Utility Aircraft Market Report Scope & Overview:

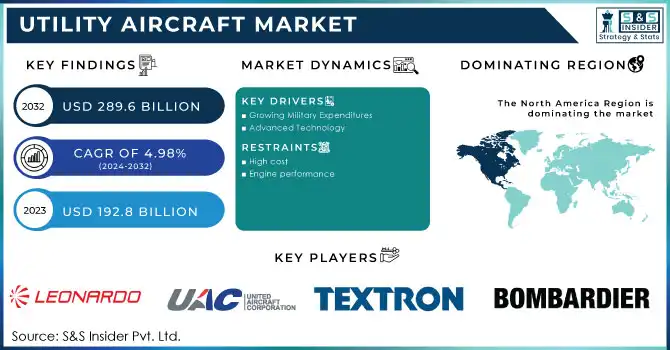

The Utility Aircraft Market size was USD 192.8 billion in 2023 and is expected to reach USD 289.6 billion by 2032, growing at a CAGR of 4.98% over the forecast period of 2024-2032.

Modern military programs and inflation in several countries to upgrade their aircraft fleet and replace old aircraft and increase the use of aircraft in various sectors such as firefighting, agriculture, sports activities, etc. are key drivers of market growth. The commercial aviation market is growing as a result of modern military systems and growing investments by developing and developing countries. In addition, the commercial aviation market is expected to benefit from a variety of aircraft applications in various industries, such as firefighting, sports, and agriculture, among others, over a limited period of time. In addition, the use of used aircraft supports their market demand and can be used in a variety of ways depending on the situation, such as transporting people and other objects, and the same aircraft can be used in place of larger and heavier aircraft when they are not available or needed.

Market Size and Forecast:

-

Market Size in 2023: USD 192.8 Billion

-

Market Size by 2032: USD 289.6 Billion

-

CAGR: 4.98% from 2024 to 2032

-

Base Year: 2023

-

Forecast Period: 2024–2032

-

Historical Data: 2020–2022

To get more information on Utility Aircraft Market - Request Free Sample Report

Utility Aircraft Market Trends:

-

Increasing demand for short-haul regional connectivity and remote area transportation is driving the growth of utility aircraft.

-

Rising defense modernization programs and surveillance requirements are boosting procurement of multi-role utility aircraft.

-

Growth in charter services, medical evacuation (air ambulance), and cargo logistics is expanding commercial application scope.

-

Technological advancements in lightweight materials, fuel-efficient engines, and avionics systems are enhancing operational efficiency.

-

Expansion of general aviation infrastructure and airport development in emerging economies is supporting market growth.

-

Strategic partnerships between aircraft manufacturers, leasing companies, and defense agencies are accelerating innovation and fleet expansion.

Market Dynamics

Key Drivers

-

Growing Military Expenditures

-

Advanced Technology

Restraints

-

High cost

-

Engine performance

Opportunities

-

Expanding demand

-

Boost up the E-commerce industry

Challenges

-

This section is included in the final report.

By Type

The global utility aircraft market is divided into two types: fixed-wing and rotary-wing. Because of the increased demand for utility helicopters, the rotary-wing segment is expected to grow significantly during the projected period. Utility helicopters are employed for a variety of military purposes, including military logistics, air assault, command and control, and troop transport. These are also utilized for firefighting and humanitarian aid.

By Application

Increased Use of Utility Aircraft for Military Applications to Drive Non-Commercial Segment Demand The global utility aircraft market is divided into commercial and non-commercial segments based on application. The non-commercial segment is expected to increase significantly in the coming years, owing to the rising use of utility aircraft for a variety of military purposes such as logistics, command and control, and air assault.

Competitive Landscape

Lockheed Martin Corporation is a global aerospace and defense company that designs, develops, manufactures, and integrates advanced defense and aircraft products. It also provides a wide range of services to the military, civil, and commercial industries, including engineering, technical, scientific, logistics, and cyber security. Aside from the United States, the company has offices in Canada, Saudi Arabia, the United Kingdom, and Russia. Aeronautics, Missiles and Fire Control, Rotary and Mission Systems, and space systems are the reportable segments of Lockheed Martin Corporation.

There are a few worldwide and regional established companies in the global utility aircraft industry. The market's established companies are working to increase their product portfolio by partnering with or purchasing another notable aviation component manufacturer. Market participants are aiming to improve their operational capabilities, lowering the cost of their product offerings and boosting their revenues while also enhancing market competition.

Key Market Segmentation

By Application

-

Commercial

-

Non-commercial

-

Military

-

Cargo

-

Others

By Aircraft Type

-

Rotorcrafts

-

Fixed Wings

Regional Analysis

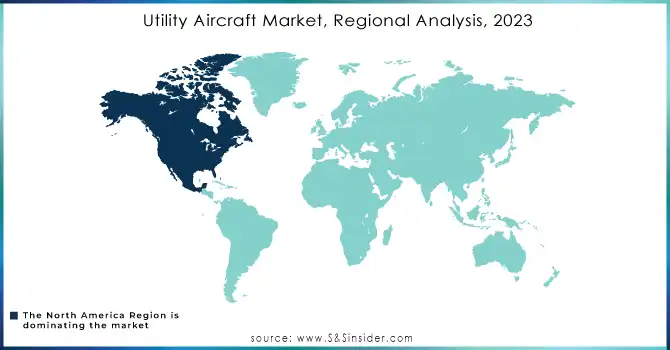

North America is ranked with the largest market share Over the past decade, North America has seen strong growth in demand for used aircraft and is likely to continue to dominate the global market during the forecast period. The US has played a key role in the strong growth of the North American aviation market, which can be attributed to the country's major military spending. The US has been, and still is, a country with huge military costs and world incomes. As well as being the world's largest military operator, the country is also home to some of the world's leading aircraft manufacturers, making it one of the world's leading airlines.

The region is home to some of the leading aircraft manufacturers, such as Lockheed Martin Corporation, Bombardier Inc., and Textron Inc. In addition, US troops have invested heavily in the construction and development of used aircraft to enhance their military capabilities. World military spending alone accounted for about 40% of global military expenditure by 2022, with much of it spent on modern military development, including new aircraft. Therefore, with US spending on the acquisition of new aircraft, the North American aviation market is expected to prove strong growth during the study period.

Over the past decade, North America has seen strong growth in demand for used aircraft and is likely to continue to dominate the global market during the forecast period. The US has played a key role in the strong growth of the North American aviation market, which can be attributed to the country's major military spending. The US has been, and still is, a country with huge military costs and world incomes. As well as being the world's largest military operator, the country is also home to some of the world's leading aircraft manufacturers, making it one of the world's leading airlines.

Need any customization research on Utility Aircraft Market - Enquiry Now

Regional Coverage

North America

-

USA

-

Canada

-

Mexico

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

Asia-Pacific

-

Japan

-

South Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

Key Players

The ajor Players are Leonardo S.p.A., Harbin Aircraft Industry Group Co. Ltd, United Aircraft Corporation, Textron Inc., Changhe Aircraft Industries Group Co. Ltd., Lockheed Martin Corporation, Bombardier Inc., Piaggio Aero Industries S.p.A., Daher Aerospace, S.A. de C.V., Airbus S.A.S, and other players.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 192.8 Billion |

| Market Size by 2032 | USD 289.6 Billio |

| CAGR | CAGR of 4.98% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Commercial, Non-commercial, Military, Cargo, Others) • By Aircraft Type (Rotorcrafts, Fixed Wings) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of the Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Leonardo S.p.A., Harbin Aircraft Industry Group Co., Ltd, United Aircraft Corporation, Textron Inc., Changhe Aircraft Industries Group Co. Ltd., Lockheed Martin Corporation, Bombardier Inc., Piaggio Aero Industries S.p.A., Daher Aerospace, S.A. de C.V., Airbus S.A.S, and other players. |

| DRIVERS | • Growing Military Expenditures • Advanced Technology |

| RESTRAINTS | • High cost • Engine performance |