Packaging Printing Market Key Insights:

Get More Information on Packaging Printing Market - Request Sample Report

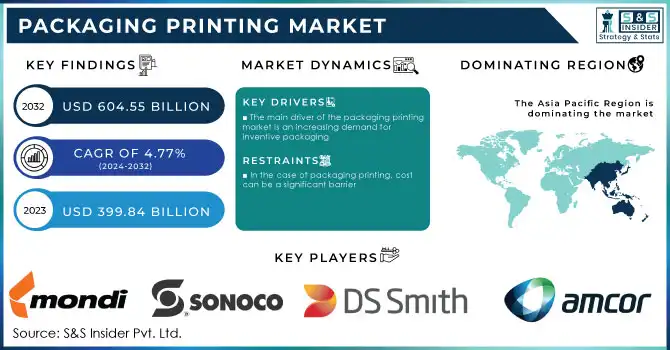

The Packaging Printing Market was valued at USD 399.84 billion in 2023 and is projected to reach USD 604.55 billion by 2032, expanding at a compound annual growth rate (CAGR) of 4.77% over the forecast period from 2024 to 2032.

Package printing technology is used to package and protect products prior to distribution, storage, sale and use. Although the main purpose of packaging is to store products, packaging printing technology can also act as a means of product and brand promotion, helping to build strong customer relationships. Printing in the packaging sector meets industry goals of quality, efficiency and innovation. Different types of inks and technologies are used when printing packaging. The most commonly used printing techniques in packaging printing are flexography, gravure, offset and digital printing.

Rising demand for innovative packaging is one of the factors driving the printing market. Packaging is an integral part of product branding and marketing strategies, and businesses are increasingly looking for innovative and attractive packaging solutions to differentiate themselves in a crowded marketplace. As a result, there is a growing demand for quality printing services that can create unique and visually appealing packaging designs. Printing technology has evolved significantly in recent years, allowing printers to offer a wide variety of options for packaging design. In addition, digital printing technology makes short-run production of packages easier and cheaper, which is especially beneficial for small businesses and start-ups.

The printing industry is also responding to the demand for green packaging solutions, with eco-friendly materials and printing processes becoming more popular. Some companies use biodegradable or compostable materials in their packaging, while others use water-based inks and other eco-friendly printing techniques.

The packaging printing market is primarily driven by increasing demand for creative packaging media due to intense competition and brand awareness. Additionally, the growing demand for innovative printing is likely to slow the pace of market growth. In addition, other factors such as growing packaging industry and increasing supply chain management also affect the growth of the packaging printing market.

Another key driver for the market growth rate is the increasing demand for sustainable printing. In addition, rapid industrialization, technological advances in the printing industry, and increasing urbanization are various factors further slowing the growth rate of the packaging printing market. In addition, changing lifestyles and higher disposable incomes of the people are expected to increase the number of events, further increasing the demand for the packaging printing market. Also, rising strong demand from various end-use industries will have a positive impact on the growth rate of the packaging printing market.

In addition, his use of RFID tags in digital printing and packaging and increasing demand in new markets also create positive opportunities for the growth of the packaging printing market. In addition, strategic cooperation among key market players, increasing demand for packaged and branded products, and new product launches are the key factors driving the growth of the packaging printing market, which is expected to grow in the future. Offer more lucrative market opportunities.

Packaging Printing Market Dynamics

KEY DRIVERS:

-

The main driver of the packaging printing market is an increasing demand for inventive packaging

Innovative packaging design and printing techniques help your products stand out in crowded storefronts. Bold graphics, creative artwork and unique finishes capture consumers' attention and influence their purchasing decisions.

-

Packaging printing has allowed the differentiation of products.

RESTRAIN:

-

In the case of packaging printing, cost can be a significant barrier

Cost can be a major barrier to packaging printing, especially for small businesses with limited budgets. Advanced printing techniques, specialty inks, and high-quality materials can drive up production costs, making it difficult for some companies to implement innovative packaging printing solutions.

OPPORTUNITY:

-

Increased Emphasis on Sustainable Packaging

As environmental concerns grow, so does the demand for sustainable packaging solutions. The packaging printing market can capitalize on this opportunity by offering eco-friendly materials such as recycled and biodegradable materials and using eco-friendly printing processes and inks. Adopting sustainable practices can help attract environmentally conscious consumers and achieve corporate sustainability goals.

-

With the continuous growth of e-commerce, there is a need for packaging solutions that meet the specific requirements of online retail.

CHALLENGES:

-

Meeting sustainability goals and complying with environmental regulations pose challenges for the packaging printing market

The demand for eco-friendly materials and processes requires investment in sustainable practices and technologies. Ensuring compliance with various environmental regulations related to materials, inks, and waste management can add complexity and costs to operations.

IMPACT OF RUSSIA-UKRAINE WAR

The sudden refusal of many of the world's leading paper, printing and packaging companies to do business with Russian firms has been severely impacted and angered the industry community following the Russian military operation in neighboring Ukraine. Several well-known 3D printing companies have banned sales to Russian companies as part of global economic sanctions imposed on Moscow. Global leaders in additive manufacturing, including US 3D Systems and HP, Germany's EOS and Poland's Zortrax, have broken off talks with Russian buyers.

Mondi, the Lviv mill of the British-based multinational packaging group in western Ukraine, has stopped producing paper bags in the country, but Russian pulp and paper mills continue to operate. The Lviv plant is Russia's larger operation, accounting for about 12% of the Group's turnover and serving mainly the domestic market. Mondi's stock has fallen 19.6% since Russia's invasion of Ukraine, but the company's integrated pulp, wrapping paper and uncoated wood-free paper mill in Syktyvkar, northeast of Moscow, the capital of Russia's Komi Republic, is still profitable. is said to be high and low cost.

Ukrainian printing is very developed, especially in the fields of flexography, corrugated board and corrugated packaging. Commercial printing, production of books and especially self-adhesive labels has developed very dynamically in the last two years. The invasion caused many printers to abandon their traditional operations and switch to volunteer work to produce materials better suited to the wartime environment. Given that Russia and Ukraine are major suppliers of wood as a raw material, a Russian invasion of Ukraine would also have significant implications for the packaging industry across Europe. With exports alone exceeding €11.5 billion, the paper and packaging industry will be greatly affected by the crisis.

IMPACT OF ONGOING RECESSION

Gas prices are affecting the European printing industry. At the moment, however, the lack of orders for finished products is a major problem. This is a result of the economic slowdown and the expectation that the severe economic crisis will significantly reduce the demand for packaging materials. Warehouses continued to hold excess inventory to prepare for high demand.

The first war in more than 70 years also worsened the situation in Europe. At the same time, China's economy, which has deteriorated since the pandemic began, is struggling. There is little room for a rapid recovery, especially when combined with rising interest rates, which will affect the growth of the packaging market.

KEY MARKET SEGMENTATION

By Printing Ink

-

Aqueous

-

UV-Based

-

Others

By Packaging Type

-

Labels

-

Others

By Printing Technology

-

Flexography

-

Digital

-

Gravure

By Application

-

Food & Beverages

-

Pharmaceuticals

-

Personal Care

-

Others

Packaging Printing Market Regional Analysis

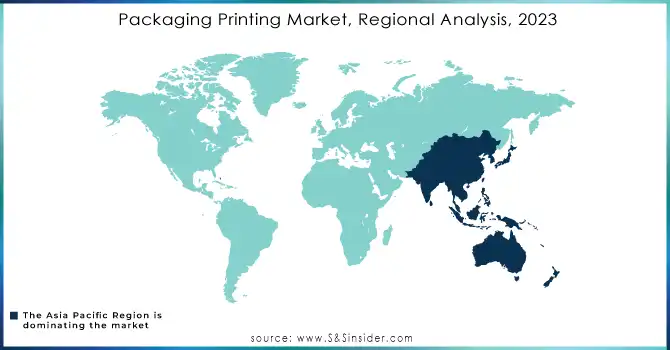

Asia Pacific region will dominate the market and will hold the largest CAGR during the forecast period. This is because Asia-Pacific regions have countries that have high populations, and demand for packaged food, which is giving rise to the packaging printing market. The Asia Pacific region is experiencing rapid growth in the packaging printing market, driven by factors such as population growth, urbanization, and rising disposable incomes. Countries like China, India, and Japan are major contributors to the market. The region has a diverse landscape, with varying packaging preferences, cultural influences, and increasing demand for customized and eye-catching packaging designs.

The North American region, including the United States and Canada, has a mature packaging printing market. It is driven by a strong consumer goods industry and a focus on innovative packaging solutions. Growing trends include eco-friendly and sustainable packaging, digital printing technologies, and customization options to enhance brand appeal.

Europe has a well-established and technologically advanced packaging printing market. The region is known for its stringent regulations on food safety, labelling, and product information, which impact packaging requirements. Growing concerns around sustainability and eco-friendly practices drive the demand for recyclable materials, low-VOC inks, and efficient printing processes.

Get Customized Report as per your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players

The Major Players are Amcor Limited, DS Smith Packaging Limited, AR Packaging Group AB, Eastman Kodak Co, Dunmore, Duncan Printing Group, Sonoco Products Company, Graphics Packaging Holding Company, Mondi Plc, Avery Dennison, Graphics Solutions and other players.

RECENT DEVELOPMENTS

-

The researchers of the Indian Institute of Technology in Roorkee have developed a technology based on water printing ink, which has been exported to the packaging industry.

-

Hubergroup has launched web offset inks for food packaging.

-

FabRx, a specialist in pharmaceutical 3D printing, has begun to manufacture personalised drug delivery equipment with its M3DIMAKER 3D printer.

| Report Attributes | Details |

| Market Size in 2023 | US$ 399.84 Billion |

| Market Size by 2032 | US$ 604.55 Billion |

| CAGR | CAGR of 4.77% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Printing Ink (Aqueous, UV-Based, Others) • By Packaging Type (Labels, Flexible Packaging, Others) • By Printing Technology (Flexography, Digital, Gravure) • By Application (Food & Beverages, Pharmaceuticals, Personal Care, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Amcor Limited, DS Smith Packaging Limited, AR Packaging Group AB, Eastman Kodak Co, Dunmore, Duncan Printing Group, Sonoco Products Company, Graphics Packaging Holding Company, Mondi Plc, Avery Dennison, Graphics Solutions. |

| Key Drivers | • The main driver of the packaging printing market is an increasing demand for inventive packaging • Packaging printing has allowed the differentiation of products. |

| Market Restraints | • In the case of packaging printing, cost can be a significant barrier |