Industrial Nitrogen Generator Market Report Scope & Overview:

Get More Information on Industrial Nitrogen Generator Market - Request Sample Report

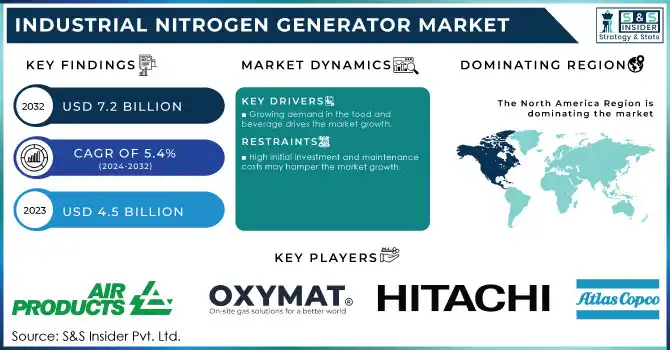

The Industrial Nitrogen Generator Market Size was USD 4.73 Billion in 2024 and is expected to reach USD 7.21 Billion by 2032 and grow at a CAGR of 5.42% over the forecast period of 2025-2032.

The move towards onsite nitrogen generation is a game changer for sectors needing cost-effective, flexible, and reliable operations. Sectors like food & beverage, electronics, and manufacturing are progressively moving to on-site nitrogen generators, reducing the need for third-party suppliers while maintaining a continuous supply of high-purity nitrogen on demand. Companies save costs over the long term by eliminating expenses related to transport, cylinder storage, and cylinder rental through on-site nitrogen generation.

According to the U.S. Department of Energy, the use of on-site nitrogen generation systems in industrial facilities can reduce nitrogen supply costs by up to 40%, primarily due to the elimination of transportation and storage expenses. In the European Union, reports from the European Commission's Energy Efficiency Directive highlight that nitrogen generators with advanced technologies like Pressure Swing Adsorption (PSA) and Membrane systems can improve energy efficiency by 15-25%, aligning with sustainability goals and reducing greenhouse gas emissions.

Furthermore, a nitrogen generator ensures better operational efficiency by delivering nitrogen as and when required, thereby minimizing the downtime and allowing for better and precise control over purity levels. In food & beverage, this guarantees the quality and shelf life of packaged products, and for electronics and manufacturing, it helps mitigate critical processes including soldering, inert blanketing, and laser cutting. On-site generation complements the increased focus on sustainability as it lowers carbon emissions associated with transportation and eliminates wastage as nitrogen is produced based on the generated volume required. On-site nitrogen generation is also a viable and preferred solution as industries focus on their efficiency and environmental responsibility, leading to the growth of the nitrogen generator market in the globe.

IoT-enabled nitrogen generators are boosting industrial operations with high efficiency, reliability, and cost-effectiveness. Utilizing IoT technology, these solutions allow real-time monitoring of crucial factors like purity levels, pressure, and flow rates to ensure that the system is always operating at its best. One of the features that really shines is predictive maintenance thanks to IoT sensors that can identify when issues are brewing which means having the ability to service the machine proactively before failure happens which means no downtime and no expensive disruptions. Moreover, through the integration of IoT, process optimization becomes easier as operational data can be collected and analyzed, allowing users to optimize nitrogen generation according to demand trends, energy consumption, and other parameters. Hence creates enormous power conservation and resource management.

The European Commission’s Industry 5.0 initiative highlights those smart systems, including IoT-enabled nitrogen generators, can improve operational efficiency by 20-30% through process optimization and energy savings.

Industrial Nitrogen Generator Market Dynamics

Drivers

-

Growing demand in the food and beverage drives the market growth.

Nitrogen generator market growth is driven by the increasing demand for nitrogen generators in the food and beverage industry owing to the growing requirement to maintain product quality with preservation ensuring the prolonged shelf-life of food and beverage products along with stringent food safety standards. Nitrogen is more often used for modified atmosphere packaging (MAP) to keep fresh perishable products by replacing oxygen (O2) with N2 so that the product will avoid oxidation and bad bacteria growth. In the beverage industry, nitrogen is used for carbonation, preservation, and the prevention of spoilage because it helps to maintain the quality of beverages in storage and during transportation.

As consumers prefer more packaged and ready-to-eat food products, it is a trend that further increases the requirement for food export activities, thus stimulating the increased demand for reliable nitrogen generation solutions. Additionally, food manufacturers can save costs and increase operational flexibility by avoiding reliance on third-party suppliers and benefitting from the continuous supply of custom high-purity nitrogen using on-site nitrogen generators. Nitrogen generators are turning out to be one of the most important tools fettering efficiency, safety, and product excellence as the food and beverage industry gears up to procure the global outlook.

Additionally, government reports from the European Food Safety Authority (EFSA) indicate that 75% of the food processing sector in the European Union utilizes nitrogen for packaging, storage, and transportation, driven by the need to reduce food waste and extend the shelf life of perishable products.

Restraint

-

High initial investment and maintenance costs may hamper the market growth.

A high initial investment and maintenance cost associated with industrial nitrogen generators pose a major restraint for a wide variety of businesses, especially small and medium-sized enterprises (SME). Initial capital associated with the purchase and installation of on-site nitrogen generation systems represents a considerable cost, often involving complicated equipment required to generate nitrogen, extensive infrastructure upgrades, and installation fees. This upfront cost could be a very discouraging factor, especially if the industry is something like small-scale manufacturing/startup, in which every dollar is counted, and the cost of purchasing nitrogen from third-party suppliers is priced relatively lower. Beyond the upfront expenses, continuous maintenance expenses can add to the cost. It needs tuning, calibration, and periodical repairs to extract the best performance which translates into operational costs down the line.

Industrial Nitrogen Generator Market Segmentation Overview

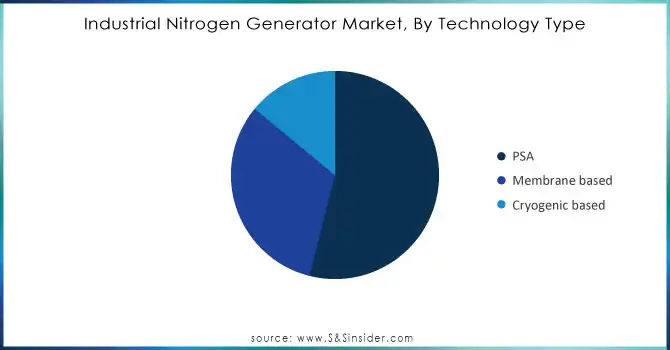

By Technology Type

The pressure swing adsorption segment held the largest market share around 54% in 2023. PSA technology is preferred for its cost-effectiveness, energy efficiency, and providing high-purity nitrogen at lower operating costs. Pressure Swing Adsorption (PSA) systems operate by adsorbing impurities from the compressed air and producing nitrogen by alternating between two vessels that contain an adsorbent medium. The method is widely used in industries such as food and beverage, pharmaceuticals, and manufacturing that require high-purity nitrogen for packaging, preservation, and production processes. Also, the energy consumed by PSA generators is significantly lower compared to other technologies such as cryogenic-based systems, which attracts companies to implement this technology to save operational costs.

Need any customization research on Industrial Nitrogen Generator Market - Enquiry Now

By Size

Stationary held the largest market share around 62% in 2023. Industries that have a high and sustained need for nitrogen such as the food and beverage processing, pharma, chemical, and metal industries favor stationary units. Commonly stationary for extended operation with high efficiency and large nitrogen production, these systems are embedded in a long-term, continuous manner. Stationary nitrogen generators are decreasing the reliance on third-party nitrogen suppliers owing to their capability to cater to large-scale industrial processes. Furthermore, since stationary units can run at full capacity the entire time, they are a more economical investment in the long run compared to the constraints of portable systems.

By End-User Industry

Food & Beverage held the largest market share around 28% in 2023. Nitrogen has a wide range of applications, including packaging, preservation, and inerting, and plays an essential role in the food and beverage industry to keep products fresh, extend shelf life, and reduce the risk of oxidation. Modified Atmosphere Packaging (MAP), which uses nitrogen to extend the shelf life of certain products (like meats, dairy, snacks, etc.) without adding preservatives, is another food packaging application of nitrogen. This large-scale uptake throughout the food and beverage sector has played a major part in increasing the demand for nitrogen generators on-site, as this solution offers a more cost-effective and reliable alternative than sourcing nitrogen from third-party providers. Finally, driving demand for nitrogen in this sector is the persistent trend of shifting to preservative-free products, alongside rising consumer demand for fresh, ready-to-eat, and drink products. Moreover, the increasing global appetite for convenience food and processed products is expected to fuel a significant contribution of the food and beverage sector to the overall market. Although industries like medical and pharmaceutical, chemicals, and electronics also utilize nitrogen, the vast demand coupled with continuous regeneration of nitrogen-based solutions adds the food and beverage segment to the dominant market space.

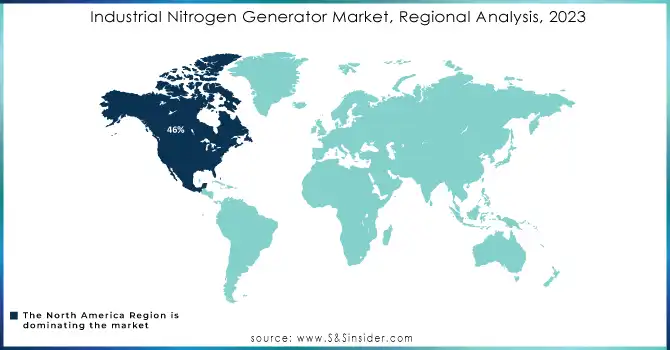

Industrial Nitrogen Generator Market Regional Analysis

North America held the highest market share around 46% in 2023. It is attributed to various factors such as a strong industrial base coupled with technology advancement and the high demand from the key sectors for the product. The USA in particular is a big source of this due to its extensive manufacturing, food and beverage, chemical, and pharmaceutical sectors utilizing nitrogen for packing, inerting, and preservation of fretwork in high volume. The push to reduce operational expenditure, improve supply chain reliability, and comply with stringent regulatory requirements (especially true from food processing and pharmaceuticals) has sped up the adoption of on-site nitrogen generation technology across the region.

North America has been adopting innovative nitrogen generation systems by companies that generate and design energy-efficient systems of generation are also gaining the opportunity to outspread the northern American market by replacing their conventional nitrogen generation therefore making the market thriving in North America by productivity and manufacturing outputs or even including smart technologies such as IoT devices for real-time monitoring as well as predictive maintenance, these factors are further expected to drive the market in the upcoming years. Moreover, the established presence of key market players for industrial nitrogen generators along with good infrastructure and availability of technology has led to the dominance of the region in the nitrogen generation solutions market. The previously mentioned factors, along with the continuous automation process of industrial processes as well as streamlining them, are expected to make North America the leading region within the global market.

Key Players in Industrial Nitrogen Generator Market

-

Atlas Copco AB (NGP+ Series, NGM Series)

-

Hitachi Ltd (OIL-FREE N2 Generator, PSA-N2 Generator)

-

Oxymat A/S (PSA Nitrogen Generator, Containerized Nitrogen Generator)

-

Linde Plc (GEN2 Onsite Nitrogen Generator, CRYOSS Cryogenic Nitrogen Generator)

-

NOVAIR S.A.S (NOXERIOR S.R.L.) (NitroSwing Modular PSA, NitroPack Plug & Play)

-

Air Products and Chemicals Inc. (PRISM PSA Nitrogen Generators, Cryogenic Nitrogen Generators)

-

L’Air Liquide S.A. (NEOS Generators, PSA Nitrogen Systems)

-

Parker Hannifin Corporation (NITROSource Compact, MIDIGAS2 Series)

-

Generon IGS (Nitrogen PSA Generators, Membrane Nitrogen Generators)

-

Ingersoll Rand Inc. (Nirvana Nitrogen Generators, Nitrogen Generator NG Series)

-

Gardner Denver Inc. (PUREGAS Nitrogen Generators, PSA Nitrogen Generators)

-

MVS Engineering Pvt. Ltd. (PSA Nitrogen Generators, Purity Nitrogen Generators)

-

On Site Gas Systems Inc. (Nitrogen Membrane Generators, PSA Nitrogen Generators)

-

South-Tek Systems (N2GEN Series, N2Blast Generators)

-

Compressed Gas Technologies Inc. (CGT Nitrogen Generators, PNC Series Generators)

-

Oxywise (PSA Nitrogen Generator, Containerized Nitrogen Plant)

-

Sysadvance (NitroGEN PSA, Modular PSA Nitrogen Generators)

-

Peak Gas Generation (GENIUS XE N2, INFINITY Nitrogen Generators)

-

PCI Gases (Portable Nitrogen Generators, PSA Nitrogen Plants)

-

Proton OnSite (Nel ASA) (H-Series Nitrogen Generators, Proton Membrane Generators)

Recent Development:

-

In 2023, Atlas Copco introduced a new range of energy-efficient PSA nitrogen generators designed to reduce operational costs and energy consumption for large-scale industrial applications. These systems focus on optimizing the balance between nitrogen purity and energy use, addressing the increasing demand for sustainability in manufacturing processes.

-

In 2023, Linde Plc expanded its product portfolio by launching modular nitrogen generator systems tailored for smaller and mid-sized companies.

-

In 2023, Oxymat introduced its membrane-based nitrogen generation system designed to cater to the growing demand for sustainable and energy-efficient solutions in the food and beverage sector.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | US$ 4.73 Billion |

| Market Size by 2032 | US$ 7.21 Billion |

| CAGR | CAGR of 5.42% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology Type (PSA, Membrane based, Cryogenic based) • By Size (Stationary, Portable) • By Design (Cylinder based, Plug & play) • By End-use industry (Food & beverage, Medical & Pharmaceutical, Transportation, Electrical & Electronics, Chemical & Petrochemical, Manufacturing, Packaging, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Atlas Copco AB, Hitachi Ltd, Oxymat A/S, Linde Plc, NOVAIR S.A.S (NOXERIOR S.R.L.), Air Products And Chemicals Inc., L’Air Liquide S.A. |

| Drivers | • Demand from the Food and Beverage Industry is Growing • The Healthcare Industry in Emerging Economies is Growing |

| Restraints | • Regulations with Strict Restrictions and Measures |