INKJET PRINTERS MARKET KEY INSIGHTS:

The Inkjet Printers Market Size was valued at USD 46.35 Billion in 2023 and is expected to reach USD 80.68 Billion by 2032 and grow at a CAGR of 6.38% over the forecast period 2024-2032. The Inkjet printer market is growing due to high demand for High-quality and cost-effective printing solutions. Digitized content and e-commerce have also increased the requirement for reliable printing solutions, including packaging and labeling. Some of the remarkable improvements witnessed in this series of printers include enhanced print speeds, good color accuracies, and energy efficiency in some lines of models to make them relatively more attractive to consumers and businesses at large. Others consider environmental issues such as water-based inks which have attracted many to the eco-friendlier types of printers. Over time, printer heads and other related inks are made better and more durable. Besides conventional usage, inkjet printers are gaining ground in niche applications like 3D printing, bio-printing, and textile printing. On-demand and personalized printing market growing in advertising and healthcare is likely to drive markets upwards. Besides, more competition from laser printers and high operational costs lie between the bright prospects of the inkjet printer market.

To Get More Information on Inkjet Printers Market - Request Sample Report

In the US, 2023 has been filled with action in the inkjet printer market, which is expected to sell around 10 million units in 2024. The projected revenue for the inkjet printer market would be around USD 2 billion. This growth comes from an increasing demand for multifunctional printers that carry out printing, scanning, and copying activities - appeal to residential and commercial users equally. It is also the development that has been witnessed in the ink technology, particularly the transition to the DOD system, which has enabled the performance as well as usability of the inkjet printers to be enhanced, thus enabling more consumers to utilize it.

MARKET DYNAMICS

KEY DRIVERS:

-

Driving Demand for Customization in Inkjet Printing Solutions Amid Rapid Market Evolution

The need for on-demand and custom printing solutions is one major driver for the market of inkjet printers. A lot of businesses and individuals require quick production of personalized materials, including marketing brochures, invitations, and customized packaging. Inkjet printers enable the production of small batches with high-quality output, which makes them perfect for personalized print jobs. It is also very prominent in the advertising, retail, and e-commerce sectors where customization and speed come into the picture. So, there is a growing acceptance of inkjet technology by businesses to answer these changing needs, pushing the market even more. In 2024, leading online printing service Vistaprint relies on relatively new inkjet technology to produce on-demand products such as customized business cards, marketing brochures, and invitations. With their printers, small business owners or individuals can design and then order such personalized materials very fast, in the turn of 24-48 hours to deliver the printed material, thus positioning the company as a strong player in the on-demand printing market.

-

Expanding Industrial Applications of Inkjet Technology Driving Demand Across Diverse Sectors in the Future

The increasing use of inkjet technology in industrial applications is also boosting its demand. Textiles, electronics, and ceramics industries are making high demand for inkjet technology in processes like fabric printing, product labeling, and decorations on surfaces of intricate designs. Inkjet printers are already making it possible to print on non-traditional materials like fabrics and ceramics and hence manufacturers can integrate printing processes into the production line. Along with the constant boom in technology, this flexibility fuels an expansion of the use of inkjet printers in industrial applications. Companies like Kornit Digital have been pushing the envelope in inkjet technology applicable to textile printing since 2023. Its DTF inkjet printers are widely mass-used by fashion brands so that intricate designs can be printed on various fabrics, thus cutting down waste for on-demand production. They can print on any kind of fabric-from cotton to synthetic material them the perfect fit for both sustainable and fast fashion.

RESTRAIN:

-

Navigating Challenges in the Inkjet Printer Market Amid Rising Costs and Competitive Pressures

Business establishments shun its utilization in large-scale operations due to these costs. Generally, replacing the ink and cartridges increases the overall costs, as heavy users have to bear most of the burden. Another threat area is through competition by laser technology printers who are producing relatively faster speeds of printing with fewer per-page costs. Inkjet may face issues related to long-term reliability for several reasons, such as problems like head clogging and inconsistent print quality which develop with time. This limits their appeal in high-demand environments and tends to bar them from broader market penetration.

KEY SEGMENTATION ANALYSIS

BY TYPE

Multifunctional printers have been one of the key forces within the printing market in the last couple of years, holding a significant 25% share in the market space in the year 2023, and is expected to grow at a CAGR of 6.91% during the forecast period. This was due to the increase in demand for convenient office solutions, which integrated all the functions such as printing, scanning, copying, and faxing into a single device. This makes organizations Favor MFPs as they are cost-effective and efficient, while, additionally, they tend to make the flow of work easier and less complicated, leading to lesser utilization of multiple devices. Advanced technology in many ways, particularly in wireless connectivity, cloud printing, and mobile printing, has made MFPs more productive and up to the expectations of an organization seeking better productivity. Recently, Canon launched its compact MFP for small to medium-sized businesses in 2023 - the imageCLASS MF453dw. This small device comes with extremely fast printing and brilliant prints with solid security features that meet modern office requirements. Equipped with functionalities such as automatic double-sided printing and mobile device support, imageCLASS MF453dw embodies the trend toward multifunction printers that fulfill changing requirements today, further fueling the growth of the MFP segment in the market.

BY TECHNOLOGY

The Continuous Ink Jet (CIJ) printer segment held the highest revenue share of 38% in 2023, primarily because of its wide acceptance in food and beverages, pharmaceuticals, and manufacturing industries. Continuous Ink Jet printers have grown on account of high speed, and high-quality printing with little or no downtime, which makes them suitable for large-scale production environments. CIJ printheads are versatile and offer a high diversity of substrates on which they can print, both porous and non-porous, hence making their applications diversified.

Printers with Drop on Demand (DOD) inkjet technology are expected to grow at a CAGR of 7.45% over the forecast period. DOD technology allows for the droplets of the ink pumped onto the paper as and when needed. Such a thing not only improves the resolution of the prints but also saves waste hence being more environmentally friendly. It is especially beneficial in industries where this capability of individualization and speed is most valuable, such as in textile printing, packaging printing, and commercial printing.

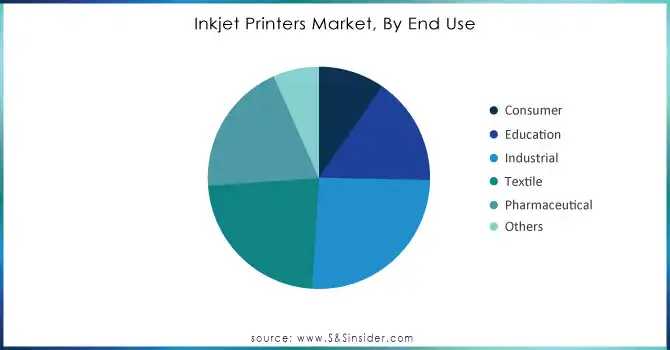

BY END USE

The industrial end-user segment dominated with a market share of 25% in 2023, because this was the result of all sorts of manufacturing sectors increasing their reliance on advanced printing technologies. This is caused by the demand for high-quality as well as efficient printing solutions to meet modern requirements in production environments. For instance, industrial printing technologies would be applied in packaging, textiles, and electronics in a way that full benefits are obtained from applications such as product labeling, surface decoration, and the creation of customized packages.

Over the forecasting period, the industrial printing segment will demonstrate the fastest growth rate at 7.17% CAGR as technological improvements are always on the horizon and the focus on automation in the manufacturing process is always increasing. On-demand capabilities of digital printing, which offers direct production and smart technologies for making the workflow more efficient, are driving business adoption of industrial printing solutions. Contributing factors to this growth include increased penetration of sustainable inks and green materials by industries, further driving the search for sustainability and cost-effectiveness.

Do You Need any Customization Research on Inkjet Printers Market - Inquire Now

REGIONAL ANALYSIS

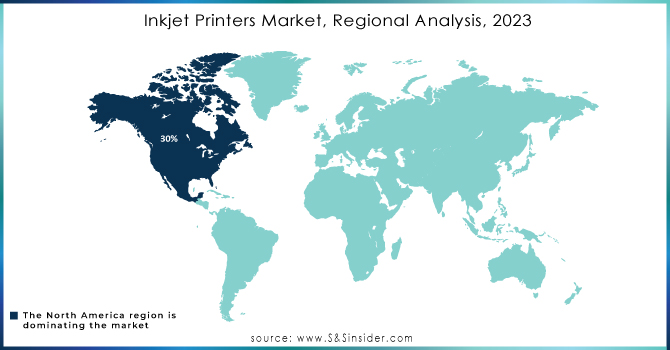

North America accounted for the largest share in revenues at 30% in 2023, primarily due to well-established technological infrastructure and the strong demand for quality printing solutions from various industries. In this region, there are more significant players in the printing industry with giant manufacturers and innovative start-ups, which further contributes to the competitive market environment. These are established sectors such as packaging, healthcare, and advertising. Many of these need enhanced advanced printing technologies that facilitate better productivity efficiency. The market has grown significantly in terms of the adoption of digital printing technologies in North America, with widespread awareness about customization and on-demand production.

The Asia-Pacific region is expected to emerge as the fastest-growing segment in the printing market with a compound annual growth rate of 7.01% in the forecast period mainly due to rapid industrialization and urbanization. With the progressive economies of countries like China, India, and nations in Southeast Asia, demand for state-of-the-art printing technologies across sectors such as packaging, textiles, and consumer goods has only increased lately. The rising middle class of the region is expected to lead to growing consumer activities, thus requiring high-quality as well as customized printing solutions that would cater to diverse consumer preferences. there is a tremendous growth of digital printing technologies here, with enormous technological advancements and investments happening in the region that can produce faster and provide greater flexibility in the process of printing. In addition, the rapidly growing e-commerce industry in Asia-Pacific sharply increases demand for more innovative packaging solutions that call for business ventures to adopt modern printing techniques for enhancing quality and personalization expectations.

KEY PLAYERS

Some of the major players in the Inkjet Printers Market are:

-

HP Inc. (HP Envy 6055, HP OfficeJet Pro 9015)

-

Canon Inc (Canon PIXMA G6020, Canon imagePROGRAF PRO-1000)

-

Epson (Epson EcoTank ET-4760, Epson WorkForce WF-7720)

-

Brother Industries, Ltd. (Brother MFC-J995DW, Brother HL-L2390DW)

-

Lexmark (Lexmark CX517de, Lexmark MB2236adw)

-

Ricoh (Ricoh SP C840DN, Ricoh MP C4504ex)

-

Xerox (Xerox VersaLink C405, Xerox WorkCentre 6515)

-

Dell Technologies (Dell E310dw, Dell C1760nw)

-

Panasonic (Panasonic KX-P7100, Panasonic KX-PX20)

-

Samsung Electronics (Samsung Xpress M2020W, Samsung Xpress C430W)

-

Kyocera (Kyocera ECOSYS P2040dn, Kyocera TASKalfa 2552ci)

-

Oki Electric Industry Co., Ltd. (Oki C332dn, Oki C942)

-

Sharp Corporation (Sharp MX-C300W, Sharp MX-3070N)

-

Hiti Digital, Inc. (Hiti P510L, Hiti P525L)

-

Zebra Technologies (Zebra ZD620, Zebra ZD421)

-

Ninestar Corporation (Ninestar C13T824200, Ninestar C13T266320)

-

Toshiba (Toshiba e-STUDIO2505h, Toshiba e-STUDIO5015AC)

-

Sato Holdings Corporation (Sato CL4NX, Sato CT4-LX)

-

Dymo (Dymo LabelWriter 450 Turbo, Dymo Rhino 5200)

-

Seiko Instruments Inc. (Seiko SLP620, Seiko SLP650)

RECENT TRENDS

-

In July 2024, Global printing company Epson introduced its latest addition to the professional printing market with the launch of the SureColor SC-P5330 Photo Graphic Inkjet Printer. This new printer promises to deliver vibrant photographic reproductions across different media, including artist canvas and premium photo papers.

-

On March 25, 2024, FUJIFILM Corporation, led by President and CEO Teiichi Goto, unveiled the Jet Press FP790, a new water-based digital inkjet press designed for the flexible packaging printing market.

-

On June 24, 2024, Tohoku Epson Corporation, a subsidiary of Seiko Epson Corporation, announced an investment of approximately 5.1 billion yen to construct a new factory dedicated to inkjet printheads

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 46.35 Billion |

| Market Size by 2032 | USD 80.68 Billion |

| CAGR | CAGR of 6.38% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Type (Multifunctional Printer, Desktop Printers, Large Format Printers, Inkjet Press, Industrial Inkjet Printers, Textile Printers, Others), • by Technology (Continuous Inkjet, Drop on Demand, UV Inkjet, Others), • by End-user (Consumer, Education, Industrial, Textile, Pharmaceutical, others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | HP Inc., Canon Inc., Epson, Brother Industries, Ltd., Lexmark, Ricoh, Xerox, Dell Technologies, Panasonic, Samsung Electronics, Kyocera, Oki Electric Industry Co., Ltd., Sharp Corporation, Hiti Digital, Inc., Zebra Technologies, Ninestar Corporation, Toshiba, Sato Holdings Corporation, Dymo, Seiko Instruments Inc |

| Key Drivers | • Driving Demand for Customization in Inkjet Printing Solutions Amid Rapid Market Evolution • Expanding Industrial Applications of Inkjet Technology Driving Demand Across Diverse Sectors in the Future |

| RESTRAINTS | • Navigating Challenges in the Inkjet Printer Market Amid Rising Costs and Competitive Pressures |