Insulated Packaging Market Report Scope & Overview

Get More Information on Insulated Packaging Market - Request Sample Report

The Insulated Packaging Market Size was valued at USD 16.2 billion in 2023 and is expected to reach USD 28.5 billion by 2031 and grow at a CAGR of 6.5 % over the forecast period 2024-2031.

Consumers are increasingly opting for fresh, pre-packaged meals, delivered groceries, and prepared meal kits. This surge in demand for perishable goods necessitates temperature-controlled packaging to ensure food safety and maintain freshness during transport.

For instance, a company like HelloFresh relies on insulated boxes with ice packs to deliver fresh ingredients directly to consumers' doorsteps. The meteoric rise of e-commerce has significantly impacted the insulated packaging market. Online grocery shopping and pharmaceutical deliveries require reliable temperature control to maintain product quality. Insulated packaging solutions ensure these items reach customers in optimal condition, minimizing spoilage and wasted food/medicine.

For example, companies like Amazon are investing in insulated packaging solutions made from recycled content to cater to the growing demand for sustainable e-commerce deliveries. also, the growing demand for biopharmaceuticals and other temperature-sensitive drugs necessitates robust cold chain logistics. Insulated packaging with advanced materials and features like temperature monitoring helps ensure the efficacy and safe transport of these life-saving medications. For instance, companies like FedEx offer specialized cold-chain packaging solutions for pharmaceuticals, employing insulated containers and temperature monitoring devices.

MARKET DYNAMICS:

KEY DRIVERS:

-

The rise in the demand for temperature-sensitive products has given growth to the market

-

The rise of online grocery shopping and meal kit delivery services has created a massive demand for temperature-controlled packaging.

-

The expansion of cold chain logistics, including the storage and transportation of temperature-controlled goods, will have a direct impact on the insulated packaging market.

The growing demand for temperature-sensitive products such as pharmaceuticals, biologics, perishables and perishables has increased the need for insulated packaging solutions. Insulated packaging helps maintain the desired temperature range during storage and transportation, ensuring product quality and safety.

RESTRAINTS:

-

Rising raw material costs is restraining the market growth

-

Some insulated packaging solutions are reusable, while others are designed for single use.

Rising raw material costs such as insulation, polymers and specialty packaging components can put pressure on manufacturers of insulation packaging. Increased procurement costs for these materials can directly impact production costs, which can lead to lower profit margins for manufacturers. This can be difficult, especially for small businesses with limited pricing flexibility.

OPPORTUNITIES:

-

Expanding Pharmaceutical Market pose several Opportunities.

-

There are untapped opportunities for insulating packaging in emerging markets and industries.

The growing demand for biopharmaceuticals and other temperature-sensitive drugs is another Opportunity. These medications require strict temperature control during storage and transportation to maintain their efficacy. Insulated packaging solutions with advanced materials and phase-change technologies can ensure these life-saving drugs reach patients in perfect condition. For example, companies like FedEx offer specialized cold-chain packaging solutions for pharmaceuticals, employing insulated containers and temperature monitoring devices.

CHALLENGES:

-

Balancing cost efficiency for insulated packaging solutions can be a major challenge

-

The insulated packaging market is susceptible to fluctuations in raw material prices.

Fluctuations in the cost of oil, for instance, can impact the price of plastic-based insulated materials. Manufacturers need to find ways to optimize production processes and explore alternative, cost-stable materials to ensure affordability for businesses and consumers.

IMPACT OF RUSSIA-UKRAINE WAR

The conflict between Russia and Ukraine disrupted the supply chain and operations of the insulated packaging market. Conflicts lead to various trade restrictions, border closures and logistical challenges, which directly affected the flow of raw materials and finished products within the industry. Glass, plastic and other raw materials are required for the production of insulated packaging. The war caused a hike in the prices of raw materials. There are 50-65 manufacturers of glass and 300-400 manufacturers who supply raw materials to other nations in the Russian and Ukrainian markets. More than 70% of these factories have already resumed production. Almost all components for window production are produced in Ukrainian factories. This dispute may also affect the transportation and logistics operations of the thermal insulation packaging market. Border closures, checkpoints, and security measures can cause delays and bottlenecks in the movement of goods in affected areas. This can impact the timely delivery of raw materials to manufacturers and the distribution of finished insulated packaged products to customers. Businesses may need to find alternative transportation or incur additional costs for rush deliveries, which can affect their profit margins and overall competitiveness.

IMPACT OF ECONOMIC SLOWDOWN

When economic conditions tighten, consumers tend to prioritize essential goods and cut back on discretionary spending. This can lead to a decrease in demand for certain products that rely heavily on insulated packaging. For example, restaurant takeout meals or premium grocery items delivered to your doorstep might become less frequent purchases. This translates to a decline in insulated packaging needed for these deliveries. During an economic slowdown, businesses across the supply chain may face tighter budgets. This can lead to cost-cutting measures that impact their use of insulated packaging. Companies might opt for less expensive, non-insulated options for specific products, even if it risks compromising quality or freshness. Imagine a bakery chain that usually delivers fresh pastries in insulated boxes. To save costs during a slowdown, they might switch to standard cardboard boxes, potentially impacting the quality of their delivered goods. Economic uncertainty can also lead businesses to delay investments in new technologies or infrastructure. This could impact the adoption of advanced insulated packaging solutions, such as those with temperature monitoring or longer-lasting insulation properties. For instance, a pharmaceutical company planning to implement a new cold-chain distribution system with high-tech insulated containers might postpone the project due to economic anxieties.

KEY MARKET SEGMENTS:

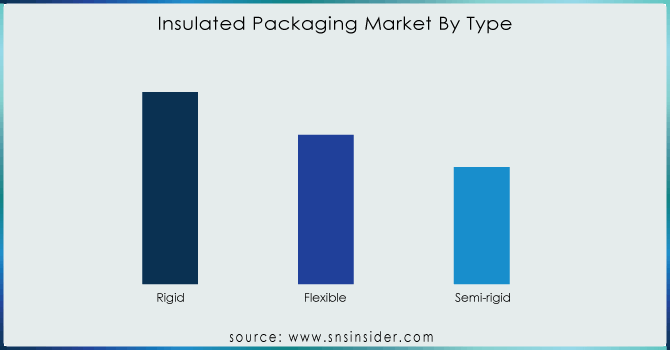

By Type

-

Rigid

-

Flexible

-

Semi-rigid

The rigid sector had the highest revenue share of 39.7%. Rigid packing products are made of paperboard, fiberboard, plastics, corrugated cardboard, and paper. The products are used to make stiff items including cases, trays, bottles, cans, cups, pots, and boxes. Rigid items are sealed with adhesives, staples, and tapes. The goods can be made with radio-frequency identification (RFID) and a variety of color printing options. The flexible category is predicted to increase at a 5.6% CAGR over the projection period. Flexible items are made using plastic films and plywood. Graphics are put into the packaging to make it appealing to consumers. Flexible packaging materials are sealed using pressure and heat. Plastic polymers are utilized to create flexible packaging items. Semi-rigid items are not flexible or rigid in nature. End-use products include folding cartons, lined cartons, aseptic cartons, and thermoformed containers. Semi-rigid IP goods are made from polypropylene and polyethylene. The items are lightweight, resistant to temperatures below freezing, and suited for refrigeration.

Get Customized Report as per Your Business Requirement - Request For Customized Report

By Product

-

Metal

-

Corrugated

-

Cardboard

-

Glass

-

Others

The corrugated cardboards segment had the highest revenue share of 27.7% in 2022. Corrugated cardboard consists of linerboard and fluted corrugated sheet. These components strengthen corrugated cardboard and enable it endure high levels of pressure. Corrugated cardboard is often made using flute lamination machines. The cardboards are quite strong in terms of impact, bending, tear, and burst resistance. Corrugated cardboard comes in a variety of flute types (A, B, C, E, etc.) with different thicknesses and wave patterns. This allows for customization based on the specific weight and protection needs of your product. For instance, delicate electronics might require a thicker double-walled construction with a finer flute type (E flute) for superior cushioning, while a book might be perfectly suited for a single-walled B flute offering a balance of protection and cost.

By Application

-

Pharmaceutical

-

Cosmetic

-

Industrial

-

Food & Beverages

-

Others

Based on Product, the food and beverage segment had the highest revenue share, at 26.1%. Insulated packaging (IP) for food and beverages prevents tampering, protects against physical damage, and maintains the nutritional value of the product. Food and beverage goods must be protected from temperature and pressure fluctuations because they are perishable and may become unusable by the time they reach their destination. The pharmaceutical segment is predicted to increase at the fastest rate of 6.1% over the projection period. Pharmaceutical intellectual property is subject to severe rules around the world because of its use in the healthcare sector and the harm it can do to patients owing to disparities. Regulatory agencies in this area assess issues such as patient safety, shelf life, migration of packaging products into the medicines, sterility, heat, moisture, and degradation of drugs by oxygen content.

REGIONAL ANALYSES

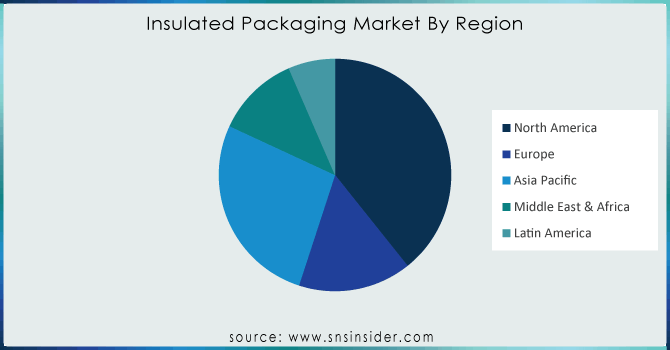

North America boasts a well-established healthcare system with a strong emphasis on pharmaceuticals. This translates to a significant demand for insulated packaging to ensure the safe and effective transport of temperature-sensitive medications, vaccines, and biological samples. North America has rigorous food safety regulations mandating proper temperature control during transportation and storage of perishable food items. This creates a robust market for insulated packaging solutions that guarantee food safety and minimize spoilage. Busy lifestyles and a preference for convenience in North America fuel the demand for pre-packaged meals and meal-kit delivery services. These offerings require insulated packaging to maintain freshness and quality during transport, directly impacting the market. North America is a hub for innovation in packaging technologies. Manufacturers are constantly developing new and improved insulated packaging solutions with features like enhanced thermal performance, biodegradability, and tamper-evident closures. These advancements cater to the specific needs of various industries and contribute to market growth.

Eg. The United States: The U.S. healthcare and pharmaceutical industries are major drivers of demand for insulated packaging, with a growing focus on cold chain logistics for temperature-sensitive medications.

Asia Pacific region is dominating the Insulated Packaging Market. Across Asia Pacific, rapid urbanization and growing disposable incomes are leading to a surge in the consumption of packaged foods. Busy lifestyles and a growing preference for convenience are driving this trend. This translates to a massive need for insulated packaging to ensure the safety, freshness, and quality of these packaged foods during transport and storage. also, the pharmaceutical industry in Asia Pacific is experiencing phenomenal growth. This is due to factors like, Aging population, Rise of biopharmaceuticals, Expanding healthcare access. The rise of modern food retail chains across Asia Pacific is another significant driver. These chains often have extensive distribution networks that require insulated packaging to ensure the freshness and quality of perishable food items as they travel from warehouses to stores.

Eg. China's massive population and booming e-commerce industry create a huge demand for insulated packaging for food and pharmaceutical products.

India's growing middle class and expanding cold chain infrastructure are driving the demand for insulated packaging in the food and pharma sectors.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players

Some major key players in the Insulated Packaging market are American Aerogel Corporation, Huhtamaki Oyj, Sonoco Products Company, Thermal Packaging Solutions, Insulated Products Corporation, Deutsche Post DHL, Amcor Ltd, Temper Pack, Exeltainer, and other players.

RECENT DEVELOPMENT

In April 2024, Eco-Friendly Focus, Sealed Air Corporation.

A major player in packaging solutions, announced a collaboration with BASF (a chemical giant) to develop next-generation, bio-based materials for insulated packaging. This partnership aims to create high-performance, compostable insulation solutions, addressing the growing demand for sustainable packaging options.

In February 2024, Collaboration for Pharmaceutical Cold Chain.

Sonoco Products, a manufacturer of rigid insulated containers, partnered with TempGuard Solutions, a cold chain logistics provider. This collaboration aims to offer comprehensive, temperature-controlled packaging solutions for the pharmaceutical industry, ensuring the safe and efficient transport of critical medications and vaccines.

| Report Attributes | Details |

| Market Size in 2023 | US$ 16.2 Billion |

| Market Size by 2031 | US$ 28.5 Billion |

| CAGR | CAGR of 6.5% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Raw Material (Plastic, Wood, Glass, Metal, Others) • By Packaging Form (Rigid, Flexible, Semi-Rigid), • By Packaging Type (Box & Container, Flexible Blanket, Bags, Wraps, Others) • By Application (Cosmetic, Food & Beverages, Pharmaceutical, Industrial, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | American Aerogel Corporation, Huhtamaki Oyj, Sonoco Products Company, Thermal Packaging Solutions, Insulated Products Corporation, Deutsche Post DHL, Amcor Ltd, Temper Pack, Exeltainer |

| Key Drivers | • The rise in the demand for temperature-sensitive products has given growth to the market • The expansion of cold chain logistics, including the storage and transportation of temperature-controlled goods, will have a direct impact on the insulated packaging market. |

| Market Restraints | • Rising raw material costs is restraining the market growth |