Insurance Analytics Market Report Scope & Overview:

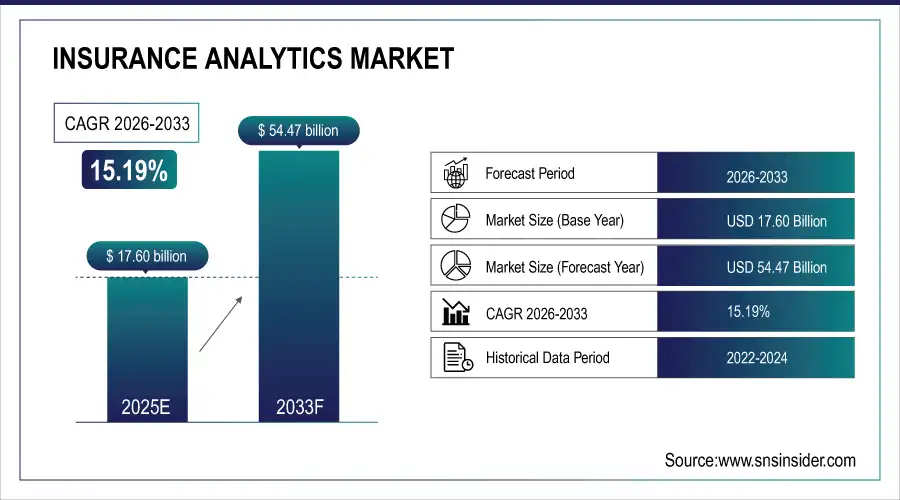

The Insurance Analytics Market Size was valued at USD 17.60 Billion in 2025E and is expected to reach USD 54.47 Billion by 2033 and grow at a CAGR of 15.19% over the forecast period 2026-2033.

The growth of the Insurance Analytics Market is primarily driven by the rising need for data-driven decision-making and risk management in the insurance sector. Claims processing is becoming complex, challenges related to increasing level of fraud, and push for personal line products force the insurers to adopt advance analytics solutions. Moreover, increasing adoption of artificial intelligence, machine learning and big data technologies further augments the capacity of detecting fraud, customer engagement and underwriting accuracy which is expected to further augment the market growth. According to study, over 80% of policyholders expect insurers to provide tailored offerings, fueling the adoption of AI/ML-powered customer engagement and retention tools.

Market Size and Forecast:

-

Market Size in 2025: USD 17.60 Billion

-

Market Size by 2033: USD 54.47 Billion

-

CAGR: 15.19% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Insurance Analytics Market - Request Free Sample Report

Insurance Analytics Market Trends

-

Increasing reliance on data-driven insights for precise underwriting and pricing.

-

Growing demand for advanced fraud detection and risk assessment solutions.

-

High implementation costs slowing adoption among smaller insurance enterprises.

-

Integration challenges with legacy systems hinder smooth analytics deployment.

-

Expanding AI and ML adoption reshaping predictive analytics in insurance.

-

Rising focus on customer-centric, personalized insurance products using analytics.

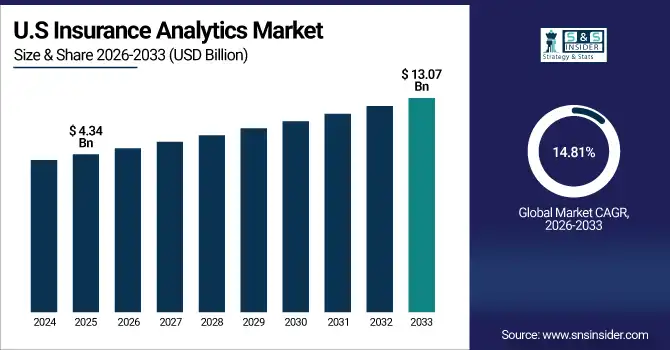

The U.S. Insurance Analytics Market size was USD 4.34 Billion in 2025E and is expected to reach USD 13.07 Billion by 2033, growing at a CAGR of 14.81% over the forecast period of 2026-2033, driven by rapid adoption of AI, big data, and cloud technologies among insurers seeking operational efficiency and competitive advantage. Key drivers include increasing instances of fraudulent claims, rising demand for personalized insurance products, regulatory compliance requirements, and the need for predictive risk assessment and improved customer engagement.

Insurance Analytics Market Growth Drivers:

-

Growing Insurance Complexity Fuels Demand for Advanced Data-Driven Decision Making

The insurance industry is experiencing a fundamental shift from intuition-driven approaches to advanced, data-driven decision-making. In the face of increasing competition, regulatory pressures, and higher customer expectations, insurers need dependable insights to remain profitable and competitive. Predictive modeling for risk assessment, sophisticated fraud monitoring, dynamic pricing, and better claims management is some of these applications that insurance analytics makes possible. With the help of structured and unstructured data sources, companies can enhance underwriting precision, minimize loss, and customize product offerings for customers. Analytic enables insurers to understand their customer behaviors to improve customer retention and personalize customer engagement strategy. Such transformation has made a data-driven decision making as essential element which is boosting the global demand for Insurance Analytics solution over the coming years.

Nearly 60% of insurers now prioritize analytics in strategic decision-making.

Insurance Analytics Market Restraints:

-

Expensive Deployment and Complex Integration Restrict Wider Adoption of Analytics

Despite the benefits, the adoption of insurance analytics has been limited due to implementation cost and technology barriers. So, while analytics helps in providing a view of the long-term impact on future earnings, the challenge with many insurers is that insuring is often built on legacy IT infrastructure and nothing is simple or inexpensive to begin integrating with advanced analytics platforms. It takes a lot of money to shift to modern solutions in a cloud, machine learning technologies, skilled professionals, and cybersecurity. Most smaller firms have a cap on the budgets they can set aside for analytics adoption, which restricts their competitive advantage. Moreover, bringing data from separate systems from customer records to claims databases causes operational bottlenecks and delays.

Insurance Analytics Market Opportunities:

-

Artificial Intelligence and Machine Learning Transform Opportunities in Insurance Analytics

Artificial intelligence (AI) and machine learning (ML) represent a transformative opportunity for the insurance analytics market. Unlike the conventional methods, AI/ML-based solutions empower insurers to look through vast amounts of data in real-time providing them actionable insights in terms of preventing possibilities of fraud occurrences, predicting risk factors, and optimizing pricing of the policy premium. Using predictive analytics, insurers identify anomalies in insured claims that help minimize losses incurred due to fraudulent behavior. On the other hand, AI-driven personalization enables firms to provide tailored products, thus enhancing customer satisfaction and loyalty. Natural language processing enables chatbots and virtual assistants to provide even greater service efficiency. In a landscape where AI/ML models continuously learn, it opens a slew of opportunities for organizations to automate the process of performing routine tasks, allowing for faster decision-making, enhanced offerings, creation of new revenue-generating opportunities, and transformation of customer experience for the insurers.

AI-driven underwriting reduces policy approval times by up to 90%.

Insurance Analytics Market Segmentation Analysis:

-

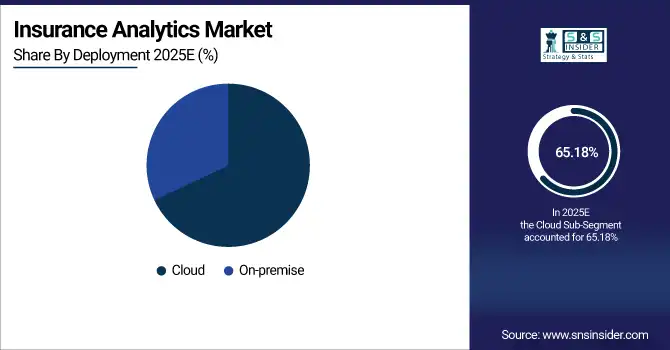

By Deployment: In 2025, Cloud led the market with share 65.18%, while On-premise fastest-growing segment with a CAGR 16.04%.

-

By Enterprise Type: In 2025, Large Enterprises the market 68.40%, while Small and Medium Enterprises (SMEs) fastest-growing segment with a CAGR 15.80%.

-

By Application: In 2025 Claims Process Optimization led the market with share 40.24%, while Fraud Detection & Risk Assessment the fastest-growing segment with a CAGR 16.20%.

-

By End-user: In 2025, Insurance Firms led the market with share 72.34%, while Government Agencies is the fastest-growing segment with a CAGR 16.04%.

By Deployment, Cloud Leads Market and On-premise Fastest Growth

The Cloud-based deployment solutions are dominating the Insurance Analytics Market where a growing number of companies are utilizing capabilities of cloud computing that provides scalability, cost-effectiveness, and the ability to manage high incidents of structured and unstructured data, all in real time. Insurers are increasingly adopting cloud platforms to streamline claims management, enhance fraud detection, and deliver personalized customer experiences while reducing infrastructure costs. Simultaneously, on-premise deployment, while losing its share in the market, is still growing appreciably in certain market segments that hold high value on sensitive customer data privacy, regulatory compliance, and control over sensitive information. In combination, this represents an even-keeled trend for the market, with cloud fueling mass market adoption, and on-premise validating as the ideal choice for the most regulated of insurance environments.

By Enterprise Type, Large Enterprises Lead Market and SMEs Fastest Growth

In terms of organization size, large enterprises dominate the segment in the Insurance Analytics Market owing to the large customer bases, high volume of travel insurance claims, and increased expenditure on advanced analytical platforms to improve fraud detection, risk assessment, and customer engagement. Such organizations are looking for enterprise grade solutions built of AI and big data that can optimize each and every decision they make and help them with their competitive advantage. Small and medium enterprises (SMEs), on the other hand, are turning out to be the fastest growing segment, driven by a growing awareness of the benefits of analytics and the provision of affordable cloud-based solutions. This segment also serves as a crucial growth driver due to the significant contribution of large enterprises but also as SMEs are adopting analytics to enhance productivity, simplify claims, and offer customized offerings.

By Application, Claims Process Optimization Leads Market and Fraud Detection & Risk Assessment Fastest Growth

Claims process optimization occupies the largest share in Insurance Analytics Market, driven by a growing focus of insurers on reducing the time taken for each processing step, eliminating errors, and enhancing customer satisfaction by providing automated, data-driven systems for the entire process. This type of application is key to cost reduction and efficiency gains as advanced analytics tools expedites claims validation, improves transparency and brings efficiency into workflows. On the other hand, fraud detection and risk assessment is projected to be the fastest-growing application, owing to the increasing fraudulent claims and subsequent regulatory scrutiny. By leveraging AI and machine learning driven models, insurers are employing anomaly detection systems to identify fraud behaviour and forecast fraud trends to fortify risk management policie.

By End-user, Insurance Firms Lead Market and Government Agencies Fastest Growth

In the Insurance Analytics Market, insurance firms lead the end-user segment as they adopt advanced analytics to enhance claims management, improve underwriting accuracy, and deliver personalized policies that drive customer retention and profitability. These strategies depend heavily on data, ensuring that the organization is efficient and cost-effective in an evolving and fast-paced market. Conversely, government agencies constitute the most rapidly expanding segment that is using analytics in order to enhance regulatory oversight, compliance, and fraud prevention monitoring in the insurance sector. As public safety, policy transparency, and risk management take center stage, agencies are investing in analytics platforms to better inform governance. They are a glimpse into the two-pronged push of commercial innovation and regulatory fanfare, dividing the end-users into easy to predict buckets.

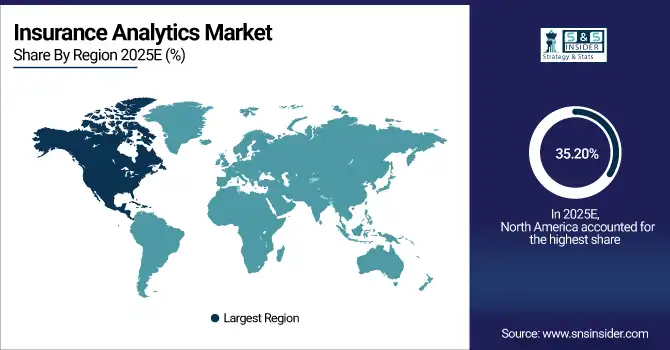

Insurance Analytics Market Regional Analysis:

North America Insurance Analytics Market Insights:

The Insurance Analytics Market in North America held the largest share 35.20% in 2025, supported by the strong presence of leading insurance providers, advanced technology adoption, and a mature regulatory framework that encourages transparency and risk management. The region benefits from widespread integration of AI, machine learning, and big data, enabling insurers to improve fraud detection, optimize claims processes, and deliver personalized policy offerings. Rising healthcare costs, growing instances of fraudulent claims, and the demand for predictive risk assessment further accelerate adoption across the U.S. and Canada. Additionally, the robust ecosystem of analytics vendors and consultancy services fosters innovation and scalability. Together, these factors solidify North America’s position as the leading market for insurance analytics solutions.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. Dominates Insurance Analytics Market with Advanced Technological Adoption

The U.S. dominates the Insurance Analytics Market with advanced technological adoption, leveraging AI, big data, and cloud solutions to enhance claims management, fraud detection, customer engagement, and overall insurance decision-making efficiency.

Asia-Pacific Insurance Analytics Market Insights

In 2025, Asia-Pacific is the fastest-growing region in the Insurance Analytics Market, projected to expand at a CAGR of 16.36%, driven by rapid digital transformation, increasing insurance penetration, and growing awareness of data-driven decision-making among insurers. Countries like China, India, Japan, and Australia are investing heavily in AI, machine learning, and predictive analytics to improve underwriting accuracy, streamline claims processing, and enhance customer engagement. The region’s expanding middle-class population and rising demand for personalized insurance products are further fueling adoption. Additionally, government initiatives promoting financial inclusion and regulatory support for advanced analytics solutions encourage insurers to modernize operations. With increasing cloud adoption and the entry of global analytics vendors, Asia-Pacific presents significant growth opportunities for the insurance analytics ecosystem over the coming years.

China and India Propel Rapid Growth in Insurance Analytics Market

China and India are driving rapid growth in the Insurance Analytics Market through increasing digitalization, expanding insurance penetration, adoption of AI-driven solutions, and growing demand for personalized policies, creating significant opportunities for analytics deployment across claims, risk, and customer engagement.

Europe Insurance Analytics Market Insights

Europe Insurance Analytics market growth is already on the rise due to emerging technologies, compliance with regulations, and growing adoption of AI & big data solutions by insurers. The U.K., Germany, and France are spending on analytics to improve claims management, fraud management, underwriting, and customer engagement. The shift towards stringent regulatory requirements such as GDPR is forcing insurers to embrace sophisticated data governance and reporting tools and digital transformation initiatives across the region are aiding the deployment of a cloud-based analytics platform. In addition, increasing competition among insurers is driving companies to use predictive analytics to offer customized products expedite operational processes drive efficiency and enhance risk management.

Germany and U.K. Lead Insurance Analytics Market Expansion Across Europe

Germany and the U.K. lead Insurance Analytics Market growth in Europe, driven by advanced technology adoption, regulatory compliance, AI-powered solutions, and increased focus on fraud detection, claims optimization, and personalized insurance offerings across both mature and emerging insurance sectors.

Latin America (LATAM) and Middle East & Africa (MEA) Insurance Analytics Market Insights

The Latin America (LATAM) and Middle East & Africa (MEA) insurance analytics market is steadily growing due to the growing penetration of insurance along with digital transformation initiatives and growing demand for data-driven decision-making among insurers in the region. Across LATAM, countries like Brazil and Mexico are seeing increased investment in analytics solutions designed to accelerate claims processes, enable better risk assessment, and enhance customer engagement, with regulatory reforms being implemented to promote greater transparency and efficiency as consumers take an even bigger role in their financial lives. Likewise, MEA markets are focusing towards the investment in AI and predictive analytics in order to improve underwriting accuracy, fraud detection and optimizing operational process in UAE, Saudi Arabia and South Africa.

Insurance Analytics Market Competitive Landscape

Microsoft leverages AI, cloud computing, and data analytics to transform insurance operations. Its solutions provide insurers with predictive insights, streamlined claims management, and enhanced policyholder engagement. By combining advanced analytics with Microsoft’s collaboration tools, insurers can improve decision-making, operational efficiency, and customer experiences, driving innovation and competitiveness in the Insurance Analytics Market.

-

May 9, 2025, Microsoft highlighted advancements in AI for healthcare, showcasing how AI is transforming healthcare with insights from Microsoft leaders on AI advancements, success stories, and future developments.

Oracle offers comprehensive cloud-based analytics and risk management solutions for insurers. Its Insurance Analytics platforms enable real-time data processing, predictive modeling, and advanced reporting, supporting fraud detection, claims optimization, and regulatory compliance. By integrating AI and machine learning, Oracle helps insurers improve underwriting accuracy, operational efficiency, and customer-centric decision-making.

-

In May 2025, Oracle's EPM Cloud update introduced new capabilities across Planning, Financial Close, Reporting, AI, and more, enhancing the platform's functionalities.

OpenText provides AI-powered document and data management solutions tailored for the insurance sector. Its analytics platforms streamline claims processing, policy administration, and regulatory compliance by enabling insurers to extract actionable insights from unstructured data. OpenText’s solutions help enhance operational efficiency, reduce errors, and improve customer engagement across insurance workflows.

-

In May 2025, OpenText launched a new AI-powered document processing solution tailored for the insurance industry, streamlining claims management and policy administration processes.

Insurance Analytics Market Key Players:

Some of the Insurance Analytics Market Companies are:

-

IBM Corporation

-

Microsoft Corporation

-

Oracle Corporation

-

SAP SE

-

SAS Institute Inc.

-

Salesforce

-

Guidewire Software Inc.

-

LexisNexis Risk Solutions (RELX plc)

-

Verisk Analytics, Inc.

-

Accenture plc

-

MicroStrategy Incorporated

-

OpenText Corporation

-

Sapiens International Corporation N.V.

-

Hexaware Technologies Limited

-

Applied Systems Inc.

-

Vertafore, Inc.

-

EXLService Holdings, Inc.

-

Wipro Limited

-

Moody's Analytics, Inc.

-

Pegasystems Inc.

| Report Attributes | Details |

| Market Size in 2025 | USD 17.60 Billion |

| Market Size by 2033 | USD 54.47 Billion |

| CAGR | CAGR of 15.19% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Deployment (Cloud, On-premise) • By Enterprise Type (Large Enterprises, Small and Medium Enterprises (SMEs)) • By Application (Claims Process Optimization, Fraud Detection & Risk Assessment, Customer Engagement & Retention, Others) • By End-user (Insurance Firms, Government Agencies, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | IBM Corporation, Microsoft Corporation, Oracle Corporation, SAP SE, SAS Institute Inc., Salesforce (Tableau Software), Guidewire Software Inc., LexisNexis Risk Solutions (RELX plc), Verisk Analytics, Inc., Accenture plc, MicroStrategy Incorporated, OpenText Corporation, Sapiens International Corporation N.V., Hexaware Technologies Limited, Applied Systems Inc., Vertafore, Inc., EXLService Holdings, Inc., Wipro Limited, Moody's Analytics, Inc., Pegasystems Inc., and Others. |