Atmospheric Water Generator Market Report Scope & Overview

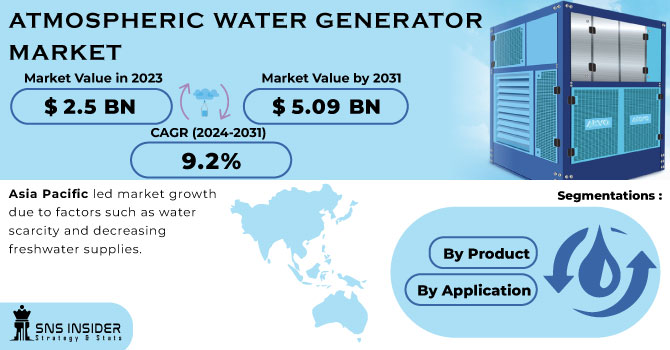

The Atmospheric Water Generator Market size was USD 2.58 billion in 2023 and is expected to Reach USD 7.21 billion by 2032 and grow at a CAGR of 12.09% over the forecast period of 2024-2032.

Get E-PDF Sample Report on Atmospheric Water Generator Market - Request Sample Report

The atmospheric water generator (AWG) market is growing rapidly due to rising water scarcity, technological progress, and government support. AWGs extract water from the air, offering a sustainable solution to water shortages, especially in drought-prone areas. Recent technological advancements have enhanced the efficiency and affordability of AWGs, making them more accessible across various sectors. Innovations in materials, condensation techniques, and energy use have boosted the performance and reliability of these systems, driving market growth. In places like California, where over 2 million people rely on depleting groundwater sources, AWGs can produce up to 10,000 liters of water daily, offering an alternative and reliable backup to municipal water systems. Low-energy technologies, such as sorption-based atmospheric water harvesting (SAWH), are further improving the ability to address water shortages in diverse regions.

Government support plays a vital role in promoting the adoption of AWGs, with policies aimed at addressing water scarcity and encouraging sustainable solutions. Many countries are investing in research and development to improve AWG technologies, leading to the creation of more energy-efficient systems. For example, various global partnerships and collaborations are emerging to advance AWG capabilities, allowing for the production of higher water volumes under diverse environmental conditions. However, challenges remain, including the high initial investment and operational costs, along with the dependency on specific environmental conditions such as humidity levels. These factors may hinder the widespread adoption of AWGs, especially in residential applications. Despite these obstacles, the market is expected to continue expanding as AWG systems evolve to become more energy-efficient, cost-effective, and suitable for different regions and industries.

MARKET DYNAMICS

DRIVERS

- The growing global water scarcity, exacerbated by climate change, is driving the demand for atmospheric water generators (AWGs), which offer a sustainable solution by extracting potable water from the air.

The growing global water scarcity is a key factor driving the demand for atmospheric water generators (AWGs). Climate change has further worsened this situation by disrupting rainfall patterns and diminishing the availability of freshwater resources. As traditional water sources become increasingly unreliable, AWGs present a promising solution by extracting water directly from the atmosphere. These systems use condensation to capture moisture in the air, converting it into potable water. AWGs are particularly beneficial in areas where freshwater is scarce or polluted, offering a sustainable and alternative water source. With the increasing need for accessible drinking water, AWGs are gaining traction as an innovative and practical method to address water shortages, especially in regions vulnerable to the impacts of climate change and water scarcity.

RESTRAINT

- High capital and maintenance costs of atmospheric water generators (AWGs) create financial barriers, limiting their adoption, especially in regions with lower purchasing power.

The high capital and maintenance costs associated with atmospheric water generators (AWGs) pose a significant challenge, especially for residential consumers. The initial investment required to purchase an AWG system can be quite substantial, often involving the cost of advanced technology and installation. Additionally, ongoing maintenance costs, such as servicing, cleaning, and replacing components, can further burden users. These expenses can be a deterrent for individuals and households in regions with lower purchasing power, limiting the widespread adoption of AWGs. In areas where economic conditions are challenging, the affordability of such systems becomes a major barrier to their use. As a result, despite the benefits of AWGs in addressing water scarcity, the financial burden may restrict their accessibility, particularly in developing or underdeveloped regions. Overcoming this challenge requires cost-effective solutions, government subsidies, or financing models to make AWGs more affordable for a broader range of consumers.

MARKET SEGMENTATION

By Product

The cooling condensation segment dominated with the market share over 64% in 2023. This method works by cooling humid air below its dew point, causing water vapor to condense into liquid water. It is a well-established, reliable, and efficient technology for generating potable water from the atmosphere. The cooling condensation process is favored for its simplicity and proven effectiveness in various applications, including residential, commercial, and industrial uses. Its widespread adoption and efficiency in converting humidity into water contribute significantly to its dominance in the AWG market.

By Application

The industrial segment dominated with the market share over 38% in 2023, driven by the substantial water requirements of industries such as manufacturing, power generation, and mining. These sectors rely heavily on large volumes of water for cooling, processing, and other operational needs, making AWG systems a sustainable and reliable solution. The ability of AWGs to generate water on-site, independent of traditional water supply systems, further enhances their appeal in industrial applications. This dominance is bolstered by increasing awareness of water scarcity and environmental concerns, encouraging industries to adopt AWG technology as part of their sustainability strategies.

KEY REGIONAL ANALYSIS

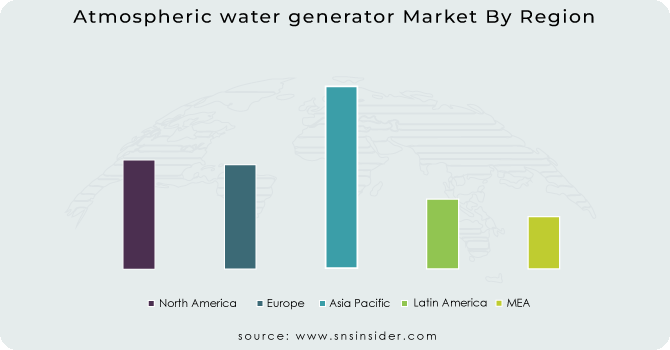

Asia-Pacific region dominated with the market share over 36% in 2023, due to its large population, escalating water scarcity, and rapid industrialization. The region's high demand for alternative water sources stems from the pressing need to address water shortages, particularly in densely populated countries like India and China. Industrial growth and urbanization further strain water resources, driving the adoption of AWG technology. Additionally, government initiatives and investments in sustainable water solutions bolster market expansion. The combination of these factors positions Asia-Pacific as the leading region in the AWG market, highlighting its critical role in addressing global water challenges through innovative technologies.

North America stands out as the fastest-growing region in the Atmospheric Water Generator (AWG) market. This growth is fueled by technological advancements that enhance the efficiency and affordability of AWG systems, making them increasingly viable for residential, commercial, and industrial applications. Rising environmental awareness has amplified the demand for sustainable water solutions, particularly in regions facing water stress. Additionally, significant investments in research, development, and infrastructure have bolstered market expansion. Government initiatives promoting eco-friendly technologies and the increasing adoption of AWG systems in disaster-prone areas further accelerate growth.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Some of the major key players of the Atmospheric water generator market

- SkyWater Air Water Machines (SkyWater AWG systems)

- Air 2 Water Solutions (Air 2 Water units)

- Akvo Atmospheric Water Systems Pvt Ltd. (Akvo Water Generator)

- Ray Agua (Ray Agua AWG)

- Atlantis Solar (Atlantis Solar Water Systems)

- EcoloBlue, Inc. (EcoloBlue Atmospheric Water Generators)

- PlanetsWater (PlanetsWater AWG units)

- Hendrx Water (Hendrx Atmospheric Water Generators)

- Dew Point Manufacturing (Dew Point Water Systems)

- Water Technologies International, Inc., (Water Technologies AWGs)

- GENAQ (GENAQ Atmospheric Water Generators)

- Watergen (Watergen AWG units)

- Ideal Water (Ideal Water Atmospheric Water Generators)

- Watair (Watair AWG systems)

- Sahajanand Aqua (Sahajanand AWG)

- Aqua Sciences (Aqua Sciences AWG Systems)

- Atmospheric Water Solutions (AWS Water Generators)

- Vero Water (Vero AWG systems)

- Skywater (Skywater AWG)

- AirWater Corporation (AirWater atmospheric water generators)

Suppliers for (Producing water with low energy consumption, and offering large-scale systems for both commercial and residential use) on Atmospheric water generator market

- Watergen Inc.

- Aqua Sciences

- Akvo Atmospheric Water Systems Pvt. Ltd.

- Dew Point Manufacturing

- Ray Agua

- WaterMaker India Pvt. Ltd.

- PlanetsWater

- Airowater Private Limited

- Genesis Systems

- Aquaria

Air 2 Water Solutions-Company Financial Analysis

RECENT DEVELOPMENT

In January 2023: Airiver launched its atmospheric water generators for the consumer market. This U.S.-based company introduced a sustainable solution for communities seeking easy access to eco-friendly, purified water. With low power consumption and a multi-stage filtration system that removes impurities often missed by standard filters, Airiver's advanced technology ensures the production of up to 30 liters of pure, alkaline water daily.

In August 2023: Spout launched a new atmospheric water generator designed by Bould, capable of producing two and a half gallons of potable water daily. The device consistently generates up to 2.5 gallons per day, with around 80% of households worldwide living in climates with enough humidity for the device to function efficiently.

In February 2023: Water Technologies International, a global leader in atmospheric water generator design and production, announced that its fully owned subsidiary, ‘Water Zone,’ had secured an agreement with a major distributor in Florida. This partnership aims to supply DI resin tanks to hospital chains across the state, marking a step toward expanding the commercial DI water business in 2023.

| Report Attributes | Details |

| Market Size in 2023 | USD 2.58 billion |

| Market Size by 2032 | USD 7.21 billion |

| CAGR | CAGR of 12.09% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Cooling Condensation, Wet Desiccation) • By Application (Commercial, Industrial, Household, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | SkyWater Air Water Machines, Air 2 Water Solutions, Akvo Atmospheric Water Systems Pvt Ltd., Ray Agua, Atlantis Solar, EcoloBlue, Inc., PlanetsWater, Hendrx Water, Dew Point Manufacturing, Water Technologies International, Inc., GENAQ, Watergen, Ideal Water, Watair, Sahajanand Aqua, Aqua Sciences, Atmospheric Water Solutions, Vero Water, Skywater, AirWater Corporation. |

| Key Drivers | • The growing global water scarcity, exacerbated by climate change, is driving the demand for atmospheric water generators (AWGs), which offer a sustainable solution by extracting potable water from the air.. |

| RESTRAINTS | • High capital and maintenance costs of atmospheric water generators (AWGs) create financial barriers, limiting their adoption, especially in regions with lower purchasing power. |