Instant Noodles Market Report Scope & Overview:

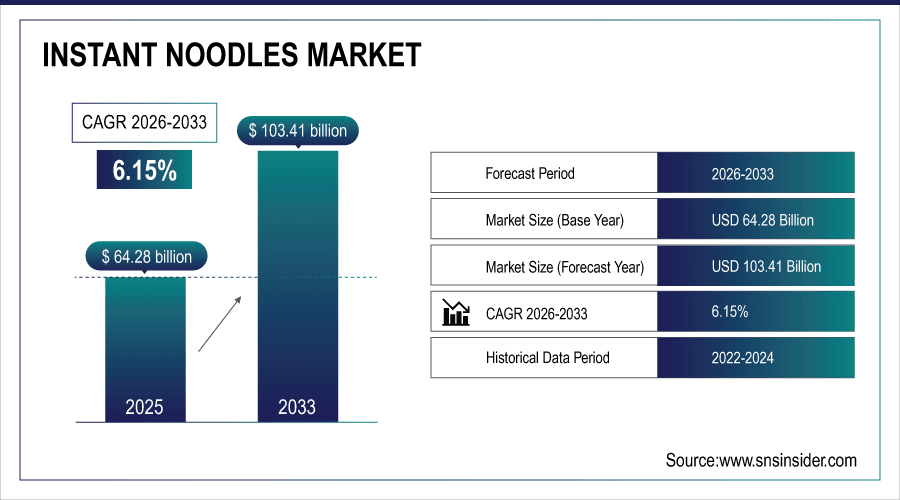

The Instant Noodles Market Size was valued at USD 64.28 Billion in 2025E and is projected to reach USD 103.41 Billion by 2033, growing at a CAGR of 6.15% during the forecast period 2026–2033.

The Instant Noodles Market analyzes the compromising patterns and key developments due to the potentiality of products like cup, bowl, packet, and regular instant noodles containing flavors such as chicken, beef, seafood, vegetable, and spicy. The market is classified based on raw materials, packaging type, and distribution channels such as supermarkets, convenience stores, and online retail. Increasing urbanization, hectic lifestyles, and rising demand for convenient, ready-to-eat products worldwide are promoting global expansion and market growth across major regions.

Cup, bowl, and packet noodles accounted for nearly 55% of the Instant Noodles Market in 2025, driven by convenience, busy lifestyles, and rising demand for ready-to-eat meals across urban and semi-urban regions.

To Get More Information On Instant Noodles Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2025: USD 64.28 Billion

-

Market Size by 2033: USD 103.41 Billion

-

CAGR: 6.15% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Instant Noodles Market Trends:

-

Instant noodles are becoming less a midday snack and more an adventure food, according to the innovative flavors boldly appealing to adventurous eating.

-

Accelerating urban life is contributing to the boom in convenient, on-the-go food and convenient items, while products like instant noodles become a staple forerunner for consumers on the run.

-

On online grocery platforms and e-commerce, the number of sources has diversified accessibility meaning a click stands between you and your favorite noodles.

-

Natural packaging and sustainable alternatives are winning the hearts of environmentally conscious millennials and Gen Z customers.

-

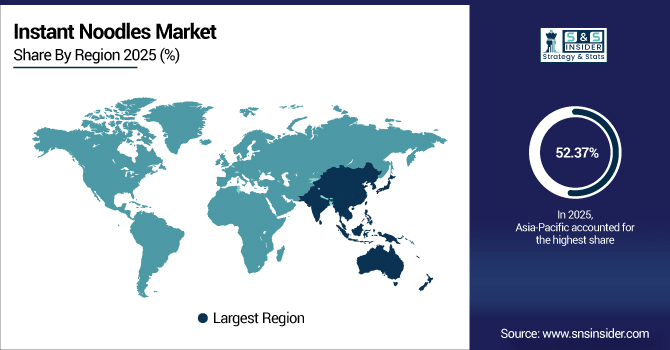

Asia-Pacific is the growth driver with rising incomes, changing diets and increased preference for convenient foods.

U.S. Instant Noodles Market Insights:

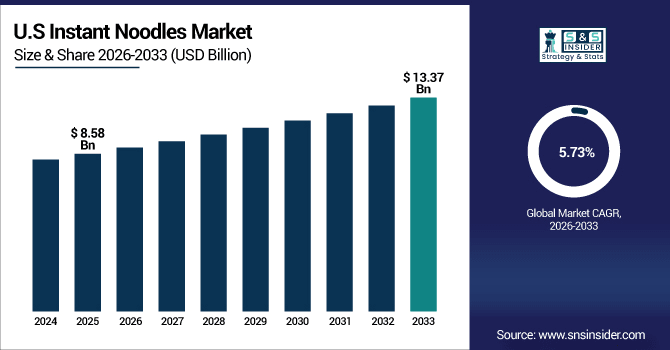

The U.S. Instant Noodles Market is expected to grow from USD 8.58 billion in 2025E to USD 13.37 billion by 2033, at a CAGR of 5.73%. Convenience demand, Asian‑inspired flavors, online retail penetration and the introduction of healthier products such as low-sodium and protein-packing varieties have contributed to growth.

Instant Noodles Market Growth Drivers:

-

Increasing consumer preference for convenient, affordable, and diverse instant noodle flavors drives global market expansion.

The Instant Noodles Market is expanding worldwide with the rising preference of consumers for tasty, convenient and inexpensive food items to help save them time in their fast-paced lifestyle. The global consumption of instant noodles is projected to cross 120 billion serving by the year 2025, driven by urbanization, rising disposable incomes and expanding retail and e-commerce network. This growth is sponsored by new product development, variety flavors as well as consumer lifestyle habits eating meal on-the-go, to make instant noodle family need around the globe.

Rising demand for convenient, ready-to-eat meals drove nearly 48% of global instant noodle consumption in 2025.

Instant Noodles Market Restraints:

-

Volatile raw material prices and health concerns limit instant noodles’ market growth and consumer adoption globally.

Instant Noodles Market has faced with challenges such as increasing cost of raw materials and health concerns. Moreover, almost 30% of manufacturers account margin pressure and fluctuating wheat and packaging prices, while supply chain disruptions disrupted the timely delivery. Rising health awareness regarding sodium and other nutritional values restrains growth in certain regions. It’s the smaller regional brands that feel these limitations most strongly and regulatory compliance, competition from fresh ready-to-eat offerings and fluctuating commodity prices continue to hamper market growth worldwide.

Instant Noodles Market Opportunities:

-

Rising demand for healthy, fortified, and gourmet instant noodles presents significant global market growth opportunities.

Increasing inclination towards healthy, professional, and gourmet instant noodles supports the global market growth. In 2025, as much as more than 40 percent of all new product launches focused on low-sodium, protein-infused or international flavors that suit consumers’ varying levels of health behavior and exploration. Growing retails and e-commerce sales further increase accessibility of these products, while flavor and functional ingredient innovation is set to continue driving growth through 2033 for the global instant noodles market.

Introduction of healthy, fortified, and gourmet instant noodles accounted for nearly 35% of global product launches in 2025.

Instant Noodles Market Segmentation Analysis:

-

By Product Type, Packet Noodles held the largest market share of 68.73% in 2025, while Bowl Noodles are expected to grow at the fastest CAGR of 10.32%.

-

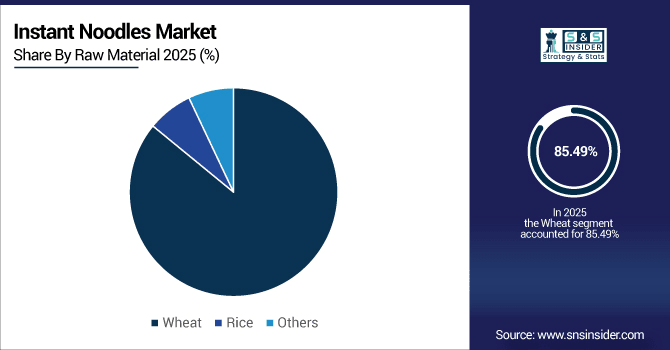

By Raw Material, Wheat-based noodles dominated with an 85.49% share in 2025, while Rice-based noodles are projected to expand at the fastest CAGR of 11.41%.

-

By Flavor, Chicken flavor accounted for the highest market share of 31.56% in 2025 and Vegetable flavor is projected to record the fastest CAGR of 6.87%.

-

By Packaging Type, the plastic packaging segment held the largest share in 2025 with 52.46% and paper packaging segment is expected to grow at fastest CAGR of 9.64%.

-

By Distribution Channel, Supermarkets/Hypermarkets held the largest share of 42.73% in 2025, while Online Retail is expected to grow at the fastest CAGR of 10.98%.

By Raw Material, Wheat Noodles Dominate While Rice-Based Noodles Gain Traction:

Wheat noodles generated some 50 billion servings in 2025, due to their long history and worldwide recognition as an inexpensive staple. Rice-based noodles, in contrast, approached 7 billion servings and grew with the increasing demand for gluten-free and plant-based substitutes. Consumers from health concerned and gluten sensitive demographics are more and more turning towards rice noodles notably in Asia and North America, fueling product diversification and an increased number of retails offers for instant noodles production.

By Product Type, Packet Noodles Lead While Bowl Noodles Expand Rapidly:

In 2025, more than 45 billion servings of packet noodles were eaten per year around the world which continued to make them very popular on other continents for being cheap and easily available. By comparison, bowl noodles tallied about 12 billion servings, which demonstrate an increasing consumer preference for single-serve to-go meals. Growing urban population and rising consumption of convenient to consume food is driving rapid expansion across the Asia-Pacific, North America, and Europe regions.

By Flavor, Chicken Remains the Most Popular While Vegetable Flavors Grow:

Instant noodles in chicken flavor dominated the market by being served on 22 billion meals across the globe in 2025. Noodles flavored by vegetables, meanwhile, represented around 9 billion servings and showed growing consumer demand for healthful, plant-based alternatives. Changes in consumer preference towards health, functional ingredients and vegetarianism are leading manufacturers to roll out a variety of vegetable and mixed flavours, especially in urban and semi-urban markets that now boast of higher disposable incomes.

By Packaging Type, Plastic Leads While Paper Packaging Expands:

Wet noodles, sold in plastic packaging were the go-to meal with more than 30 billion servings consumed in 2025 due to their ease and durability. Noodles, Paper Packaged registered close to 13 billion servings from increasing environmental awareness and movement toward more sustainable packages. Amid government and brand-led pressure for more eco-friendly options, paper and biodegradable formats are picking up pace, particularly among Millennials and Gen Z consumers, while single-serve cups/bowls remain popular with the on-the-go urban population.

By Distribution Channel, Supermarkets/Hypermarkets Drive Volume While Online Retail Surges:

With over 28 billion packets of instant noodles sold across the globe, supermarkets/hypermarkets formed the most preferred shopping destination as variety products are stocked. Nearly 16 billion orders were handled by online retail, which indicates a rise in e-commerce and consumers looking for home delivery and convenience. Digital platforms and app-based grocery shopping are expanding instant noodles’ reach, particularly in Asia-Pacific and North America

Instant Noodles Market Regional Analysis:

Asia-Pacific Instant Noodles Market Insights:

The Asia-Pacific instant noodles market is had 52.37% of global consumption, and achieved 27 billion servings in 2025 with China (12 billion) and Japan (6 billion). Packet and cup noodles hogged the consumption scene, with online retail and convenience stores channelling orders worth over 8 billion. Increasing urbanization, busy lifestyles, shifting tastes; and also increase in convenient or easier to cook healthier options of instant noodle products in the regional markets are accelerating the category’s growth.

Get Customized Report as Per Your Business Requirement - Enquiry Now

China Instant Noodles Market Insights:

In 2025, China consumed more than 12 billion portions of instant noodles (7 billion packet noodles and 5 billion cup/bowl). Online retail accounted for roughly 4.5 billion of those orders, with the rest occurring in grocery stores. The growth is driven by urbanisation, busy lifestyle and increased demand of flavoured paycheque, convenient and healthier noodle products across the country.

North America Instant Noodles Market Insights:

The North American instant noodles industry is on a positive growth trajectory, with an annual consumption estimated to exceed 8.2 billion serving by the year 2033. Interest is increasing amid hectic schedules, multicultural inspirations and a love of Asian flavors. Accessibility increases thanks to online retail and convenience store sales, and health-minded US and Canadian consumers are reaching for low-sodium, gluten-free, protein-enhanced noodles that are edging the regional demand outlook.

U.S. Instant Noodles Market Insights:

By 2025, the U.S. had sucked down more than 5.9 billion servings of instant ramen from some 120+ active brands stocked on store shelves. Online outlets handled nearly 1.4 billion orders, and convenience stores provided about 2.3 billion servings. Behind the increase: Growth is fueled by multicultural flavors, health-focused innovations and the proliferation of digital grocery platforms across the U.S.

Europe Instant Noodles Market Insights:

In 2025, Europe’s Instant Noodles Market was estimated at more than 4.3 billion servings, Germany Emerged as leader with 1.1 billion followed by UK (1.05 billion) and France (1Billion). Convenience stores and supermarkets accounted for 2.2 billion orders and online retail processed 1.1 billion. Growth is spurred on by urbanisation, increasing demand for convenient and quick meals, exotic tastes as well as growing acceptance of ready-to-eat and healthier noodle offerings in the region.

Germany Instant Noodle Market Insights:

In 2025 Instant Noodles Market in Germany was served more than 1.1 billion times, and of this packet noodles accounted for consumption of 650 million and the rest for cup/bowl format. Online retail processed 550 million orders and supermarkets plus convenience stores accounted for the remainder. Urbanization, time-pressed consumers and demand for flavourful and convenient on-the-go noodle products are fueling growth.

Middle East and Africa Instant Noodles Market Insights:

In 2025, the Middle East & Africa Instant Noodles Market is estimated to overserve over 650 million serving, out of which 400 million from supermarkets/convenience stores and the remaining 250 million through online retail. The market is driven by increasing urbanisation, hectic lifestyles and surging demand for convenient, flavoured and ready-to-eat noodles. The region is anticipated to grow at a CAGR of 8.90% until 2033.

Latin America Instant Noodles Market Insights:

In the year 2025, Latin America Instant Noodles Market was number 1 with over 1.2 billion servings, followed by Brazil with 500 million) and Mexico (420 million) and Argentina (200 million). Some 750 million servings were dealt out via convenience stores and supermarkets, with the balance of 450 million coming from online retail.

Instant Noodles Market Competitive Landscape:

Nissin Foods, which was founded in 1948, transformed the instant noodles industry with inventions such as Cup Noodles. By 2025, it largely dominated the international market partly due to buzz around or wide availability and variety flavors and positive marketing. With billions of servings consumed annually, Nissin products have fed people all over the world 5 billion servings worldwide in 2013, Asia, North America, and Europe Nissin have pioneered the production of instant noodles in Japan.

-

In June 2025, Nissin Foods released Cup Noodles Protein, which doubles the amount of protein to 16 grams per serving and is designed for the health‐conscious consumer. They also launched the Kanzen Meal, a line of frozen nutrient-dense meals and their first offering in the frozen meal aisle.

Indofood, the maker of the iconic Indomie brand, is a leader in Indonesia’s market for instant noodles and sends its products to more than 100 countries. In 2025, billions of packs are sold worldwide under Indomie name due to its cheap price and various flavors as well as distributions. Through its brand equity, market reach through region and product renewal capabilities Indofood lead in the growing international instant noodle market mainly within Asia, Africa and Middle East.

-

In June 2025, Indofood introduced Indomie Hype Abis Mi Nyemek Curry Flavor, that needs just twelve spoons of boiling water for instant cooking. They added POP Spageti in Spicy Bolognese and Spicy Carbonara flavor, which brings out a rich spaghetti taste instantly.

Maggi brand is a major player in the instant noodles category especially in India, where there are high levels of Maggi consumption. By 2025 – the magic of trust, the journey to success for Maggi came from rebuilding trust, introducing a wider range of products and innovating with flavors as well as formats. Through powerful marketing, easy packaging options and broad retail coverage, Nestlé manufactures seamless success across the world demand for quick and convenient, tasty ready-to-eat meals.

-

In March 2025, Nestlé expanded Maggi in the U.S. with Indian Classic Masala, Chinese Spicy Garlic, and Korean Spicy BBQ flavors. They also launched Maggi Masala in the UK, catering to the Indian diaspora and global consumers seeking ethnic flavors.

Instant Noodles Market Key Players:

Some of the Instant Noodles Market Companies are:

-

Nissin Foods Holdings Co., Ltd.

-

Indofood Sukses Makmur Tbk

-

Nestlé S.A.

-

Ajinomoto Co., Inc.

-

Unilever PLC

-

ITC Limited

-

Uni-President Enterprises Corporation

-

Samyang Foods Co., Ltd.

-

Nongshim Co., Ltd.

-

Acecook Vietnam Joint Stock Company

-

Mamee-Double Decker Sdn. Bhd.

-

Koka (Tat Hui Foods Pte. Ltd.)

-

Capital Foods Pvt. Ltd.

-

The Campbell Soup Company

-

General Mills, Inc.

-

Vina Acecook Co., Ltd.

-

Maruchan (Toyohashi Foods Co., Ltd.)

-

Ottogi Corporation

-

Paldo Co., Ltd.

-

Korean Ramyeon Manufacturers Association

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 64.28 Billion |

| Market Size by 2033 | USD 103.41 Billion |

| CAGR | CAGR of 6.15% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Cup Noodles, Bowl Noodles, Packet Noodles, Others) • By Raw Material (Wheat, Rice, Others) • By Flavor (Chicken, Beef, Seafood, Vegetable, Spicy, Others) • By Packaging Type (Plastic, Paper, Foil, Others) • By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retail, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Nissin Foods Holdings Co., Ltd., Indofood Sukses Makmur Tbk, Nestlé S.A., Ajinomoto Co., Inc., Unilever PLC, ITC Limited, Uni-President Enterprises Corporation, Samyang Foods Co., Ltd., Nongshim Co., Ltd., Acecook Vietnam Joint Stock Company, Mamee-Double Decker Sdn. Bhd., Koka (Tat Hui Foods Pte. Ltd.), Capital Foods Pvt. Ltd., The Campbell Soup Company, General Mills, Inc., Vina Acecook Co., Ltd., Maruchan (Toyohashi Foods Co., Ltd.), Ottogi Corporation, Paldo Co., Ltd., Korean Ramyeon Manufacturers Association |