Interactive Tables Market Size:

Get More Information on Interactive Tables Market - Request Sample Report

The Interactive Tables Market was valued at USD 1.43 Billion in 2023 and is expected to reach USD 3.01 Billion by 2032 and grow at a CAGR of 8.66% over the forecast period 2024-2032.

The interactive tables market is growing due to increasing interest in learning digital solutions within educational institutions. Other companies and organizations operating in all industries, including retail, hospitality, and transportation, among many others, are using interactive tables to enhance customer experience and streamline their operations. For example, in the retail industry, an interactive table can be used as a product demonstration tool and an assistive shopping guide. Interactive table increases consumer interaction by about 60%, a figure that should not be taken lightly. Also, 62% of customers will be forced to make impulse buys if caught by an interactive display. Regarding the elicitation of positive emotional responses and establishing the brand in memory, interactive display is eight times more efficient than static content. In addition, 40% of respondents said the placement of digital signage at the point of sale promotes the purchase. In hospitality, these tables act as digital menus and entertainment devices. There is also the increased demand, which surges through the rising numbers of trade shows and exhibitions where these tables are now widely used for interactive product displays and presentations.

Advances in touchscreen technology have also increased usability and affordability, coupled with better integration of software across sectors, all contributing to wider take-up. Self-service interactive tables enable diners to browse menus, place orders, and pay independently at their own pace. This setup allows restaurants to reallocate staff to more critical tasks, while also boosting revenue. Self-service kiosks can be programmed for automatic upselling, which can lead to sales increases of up to 38%. Additionally, 91% of consumers report that digital menus have influenced their purchasing decisions, highlighting their positive impact on sales. Another trend is towards smart control rooms, especially in environments dealing with security and surveillance, where interactive tables help to manage real-time data and aid better decision-making processes. More generally, growth in the market is through the expansion of digitization into areas of business and the desire for dynamic, interactive solutions.

MARKET DYNAMICS

KEY DRIVERS:

-

Transforming Customer Experience with Interactive Tables in Entertainment Gaming and Dining Venues for Engagement

The emergence of the Interactive Tables market is the growing emphasis on improving customer experience across a variety of markets, particularly entertainment and gaming. Interactive tables provide unique, immersive experiences that attract consumers by offering interactive games, quizzes, as well other multimedia content. This is an exciting, hands-on experience in the environment with gaming zones, restaurants, and family entertainment centers. About 20% of customers would like to use modern table technology instead of a waiter as it has numerous advantages that give the fullest control over their dining and allow comfortable satisfaction of their every requirement. Moreover, by enabling customers to place orders directly from the table, ordering and settling the bill time decreases sales profitability increase over 10.70%, since customers are naturally in a hurry to place orders and finish their food. Being widely used by entertainment sites trying to carve out some identity for themselves and attract more customers, interactive tables have been used across the board; featuring a broad range of user interface and content that can be customized to appeal to different themes or needs. With businesses now focusing on gaining customer retention through more personalized experiences, the demand for interactive tables is the key tool that will continue increasing engagement levels.

-

Innovative Touch and Gesture Recognition Technologies Driving Growth in Interactive Tables for Various Applications

The developing technology of touch and gesture recognition has continued to spur growth in the market. Multitouch and gesture-based systems have further advanced the development of interactive tables and made them more intuitive, allowing for more precise manipulation of data, images, and digital content. Advancements in hardware and software have also made them far more reliable and responsive, which enhances the performance of such interactive systems in high-demand environments like corporate meeting rooms, control centers, and industrial applications. Future research and developments on touchless interactions, augmented reality, and haptic feedback technologies should extend the capabilities of interactive tables to new applications and subsequently fuel market demand during the coming years. This is a continuous technology innovation, and thus a prime motivator for businesses in search of an efficient, easy-to-use solution.

RESTRAIN:

-

Challenges of High Costs and Training Needs Hindering Adoption of Interactive Tables in Various Sectors

The high price of advanced interactive table systems is one of the major limitations in the interactive tables market mainly for small businesses and educational institutions which have less budget. For example, schools may not be ready to afford multiple units needed in various classrooms, thereby limiting the huge adoption rate. An additional regular maintenance cost, cost of software updating, and possible technical faults may also deter organizations from investing in such a system. Another challenge stems from the lack of users' familiarity with the time it takes to train them to work with this type of device. This may be a major problem when sectoral requirements, such as healthcare or industrial control rooms, where interactive tables could help optimize their businesses, create shockingly steep learning curves toward working with this technology. For instance, hospital workers would require extensive training to work efficiently through patient data on an interactive table which is likely to delay adoption considerably in the short term. The benefits of interactive tables are poorly achieved without adequate training. This is because integration into workflow processes might be hindered.

KEY MARKET SEGMENTS

BY TECHNOLOGY

The capacitive segment dominated the market share of 42% in 2023. Its advantage across most industries requires responsiveness and multi-touch capabilities. Capacitive technology, which responds to the touch of human skin or a conductive object, features better sensitivity in touch, accuracy, and a higher response speed than resistive alternatives. This gives it the preference in sectors that have a seamless contact interplay with customers such as education, retail, and hospitality. For example, on interactive educational tables in school environments, capacitive offers a more intuitive and engaging interface for student learning, promoting collaborative learning and multitasking capabilities.

The LED segment will witness the fastest growth in the forecast period 2024-2032 due to its energy efficiency, longevity, and enhanced visual quality. LED displays have images that are more vivid with deeper contrast and are also capable of supporting high-vibrancy dynamic content, making them highly sought after for interactive tables used in retail, exhibitions, and entertainment. Such as, retailers are using LED-based interactive tables to stun and grab customers with high-performance conversion rates of product presentations. Also, the rising industrial focus on sustainability and energy-efficient solutions is well in alignment with the ever-increasing demand for LED technology.

BY SCREEN SIZE

The 32 to 65 inches dominated the market share of 58.6% in 2023 and is expected to show the fastest CAGR during 2024-2032 since it is relevant and suitable for multiple applications across varied industries. These tables are well suited for being large enough to provide some interesting display for group interaction purposes yet small enough to fit comfortably anywhere-from classrooms, corporate boardrooms, retail establishments, or hospitality environments. This means that educational institutions, support collaborative learning without overcrowding the space, and in retail and corporate settings, it effectively promotes the products and presents ideas while blending functionality with aesthetic appeal. For education, the 42-inch SMART Table 442i allows learning to take place for many users as well as for the educational applications offered. In retail, the Samsung Flip at 55 inches provides easier exploration and tailoring of products according to customer preferences. In the corporate setting, the Microsoft Surface Hub 2S at 50 inches allows real-time collaboration among participants as Microsoft has integrated applications available for use in corporate meetings. Hospitality is one application wherein the ELO Touch Solutions 32-inch Interactive Table can be used to let a guest look at menus and may even order from it. On the other point, the Ideum Platform 55 is utilized in museums for visitors to play around with digital content as a way of enriching their stay.

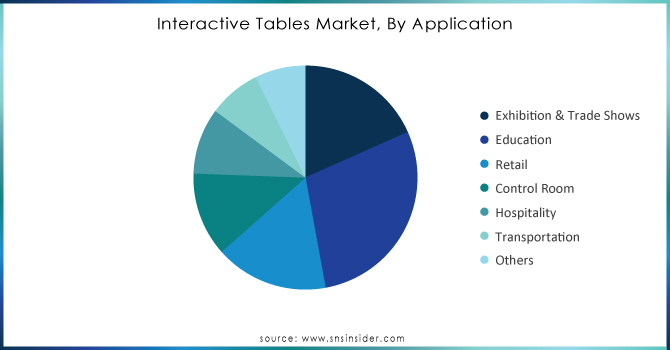

BY APPLICATION

The education segment dominated the market share of 28.7% in 2023, driven by the increasing need to integrate interactive technologies into educational institutions. Interactive tables are now an essential tool in modern classrooms to promote collaborative learning, engagement, and improved interactivity between students and educators. The usage of interactive tables and, in general, digital learning is greatly dependent upon technological advancements, which brought along the shift toward distant or blended learning environments in schools and universities. These tables are useful for performing hands-on activities, interacting with digital content, and group collaborations, presenting an indispensable component in the modern landscape of learning.

The retail segment is likely to expand with the fastest CAGR during 2024-2032. This is primarily because more displays are used to enhance customer experience in interactive displays. Retailers use these interactive tables to develop engaging and interactive shopping experiences such as virtual product demonstrations, personal shopping, and interactive catalogs. As the retail industry welcomes digital transformation, these tables introduce innovative in-store ways to attract and retain customers by providing them with interactivity and dynamic content. The further value to this consumer behavior tracking and preferences ability of the table further propels its value in the retail space, leading to really huge demand and growth in that segment.

Need Any Customization Research On Interactive Tables Market - Inquiry Now

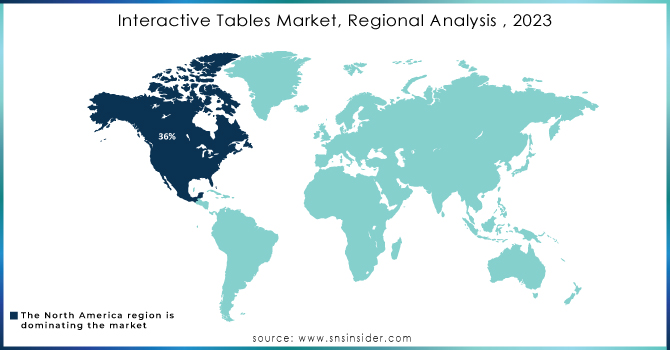

REGIONAL ANALYSIS

North America dominated the market share of 36% in the year 2023, owing to various factors such as advanced technological infrastructure and high interactive technology adoption levels, with significant investments in education and business sectors. Many educational institutions and corporate entities are present in the region, seeking innovative solutions that can further improve learning processes and enhance operations. For instance, more than 99% of colleges and universities in the United States have installed interactive tables in their classrooms. Interactive tables are also deployed in conference rooms of North American companies for PowerPoint presentations and brainstorming sessions. Both of these have made a great contribution to cornering a major part of the market.

The Asia-Pacific region is going to witness the highest growth rate from 2024-2032. These consist of a multitude of variables that are fast working towards increasing speed. Urbanization is happening at a breakneck pace. Disposable income is on the rise while digitalization ventures are catapulting sectors into advancing, all of which contribute to the rising implementation of educational technology in nations like China and India. Demand for Interactive Tables Skyrockets Schools and colleges are becoming increasingly interested in interactive tables, largely due to a demand for collaborative environments of learning in schools located within the city limits to ensure enhanced participation from students. The retail sector in Asia Pacific is embracing interactive solutions that enhance customer experience. Innovative retailers use digital catalogs and product displays at interactive tables to engage a lot of consumers. It can be expected that as the region continues its investment in the technological and digital aspects, the interactive table will pick up rapidly over the years compared with other markets.

Key players

Some of the major players in the Interactive Tables Market are:

-

Samsung Electronics (Samsung Flip, Samsung Smart Signage)

-

LG Electronics (LG Interactive Whiteboard, LG Touch Table)

-

Microsoft (Surface Hub, Surface Pro)

-

Sharp Corporation (Sharp Aquos Board, Sharp Touch Screen Table)

-

Elo Touch Solutions (Elo Touchscreen Table, Elo Interactive Kiosk)

-

ViewSonic (ViewSonic Interactive Flat Panel, ViewSonic Smart Table)

-

Zytech (Zytech Interactive Display Table, Zytech Touchscreen Table)

-

BenQ (BenQ Interactive Flat Panel, BenQ Smart Table)

-

InFocus Corporation (InFocus Mondopad, InFocus Interactive Table)

-

SMART Technologies (SMART Table, SMART Board)

-

Vivo (Vivo Interactive Touch Table, Vivo Smart Table)

-

Touchsource (Touchsource Interactive Table, Touchsource Touch Screen)

-

Ideum (Ideum Pro Table, Ideum Touch Table)

-

Perch (Perch Interactive Table, Perch Smart Display)

-

Mimio (Mimio Interactive Table, Mimio Teach)

-

WizKids (WizKids Interactive Table, WizKids Touch Table)

-

Clever Touch (Clever Touch Interactive Table, Clever Touch Plus)

-

Avocor (Avocor Interactive Display, Avocor Collaboration Table)

-

Rugged Tablets (Rugged Touch Table, Rugged Interactive Table)

-

ViewSonic (ViewSonic Interactive Table, ViewSonic Touch Panel)

Some of the Raw Material Suppliers for Interactive Tables Companies:

-

3M

-

Corning

-

DuPont

-

Samsung SDI

-

LG Chem

-

Nitto Denko

-

Avery Dennison

-

Henkel

-

BASF

-

Taiwan Semiconductor Manufacturing Company (TSMC)

RECENT TRENDS

-

In September 2024, Ideum introduced the Tasting Table, a touch-table product bundled with Wine Experience software, designed to create interactive and engaging wine-tasting events for wineries and restaurants.

-

In September 2024, GruvCard introduced an Interactive Trade Show Booth Sign System that features dynamic digital signage and touch-screen technology, enhancing attendee engagement and facilitating real-time product interaction at trade shows.

-

In October 2024, AGS unveiled its latest table innovation, Bonus Spin Xtreme for poker rooms, along with an exciting new lineup of slot games at the Oklahoma Indian Gaming Association (OIGA) 2024 conference.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.43 Billion |

| Market Size by 2032 | USD 3.01 Billion |

| CAGR | CAGR of 8.66 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (LCD, LED, Capacitive, Others) • By Screen Size (32-65 inch, 65 inch & above) • By Application (Exhibition & Trade Shows, Education, Retail, Control Room, Hospitality, Transportation, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Samsung Electronics, LG Electronics, Microsoft, Sharp Corporation, Elo Touch Solutions, ViewSonic, Zytech, BenQ, InFocus Corporation, SMART Technologies, Vivo, Touchsource, Ideum, Perch, Mimio, WizKids, Clever Touch, Avocor, Rugged Tablets |

| Key Drivers | • Transforming Customer Experience with Interactive Tables in Entertainment Gaming and Dining Venues for Engagement • Innovative Touch and Gesture Recognition Technologies Driving Growth in Interactive Tables for Various Applications |

| Restraints | • Challenges of High Costs and Training Needs Hindering Adoption of Interactive Tables in Various Sectors |