Robotics and Automation Actuators Market Report Scope & Overview:

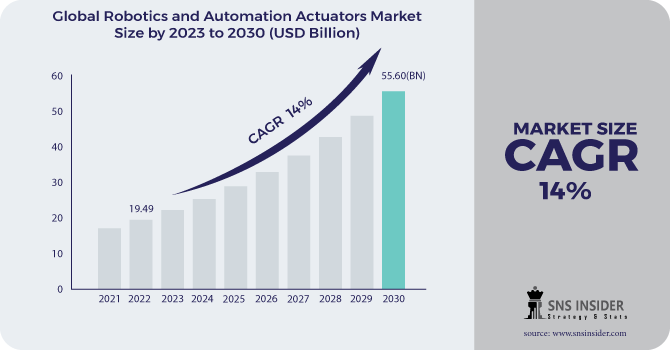

The Robotics and Automation Actuators Market Size was valued at USD 19.49 billion in 2022, expected to reach USD 55.60 billion by 2030 and grow at a CAGR of 14% over the forecast period 2023-2030.

Some of the opportunities influencing the growth of the robotics and automation actuators market include the development of advanced and cost-effective robotics and automation actuators, as well as increased demand in various industry verticals for industrial robots and process automation.

To get more information on Robotics and Automation Actuators Market - Request a Free Sample Report

MARKET DYNAMICS

KEY DRIVERS

-

Continuous technical progress in robotics and automation actuators.

-

Process automation investments in emerging economies' industries.

RESTRAINTS

-

Crude oil prices have plummeted in recent years, affecting the overall market for various components used in the oil and gas supply chain, including robotics and automation actuators.

-

The ongoing volatility in the oil and gas business, as well as the price of crude oil.

OPPORTUNITIES

-

In several industries, there is a high demand for new and sophisticated actuators.

-

Smart city development throughout the world.

CHALLENGES

-

Problems with power usage, noise, and leaking.

-

Customers may not prefer purchasing actuators due to the possibility of defective circuit designs.

THE IMPACT OF COVID-19

However, in light of the recent COVID-19 outbreak, numerous industries' operations have either been temporarily halted or are operating with a reduced workforce due to imposed lockdown and restrictions by respective governing bodies. The global Robotics and Automation Actuators market is no exception, and this factor is expected to have a significant negative impact on the industry's revenue growth. Furthermore, the high costs associated with the installation and maintenance of these machines may impede the revenue growth of the global Robotics and Automation Actuators market during the forecast period.

The electric segment is expected to lead the robotics and automation actuators market by actuation in 2022. This segment's growth can be attributed to high power efficiency, lower system weight, and increasing power output. In 2022, the robotics segment is expected to grow at the fastest CAGR in the robotics and automation actuators market. The robotics market has been further subdivided into industrial robots and service robots. The expansion of this segment is increasing the demand for industrial robots in large-scale enterprises, while service robots are used for both professional and personal applications. The rotary is expected to grow at the fastest CAGR during the forecast period.

They convert electrical energy into rotational motion. These actuators are primarily used in automation applications such as gates, valves, and so on, as well as industries where accurate positioning of end effector, such as valve movement in a pipeline, is required, and are thus fueling market growth.

The electronics & electricals segment is expected to lead the market for robotics and automation actuators during the forecast period, owing to rising demand for batteries, chips, and displays, which is fueling growth in the robotics and automation actuators market for electronics & electrical.

KEY MARKET SEGMENTATION

By Application

-

Process Automation

-

Robotics

By Vertical

-

Automotive

-

Electronics

-

Healthcare

By Actuation

-

Electric

-

Pneumatic

-

Hydraulic

By Characteristics

-

Load

-

Torque

By Type

-

Linear Actuators

-

Rotary Actuators

.png)

Need any customization research on Robotics and Automation Actuators Market - Enquiry Now

REGIONAL ANALYSIS

In 2023, the Asia Pacific region is expected to lead the robotics and automation actuators market. This region's robotics and automation actuators market has been researched for Japan, China, India, South Korea, Taiwan, and the rest of Asia Pacific. Countries in the Asia Pacific region are improving their varied capacities by developing actuators. China and Japan are investing primarily in robotics and automation in order to improve and achieve a tactical advantage in robotics and process automation. This is a good opportunity for producers of robotics and automation actuators to grow their operations in the Asia Pacific area.

REGIONAL COVERAGE:

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

KEY PLAYERS

The Major Players are ABB, Rockwell Automation, Altra Industrial Motion., Moog, Curtis Wright, MISUMI, SKF Motion Technologies, SMC Corporation, Thomson Industries, Inc., and other players.

Rockwell Automation-Company Financial Analysis

| Report Attributes | Details |

|---|---|

| Market Size in 2022 | US$ 19.49 Billion |

| Market Size by 2030 | US$ 55.60 Billion |

| CAGR | CAGR of 14% From 2023 to 2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Historical Data | 2020-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Process Automation, Robotics) • By Vertical (Automotive, Electronics, Healthcare) • By Actuation (Electric, Pneumatic, Hydraulic) • By Type • By Characteristics |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | ABB, Rockwell Automation, Altra Industrial Motion., Moog, Curtis Wright, MISUMI, SKF Motion Technologies, SMC Corporation, Thomson Industries, Inc. |

| DRIVERS | • Continuous technical progress in robotics and automation actuators. • Process automation investments in emerging economies' industries. |

| RESTRAINTS | • Crude oil prices have plummeted in recent years, affecting the overall market for various components used in the oil and gas supply chain, including robotics and automation actuators. • The ongoing volatility in the oil and gas business, as well as the price of crude oil. |