Inhalation Anesthesia Market Report Scope & Overview:

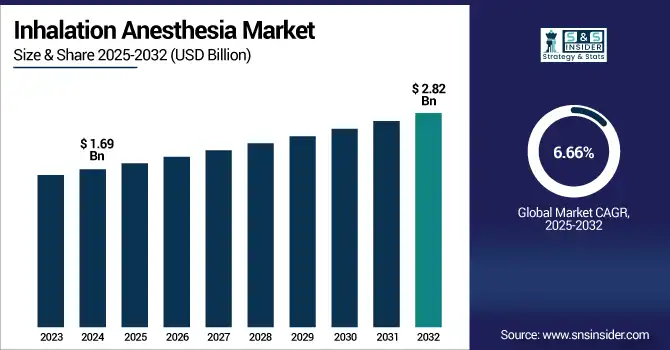

The inhalation anesthesia market size was valued at USD 1.69 billion in 2024 and is expected to reach USD 2.82 billion by 2032, growing at a CAGR of 6.66% over the forecast period of 2025-2032.

The global inhalation anesthetics market is growing steadily due to a surge in the surgical volume globally, advancements in anesthetic devices, and a surge in demand for short-acting agents such as sevoflurane. Increasing geriatric and pediatric population and rising surgical infrastructure in developing regions also create demand opportunities. Fears over the environmental impact are driving change towards low-GWP anesthetics and driving innovation.

To Get more information on Inhalation Anesthesia Market - Request Free Sample Report

The U.S. inhalation anesthesia market size was valued at USD 0.66 billion in 2024 and is expected to reach USD 1.07 billion by 2032, growing at a CAGR of 6.39% over the forecast period of 2025-2032.

The U.S. dominated the North American inhalation anesthesia market growth, which is well supported by the volume of surgeries, usage of advanced anesthetic delivery systems, and early availability and acceptance of environmentally benign anesthetic steroids as sevoflurane. They have robust regulatory systems and an already well-developed hospital-based infrastructure in place.

Fresenius Kabi introduced Rocuronium Bromide Injection in the U.S. in May of 2023 with updated RFID tags. This is the initial product in the Fresenius Kabi '+RFID' range, which is compatible with Bluesight’s KitCheck in the inhalation anesthetic segment. The RFID system is designed for better drug management, safer patient treatment, and more accurate inventory management.

Market Dynamics:

Drivers

-

Improvement in Anesthesia Delivery Systems is Driving the Market Growth

The global inhalation anesthesia market is largely propelled due to technological advancements in anesthesia delivery systems. Contemporary engines are now equipped with vaporisers controlled digitally and closed-circuit systems, which permit the accurate measurement and control of volatile agents such as sevoflurane and desflurane. These advancements help ensure patient safety by sustaining accurate concentrations of anesthetic and reducing the likelihood of human error. Premium systems also allow for low-flow anesthesia techniques in order to conserve agents and save costs. Perioperative care is further facilitated by linkage to electronic health records (EHR) and real-time patient monitoring. While hospitals seek innovative solutions that balance efficiency, performance, and safety, the use of these advanced anesthesia machines continues to rise, leading to an increase in demand for inhalation anesthetics suitable for use in such systems.

In January 2025, a new GE Healthcare compact anesthesia machine, the Carestation 600 series V2, was introduced, emphasising its use in limited operating space, showcasing continued development of delivery technology.

-

The Growing Adoption of Inhalation Induction in Pediatrics and Geriatrics is Boosting the Market

Due to its non-invasive and well-tolerated administration, inhalation anaesthesia is favoured even for the induction of anaesthesia in paediatric and aged patients. Furthermore, rather than an IV induction that can be painful, or difficult to achieve in small children or patients with frail veins, inhalational agents such as sevoflurane provide a calm, comfortable mask induction. Sevoflurane is especially preferred for its pleasant smell and low airway irritability as well as rapid onset without excitation. In the geriatric population, when inhalation induction is used, there are fewer complications related to IV access and drug metabolism, because of the inhalation agents’ lack of systemic effect. This clinical flexibility renders inhalation induction a safer and more useful alternative, which may increase its application in these vulnerable patient populations.

Restraint

-

Side Effects and Safety Concerns are Hampering the Market Growth

A major restriction on the inhalation anesthesia market trends is the possibility of side effects of volatile anesthetic agents. Conventional inhaled drugs such as sevoflurane, isoflurane, and desflurane can irritate the airway, especially during induction, and can lead to coughing, laryngospasm, or breath-holding, especially when used in young children or in sensitive adult patients. A small number of agents can also cause malignant hyperthermia, a lethal phenomenon in genetically predisposed individuals.

Furthermore, chronic work exposure to trace anesthetic gases in operating rooms with ineffective scavenging may adversely affect the health of anesthesia providers, such as cognitive impairment and reproductive dysfunction. Integrating these observations, there has been a reinforcement in clinical practice toward a guarded approach, and more regulation has been enforced. In addition to organ toxicity (e.g., nephrotoxicity with prolonged sevoflurane in high doses), agents need to be selected and monitored with care, thus complicating anesthetic management and impairing adoption in low-risk or resource-poor settings.

Segmentation Analysis:

By Drug

The sevoflurane segment dominated the inhalation anesthesia market share of 40.6% in 2024, primarily due to the advantages offered, such as rapid induction and recovery, low pungency, and high safety margin, making it the preferred choice for both adult and pediatric surgeries. Its compatibility with low flow techniques fulfills economic and ecological objectives, even more in developed areas (e.g., North America and Europe). In addition, sevoflurane is favored by hospital protocols and preferences among anesthesiologists, which strengthens its foothold in the market.

The desflurane segment is expected to register the highest CAGR over the forecast period as ultra-fast onset and emergence help in ambulatory and outpatient surgery settings. With the current medical trend toward shorter hospital stays and with more day-care surgery, the pharmacokinetic properties of desflurane are more and more interesting. Furthermore, ongoing developments aimed at minimising its ecological impact (including the introduction of scavenging systems and upgrades to vapourisers) should help drive its uptake in high-volume surgical centers, including in anesthesia modernization areas.

By Application

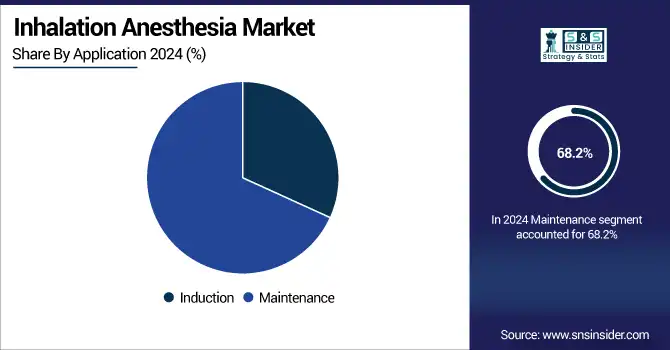

The maintenance segment dominated the inhalation anesthesia market in 2024 with a 68.2% market share. The various drugs used in inhalation anesthesia are mainly used to maintain anesthesia during surgeries. At the end of induction, typically using IV agents, volatile anesthetics (eg, sevoflurane, isoflurane) are administered via vaporizers on the tissue until the end of anesthesia. The extended maintenance period versus the induction, in combination with the high use of agents in this phase, makes it the most economically impactful course of action. Hospitals also favour inhalational maintenance due to it is more adjustable and controllable for anesthetic depth.

The induction segment is anticipated to grow at the highest CAGR during the forecast period due to the preference for inhalation induction is growing, particularly among pediatric and geriatric patients in whom venous access can be difficult. Sevoflurane, especially, is becoming increasingly popular for its non-irritating nature and pleasant mask induction, which is suitable in children and for ambulatory surgery. Moreover, the growing preference for minimally invasive and day care surgeries is favorable to inhaled agents for induction and maintenance, thereby driving the demand for inhalation-based induction techniques.

By Patient Type

The adult segment held the largest share of the inhalation anesthesia market in 2024 due to the high incidence of the large number of surgical procedures being performed on the adult population, such as orthopedic, cardiovascular, and general surgeries, which is driving the growth of this market segment. The adult population is the predominant patient group for both elective and emergency surgery, leading to considerable demand for maintenance and induction anesthesia. Most clinical protocols and anesthesia machines are also designed for use in adults, and hospitals in both developed and developing countries emphasise adult surgical care due to its higher prevalence and wider range.

The pediatric segment is projected to grow at a significant rate during the forecast period as global awareness and access to pediatric surgical care increase. Inhaled anesthesia, especially with an agent such as sevoflurane, is a commonly favored technique in pediatric patients, as it is non-irritating, quick-acting, and conducive to mask induction without the pain associated with IV access. Increasing prevalence of pediatric hospitals, neonatal surgical programs, and government initiatives for child health are also driving the adoption of inhalation anesthesia among the pediatric age group.

By End Use

The hospital segment accounted for the largest share of the inhalation anesthesia market in 2024, with a 66.34%. Due to the high volume of complex and high-risk surgeries performed in hospitals, the need for continuous monitoring and an advanced level of anesthesia management is the major factor responsible for the dominance of this end-user segment. General hospitals have state-of-the-art anesthesia workstations, anesthetists, and the presence of recovery units; for this reason, inhalation agents such as sevoflurane and isoflurane are widely used in hospitals.

The Ambulatory Surgical Centers (ASCs) segment is anticipated to exhibit the fastest growth over the forecast years as a result of the growing global trend toward outpatient and day surgeries. ASCS can take advantage of cheaper overheads, shorter patient turnaround times, and higher procedural throughput, well-served by rapidly-acting inhaled agents such as desflurane and sevoflurane. With healthcare systems pushing to lower hospitalization costs and increase efficiency, the uptake of inhaled anesthesia in ASCs is anticipated to witness promising growth, particularly in developed regions and metropolitan cities.

Regional Analysis:

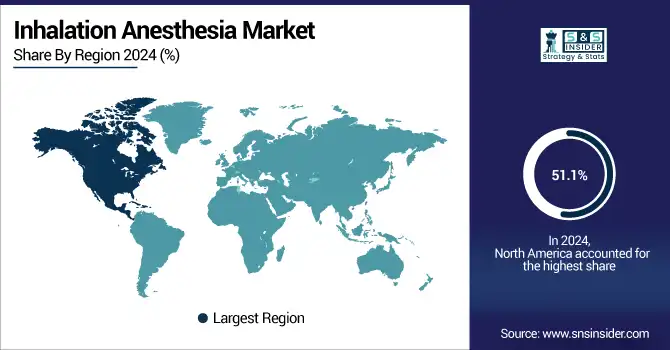

North America dominated the inhalation anesthesia market with a 51.1% market share in 2024, with leading healthcare facilities, high utilization of surgical procedures, and high expenditure on advanced anesthesia delivery systems. It is served by a large, skilled pool of anesthesiologists, possesses high penetration of low-flow, eco-friendly techniques, and has a well-regulated environment that guarantees the safe and optimal application of inhaled agents. Furthermore, ongoing technology improvement and mature reimbursement infrastructure are ideal for the gap there in has resulted in automated anesthesia machines and digital perioperative monitors among other products in the North America market for its continued domination.

The Asia Pacific region is expected to grow at the highest CAGR with a 6.65% over the forecast period due to the growing healthcare industry, flourishing medical tourism, increasing penetration of surgical care in the emerging Asia Pacific countries (such as India and China), and the development of medical facilities in the Asia Pacific countries. Government-led initiatives to enhance access to healthcare services, coupled with increasing patient consciousness regarding the benefits of safe anesthesia, continue to bolster the sales of inhalation anesthetics. A large base of population in the region, a rise in geriatric population across the Asia-Pacific region, and growing demand for minimally invasive and elective surgical procedures are accelerating the market in the region at a high pace as compared to other regions.

Europe is rapidly growing in the inhalation anesthesia market analysis owing to the emphasis placed on surgical safety, environmental safety, and modernization of healthcare. Use of advanced anesthesia delivery systems in the region is expected to create demand for low global warming potential (GWP) anesthetic agents, primarily sevoflurane, in the wake of stringent regulations set forth by the European Medicines Agency (EMA) and environmental policies under the EU green deal. Market growth is also supported by an aging patient population, a growing number of elective surgeries, and increasing healthcare spending, both for Western and Central Europe.

Latin America and MEA continue to demonstrate moderate growth in the inhalation anesthesia market, mainly supported by the ongoing development of healthcare infrastructure and the expansion of surgical procedures. In Latin America, public health campaigns and growing investments in hospital upgrading will continue to boost the use of simple inhalation anesthetics such as isoflurane. MEA's markets are helped by increased healthcare access in urban areas, with a caveat that limited resources and economic hardship in rural areas limit overall market penetration.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The inhalation anesthesia market companies are Baxter International Inc., AbbVie Inc., Piramal Critical Care, Hikma Pharmaceuticals PLC, Fresenius Kabi AG, Halocarbon Life Sciences, LLC, Lunan Pharmaceutical Group Co., Ltd., Jiangsu Hengrui Pharmaceuticals Co., Ltd., Beijing Tongrentang Co., Ltd., Troikaa Pharmaceuticals Ltd., Boehringer Ingelheim International GmbH, Abbott Laboratories, Novartis AG, AstraZeneca plc, Maruishi Pharmaceutical Co., Ltd., Mylan N.V. (Viatris Inc.), Shanghai Hengrui Pharmaceutical Co., Ltd., Drägerwerk AG & Co. KGaA, Mindray Medical International Limited, GE HealthCare Technologies Inc., and other players.

Recent Developments:

-

March 2025 – Hikma Pharmaceuticals PLC, an international pharmaceutical company, revealed the U.S. launch of Cisatracurium Besylate Injection, USP. The drug is available in 200mg/20mL and 20mg/10mL formulations, adding to Hikma's portfolio of anesthesia products.

-

April 2024 – Baxter International Inc., a leading manufacturer of anesthesia, injectables, and drug compounding, announced the addition of its U.S. pharmaceuticals portfolio with the launch of five new injectable products, affirming its commitment to hospital-based care solutions.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.69 Billion |

| Market Size by 2032 | USD 2.82 Billion |

| CAGR | CAGR of 6.66% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Drug (Sevoflurane, Desflurane, Isoflurane, Others) • By Application (Induction, Maintenance) • By Patient Type (Pediatric, Adult) • By End Use (Hospitals, Ambulatory Surgical Centers) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Baxter International Inc., AbbVie Inc., Piramal Critical Care, Hikma Pharmaceuticals PLC, Fresenius Kabi AG, Halocarbon Life Sciences, LLC, Lunan Pharmaceutical Group Co., Ltd., Jiangsu Hengrui Pharmaceuticals Co., Ltd., Beijing Tongrentang Co., Ltd., Troikaa Pharmaceuticals Ltd., Boehringer Ingelheim International GmbH, Abbott Laboratories, Novartis AG, AstraZeneca plc, Maruishi Pharmaceutical Co., Ltd., Mylan N.V. (Viatris Inc.), Shanghai Hengrui Pharmaceutical Co., Ltd., Drägerwerk AG & Co. KGaA, Mindray Medical International Limited, GE HealthCare Technologies Inc., and other players. |