Automotive Disc Brake Market Report Scope & Overview:

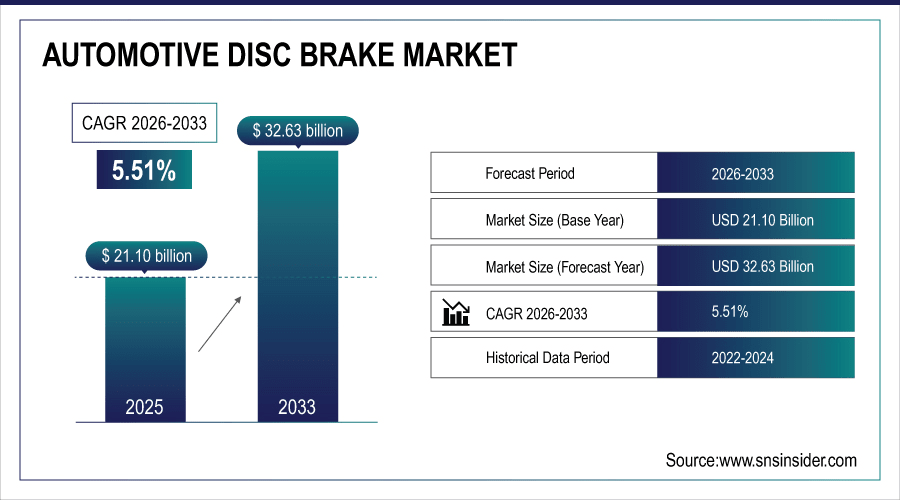

Automotive Disc Brake Market was valued at USD 21.10 billion in 2025E and is expected to reach USD 32.63 billion by 2033, growing at a CAGR of 5.51% from 2026-2033.

The growth of the Automotive Disc Brake Market is primarily driven by increasing vehicle production, rising demand for safety and high-performance braking systems, and the adoption of advanced technologies such as carbon-ceramic brakes in premium vehicles. Expansion in the electric and hybrid vehicle segments, coupled with stricter government regulations on vehicle safety standards globally, is further boosting market demand. Additionally, growing replacement and aftermarket sales contribute significantly to overall market growth.

To Get More Information On Automotive Disc Brake Market - Request Free Sample Report

Market Size and Forecast

-

Market Size in 2025: USD 21.10 Billion

-

Market Size by 2033: USD 32.63 Billion

-

CAGR: 5.51% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Automotive Disc Brake Market Trends

-

Growing demand for vehicle safety and braking performance is driving automotive disc brake adoption.

-

Increasing production of passenger cars, commercial vehicles, and electric vehicles is boosting market growth.

-

Advancements in materials, such as carbon-ceramic and lightweight alloys, are improving durability and efficiency.

-

Integration with ABS, ESP, and regenerative braking systems is enhancing vehicle control and safety.

-

Rising focus on reducing emissions and vehicle weight is promoting adoption of advanced disc brake systems.

-

Expansion of aftermarket replacement and upgrade services is supporting market growth.

-

Collaborations between OEMs, component suppliers, and technology providers are accelerating innovation and performance optimization.

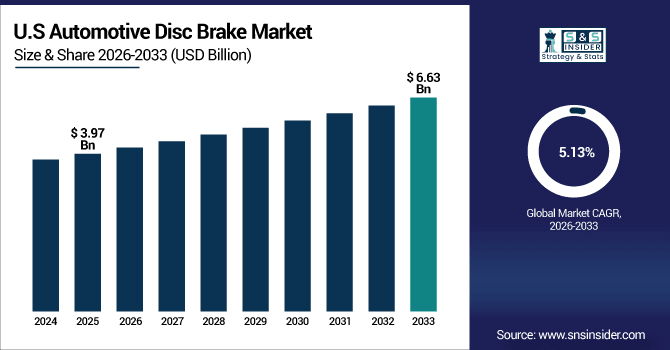

U.S. Automotive Disc Brake Market was valued at USD 3.97 billion in 2025E and is expected to reach USD 6.63 billion by 2032, growing at a CAGR of 5.13% from 2026-2033.

The U.S. market growth is driven by rising vehicle production, increasing adoption of advanced braking systems, growing demand for electric and hybrid vehicles, and stringent safety regulations, along with expanding replacement and aftermarket sales supporting overall market expansion.

Automotive Disc Brake Market Growth Drivers:

-

Expansion of passenger and commercial vehicle production coupled with rising urbanization and global automotive sales enhancing disc brake installations

The rapid growth of passenger and commercial vehicle production across emerging economies significantly boosts demand for automotive disc brakes. Rising disposable incomes, increasing urbanization, and expanding infrastructure drive higher vehicle ownership rates, creating greater need for safe and efficient braking systems. Additionally, with commercial vehicles being central to logistics and transportation growth, disc brakes offer durability and performance advantages critical for heavy-duty usage. Global automotive sales recovery, especially post-pandemic, further accelerates disc brake integration across multiple segments. Automakers, driven by consumer demand and competitive differentiation, continue to expand the use of disc brake systems as standard across models.

Automotive Disc Brake Market Restraints:

-

Dependence on raw material availability and volatility of prices affecting production costs and profitability within the disc brake market globally

Automotive disc brake production heavily relies on raw materials such as steel, aluminum, and composite alloys, which are subject to frequent price fluctuations. Volatility in global supply chains, driven by geopolitical tensions, trade restrictions, or economic downturns, directly affects the cost of manufacturing. Shortages or price hikes in these materials can increase production costs, impacting both OEMs and suppliers, and reducing profitability. This challenge is more pronounced for manufacturers operating on thin margins or serving price-sensitive markets. Long-term dependency on raw material stability remains a key limiting factor for the disc brake industry, requiring careful supply chain management.

Automotive Disc Brake Market Opportunities:

-

Rising adoption of electric and hybrid vehicles fueling need for advanced disc brake systems with regenerative braking integration worldwide

The rapid shift toward electric and hybrid vehicles creates new opportunities for disc brake systems as these vehicles demand enhanced braking efficiency. Electric vehicles require specialized braking systems capable of working seamlessly with regenerative braking technology while maintaining consistent performance under varying conditions. Disc brakes, with their heat dissipation and durability advantages, align well with these needs. Growing government incentives for EV adoption, combined with consumer preference for sustainable mobility, amplify demand for advanced braking systems. This transition offers suppliers and OEMs avenues to innovate, integrate new technologies, and capture significant market share in the evolving EV landscape.

Automotive Disc Brake Market Segment Highlights

-

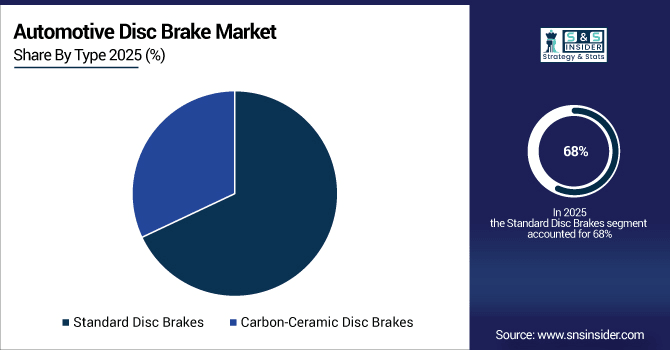

By Brake Type, Standard Disc Brakes dominated with ~68% share in 2025; Carbon-Ceramic Disc Brakes fastest growing (CAGR).

-

By End-User, OEM dominated with ~76% share in 2025; Aftermarket fastest growing (CAGR).

-

By Material Type, Cast Iron Disc Brakes dominated with ~54% share in 2025; Composite Disc Brakes fastest growing (CAGR).

Automotive Disc Brake Market Segment Analysis

By Type, Standard disc brakes dominated the automotive disc brake market in 2025. Carbon-ceramic disc brakes are expected to grow fastest from 2026–2033.

Standard disc brakes held the largest market share in 2025 due to their cost-effectiveness, durability, and widespread adoption in passenger and commercial vehicles. Their compatibility with mass-produced models and ability to provide reliable braking performance make them the preferred choice for manufacturers seeking affordability and efficiency across global automotive markets.

Carbon-ceramic disc brakes are projected to grow fastest from 2026–2033, driven by rising demand for high-performance and luxury vehicles requiring advanced braking efficiency. Their lightweight construction, superior heat resistance, and enhanced durability appeal to sports and premium car segments, supported by increasing consumer preference for technologically advanced automotive components.

By Sales Channel, OEM segment dominated in 2025. Aftermarket segment is set to grow fastest from 2026–2033.

OEM segment dominated in 2025 because vehicle manufacturers increasingly integrate disc brakes during production to comply with safety standards and improve performance. Disc brakes are now standard in most new vehicles, ensuring long-term reliability and reducing dependence on aftermarket installations, thereby cementing OEMs’ leadership in the automotive disc brake market.

Aftermarket segment is set to grow fastest from 2026–2033 due to rising replacement needs, frequent maintenance cycles, and consumer demand for upgraded braking solutions. Growing awareness of road safety, coupled with expansion of vehicle fleets and aging cars in emerging markets, boosts aftermarket opportunities for disc brake systems globally.

By Material, Cast iron disc brakes dominated in 2025. Composite disc brakes are expected to grow fastest from 2026–2033.

Cast iron disc brakes dominated in 2025 owing to their affordability, strength, and proven reliability across mass-market and commercial vehicles. Their widespread use in standard models, established supply chains, and compatibility with cost-sensitive automotive segments make cast iron disc brakes the preferred choice, ensuring dominance within the global automotive disc brake market.

Composite disc brakes are expected to witness the fastest growth from 2026–2033, driven by increasing demand for lightweight and fuel-efficient vehicle components. Their advanced material composition offers superior performance, reduced weight, and improved heat management, aligning with automakers’ focus on sustainability and performance enhancement in electric, hybrid, and high-performance vehicles.

By Vehicle Type, SUVs dominated in 2025 and are expected to grow fastest from 2026–2033.

SUVs dominated the automotive disc brake market in 2025 and are expected to grow fastest from 2026–2033 due to rising global consumer preference for larger, versatile vehicles offering safety, performance, and comfort. Their heavier weight and powerful engines require advanced braking systems, making disc brakes essential. Increasing urbanization, higher disposable incomes, and expansion of premium and electric SUV models further drive adoption. Automakers increasingly focus on equipping SUVs with advanced disc brakes to meet safety regulations and performance expectations.

Automotive Disc Brake Market Regional Analysis

North America Automotive Disc Brake Market Insights

North America held a significant position in the Automotive Disc Brake Market, supported by high vehicle ownership, advanced automotive technology adoption, and stringent safety regulations. The region’s focus on premium and electric vehicles, coupled with strong aftermarket demand and replacement cycles, drives market growth. Additionally, the presence of leading automotive manufacturers, continuous innovation in braking systems, and increasing consumer preference for safety and performance contribute to North America’s sustained market expansion.

Get Customized Report as Per Your Business Requirement - Enquiry Now

Asia Pacific Automotive Disc Brake Market Insights

Asia Pacific dominated the Automotive Disc Brake Market with a revenue share of about 36% in 2025, driven by rapid industrialization and increasing vehicle production. Growing consumer demand, presence of major automotive manufacturers, and rising adoption of advanced braking technologies further fueled growth. Expansion of electric and hybrid vehicle markets, supportive government policies, affordable labor, and strong aftermarket development collectively reinforced the region’s leading position in the market.

Europe Automotive Disc Brake Market Insights

Europe holds a strong position in the Automotive Disc Brake Market due to the presence of major automotive manufacturers and high demand for premium and performance vehicles. Strict vehicle safety and emission regulations, growing adoption of advanced braking technologies, and expansion of electric and hybrid vehicles drive market growth. Additionally, increasing replacement and aftermarket sales, along with technological innovations in disc brake systems, further strengthen Europe’s market presence and revenue share.

Middle East & Africa and Latin America Automotive Disc Brake Market Insights

The Middle East & Africa and Latin America Automotive Disc Brake Market is growing steadily, driven by rising vehicle production, infrastructure development, and increasing demand for commercial and passenger vehicles. Expansion of electric and hybrid vehicle adoption, coupled with growing awareness of vehicle safety, supports market growth. Additionally, rising replacement and aftermarket sales, along with the presence of regional distributors and automotive manufacturers, contribute to the market’s gradual expansion in these regions.

Automotive Disc Brake Market Competitive Landscape:

Robert Bosch GmbH

Robert Bosch GmbH is a leading player in the Automotive Disc Brake Market, offering a wide range of high-performance braking systems for passenger and commercial vehicles. The company focuses on innovation, advanced technology integration, and safety enhancement, including electronic and regenerative braking solutions. Strong global presence, strategic partnerships with OEMs, and consistent R&D investments enable Bosch to maintain market leadership, expand its product portfolio, and cater to growing demand worldwide.

-

In 2025, Robert Bosch GmbH successfully completed a 2,050-mile public-road test of its hydraulic brake-by-wire system, eliminating the mechanical pedal linkage. The market launch is scheduled for Fall 2025, with the system projected to equip 5.5 million vehicles by 2030.

Brembo S.p.A.

Brembo S.p.A. is a prominent player in the Automotive Disc Brake Market, renowned for its high-performance braking systems for passenger cars, motorcycles, and commercial vehicles. The company emphasizes innovation, lightweight materials, and advanced technologies to enhance safety, durability, and performance. Brembo’s strong global presence, collaborations with OEMs, and continuous R&D investments enable it to deliver premium braking solutions, catering to growing demand across passenger, commercial, and specialty vehicles worldwide.

-

2025: Brembo S.p.A. unveiled the GREENTELL disc and pad set at Auto Shanghai 2025, featuring dual-layer nickel-free coating via laser metal deposition, delivering up to 90% reduction in brake dust emissions and 80% improved disc durability.

-

2024: Launched PRO and PRO+ front brake packages for supersport motorcycles at EICMA 2024, equipped with T-Drive finned discs, Hypure nickel-plated calipers, and GP4 billet aluminum monobloc calipers for high-performance braking.

-

2024: Brembo also introduced the Sport disc to its Xtra family, featuring slot enhancements for consistent braking, improved heat dissipation, and stability for everyday and sporty driving.

-

2023: Debuted the SSV (Side-by-Side Vehicle) brake system at EICMA 2023, offering a lightweight aluminum caliper and steel disc optimized for intense off-road use in Side-by-Side vehicles.

Key Players

Some of the Automotive Disc Brake Market Companies

-

Robert Bosch GmbH

-

ZF Friedrichshafen AG

-

Continental AG

-

Aisin Seiki Co., Ltd.

-

Knorr-Bremse AG

-

Brembo S.p.A

-

Haldex AB

-

Mando Corporation

-

Hitachi Astemo, Ltd.

-

WABCO Holdings Inc.

-

Nissin Kogyo Co., Ltd.

-

ADVICS Co., Ltd.

-

TRW Automotive Holdings Corp.

-

Akasaka Brake Industry Co., Ltd.

-

AP Racing Ltd.

-

EBC Brakes

-

Performance Friction Corporation

-

Endurance Technologies Limited

-

TMD Friction Holdings GmbH

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 21.10 Billion |

| Market Size by 2033 | USD 32.63 Billion |

| CAGR | CAGR of 5.51% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Standard Disc Brakes, Carbon-Ceramic Disc Brakes) • By Vehicle Type (Hatchback/Sedan, SUVs, LCV, HCV) • By Sales Channel (OEM, Aftermarket) • By Material (Cast Iron Disc Brakes, Aluminum Disc Brakes, Composite Disc Brakes) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Robert Bosch GmbH, ZF Friedrichshafen AG, Continental AG, Aisin Seiki Co., Ltd., Knorr-Bremse AG, Brembo S.p.A, Haldex AB, Mando Corporation, Hitachi Astemo, Ltd., WABCO Holdings Inc., Nissin Kogyo Co., Ltd., ADVICS Co., Ltd., TRW Automotive Holdings Corp., Akasaka Brake Industry Co., Ltd., AP Racing Ltd., EBC Brakes, Performance Friction Corporation, Endurance Technologies Limited, TMD Friction Holdings GmbH |