Private Cloud Services Market Report Scope & Overview:

Get more information on Private Cloud Services Market - Request Sample Report

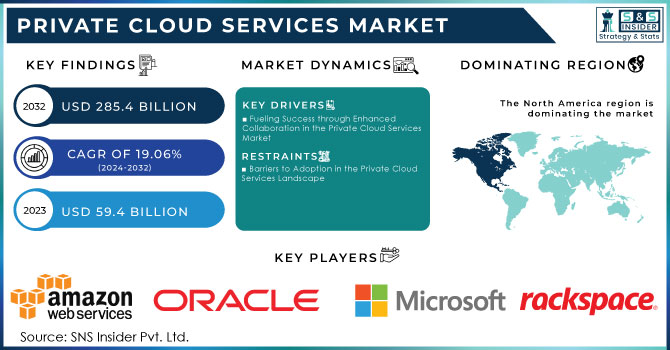

The Private Cloud Services Market Size was valued at USD 59.4 Billion in 2023 and is expected to reach USD 285.4 Billion by 2032 and grow at a CAGR of 19.06% over the forecast period 2024-2032.

The private cloud services market is experiencing rapid growth as organizations prioritize enhanced data security, customization, and control over their cloud environments. With the global shift toward digital transformation, the demand for private cloud solutions has surged, allowing companies to secure sensitive data while still benefiting from the flexibility and scalability of cloud computing. Key growth drivers include the increasing need for enhanced security and regulatory compliance, especially in sectors such as healthcare, finance, and government, where data protection is critical. The rising adoption of hybrid cloud solutions is further accelerating market expansion. Many organizations are integrating both private and public cloud services, utilizing the scalability of public clouds while maintaining control and security through private cloud environments. This hybrid approach has driven demand for cloud orchestration tools and cloud management platforms, streamlining operations across varied infrastructures. Technological advancements in areas such as artificial intelligence (AI), machine learning (ML), and automation are reshaping the private cloud market, improving efficiency and reducing operational costs. The integration of these technologies enhances the functionality of private clouds, making them more adaptable to evolving business needs. Additionally, hybrid cloud adoption allows organizations to manage workloads flexibly, balancing innovation with security for mission-critical processes.

As more enterprises transition to digital operations, the need for private cloud solutions that offer better control over sensitive data is paramount. According to recent reports, more than one-third of cloud environments are critically exposed, heightening concerns over data security and compliance, which is why many businesses are opting for private cloud environments that ensure stronger protection measures. The private cloud services market is projected to witness significant growth, highlighting its expanding role in enterprise IT strategies. Industry cloud platforms are gaining traction as organizations seek to tailor their cloud environments to specific business needs, driving demand for private cloud solutions. In fact, a survey indicated that 75% of executives consider industry cloud platforms critical for achieving their strategic goals. The adoption of private cloud services is expected to accelerate as businesses prioritize data security and regulatory compliance. A notable trend is the increased investment in low-code platforms, which enable faster application development and deployment within private cloud environments.

Organizations across various sectors, including healthcare, finance, and manufacturing, are adopting tailored private cloud solutions that meet industry-specific requirements for regulatory compliance. Moreover, the rise of multicloud strategies is further boosting the private cloud market, with businesses seeking to optimize workloads while maintaining control over sensitive operations. The integration of Cloud Security Posture Management (CSPM) solutions is helping companies navigate the complexities of securing their cloud environments, contributing to the market’s growth.

Private Cloud Services Market Dynamics

Drivers

-

Fueling Success through Enhanced Collaboration in the Private Cloud Services Market

Private cloud services are increasingly recognized for their capacity to enhance collaboration and productivity within organizations. By providing secure and centralized access to applications and data, private clouds facilitate seamless communication among teams, regardless of their geographic locations. This aspect has become particularly crucial in the current digital landscape, where remote work and distributed teams are the norm. Recent developments in cloud technology emphasize collaboration features that support multi-platform analytics, allowing teams to work together more efficiently. For instance, the partnership between Vodafone and Google is designed to integrate AI capabilities with cloud services, improving data analytics and operational workflows across Europe and Africa. These advancements enable businesses to leverage real-time insights and streamline decision-making processes, ultimately enhancing productivity. According to a report by DBTA, organizations utilizing private cloud services have reported significant increases in productivity, as teams can share insights and collaborate on projects without the security concerns often associated with public cloud solutions. The emphasis on secure environments fosters trust among team members, enabling them to confidently share sensitive information and innovative ideas. The combination of these factors makes enhanced collaboration and productivity a significant driver for the private cloud services market. As businesses continue to seek solutions that not only secure their data but also empower their teams, the demand for private cloud solutions is expected to grow. Companies looking to adopt private cloud services will find that these solutions not only optimize their operations but also foster a culture of collaboration, ultimately leading to greater business success.

Restraints

-

Barriers to Adoption in the Private Cloud Services Landscape

Implementing a private cloud can be complex and resource-intensive for organizations due to several factors. One major challenge is the need for specialized knowledge and skills; organizations require skilled IT personnel who are well-versed in cloud architecture, virtualization, and networking to effectively design, deploy, and manage the private cloud infrastructure. Migrating existing applications and data to the private cloud environment is another significant challenge, as this process requires careful planning and execution to avoid disruptions in critical business operations. Organizations may need to refactor or redesign applications for compatibility, leading to increased costs and time. Additionally, unforeseen issues during setup, such as hardware compatibility problems or software configuration challenges, can extend project timelines and strain resources. Once operational, ongoing management of the private cloud infrastructure poses further challenges, requiring continuous monitoring, performance optimization, and compliance with industry regulations. This ongoing demand can divert attention and resources from other critical IT tasks. In summary, the complexities involved in the implementation and management of private cloud services present significant hurdles that organizations must navigate to achieve a successful deployment while ensuring optimal performance and security.

Private Cloud Services Market Segmentation Overview

By Services

In 2023, Software as a Service (SaaS) emerged as the dominant player in the private cloud services market, capturing approximately 47% of total revenue. This leadership position highlights the increasing trend among organizations to adopt SaaS solutions for a variety of business functions, capitalizing on the benefits of flexibility, cost-effectiveness, and simplified management. One of the key drivers behind this dominance is cost efficiency; SaaS removes the necessity for substantial upfront investments in hardware and software, allowing organizations to subscribe on a pay-as-you-go basis, which aids in budget predictability. Additionally, SaaS solutions offer remarkable scalability, enabling organizations to adjust their usage according to changing business needs, making them particularly advantageous for those experiencing growth or seasonal fluctuations. Rapid deployment is another significant benefit, as SaaS applications can be implemented much faster than traditional software, enhancing operational efficiency and responsiveness to market dynamics. Furthermore, adopting SaaS allows organizations to delegate software maintenance, updates, and security to service providers, enabling internal IT teams to concentrate on strategic initiatives. Enhanced accessibility facilitates collaboration among remote teams, and continuous innovation from SaaS providers ensures organizations benefit from the latest advancements without the need for manual upgrades.

By Enterprise Size

In 2023, large enterprises represented approximately 60% of the revenue in the private cloud services market, highlighting their substantial reliance on these solutions to address complex operational demands and improve efficiency. This dominance is driven by several key factors tailored to meet the specific needs of large organizations.

One significant factor is increased data security; large enterprises manage sensitive information that requires robust protection. Private cloud services provide advanced security protocols and compliance options that align with industry regulations, making them appealing. Additionally, these solutions offer customizability and control, allowing organizations to tailor their infrastructure and applications to fit unique business processes, optimizing resources effectively. Scalability is also critical; as large enterprises expand, they experience varying demands that necessitate flexible solutions. Private clouds allow for quick adjustments to resource allocation, ensuring performance and cost efficiency. Furthermore, many large organizations rely on legacy systems that require seamless integration with new cloud solutions, and private clouds can be designed to work compatible with existing infrastructure.

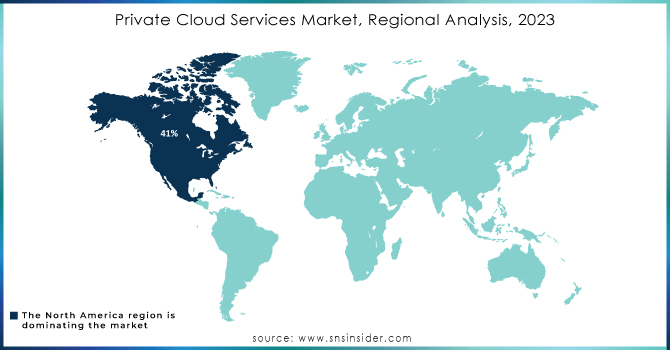

Private Cloud Services Market Regional Analysis

In 2023, North America emerged as the leading region in the private cloud services market, capturing around 41% of the total revenue. This prominence can be attributed to several critical factors that enhance the region's capability to adopt and implement private cloud solutions. Firstly, North America benefits from a highly advanced technological infrastructure, featuring high-speed internet and state-of-the-art data centers, which facilitate the efficient deployment of private cloud services. The region is also characterized by a strong demand from large enterprises across diverse sectors, such as finance, healthcare, and technology, which require secure and scalable cloud environments for managing sensitive data and complex operations. Moreover, as regulatory requirements and data security concerns grow, organizations prioritize robust security measures, making private cloud services an attractive option. Additionally, companies in North America are heavily investing in digital transformation initiatives to enhance operational efficiency and competitiveness, viewing private cloud solutions as vital to modernizing IT infrastructure. The presence of innovative service providers that offer tailored cloud solutions further drives market growth, complemented by a skilled workforce with expertise in cloud computing and IT management, enabling effective implementation and management of private cloud environments.

In 2023, the Asia-Pacific region emerged as the second fastest-growing market for private cloud services, driven by several key factors. Rapid digital transformation across various sectors is prompting organizations to adopt private cloud solutions to modernize their IT infrastructure. The expanding middle-class population in countries like China and India is increasing demand for digital services, leading businesses to invest in cloud technologies. Government initiatives supporting cloud adoption further enhance competitiveness. Additionally, a heightened focus on data security and significant investments in IT infrastructure are creating a conducive environment for the growth of private cloud services in the region.

Need any customization data on Private Cloud Services Market - Enquiry Now

Key Players in Private Cloud Services Market

Some of the major in the private cloud services market, along with their notable products:

-

Amazon Web Services (AWS) (Amazon EC2, Amazon S3)

-

Microsoft (Azure Stack)

-

Google Cloud (Google Cloud Anthos)

-

IBM (IBM Cloud Private)

-

Oracle (Oracle Cloud Infrastructure)

-

VMware (VMware Cloud Foundation)

-

Dell Technologies (Dell EMC VxRail)

-

Hewlett Packard Enterprise (HPE) (HPE GreenLake)

-

Cisco Systems (Cisco Private Cloud)

-

Red Hat (Red Hat OpenShift)

-

Alibaba Cloud (Alibaba Cloud Private Cloud)

-

SAP (SAP HANA Enterprise Cloud)

-

DigitalOcean (DigitalOcean App Platform)

-

Platform9 (Platform9 Managed OpenStack)

-

Rackspace Technology (Rackspace Private Cloud)

-

Fujitsu (Fujitsu Cloud Services)

-

Citrix (Citrix Virtual Apps and Desktops)

-

Mitsubishi Electric (Mitsubishi Electric Cloud)

-

T-Systems (T-Systems Cloud Infrastructure)

-

Atos (Atos Private Cloud Services)

List of 10 major suppliers in the private cloud services market:

-

Amazon Web Services (AWS)

-

Microsoft

-

Google Cloud

-

IBM

-

Oracle

-

VMware

-

Dell Technologies

-

Hewlett Packard Enterprise (HPE)

-

Cisco Systems

-

Red Hat

Recent Development

-

Platform9 Unveils Private Cloud Director for Enterprise Cloud Management On October 17, 2024, Platform9 launched Private Cloud Director, a new solution designed to streamline the migration from legacy-virtualized infrastructure to a developer-friendly and cost-effective private cloud environment.

-

Deutsche Telekom and Broadcom Expand Cloud Partnership On October 16, 2024, Deutsche Telekom's T-Systems achieved the highest VMware Cloud Service Provider status, leading to an expanded cloud deal with Broadcom that enhances their cloud services and introduces new white-label options on a global scale.

-

Apple Introduces Private Cloud Compute for Enhanced AI Privacy On June 10, 2024, Apple announced the launch of Private Cloud Compute (PCC), a pioneering cloud intelligence system designed for private AI processing that ensures user data remains inaccessible to anyone except the user, even within Apple’s infrastructure. This innovative system combines custom Apple silicon with a privacy-focused operating system, establishing a new standard for security in cloud AI computing.

| Report Attributes | Details |

| Market Size in 2023 |

USD 6.1 Billion |

| Market Size by 2032 |

USD 31 Billion |

| CAGR |

CAGR of 19.8% From 2024 to 2032 |

| Base Year |

2023 |

| Forecast Period |

2024-2032 |

| Historical Data |

2020-2022 |

| Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

• By Services (SaaS, PaaS, and IaaS) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles |

BMC Software, Amazon Web Services, Inc, Eucalyptus, Oracle, IBM Corporation, Rackspace, VMware, Inc, Microsoft, Citrix, Hewlett Packard Enterprise Company, Red Hat, Inc |

| Key Drivers |

• Low-cost, secure IT operations are in high demand |

| Market Opportunities |

• Increasing investment in digital infrastructure by several developing countries |