Insect Growth Regulators Market Report Scope & Overview:

Get More Information on Insect Growth Regulators Market - Request Sample Report

The Insect Growth Regulators Market Size was valued at USD 1.2 billion in 2023, and is expected to reach USD 2.0 billion by 2032, and grow at a CAGR of 6.0% over the forecast period 2024-2032.

The insect growth regulators market is witnessing significant transition in the wake of rising concerns related to environmental and health hazards due to traditional use of the chemical class. Compounds of this modality are specialized chemicals interfered with in the development of insects at particular stages of their life cycle, such as eggs, larvae, and pupae, at which the targeted insect fails to attain maturity and thus eradicate the phenomenon of breeding. It can efficiently control target pests, be relatively non-toxic to non-target organisms, and does not cause major disruption to ecosystems—in line with the increasing needs for sustainable and benign pest management solutions.

Major driving factors for the insect growth regulator market across the globe are the rising awareness of the negative impacts of broad-spectrum conventional pesticides on human health and the environment. Traditional insecticides are highly hazardous to humans and animals; thus, there is an increased usage of safer alternatives like insect growth regulators. These regulators are less toxic and provide an environmentally friendlier means of controlling pests. According to the World Health Organization, insect growth regulators have a great potential use in the control of vector-related diseases like malaria and dengue fever from mosquitoes, accounting to hundreds of thousands of lives annually. insect growth regulators specifically target insects that carry diseases, thus reducing the prevalence of these biological health hazards.

Recent insect growth regulator technology boosts the growth of the market. Notably, in August 2023, Syngenta introduced the Advion Trio Cockroach Gel Bait, an innovative insect growth regulator-based product to address urban populations of cockroach infestations. The product is formulated with insect growth regulators and complimenting actives to increase efficiency while delivering long-lasting control. The effort noted by Syngenta would also show/reflect ongoing activities by the sector to continue innovating and noting issues that deal with environmental concern, like better pest management solutions.

The agricultural sector is increasingly adopting insect growth regulators for crop protection while reducing dependence on broad-spectrum chemical pesticides. The investment is a larger commitment toward better technology in pest control aimed at keeping the environment and human health safer. California dedicated $3.75 million in May 2024 to support projects in the area of safer and more sustainable control of pests, including the adoption of insect growth regulators. Considering rapid technological advancement coupled with the huge investments, the insect growth regulator market is expected to develop and play a critical role in the resolution of both agricultural and public health-related pest infestation problems.

Market Dynamics:

Drivers:

-

Rising Demand for Pest Control Drives Growth in Insect Growth Regulators Market with Innovations

Growing demand for pest control is one of the major drivers for the growing insect growth regulators market in reflection of increasing trends toward efficacious and sustainable ways for managing pest populations. This is mainly driven by challenges that are increasing day by day as a result of pest infestations in both agricultural and urban areas. For instance, BASF, in March 2024, introduced the new insect growth regulator-based solution AgriPest Shield, which has been developed to meet the increasing menace of pest resistance to conventional pesticides in crops. This innovation meets the immediate need for stronger control measures against pests as conventional practices go down. In parallel, FMC Corporation launched its next-generation insect growth regulator product, EcoGuard Plus, in June 2024, for urban pest management. This product addresses the increased pest problems metropolitan areas are facing in light of rising temperatures and sustainability concerns. With continued growth in the complexity of pest management issues and a deficiency in current chemical solutions, demand for insect growth regulators continues to rise exponentially. These regulators provide site-specific intervention that reduces the dependency on broad-spectrum chemicals and lowers the risks of resistance and environmental damages. With climate change and the urbanization process going on across the world, the need for pest control is becoming increasingly critical. As a result of that, demand for insect growth regulator technologies is rapidly growing. The continuous growth of the insect growth regulators market and companies such as BASF and FMC are developing new solutions in these areas.

-

Growing Environmental Sustainability Awareness Fuels Insect Growth Regulators Market

Growing awareness toward environmental sustainability is upscaling the growth of the insect growth regulators market, as both consumers and industries are becoming more prone to using environmentally viable solutions for pest control. A very clear shift in this landscape has turned dramatic, showing commitments by major companies to reduce environmental impacts through technological innovations. Most recently, in April 2024, Bayer CropScience launched its new insect growth regulator-based products under the name ECO-NEXT, which has been formulated to deliver sound pest control while minimizing the environmental footprint. This product epitomizes Bayer's commitment to advancing sustainable agricultural practices by targeting specific pest life stages, thus reducing the level of broad-spectrum chemicals. Similarly, Corteva Agriscience recently launched its sustainable insect growth regulator solution, GreenGuard Pro, in September 2023 to conserve biodiversity, protect crops, and reduce chemical runoff. This not only epitomizes Corteva's commitment to addressing the concerns related to the environment but also allows advanced pest management technologies. An increased focus on environmental sustainability in regulatory trends worldwide, by governments and organizations, also is evident by stricter guidelines on pesticide use. Such a scenario pushes companies toward more sustainable practices and, in turn, promotes demand for insect growth regulators. The market of insect growth regulator is expected to increase on the rise of environmental consciousness, giving frontier companies like Bayer, Corteva an edge in crafting solutions that work in line with global sustainability goals.

Restraint:

-

Limited awareness and understanding can hamper the growth of insect growth regulators market

Low awareness and understanding of insect growth regulators have been acting as a major restraint to market growth, as most stakeholders are unaware of the accrued benefits of insect growth regulator technologies and their respective uses. For instance, in February 2024, Syngenta announced that, among farmers in Latin America, especially from rural areas, the awareness about insect growth regulators and their advantages over conventional pesticides is low. This knowledge gap tends to slow down the acceptance of insect growth regulators, with the possible users sticking to more familiar chemical methods. Additionally, FMC Corporation also made it known in October 2023 that market limitations in its insect growth regulator product line expansion relate to incomplete educational outreach and training for local pest control professionals. Poorly understood mechanisms of insect growth regulator and their environmental benefits might not be recognized by any potential user, hence not appreciating the after-sales advantage that might arise in the future from switching to such sustainable solutions. This may be reflected in the market penetration and growth rate for those sustainable solutions.

Opportunity:

-

Increasing shift towards integrated pest management practices

Increased focus on the adoption of integrated pest management practices serves as a strong opportunity for the market of insect growth regulators, as integrated pest management motivates the use of various strategies for effective control of pests. For instance, in July 2024, Dow AgroSciences introduced its novel insect growth regulator product HarmonyBlend, specially formulated to complement the IPM approaches that most effectively employ integration with biological control agents and cultural practices. The product increases IPM overall effectiveness by targeting the specific life stages of insects with minimal use of chemicals. Also, in January 2024, a publication by Bayer based on the company's efforts in developing insect growth regulators that act synergistically with IPM practices to enhance crop health and sustainability. The growing adoption of IPM, driven by its approach and benefits to the environment, is creating a perfect environment for insect growth regulators. It is the sustainability in IPM that is wanting in other methods of pest control. An underlying and growing public interest in the environment, scientific innovations in this area, and technologies for the development of sustainable forms of bio-control and treatment are driving these trends but have yet to deliver realization in terms of growth.

Challenge:

-

Development of resistance in insects for the insect growth regulators

The development of resistance in insects to insect growth regulators represents a massive challenge to the market, since it impacts their effectiveness, resulting in higher costs for pest control. For example, in March 2024, a study published by the University of California showed that some important pest populations have begun developing reduced sensitivity to widely used insect growth regulator active ingredients and require increased dosages for the same level of control. This resistance development came to light in February 2024, when Syngenta reported that its insect growth regulator product, PestGuard X, was unable to hold its turf well in areas where this pest had gained resistance. Resistance of the insect strains takes away the long-term effectiveness of insect growth regulators and, therefore, also further complicates pest management, hence the investment in research and development to develop new formulations and resistance management strategies. This is a continuous challenge that highlights the need for further technological innovations in insect growth regulators to remain efficient in controlling the population of these pests.

KEY MARKET SEGMENTS

By Product

The Chitin Synthesis Inhibitors segment dominated the insect growth regulators market and accounted for a massive share of 45% of the market in 2023. The leading position of the chitin synthesis inhibitor in the market is attributed to its strong ability to disrupt the development process in insects with respect to their exoskeleton-an aspect crucial for insect growth and reproduction. For example, in November 2023, a report by BASF highlighted that its premium chitin synthesis inhibitor, Exospec, found wide acceptance for agricultural pest management because of its proven efficacy against a wide spectrum of pests, even those resistant to other insect growth regulator types. Strong performance and reliability of chitin synthesis inhibitors have fostered their leading position in agricultural and urban applications. The fact that this sector ensured long-term pest management potential with minimal environmental impact further strengthened its standing as the major sector in the insect growth regulator field.

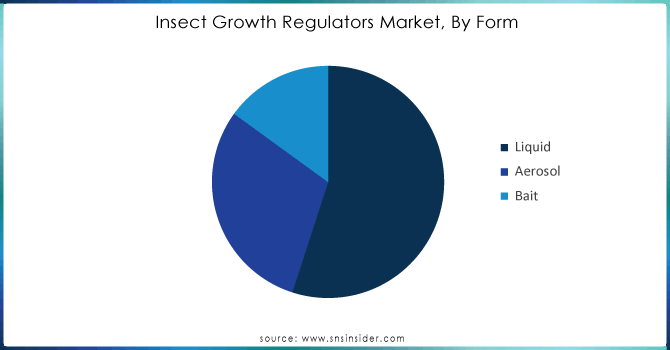

By Form

The insect growth regulators market was dominated by the Liquid form segment in 2023 and captured a market share of about 55%. Liquid insect growth regulators are preferred because of their versatility in different applications, such as agriculture and urban pest control. For example, Syngenta, in one of the major reports in the industry in June 2023, claimed that liquid insect growth regulator product FlexiGuard, owing to easy application and its fast absorption by the plants, offers excellent performance against a wide array of pests affecting agriculture. In turn, liquid insect growth regulators have been preferred to their counterparts, since they can be uniquely applied with much ease on large expanses and are compatible with current spraying equipment. This has made them the product of choice while dealing with pests in the industry. It is because of this widespread adoption and functionality that the liquid segment leads the market.

Need any customization research on Insect Growth Regulators Market - Enquiry Now

By Application

The Agriculture & Gardens segment dominated the insect growth regulators market, grabbing an estimated share of about 50% in 2023. Such segment leadership is mainly because of serious need for effective pest control in agriculture and other farming settings to protect and maximize the produce from crops. For instance, in April 2023, Corteva Agriscience unveiled its new agriculture-specific insect growth regulator product known by the name AgriShield Pro. This product gained massive demand because it effectively combated pests that were deteriorating plant health, reflecting great segment performance and high demand in the market. The immense use of the product in the field of agriculture and related sectors due to the demand for effective and eco-friendly solutions for pest control in agricultural farming and gardening places the Agriculture & Gardens segment at the topmost position in the insect growth regulator market.

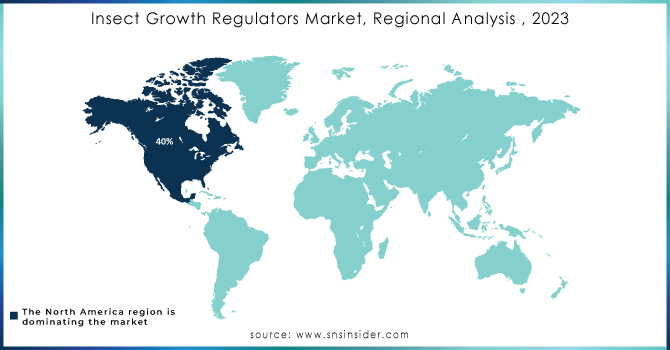

Regional Analysis

In 2023, North America dominated the insect growth regulators market and is estimated to hold approximately a 40% market share. This can be attributed to the advanced agricultural practices of the region, along with significant investments in technologies for pest control. For example, Bayer CropScience in July 2023 said sales of its insect growth regulator product were strong in North America, where the use of the insect growth regulator formulation known as PestSafe 360 and is broadly used in crop protection from pest infestation in both agricultural and urban economies. Besides, in this region, the infrastructure is very well developed, and due to the high rate of acceptance of new inventions in pest control management, it leads the global market.

Moreover, the Asia-Pacific region emerged as the fastest-growing market for insect growth regulators, capturing a market share of around 25%. This can be attributed to the continuous growth of the agricultural sector and steadily increasing awareness regarding the use of sustainable methods for pest control in countries like China and India. In March 2023, Syngenta launched EcoGuard Plus, its new insect growth regulator product targeted to markets in Asia; thus, underpinning demand for effective pest management solutions in the region. Growing agricultural investments coupled with increased interest in eco-friendly solutions for pest control propels fast growth in the Asia-Pacific region for the said insect growth regulator market.

Key Players

Some of the major players in the Insect Growth Regulators Market are Russel IPM Ltd., Bayer CropScience AG, Valent U.S.A Corporation, DOW Chemical Company, Central Gardens, Syngenta AG, Nufarm, ADAMA India Pvt. Ltd., Pets Co., Sumitomo Chemical Company and other key players

Recent Developments

-

June 2024: Zoëcon Professional Products introduced Formitrol Ant Bait Gel, a new solution that can be used to deliver immediate knockdown and long residual of a wide array of nuisance ants.

-

March 2024: Syngenta introduced Advion Trio cockroach gel bait, a game-changing solution that will help pest management professionals achieve total control of cockroaches at every stage of their life cycle with a powerful trio of active ingredients, including two insect growth regulators.

-

March 2023: Bayer CropScience introduced Intrepid, a novel non-systemic insect growth regulator effective against aphids, mealybugs, whiteflies, among others.

-

January 2022: Syngenta Crop Protection AG signed an agreement with Bionema Limited for the acquisition of the two major bioinsecticides, namely NemaTrident and UniSpore.

Insect Growth Regulators Market Report Scope:

Report Attributes Details Market Size in 2023 US$ 1.2 Billion Market Size by 2032 US$ 2.0 Billion CAGR CAGR of 6.0% From 2024 to 2032 Base Year 2023 Forecast Period 2024-2032 Historical Data 2020-2022 Report Scope & Coverage Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook Key Segments •By Product (Chitin Synthesis Inhibitors, Juvenile Hormone Analogs & Mimics, Anti-juvenile Hormone Agents, Others)

•By Form (Liquid, Aerosol, Bait)

•By Application (Agriculture & Gardens, Livestock Pest Control, Commercial Pest Control, Others)Regional Analysis/Coverage North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) Company Profiles Russel IPM Ltd., Bayer CropScience AG, Valent U.S.A Corporation, DOW Chemical Company, Central Gardens, Syngenta AG, Nufarm, ADAMA India Pvt. Ltd., Pets Co., Sumitomo Chemical Company and other key players Key Drivers • Rising Demand for Pest Control Drives Growth in Insect Growth Regulators Market with Innovations

• Growing Environmental Sustainability Awareness Fuels Insect Growth Regulators MarketRESTRAINTS • Limited awareness and understanding can hamper the growth of insect growth regulators market