsu Ltd., ABB Ltd., Caterpillar Inc., MTU Friedrichshafen GmbH, MAN Energy Solutions SE, Wabtec Corporation, Cummins Turbo Technologies Ltd. |

| Key Drivers | • Growing Demand for Fuel-Efficient Diesel Engines Across Industries Boosts the Industrial Diesel Turbocharger Market Growth • Stringent Emission Regulations Drive Innovation and Adoption of Advanced Turbocharger Technologies in Diesel Engines |

| Restraints | • High Initial Costs and Complexity of Turbocharger Systems Limit Widespread Market Adoption |