Industrial Safety Market Report Scope & Overview:

Get more information on Industrial Safety Market - Request Sample Report

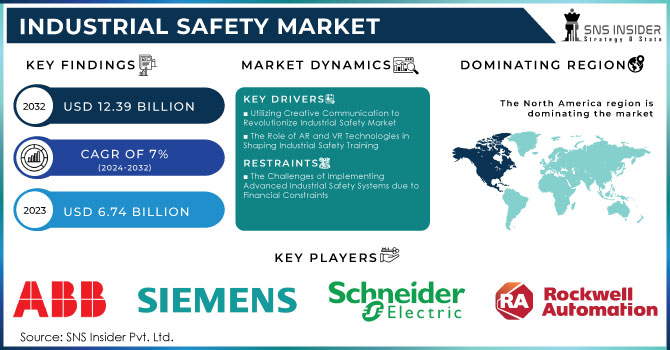

Industrial Safety Market Size was valued at USD 6.74 billion in 2023 and is expected to reach USD 12.39 billion by 2032, and grow at a CAGR of 7% over the forecast period 2024-2032.

The industrial safety market is crucial for safeguarding the well-being of workers, equipment, and the environment in industrial environments. It consists of a broad array of technologies, products, and services aimed at avoiding accidents, reducing risks, and ensuring adherence to safety rules. The market is being influenced by a heightened emphasis on workplace safety, strict government regulations, and the rising usage of automation in industries like manufacturing, energy, chemicals, oil & gas, pharmaceuticals, and more. Important elements of the industrial safety sector consist of safety sensors, emergency shutdown systems (ESD), fire and gas monitoring systems, safety controllers, industrial protective gear, and personal protective equipment (PPE). These systems are created to oversee and regulate crucial operations in dangerous settings in order to avoid mishaps, harm, and machinery malfunctions. An example is when ESD systems can stop industrial operations during emergencies, leading to a prompt reaction to avoid harm or destruction.

The initiation of the Electrical Transmission and Distribution (ET&D) strategic partnership in 2004 has underscored a major growth potential in the industrial safety market. The active cooperation among major companies, labor groups, and OSHA has not only decreased deaths in electrical construction industry from over 40 per 100,000 workers yearly to under four per year from 2018 to 2022 but also proved the importance of safety protocol investment. The use of data-driven analysis, training, and benchmarking in industries is increasing, leading to a higher demand for industrial safety solutions like protective equipment, monitoring systems, and safety management software. This change is motivated by regulatory pressure and the acknowledgement of safety as a form of investment rather than an expense. For example, the implementation of insulated gloves and sleeves and the establishment of pre-job briefing guidelines have established fresh benchmarks in the industry, driving the expansion of safety equipment markets. The growing necessity for thorough safety systems is highlighted in industries with high risks, such as electrical grid maintenance, showing a strategic focus on employee protection. This progress is also boosted by external influences such as weather changes, resulting in more frequent and intense natural calamities, resulting in increased dependence on safety protocols to safeguard workers during emergencies. As a result, the industrial safety sector is expected to see significant expansion, with companies in various industries such as energy and utilities placing a greater emphasis on workplace safety to prevent injuries, lower fatalities, and improve operational performance. The success of the ET&D partnership demonstrates how collaboration can be transformative, serving as a blueprint for other high-risk industries looking to enhance safety and generate long-term value in safety-focused markets.

Transformational growth in the industrial safety market is being driven by progress in data analytics, AI, and IoT technologies. The UK Health and Safety Executive has recorded 565,000 work-related injuries and a financial impact of over £18 billion for the fiscal year 2021-2022, highlighting the crucial necessity for creative workplace safety measures. The industrial safety market is being transformed by data analytics and AI, which are improving hazard detection, minimizing risks, and promoting safer work environments. These technologies help companies anticipate potential dangers before they worsen, changing the emphasis from reacting to hazards to preventing them. The inclusion of IoT devices enhances this change by providing instant monitoring and smart analysis to ensure adherence to safety protocols and enhance safety standards. This shift to digital technology within the industrial safety sector tackles the urgent problem of workplace injuries while also improving safety measures in different industries. By utilizing AI-generated data and IoT advancements, companies can reduce the economic effects of workplace accidents by improving employee safety and managing risks effectively. The quick implementation of these technologies in the industrial safety sector reflects a larger movement towards utilizing data for decision-making and taking a proactive approach to managing safety, enabling companies to enhance worker protection and meet changing safety laws. The increasing size of the industrial safety market will rely heavily on AI and IoT to create safer workplaces and ultimately decrease injury rates while improving operational performance.

Market Dynamics

Drivers

- Utilizing Creative Communication to Revolutionize Industrial Safety Market

Efficient communication plays a vital role in improving workplace safety, particularly in the industrial safety sector. As per the 2024 State of Employee Safety Report, 86% of workers have experienced workplace emergencies, but 34% do not feel ready to deal with them. This highlights the important requirement for safety training programs that are interesting and interactive. Utilizing creative communication techniques, like testing different platforms, merging augmented and virtual reality, and adding gamification, can greatly improve training outcomes and employee involvement. For example, integrating mobile Component s, social media posts, and interactive features such as trivia games or scavenger hunts can enhance the engagement and memorability of safety training. Augmented and virtual reality technology offers immersive experiences that enable workers to see and engage with potential risks in a safe environment, enhancing understanding and implementation of safety procedures. Moreover, encouraging mentorship among employees and seeking constructive criticism can assist in customizing training initiatives to effectively tackle practical safety issues. In the industry safety sector, these inventive methods not only improve adherence and efficiency but also promote a proactive safety mindset. By adopting these modern methods of communication, businesses can effectively ready their employees, decrease incident frequencies, and ultimately lower the hefty expenses linked to workplace injuries. This proactive strategy supports the increasing emphasis in the industrial safety sector on utilizing cutting-edge technology and creative strategies to manage safety hazards efficiently.

- The Role of AR and VR Technologies in Shaping Industrial Safety Training

Augmented Reality (AR) and Virtual Reality (VR) are leading the way in transforming industrial safety training by providing immersive and interactive experiences that greatly improve worker readiness and response skills. These innovative technologies overcome the drawbacks of conventional training methods by offering very realistic simulations of dangerous situations, allowing employees to participate in hands-on activities without facing actual dangers. AR technology superimposes digital data onto the real world, providing instant guidance and warnings about dangers. For example, Augmented Reality (AR) is able to display detailed guidelines on how to operate complicated machinery or can identify possible safety risks while workers engage with their surroundings. This immediate, relevant data assists in minimizing mistakes and lowering the risk of incidents. On the flip side, VR constructs a fully simulated setting for employees to train in responding to emergencies like fires, chemical spills, or equipment malfunctions. This hands-on method promotes practical experience, helping employees develop muscle memory and confidence in handling risky situations. The use of AR and VR in safety training has a significant impact on the industrial safety sector, as proper training is essential in preventing workplace accidents and following safety regulations. These technologies improve training effectiveness and promote a safer work environment by allowing employees to virtually experience and manage hazardous conditions. The fusion of AR and VR is consistent with the general direction of the industrial safety sector, where there is a growing focus on creative solutions and technology-driven strategies to enhance safety results and operational productivity. While industries are adopting these advancements, AR and VR are expected to have a major impact on the evolution of industrial safety training.

Restraints

- The Challenges of Implementing Advanced Industrial Safety Systems due to Financial Constraints

Implementing complex safety technology in businesses can be costly because of the expensive nature of automation and safety technology. Big companies can easily manage these costs because they understand the benefits of the enhanced safety and efficiency provided by these systems. However, small and medium-sized enterprises face important financial obstacles when attempting to implement and uphold these sophisticated safety measures. The costs of improving safety measures to meet evolving regulatory requirements just add to this difficulty. Organizations need to invest in the latest safety technologies to align with compliance requirements due to the ongoing progress of safety regulations and technological advancements. This involves SMEs needing to consistently update and change safety components, which may incur high costs. Smaller companies struggle to meet the demands because of the increased complexity and expenses associated with adhering to stringent safety regulations. Financial constraints impede the growth of the industrial safety sector, particularly affecting small and medium-sized businesses that struggle to afford regular upgrades and compliance with regulations. While advanced safety systems are necessary to protect workers and keep operations running smoothly, the high cost is a major hindrance for smaller and medium-sized industrial companies, affecting their acceptance and financial viability.

Segment Analysis

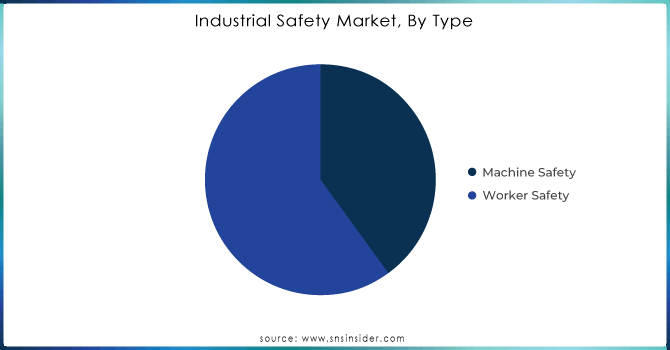

By Type

In 2023, worker safety emerged as the leading sector in the industrial safety market based on type, capturing a significant 58% of the revenue. This significant section emphasizes the highest importance placed on safeguarding workers in various industries such as manufacturing, construction, and energy. Safety precautions for employees include different technologies and practices, like PPE, safety training initiatives, and real-time monitoring tools. Developments in this industry are driving growth and improving safety outcomes. Honeywell and 3M are leading the way in creating advanced wearable safety technology like smart helmets and vests that monitor employees' health and surroundings using sensors. Additionally, the implementation of advanced safety measures, such as smart personal protective gear that connects to IoT systems for live data analysis, showcases the shift of the sector towards data-driven proactive safety control. Placing importance on enhancing worker safety not only reduces workplace accidents but also aligns with increasing regulatory demands for comprehensive safety protocols, establishing worker safety as the primary focus in the industrial safety sector.

Get Customized Report as per your Business Requirement - Request For Customized Report

By Component

In terms of Component, presence sensing safety sensors had the highest revenue share of 27% in 2023. These sensors play a crucial role in enhancing safety in industrial environments by detecting people and objects in hazardous areas, thereby preventing accidents and ensuring efficient operations. Safety sensors with presence detection such as light curtains, laser scanners, and proximity sensors are designed to provide immediate detection and response functions. The increasing demand for automated safety systems that can improve operations underscores their importance. Progress in this industry is driving the market forward. Advanced light curtain systems like those from SICK AG and Omron have been created to offer better resolution and reliability, allowing for the detection of smaller objects and providing more accurate safety functions. Furthermore, the latest laser scanning technology from Keyence and Pepperl+Fuchs provides increased range and precision, simplifying the monitoring of hazardous areas. The increasing focus on safety compliance and automation in industries is fueling the growing need for presence sensing safety sensors in the market. Incorporating these sensors into intelligent safety systems allows for instant data examination and proactive maintenance, improving workplace safety and efficiency. With industries prioritizing safety and technological advancements, the growth of presence sensing safety sensors is expected to lead the way in driving further expansion in the industrial safety market.

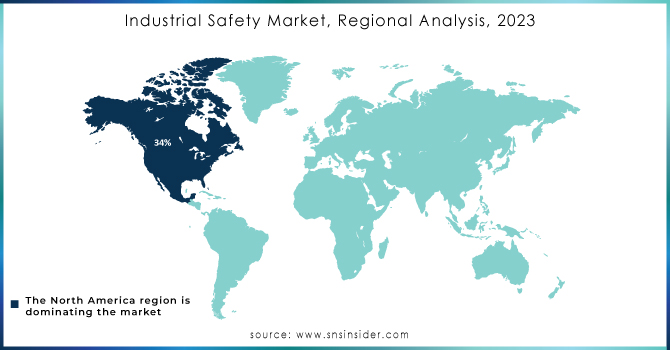

REGIONAL ANALYSIS:

In 2023, North America held the highest market share in industrial safety, accounting for 34% of total revenue. The area's advanced industrial infrastructure, stringent safety regulations, and high levels of using innovative safety technologies all play a role in its leading position. OSHA in the United States and its Canadian equivalents impose rigorous safety regulations, leading to demand for innovative safety solutions and technologies. Significant investments in automation and safety systems by major industrial companies in North America are crucial factors in the region's leading position. Honeywell and Rockwell Automation have introduced new solutions, such as Honeywell's Safety Manager and Rockwell's Integrated Safety Systems, to enhance real-time monitoring and risk assessment features. Moreover, Emerson's advanced safety systems, including its Rosemount and DeltaV products, offer improved diagnostic features and predictive maintenance choices, strengthening safety in industrial environments. Government measures play a crucial role in fostering development. In the United States, programs such as OSHA's Voluntary Protection Programs (VPP) promote the adoption of cutting-edge safety technology and compliance with strict safety standards. The data provided by the U.S. Department of Labor demonstrates a continual dedication to improving safety in the workplace, aligning with the broader goal of reducing work-related injuries and fatalities. Recent releases in the area, such as Banner Engineering's new safety sensors and Pilz's advanced safety relays, highlight a significant focus on innovation. These developments aid in improved hazard recognition, ongoing safety surveillance, and enhanced overall workplace safety. The North American industrial safety market is expected to expand more as industries place more emphasis on safety and technology to uphold its leading global status.

By 2023, the Asia-Pacific region had become the second fastest-growing market in industrial safety, demonstrating significant advancements and increasing investment in safety technologies across the area. This rise is driven by rapid industrial growth, expanding manufacturing sectors, and a heightened emphasis on workplace safety. Rapidly developing economies such as China and India are investing heavily in safety infrastructure to meet the demands of their growing industrial sectors. China, known for its vast manufacturing industry, has implemented stringent safety regulations under the Ministry of Emergency Management, formerly known as the State Administration of Work Safety (SAWS). These regulations emphasize the use of cutting-edge safety technologies, resulting in a greater demand for safety products in the industrial sector. The Chinese government's commitment to enhancing industrial safety is highlighted in the "Made in China 2025" initiative, which encourages the adoption of advanced technologies like safety systems in manufacturing. India is also making advancements by implementing updated safety standards with the help of the Ministry of Labour and Employment. The country is experiencing rapid growth in sectors like automotive and electronics, resulting in the enforcement of safety protocols. Recent developments in products, like Tata Steel's advanced safety sensors and Siemens India's enhanced safety automation systems, highlight the area's dedication to improving industrial safety measures. The rise of the industrial safety market in Asia Pacific can be attributed to a heightened emphasis on workplace safety, spurred by government programs and private sector funding.

Key Players

Some of the major key players in the Global Industrial Safety Market providing some of the offerings & Products

- ABB Ltd - (ABB Safety Instrumented Systems, ABB S800/S900 Safety Systems)

- Siemens AG - (Siemens SIMATIC Safety Integrated, SIRIUS Safety Relays)

- Schneider Electric SE - (Modicon Safety PLC, Preventa Safety Sensors)

- Baker Hughes - (Bently Nevada Machinery Protection, Ruggedized Pressure Transmitters)

- Yokogawa Electric - (STARDOM Safety System, ProSafe-RS Safety Instrumented System)

- Hima Paul Hildebrandt - (HIMax Safety System, HIMA SIL3 Certified Solutions)

- Johnson Controls - (Tyco Fire Protection Products, Johnson Controls Building Automation Systems)

- Fortress Interlocks - (Fortress Safety Interlock Systems, Safety Gate Systems)

- Rockwell Automation - (Allen-Bradley Guardmaster Safety, Rockwell Automation SafetyPLC)

- Emerson Electric - (DeltaV SIS, Rosemount Safety Products)

- Omron Corporation - (Omron Safety Controllers, Safety Light Curtains)

- General Electric - (GE Fanuc Safety PLCs, GE Industrial Sensors)

- Proserv Ingenious Simplicity - (Proserv Safety Systems)

- Euchner - (Euchner Safety Switches, Euchner Safety Relays)

- 3M - (3M Fall Protection, 3M Safety Signage)

- SICK AG - (SICK Safety Laser Scanners, SICK Safety Light Curtains)

- KEYENCE CORPORATION - (KEYENCE Safety Sensors, Safety Light Curtains)

- Pepperl+Fuchs - (Pepperl+Fuchs Safety Barriers, Safety Light Curtains and Sensors)

- Others

Recent Development

-

October 26, 2023: Pepperl+Fuchs Enhances Industrial Safety with New Safe Absolute Positioning Systems Offering SIL 3 and PL e Certifications

-

On November 17, 2023, ABB Ability™ Smart Sensor for Hazardous Area was introduced, a wireless gas detector designed for tough industrial settings. This sensor makes installation and maintenance easier while enhancing worker safety.

-

On October 25, 2023, a collaboration was established with TÜV Rheinland to provide a wide range of industrial safety services, such as risk evaluations, education, and accreditation. This partnership is focused on assisting customers in enhancing their safety culture and adherence to regulations.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 6.74 Billion |

| Market Size by 2032 | USD 12.39 Billion |

| CAGR | CAGR of 7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by type (Machine Safety, Worker Safety) • by component (Presence Sensing Safety Sensors, Programmable Safety Systems, Safety Interlock Switches, Emergency Stop Controls, Safety Controllers/ Modules/ Relays, Two-Hand Safety Controls, Others) • by Industry (Oil & Gas, Food & Beverages, Aerospace & Defense, Healthcare & Pharmaceuticals, Energy & Power, Chemicals, Automotive, Semiconductor, Metals & Mining, Others) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles |

ABB Ltd,Siemens AG , Schneider Electric SE,Baker Hughes,Yokogawa Electric,Hima Paul Hildebrandt,Johnson Controls, Fortress Interlocks,Rockwell Automation,Emerson Electric,Omron Corporation,General Electric,Proserv Ingenious Simplicity,Euchner,3M,SICK AG,KEYENCE CORPORATION,Pepperl+Fuchs,Others |

| Key Drivers |

• Utilizing Creative Communication to Revolutionize Industrial Safety Market |

| Restraints |

• The Challenges of Implementing Advanced Industrial Safety Systems due to Financial Constraints |