Inertial Navigation System Market Report Scope & Overview:

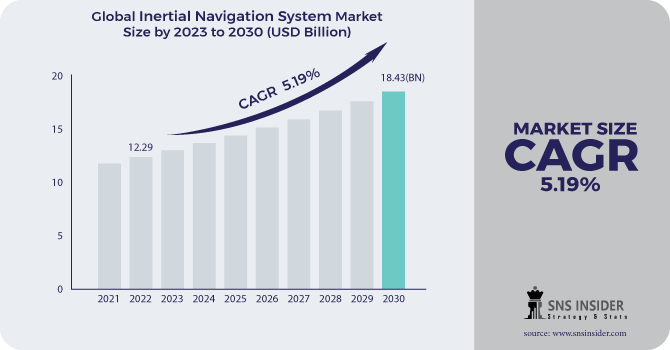

The Inertial Navigation System Market Size was valued at USD 12.29 billion in 2022 and is expected to reach USD 18.43 billion by 2030 with an emerging CAGR of 5.19% over the forecast period 2023-2030.

The Inertial Navigation System (INS) is a navigation device that combines accelerometer and gyroscope readings to determine the velocity and position of a vehicle. The increase of the vehicle segment and utilisation of cars helps the Inertial Navigation System Market. The market is expanding and has demonstrated moderate growth trends in recent years. The Market is expected to expand in the approaching years as well. When an item is in motion, the INS monitors the gravitational force acting on it, as well as its angular velocity and directional position. The Inertial Navigation System collaborates with current accelerometers, gyroscopes, and sensors.

To get more information on Inertial Navigation System Market - Request Free Sample Report

The associated Inertial Navigation System Market is predicted to expand since sensor technology has grown into an accurate and fast technology as a result of recent advancements. The INS is utilised not just by aeroplanes but also by military aviation for missile launches. The INS is also utilised in commercial games and medical devices that use GPS tracking. The Inertial Navigation System Industry will benefit in the future as the use of inertial reference systems expands.

MARKET DYNAMICS

KEY DRIVERS

-

Missile demand has increased as a result of geopolitical instabilities and the changing nature of warfare.

-

Miniaturized Components Are Available at Reasonable Prices

RESTRAINTS

-

High-End Instability Is Associated With Operational Complexity

-

Defense budget cuts in developed countries

OPPORTUNITY

-

MEMS-Based Insights: Technological Advances

-

Commercial Driver-less Vehicle Development

CHALLENGES

-

Operational complexity associated with inertial navigation systems, as well as a fall in defence budgets in several large countries

-

To eliminate measurement errors, these joints must be frictionless. The inaccuracy due to friction grows with repeated use and wear and tear of these systems.

IMPACT OF COVID-19

The COVID 19 epidemic harmed the Inertial Navigation System Market, as it did all other industrial segments. As the travel sector suffered as a result of the epidemic and subsequent shutdown, the market shrunk in size and application. The industrial industry, including the Inertial Navigation System Market, experienced a downturn in production and sales. As a result, the growth rate of the Inertial Navigation System Market slowed during the epidemic.

However, when the production of planes and missiles for various purposes acquires traction in the post-pandemic age, the Market will also witness a recovery. The military and naval fields will see a greater use of inertial navigation system aircraft.

The implementation of a more advanced ship inertial navigation system will also result in strong overall market growth trends. As a result, the Market will expand throughout the predicted period.

The gyroscopes sector is expected to account for the highest share of the total market in 2021. The introduction of efficient, cost-effective, and compact gyroscopes is expected to boost demand for gyroscopes in the inertial navigation system market. Gyroscopes' popularity can be linked to its ability to address high-level motion sensing and navigational help. Gyroscopes can also detect angular velocity in three dimensions. Fiber Optics Gyros (FOGs), Ring Laser Gyros (RLGs), mechanical gyros, Micro-Electro-Mechanical System (MEMS), vibrating gyros, and Hemispherical Resonator Gyros are some of the most prevalent gyroscope varieties used in inertial navigation systems (HTGs).

The space launch vehicles segment is expected to account for the highest proportion of the inertial navigation system market in 2021 based on application. The increased deployment of space launch vehicles, such as tiny satellites, around the world is expected to boost the demand for highly reliable and accurate inertial navigation systems, which will assure the vehicle's safety. A launch vehicle is a rocket that transports spacecraft, satellites, and payload from the earth's surface into outer space. Space launch vehicles range in size from a modest lift launch vehicle to a super-heavy lift vehicle, depending on their capabilities.

Furthermore, the increased frequency of satellite launches for diverse uses such as research and development, scientific study, and communication is expected to stimulate demand for inertial navigation systems in these space launch vehicles.

KEY MARKET SEGMENTATION

By Technology

-

Mechanical

-

Ring Laser

-

Fiber Optic

-

MEMs

By Grade

-

Marine

-

Navigation

-

Tactical

-

Space

-

Commercial

By Application

-

Aircraft

-

Missile

-

Marine

-

UAV

-

UGV

-

UMV

By Component

-

Accelerometers

-

Gyroscopes

-

Algorithms & Processors

-

Wireless

.png)

Need any customization research on Inertial Navigation System Market - Enquiry Now

REGIONAL ANALYSIS

The inertial navigation system market analysis by region is required to comprehend revenue distribution and competitor existence in various parts of the world. The global inertial navigation system market is divided into five major regions: North America, Asia Pacific, Europe, the Middle East and Africa, and Latin America. The largest markets for inertial navigation systems are in North America, Europe, and Asia Pacific. While all regions will exhibit positive market trends, the North American region will continue to be the dominating regional market in terms of revenue and competitors. Major inertial navigation system manufacturers are based in North America.

REGIONAL COVERAGE:

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

KEY PLAYERS

The Major Players are Honeywell International Inc., Safran, GENERAL ELECTRIC, Trimble Inc., Collins Aerospace, Gladiator Technologies, Northrop Grumman Corporation., Thales Group, Raytheon Technologies Corporation, Teledyne Technologies Incorporated and Other Players

Honeywell International Inc-Company Financial Analysis

| Report Attributes | Details |

|---|---|

| Market Size in 2022 | US$ 12.29 Billion |

| Market Size by 2030 | US$ 18.43 Billion |

| CAGR | CAGR of 5.19% From 2023 to 2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Historical Data | 2020-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Mechanical, Ring Laser, Fiber Optic, MEMs) • By Grade (Marine, Navigation, Tactical, Space, Commercial) • By Application (Aircraft, Missile, Marine, UAV, UGV, UMV) • By Component (Accelerometers, Gyroscopes, Algorithms & Processors, Wireless) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Honeywell International Inc., Safran, GENERAL ELECTRIC, Trimble Inc., Collins Aerospace, Gladiator Technologies, Northrop Grumman Corporation., Thales Group, Raytheon Technologies Corporation, Teledyne Technologies Incorporated. |

| DRIVERS | • Missile demand has increased as a result of geopolitical instabilities and the changing nature of warfare. • Miniaturized Components Are Available at Reasonable Prices |

| RESTRAINTS | • High-End Instability Is Associated With Operational Complexity • Defense budget cuts in developed countries |