Automotive DC-DC Converters Market Report Scope & Overview:

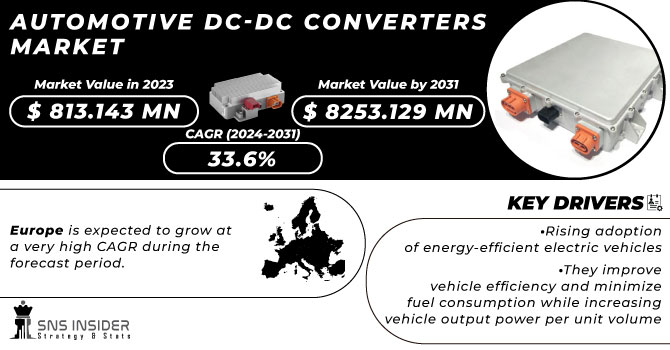

The Automotive DC-DC Converters Market Size was valued at US$ 813.143 million in 2023 expected to reach USD 8253.129 million by 2031 and grow at a CAGR of 33.6% over the forecast period 2024-2031.

The demand for electronic systems such as entertainment and increased safety through the integration of ADAS in modern automobiles is driving market expansion. The growing popularity of electric vehicles, both battery-powered and hybrid, has increased demand for DC-DC converters, as a DC-DC converter is required to convert a 24V or 48V power supply into a 12V power supply in order to assure the safe and dependable operation of onboard electrical equipment. Factors such as variations in global car manufacturing may impede market growth, resulting in an oversupply situation that could harm market participants' financial positions.

Get More Information on Automotive DC-DC Converters Market - Request Free Sample Report

MARKET DYNAMICS:

KEY DRIVERS:

-

Rising adoption of energy-efficient electric vehicles

-

They improve vehicle efficiency and minimize fuel consumption while increasing vehicle output power per unit volume

RESTRAINTS:

-

Regulatory compliance and safety standards vary by region or country

-

These requirements and standards must be followed by DC-DC converter manufacturers

OPPORTUNITIES:

-

Miniaturized DC-DC converter development to achieve high-efficiency and high-speed

-

Miniaturized DC-DC converters have reduced output noise and can operate at higher temperatures

CHALLENGES:

-

Low-quality goods on the black market

THE IMPACT OF COVID-19

The COVID-19 epidemic has had a profound impact on the global automotive industry. Symptoms include disruptions in the export of Chinese parts, disruptions of major products throughout Europe, and closures of mergers in the US. This puts a lot of pressure on the industry which is already facing a declining national demand and which could lead to an increase in merger and acquisition activity. According to industry experts, car sales are likely to fall by 14-22% between Chinese, US, and European markets by 2020. The automotive industry in the US continued to weaken in August and September, while China's car sales. they can continue their recovery as soon as possible. Vehicle exports reached about 2.4 million units in August, an increase of 11.8% according to reports. The simplification of land closures in many European countries coupled with economic recovery packages seems to have begun to benefit the region's automotive industry. The COVID-19 epidemic has led to many changes in the behavior and behavior of car buyers. Digital services and features are easily accepted by people as a way to stay connected, track able, and secure. Increased penetration of car screens will lead to easier integration of many of these digital features. Therefore, the rise of digital technology practices in automobiles, communications, and improved safety features will drive the need for DC-DC converters.

The automotive DC-DC converters market is divided into two segments: commercial vehicles and passenger vehicles. During the forecast period, the passenger car category accounted for the biggest proportion of the automotive DC-DC converters market. Tesla, Honda, Hyundai, and Ford, among others, are producing passenger electric vehicles in order to reduce GHG emissions from the automobile sector. Furthermore, government programmer such as tax breaks for electric car use are raising consumer demand for environmentally friendly automobiles for private and shared mobility, which is driving demand for passenger vehicles. Based on the type of propulsion, the DC-DC automotive conversion market is divided into battery-powered vehicles, fuel cell electric vehicles, and plug-in electric vehicles. The BEV component is estimated to have the largest share and grow at the highest CAGR at the time of forecasting. This is due to the increasing demand for electricity in the automotive sector. In addition, increased environmental awareness, government subsidies, and tax exemptions are expected to lead to an increase in the demand for DC-DC converters in this sector. Industry experts say that, worldwide, countries are converting petrol and diesel cars into electric vehicles. Due to the rapid transition to EVs, some estimates suggest that by 2028, EVs will account for more than 50% of new car sales worldwide. Moreover, in line with the transition to EVs, the development of autonomous vehicles is accelerated. To meet the growing demand for BEVs, a variety of players are developing advanced, integrated DC-DC converters.

The demand for electronic systems such as entertainment and increased safety through the integration of ADAS in modern automobiles is driving market expansion. The growing popularity of electric vehicles, both battery-powered and hybrid, has increased demand for DC-DC converters, as a DC-DC converter is required to convert a 24V or 48V power supply into a 12V power supply in order to assure the safe and dependable operation of onboard electrical equipment. Factors such as variations in global car manufacturing may impede market growth, resulting in an oversupply situation that could harm market participants' financial positions.

KEY MARKET SEGMENTATION:

By Product Type

-

Isolated

-

Non-isolated

By Vehicle Type

-

Passenger Vehicle

By Output Voltage

-

3.3V

-

5V

-

12V

-

15V

-

24V and Above

By Propulsion Type

-

Battery Electric Vehicle

-

Fuel Cell Electric Vehicle

-

Plug-in Hybrid Vehicle

By Input Voltage

-

<40V

-

40–70V

-

>70V

REGIONAL ANALYSIS:

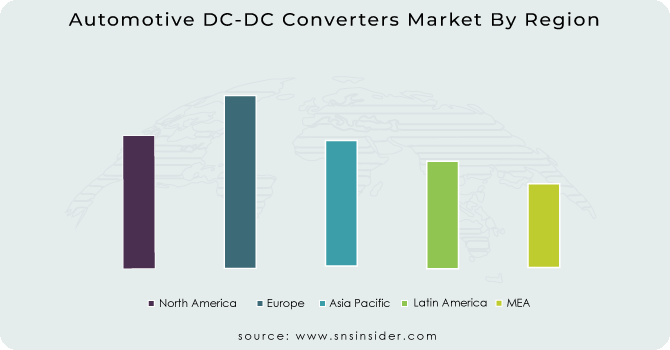

Europe is expected to grow at a very high CAGR during the forecast period. The European market is projected to show growth in the coming years, due to increased demand for electric vehicles. It is home to major car manufacturers such as Volkswagen AG, BMW AG, and Daimler AG. According to Clean Technica, the European passenger car market witnessed 35,000 registrations in January 2022. In the first month of 2023, total electricity exceeded 69% Annually, with about 23,000 deliveries. This is now 63% of all imported vehicles, vehicles sold, resulting in a record 1.8% share of electric vehicles. In Europe, almost all vehicles are EPS enabled and start stopping systems. The increase in electrification of these components contributes to the significant demand for electrical and electronic components, including DC-DC converters.

Need any customization research on Automotive DC-DC Converters Market - Enquiry Now

REGIONAL COVERAGE:

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

KEY PLAYERS:

The Major Players are Robert Bosch GmbH, Hyundai Mobis, BorgWarner Inc., Denso Corporation, TDK-Lambda Corporation, Delta Electronics, Continental AG, Toyota Industries Corporation, Valeo, Vicor Corporation, and other players.

Denso Corporation-Company Financial Analysis

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 813.143 Million |

| Market Size by 2031 | US$ 8253.129 Million |

| CAGR | CAGR of 33.6% From 2023 to 2030 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Vehicle Type (Commercial, Passenger) • By Propulsion Type (BEV, FCEV, PHEV) • By Product Type (Isolated, Non-Isolated) • By Output Voltage (3.3V, 5V, 12V, 15V, 24V and Above) • By Input Voltage (<40V>70V) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Robert Bosch GmbH, Hyundai Mobis, BorgWarner Inc., Denso Corporation, TDK-Lambda Corporation, Delta Electronics, Continental AG, Toyota Industries Corporation, Valeo, Vicor Corporation, and other players. |

| DRIVERS | • Rising adoption of energy-efficient electric vehicles • They improve vehicle efficiency and minimize fuel consumption while increasing vehicle output power per unit volume. |

| RESTRAINTS | • Regulatory compliance and safety standards vary by region or country. • These requirements and standards must be followed by DC-DC converter manufacturers. |