Inertial Measurement Unit (IMU) Market Report Scope & Overview:

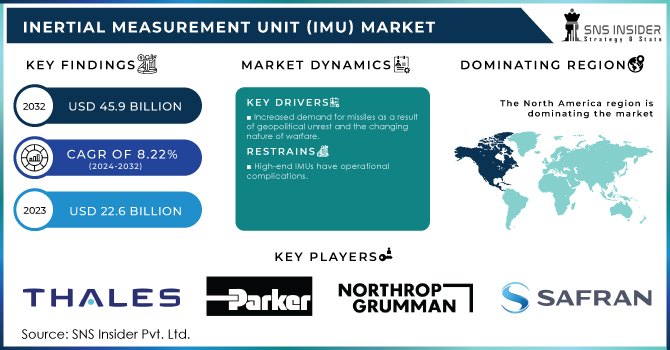

Inertial Measurement Unit (IMU) Market was valued at USD 22.6 billion in 2023 and is projected to grow to USD 45.9 billion by 2032, registering a CAGR of 8.22% during the forecast period of 2024-2032.

An inertial measurement unit is an electronic device that uses accelerometers, gyroscopes, and magnetometers to detect velocity, angular rate, direction, and gravitational forces. Inertial measurement units are employed as components of navigation and guidance systems to track a vehicle's position, velocity, and orientation. Navigation and correction, control and stabilisation, measurement and testing, mobile mapping, and unmanned system control all make use of inertial measurement units. The data obtained from inertial measurement units is processed by a computer in order to establish the current position based on velocity and time in an inertial navigation system.

microelectromechanical systems (MEMS) Due to the widespread use of MEMS in unmanned systems, gyro technology is expected to account for the largest CAGR during the review period. MEMS gyroscopes are commonly used to determine angular velocity utilising a sensor vibrating mechanical element. It does not have any spinning parts due to its modest size.

To get more information on Inertial Measurement Unit (IMU) Market - Request Free Sample Report

MARKET DYNAMICS

KEY DRIVERS

-

Increased demand for missiles as a result of geopolitical unrest and the changing nature of warfare

-

Miniaturized components are available at reasonable prices.

RESTRAINTS

-

High-end IMUs have operational complications.

-

Defense budgets of affluent countries fluctuate

OPPORTUNITY

-

Improved performance when combined with other systems

-

MEMS-based IMU technological developments

CHALLENGES

-

Time required for system startup

-

Commercial drone use restrictions

IMPACT OF COVID-19

Because of the COVID-19 scenario, ongoing research and development in inertial measurement units has been hampered by announced lockdowns and government bans on public gatherings.

The COVID-19 impact has caused a slowing in the economies of various countries, which may hamper government spending in defence projects. Such a reduction in expenditure will have a direct impact on the growth of the inertial measurement unit market.

Travel restrictions and reduced military activity as a result of COVID-19 have also hampered the expansion of the inertial measurement market, as the supply chain of associated spare components has been disrupted.

The global inertial measuring unit market may see significant growth in the coming quarter, as industry output has begun to pick up steam following the difficult phase of COVID-19.

The MEMS category is expected to have the highest CAGR rate for the inertial measurement unit market during the forecast period, based on technology. Because of their low weight and comparably superior accuracy in a small package, these small, lightweight systems offer an advantage over other types of IMUs. In the next years, MEMS-based IMUs are likely to replace FOG IMUs in tactical grade performance applications.

The commercial grade category is expected to develop at the fastest CAGR for the inertial measurement unit market during the forecast period. Consumer and enterprise-grade IMUs are examples of commercial grade IMUs. Consumer-grade IMUs are utilised in low-end applications like phones, tablets, car airbag systems, and so on, whereas enterprise-grade IMUs are employed in small UAVs.

A gyroscope is used to determine the orientation and quantify the angular motion of UMVs, aircraft, UGVs, and UAVs utilising the earth's gravity. An accelerometer is a significant component of an aircraft since it measures non-gravitational acceleration and velocity. Magnetometers are commonly used in conjunction with gyroscopes and accelerometers to improve the accuracy of attitude estimation.

Autonomous vehicles are outfitted with a variety of sensors, including a motion sensor, to collect data on their properties and control movements. In autonomous vehicles, inertial measurement units are used to determine location and orientation. Furthermore, such vehicles are outfitted with a variety of electronic technologies, including backup assistance systems, autonomous braking systems, front collision warning systems, and others. Inertial measuring units are used to regulate the majority of these electronic systems. As a result, increased investments in self-driving cars will contribute to the growth of the worldwide inertial measurement unit market.

KEY MARKET SEGMENTATION

By Grade

-

Commercial Grade

-

Marine Grade

-

Navigation Grade

-

Space Grade

-

Tactical Grade

By Component

-

Accelerometers

-

Gyroscopes

-

Magnetometers

By Technology

-

Fiber Optics Gyro

-

Mechanical Gyro

-

Ring Laser Gyro

-

MEMS

-

Others

By Application

-

Aircraft

-

Military Armored Vehicles

-

Missiles

-

Marine

-

Unmanned Ground Vehicles (UGVs)

-

Unmanned Marine Vehicles (UMVs)

-

Consumer Electronics

-

Automotive

-

Survey Equipment

REGIONAL ANALYSIS

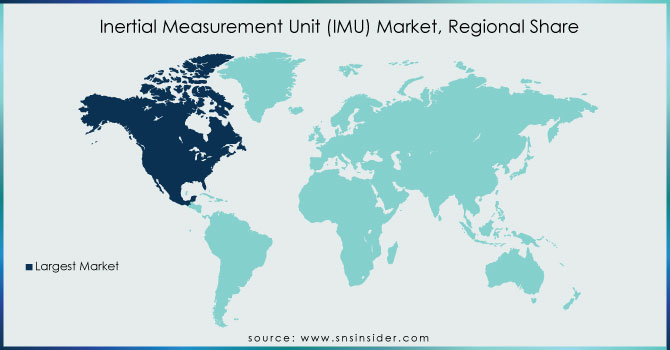

Because of the presence of prominent key players such as Northrop Grumman Corporation, General Electric Company, United Technologies Corporation, and Honeywell International Inc. in the region and their high investments in IMU development, the North American regional market is expected to dominate the global market by holding the largest Market Share during the forecast period. Furthermore, the Asia-Pacific market is expected to grow at a rapid pace throughout the research period. Because of increased demand for new aircraft and rising defence spending in developing countries such as India and China, this area is driving market expansion. Furthermore, the Middle East and Africa's Inertial Measurement Unit Market is expanding as a result of rising defence spending in nations such as Israel, the United Arab Emirates, and Saudi Arabia. Furthermore, the Latin American regional market is booming due to the widespread usage of UAVs for monitoring and controlling illicit migration, drug trafficking, and deforestation.

Need any customization research on Inertial Measurement Unit (IMU) Market - Enquiry Now

REGIONAL COVERAGE:

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

KEY PLAYERS

The Major Players are Thales Group, Parker Hannifin Corp, Northrop Grumman Corporation., Sensonor, Safran, GENERAL ELECTRIC, Gladiator Technologies, Honeywell International Inc., Bosch Sensortec GmbH, STMicroelectronics and Other Players

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 22.6 Billion |

| Market Size by 2032 | USD 45.9 Billion |

| CAGR | CAGR of 8.22% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Grade (Commercial Grade, Marine Grade, Navigation Grade, Space Grade, and Tactical Grade) • By Component (Accelerometers, Gyroscopes, Magnetometers) • By Technology (Fiber Optics Gyro, Mechanical Gyro, Ring Laser Gyro, MEMS, and Others) • By Application (Aircraft, Military Armored Vehicles, Missiles, Marine, Unmanned Aerial Vehicles (UAVs), Unmanned Ground Vehicles (UGVs), Unmanned Marine Vehicles (UMVs), Consumer Electronics, Automotive, and Survey Equipment) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Thales Group, Parker Hannifin Corp, Northrop Grumman Corporation., Sensonor, Safran, GENERAL ELECTRIC, Gladiator Technologies, Honeywell International Inc., Bosch Sensortec GmbH, STMicroelectronics. |

| DRIVERS | • Increased demand for missiles as a result of geopolitical unrest and the changing nature of warfare • Miniaturized components are available at reasonable prices. |

| RESTRAINTS | • High-end IMUs have operational complications. • Defense budgets of affluent countries fluctuate |