Medical Gas Analyzers Market Size & Overview:

Get more information on Medical Gas Analyzers Market - Request Sample Report

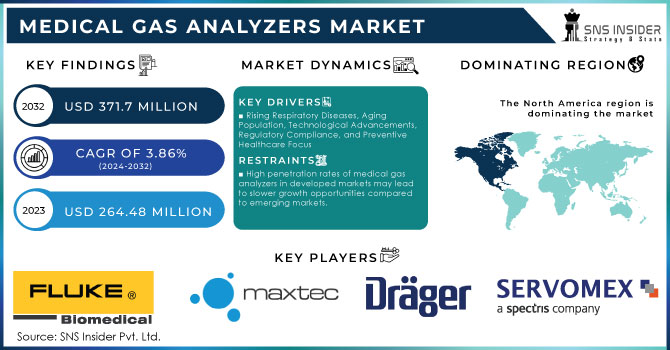

The Medical Gas Analyzers Market Size was valued at USD 264.48 million in 2023 and is expected to reach USD 371.7 million by 2032 and grow at a CAGR of 3.86% over the forecast period 2024-2032.

Many critical factors are driving the growth of this medical gas analyzer market. The steep increase in surgical procedures worldwide and the advancements of medical gas analyzers with modern technology are the biggest drivers of this growth. The aged population is primarily driving this trend since an aging person is more exposed to health issues. The United Nations approximates that the world's population over 60 years old has been estimated to stand at around 1.4 billion in 2020, which represents 18% of the total population. This population is still estimated to increase with a potential of reaching 2.1 billion by 2050 through an annual growth rate of about 3%. With this surge in the population of elderly people, multiple disorders and diseases are bound to increase, thus increasing the need for medical gas analyzers.

Another determinant that defines the burden of disease is the increasing number of medical procedures. Sources indicate over 54 million surgical procedures were carried out in the U.S. during 2020. Cardiovascular and respiratory surgical volumes have been going up year after year. The rise in chronic conditions such as cancer, cardiovascular diseases, strokes, and respiratory disorders has increased the demand for efficient medical gas treatments mainly for critical operations, such as cerebrovascular and cardiac interventions. According to the Centers for Disease Control and Prevention, nearly 160,000 people die from a stroke in the United States annually and 795,000 have a stroke per year; hence, medical gases are an essential part of therapy.

Advances in technology and product innovations are further aiding the market growth. Microbubbles and liposomes as new delivery methods of gases are seen to significantly boost the market. The advanced healthcare system, which is gradually evolving and trying to adapt to the rising care for patients, will, therefore see a steady expansion in this medical gas analyzer market. This growth is being spurred by the growing demand to monitor and administer medical gases with accuracy in healthcare delivery environments, especially due to the rising incidence of chronic diseases and the expanding geriatric population.

Medical Gas Analyzers Market Dynamics

Drivers

-

Rising Respiratory Diseases, Aging Population, Technological Advancements, Regulatory Compliance, and Preventive Healthcare Focus

The growing rate of respiratory diseases, such as COPD and asthma, demanded medical gas analyzers in hospitals and other health facilities. Such medical gas analyzers are very vital for observing the oxygen and carbon dioxide levels of those patients under treatment to ensure their effective management and treatment.

Further, the world is witnessing an increasing number of aged populations. Seniors are more prone to respiratory infections. Medical gases are required to be checked frequently and hence, the demand for medical gas analyzers is increasing in the market. Additionally, various advanced technologies in portable and easy-to-use analyzers, which have surfaced in the recent past, have also made them even more user-friendly in clinics as well as houses. The requirement of medical-grade quality and safety in medical facilities, which steadily increases the overall market growth, also encompasses the employment of accurate and reliable gas analyzers in the quality and safety of medical gases utilized in a wide range of therapeutic applications. In addition, the rise of outpatient procedures and home healthcare has also led to increasing demand for portable gas analyzers, which would allow for real-time patient health monitoring outside of conventional clinical environments. The increasing focus on preventive healthcare and early diagnosis, which can enforce timely interventions and better management of respiratory diseases, contributes to the growing usage of medical gas analyzers. All these factors influence the medical gas analyzers market and create opportunities for innovation and growth within the sector.

Restraints

-

High Cost of Equipment

-

Limited Awareness and Training

-

Maintenance and Calibration Challenges

-

Competition from Alternative Technologies

-

High penetration rates of medical gas analyzers in developed markets may lead to slower growth opportunities compared to emerging markets.

Medical Gas Analyzers Market - Key Segmentation

by Product Type

Multi-gas analyzers, which measure multiple gases at a time, including oxygen, carbon dioxide, and nitrous oxide, held the largest market share at 57.4% in 2023. With more patients requiring strict monitoring in critical care for various types of gases, single-gas analyzers, and other forms are unusable for such patient care environments. With the complexity of inpatients' conditions at hospitals and emergency care, demand has increased for advanced analyzers that can give comprehensive data in a quick time. Further, the ability to streamline workflow and reduce the time spent on each gas measurement is also an essential benefit, which has allowed multiple gas analyzers to establish their ground.

The single gas analyzer segment is growing at a healthy rate on account of the cost-efficiency and user-friendliness that it offers for certain applications. Generally, analyzers are preferred in smaller healthcare facilities, where monitoring only one gas, such as oxygen, is sufficient. The demand for focused and cost-effective solutions is thus boosting the growth of single-gas analyzers particularly in outpatient and home care settings.

by Modality Type

by 2023, benchtop analyzers held 29.8% of the share as they are one of the most in-demand types of modality due to their precision and reliability in gas measurement among laboratories. They are widely used in hospitals and research facilities due to the accuracy of gas analysis. The increasing demand for the pharmaceutical and critical care industries requiring high-grade testing and quality assurance encourages the application of benchtop analyzers.

The medical gas analyzers market's fastest-growing segment is handheld analyzers. Their compact design and portability make them extremely favorable for point-of-care testing and emergencies. They provide healthcare professionals with quick assessments with minimal rigorous setup or equipment. The healthcare system is increasingly embracing immediate and accessible diagnostic solutions, which boosts demand for handheld analyzers. The possibility of making quick decisions in life-or-death situations, particularly in ambulatory surgical centers and emergency rooms, makes handheld analyzers an essential tool in modern healthcare.

by End User

The hospital segment is the largest end-user of medical gas analyzers with a share of 28.7% in 2023 due to the large volumes of patients who receive diagnosis and treatment at these institutions. These analyzers are required by hospitals to ensure that all medical gases are administered safely and are integral to most treatments carried out in departments, including intensive care units and surgical theaters. Strict safety standards and norms on regulatory compliance for the hospitals lead to a rise in demand for reliable and accurate gas analysis equipment, making it simple for this segment to remain at the very top of the market. The increasing prevalence of chronic respiratory diseases in the elderly contributes to the rising demand for medical gas analyzers in hospitals.

ASCs are the fastest-growing end-user segment as these facilities increasingly adopt advanced medical technologies to better the care of patients and improve operational efficiency. Any shift toward the use of outpatient surgeries and procedures will create increased demand for medical gas analyzers in ASCs where rapid accurate gas monitoring is critical. The growing demand for minimally invasive procedures and the thrust toward staying in the shortest period possible in the hospital further supports the growth of medical gas analyzers in such settings and makes them imperative for the future direction of surgical care.

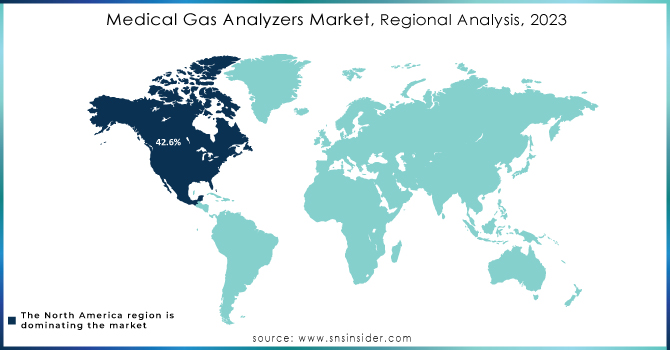

Medical Gas Analyzers Market Regional Analysis

North America was the dominant segment in 2023, with a 42.6% share. Growth here can mainly be accredited to the extensive adoption of new technology and modern healthcare structures. The United States dominates the majority of the market in this region; this is attributed to an aging population and the continually increasing health sector, which will drive up demand for medical gas analyzers.

The Asia-Pacific region will be expected to lead the way by far in terms of growth rates during the forecast period. The growth recently reported in this region can be attributed to a few factors, mainly a rise in diseases with increased hospitalization rates of patients and increased air pollution, primarily in India, China, and Japan. All these factors collectively contribute to the rising demand for medical gas analyzers in this region and the changing healthcare scenario in the Asia-Pacific.

Need any customization research on Medical Gas Analyzers Market - Enquiry Now

Key Players

-

Fluke Biomedical (Fluke Biomedical ProSim)

-

Maxtec LLC (MaxO2 Analyzer)

-

Draegerwerk AG & Co. KGaA (Draeger X-plore 8000)

-

Servomex Group Ltd (Servomex 3000)

-

Teledyne Technologies Incorporated (Teledyne 6000 Series)

-

MEECO Inc (MEECO 3900)

-

Graco Inc. (Geotechnical Instruments (UK) LTD) (Graco Gas Monitor)

-

NOVAIR S.A.S (NOVAIR Analyzer)

-

Roscid Technologies (Roscid Gas Analyzer)

-

Systech Illinois (Systech 8000)

-

WITT-Gasetechnik GmbH & Co KG (WITT MultiGas Analyzer)

-

Tenex Capital Management (Ohio Medical) (Ohio Medical Gas Analyzers)

-

Sable Systems International (Sable Gas Analyzer) and others.

Recent Developments

In May 2020, Roche announced that its Roche v-TAC received CE mark approval. This innovative digital diagnostic solution enables clinicians to obtain arterial blood gas values for patients with respiratory or metabolic issues through a simpler and less invasive venous puncture, utilizing a digital algorithm for accurate results.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 264.48 Million |

| Market Size by 2032 | USD 371.7 Million |

| CAGR | CAGR of 3.86% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Single Gas Analyzer, Multiple Gas Analyzer) • By Modality Type (Handheld Analyzer, Portable Analyzer, Benchtop Analyzer) • By End User (Hospitals, Ambulatory Surgery Centers, Pharmaceutical Industry, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Fluke Biomedical, Maxtec LLC, Draegerwerk AG & Co. KGaA, Servomex Group Ltd, Teledyne Technologies Incorporated, MEECO Inc, Graco Inc., NOVAIR S.A.S, Roscid Technologies, Systech Illinois, WITT-Gasetechnik GmbH & Co KG, Tenex Capital Management, Sable Systems International and Others |

| Key Drivers | • Rising Respiratory Diseases, Aging Population, Technological Advancements, Regulatory Compliance, and Preventive Healthcare Focus |

| Restraints | • High Cost of Equipment • Limited Awareness and Training • Maintenance and Calibration Challenges • Competition from Alternative Technologies • High penetration rates of medical gas analyzers in developed markets |