Exosome Diagnostics And Therapeutics Market Size:

Get More Information on Exosome Diagnostics And Therapeutics Market - Request Sample Report

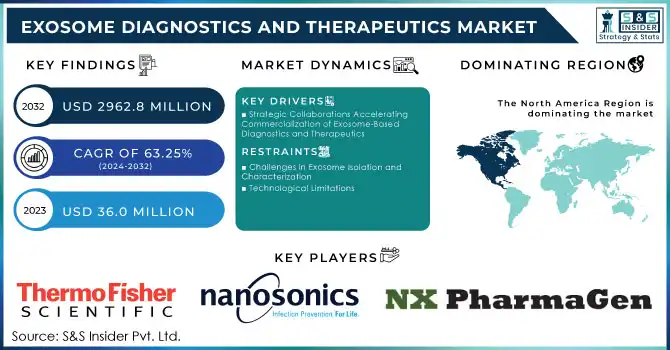

The Exosome Diagnostics And Therapeutics Market Size was valued at USD 36.0 million in 2023 and is expected to reach USD 2962.8 million by 2032, growing at a CAGR of 63.25% over the forecast period 2024-2032.

The exosome diagnostics and therapeutics market is experiencing robust growth, driven by advancements in exosome-based technologies for non-invasive diagnostics and targeted therapies. Key growth drivers include the rising prevalence of chronic, infectious, autoimmune diseases, and notably cancer, which demands innovative diagnostic tools. Exosomes, nanosized particles released by cells, are particularly useful in detecting diseases like cancer due to their molecular cargo, which mirrors the genetic and protein landscape of tumors. As a result, exosome-based liquid biopsies are gaining traction for their ability to detect cancers at early stages, providing critical insights into disease pathology without the invasiveness of traditional biopsies.

Demand for exosome technology is further propelled by its multifunctional applications in treating neurodegenerative and cardiovascular diseases, along with various cancers such as breast, prostate, liver, and lung cancer. Recent research underscores the potential of exosomes in translational precision medicine and targeted drug delivery. Modified exosome membranes are being explored for delivering cancer therapies, immune modulators, and anti-cancer agents directly to tumors, enhancing treatment efficacy and minimizing side effects.

Continued investment in exosome R&D is driving notable commercial developments and partnerships. For instance, Aethlon Medical's 2020 collaboration with the University of Pittsburgh aims to advance exosome-based therapies for head and neck cancer. Additionally, Exosome Diagnostics launched the ExoDx Prostate test kit in 2020, expanding prostate cancer screening accessibility through a urine-based liquid biopsy, which has since been incorporated into the National Comprehensive Cancer Network guidelines. These collaborations and product advancements reflect the strong commercial interest in exosome-based applications, spurred by the rising cancer burden globally.

With the global incidence of cancer projected to escalate, the market for exosome-based diagnostic and therapeutic solutions is poised for sustained growth, fueled by both clinical need and technological innovation. Exosome diagnostics and therapeutics are anticipated to significantly influence personalized medicine and improve early detection, driving substantial advancements in healthcare outcomes.

Exosome Diagnostics And Therapeutics Market Dynamics

Drivers

-

Strategic Collaborations Accelerating Commercialization of Exosome-Based Diagnostics and Therapeutics

The exosome diagnostics and therapeutics market is experiencing significant growth driven by increasing initiatives for product commercialization. Despite robust efforts in product development, the commercialization of exosome-based diagnostics and therapeutics has been somewhat slow. This challenge has led to a rise in strategic collaborations aimed at accelerating market entry. Companies in the exosome diagnostics market are actively seeking to leverage the growing opportunities within the industry while overcoming barriers related to the development and commercialization of exosome-based technologies. These partnerships focus on enhancing the accessibility and reliability of diagnostic tools, particularly in oncology and other chronic diseases.

On the therapeutics side, collaborations are increasingly focused on utilizing advanced exosome technologies, such as improved isolation, characterization, and analysis techniques, to ensure faster and more efficient launch of therapeutic candidates. For instance, in March 2024, BIONET, a key player in Taiwan's regenerative medicine sector, entered into a partnership with UNIVERCELLS TECHNOLOGIES of Belgium. This collaboration aims to integrate UNIVERCELLS' scale-X fixed-bed bioreactor technology to optimize the production of extracellular vesicles, including exosomes, derived from mesenchymal stem cells (MSCs) for therapeutic applications. This collaboration represents a crucial step towards enhancing the large-scale manufacturing of standardized exosome-based therapies, potentially addressing the demand for more scalable and cost-effective production. Such developments are expected to fuel the commercialization of exosome-based diagnostics and therapeutics, opening new opportunities for growth and market expansion.

Restraints

-

Challenges in Exosome Isolation and Characterization

-

Technological Limitations

Exosome Diagnostics And Therapeutics Market Segmentation Overview

By Type

In 2023, the Exosome Diagnostics segment dominated the market by type, accounting for over 58.0% of the market share. This leadership stems from a surge in demand for non-invasive diagnostic solutions, especially liquid biopsy techniques for cancer detection. Exosome diagnostics are rapidly being adopted in clinical settings due to their ability to provide valuable molecular insights with minimal invasiveness, meeting a critical need for early-stage cancer detection and precise monitoring. Moreover, increasing R&D investments in exosome diagnostics for applications across various cancers, including prostate, breast, and lung cancer, have accelerated the adoption of these diagnostic methods.

The Exosome Therapeutics segment is the fastest-growing in this category, projected to grow at a compound annual growth rate (CAGR) of over 18.0% through the next several years. This growth is fueled by the emerging role of exosomes in targeted drug delivery systems, particularly for neurodegenerative diseases, cardiovascular conditions, and cancers. Research into the therapeutic potential of exosomes is gaining momentum, as modified exosomes offer targeted delivery capabilities that minimize side effects and improve treatment outcomes, driving interest and investment in this segment.

By Product & Service

The Kits & Reagents segment dominated the market by product & service, holding nearly 62.0% of the market share in 2023. This segment’s dominance is attributed to the widespread need for reliable, ready-to-use reagents and kits in research and diagnostic settings. Kits and reagents simplify exosome isolation and analysis, meeting the growing demand from clinical laboratories and research institutions for standardized tools that facilitate accurate and efficient exosome studies. Their popularity is expected to persist as they are essential for most exosome diagnostic and therapeutic applications.

The Instruments & Services segment is the fastest-growing within this category, with an anticipated CAGR of 17.0% over the forecast period. The demand for specialized instruments capable of precise exosome isolation, characterization, and quantification has led to rapid development in this area. Additionally, services providing exosome-related testing and analysis support a wide range of pharmaceutical and clinical research needs, particularly in oncology and neurology. This surge is reinforced by increasing collaborations between exosome technology providers and healthcare facilities to advance diagnostic capabilities.

By Source

Blood & Blood Plasma sources led the market by source, with over 55.0% of the market share in 2023. Blood and plasma are preferred sources for exosome extraction due to the high concentration of exosomes they contain, which are rich in disease-relevant information. Blood-derived exosomes have become pivotal in liquid biopsy applications, particularly for oncology diagnostics, as they enable detailed molecular analysis of tumors with a simple blood draw. The ease of blood sample collection and the wealth of actionable data it provides have solidified this segment’s dominance.

Urine is the fastest-growing source for exosome applications, projected to grow at a CAGR of approximately 16.0%. Urine-based exosome tests are non-invasive, easy to collect, and increasingly used in diagnostics, particularly in urological cancers such as prostate and bladder cancer. Recent developments in urine-based testing have shown promising accuracy in detecting biomarkers, fueling the adoption of urine exosomes in diagnostic protocols. This growth reflects the potential of urine as a valuable, patient-friendly source for non-invasive diagnostics and disease monitoring.

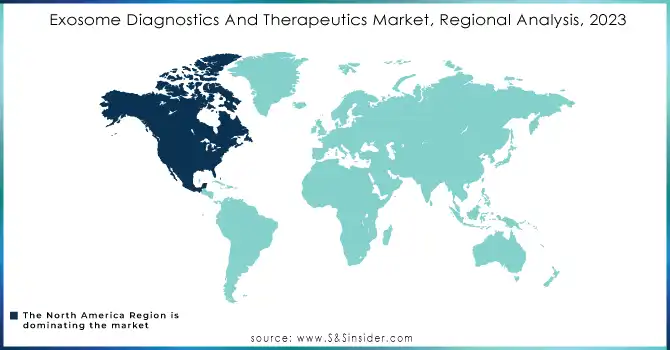

Exosome Diagnostics And Therapeutics Market Regional Analysis

In 2023, North America accounted for the largest market share in exosome diagnostics and therapeutics and is going to lead over the forecasting years. Strong biotechnology and pharmaceutical sector, high private and public investments in R&D, and numerous manufacturers of exosome isolation kits as well as diagnostic solution providers, mostly headquartered in the US and Canada, contribute to the region's market leadership. Further, supporting this would be the advanced research infrastructure, comprehensive coverage by health care, and attractive reimbursement policies that greatly contributed to the extensive expansion of exosome-based diagnostic test clinical adoption across North America.

Asia Pacific is anticipated to be the fastest-growing region over the forecast period. This is because of the fast growth in the healthcare industry. Medical tourism is rising along with an increase in geriatric populations that are prone to chronic diseases and will mark its growth trajectory. Supporting the regional market expansion are key life science clusters in China, Japan, and India, as well as the expanding capabilities of local contract manufacturing and research organizations. Moreover, developing economies such as South Korea, Taiwan, and Singapore are heavily investing in building a stronger framework of precision medicine and other next-generation diagnostic platforms like liquid biopsy and exosome isolation kits. This is expected to give a significant fillip to the penetration of exosome-based products in the region. The increasing adoption of Western treatment practices and increasing affordability have ensured that Asia Pacific is one of the most financially attractive markets for diagnostic and therapeutic innovations. In addition, foreign investments are pouring in, along with strategic partnerships that strengthen the ability of the region to innovate and increase self-sufficiency going forward in the event of healthcare requirements.

Key Players in Exosome Diagnostics And Therapeutics Market

-

Thermo Fisher Scientific - Exosome Isolation Kits, Exosome Characterization Reagents

-

NanoSomix - NanoSomix Exosome Isolation and Purification Kits

-

NX Pharmagen - Exosome Isolation and Purification Products

-

Malvern Instruments - Zetasizer (for Exosome Sizing and Characterization)

-

Capricor Therapeutics - CAP-1002 (Exosome-based Therapy for Cardiac Disease)

-

Exosome Diagnostics - ExoDx Prostate (EPI) Test, Exosome Isolation Kits

-

Exiqon A/S - Exosome RNA Isolation Kits, qPCR Assays

-

System Biosciences - ExoQuick Exosome Isolation Kit, Exosome RNA Isolation Kit

-

Exosome Sciences - Exosome-based Diagnostics for Neurological Disorders

-

Aegle Therapeutics - Exosome-based Therapeutic Platforms for Regenerative Medicine

-

AMS Biotechnology - Exosome Isolation Kits, Exosome Characterization Reagents

-

Miltenyi Biotec - MACS Exosome Isolation Kit

-

Codiak BioSciences Inc. - EngEx Platform for Exosome-based Therapeutic Development

-

Lonza Group (HansaBioMed Life Sciences Ltd.) - Exosome Isolation and Characterization Products

-

AcouSort AB - AcouTrap (Exosome Isolation Using Acoustic Technology)

-

Aethlon Medical, Inc. - Aethlon ADT (Exosome-based Therapeutic for Cancer)

-

AGC Biologics - Exosome-based Drug Delivery Services

-

Anjarium Biosciences AG - Exosome-based Therapeutics for Targeted Drug Delivery

-

Aruna Bio - Exosome-based Platforms for Neurodegenerative Disease Treatment

-

Brexogen - Exosome Isolation Kits, Exosome-based Therapeutic Development

-

Cells for Cells - Exosome-based Therapeutics for Regenerative Medicine

-

Ciloa - Exosome Isolation and Analysis Products

-

ConvEyXO - Exosome-based Therapeutic Delivery Systems

-

INOVIQ: EXO-NET, Exosome-based ovarian cancer screening test

Recent Developments

In September 2023, INOVIQ entered into a licensing and supply agreement with ResearchDx to include INOVIQ’s EXO-NET exosome capture technology in ResearchDx’s portfolio of exosome diagnostic services.

In April 2022, INOVIQ strengthened its partnership with the University of Queensland (UQ) to co-develop an exosome-based ovarian cancer screening test. As part of this collaboration, INOVIQ gained exclusive rights to license and commercialize the early detection test for ovarian cancer.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 36.0 Million |

| Market Size by 2032 | US$ 2962.8 Million |

| CAGR | CAGR of 63.25% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Exosome Diagnostics, Exosome Therapeutics) • By Product & Service (Instruments & Services, Kits & Reagents) • By Source (Stem Cells, Blood & Blood Plasma, Urine, Other Sources) • By Application (Cancer, Dermatological Diseases, Musculoskeletal Disorders, Cardiovascular Diseases, Other Applications) • By End User (Hospitals, Clinics and Physician Settings) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Thermo Fisher Scientific, NanoSomix, NX Pharmagen, Malvern Instruments, Capricor Therapeutics, Exosome Diagnostics, Exiqon A/S, System Biosciences, Exosome Sciences, Aegle Therapeutics, AMS Biotechnology, Miltenyi Biotec, Codiak BioSciences Inc., Lonza Group (HansaBioMed Life Sciences Ltd.), AcouSort AB, Aethlon Medical, Inc., AGC Biologics, Anjarium Biosciences AG, Aruna Bio, Brexogen, Cells for Cells, Ciloa, ConvEyXO |

| Key Drivers | • Strategic Collaborations Accelerating Commercialization of Exosome-Based Diagnostics and Therapeutics |

| Restraints | • Challenges in Exosome Isolation and Characterization • Technological Limitations |