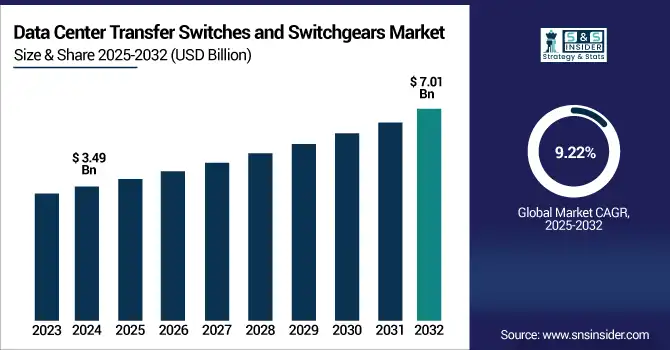

Data Center Transfer Switches and Switchgears Market Size Analysis:

The Data Center Transfer Switches and Switchgears Market Size was valued at USD 3.49 billion in 2024 and is expected to reach USD 7.01 billion by 2032 and grow at a CAGR of 9.22% over the forecast period 2025-2032.

To Get more information on Data Center Transfer Switches and Switchgears Market - Request Free Sample Report

The global Data Center Transfer Switches and Switchgears Market is witnessing strong growth driven by increasing reliance on digital infrastructure as a result of the streaming flow of data. With businesses embracing the cloud, AI, IoT, and automation, data centers are growing bigger and becoming more complex. This growth also demands sophisticated, industrial strength electrical systems that don’t back down and keep going day after day. There is a growing requirement for resilient and scalable power distribution solutions in hyperscale and enterprise data centers. Regional trends such as emerging competitive strategies and requirements for modular, compact switchgear & transfer switch will also influence market dynamics.

The U.S. Data Center Transfer Switches and Switchgears Market size was USD 0.86 billion in 2024 and is expected to reach USD 1.54 billion by 2032, growing at a CAGR of 7.58% over the forecast period of 2025–2032.

The US data center transfer switches and switchgears market growth is driven by due to surge in investments in hyperscale and colocation data centers, rising dependency on UPS and surge in demand for advanced electrical infrastructure to power edge computing and AI workloads. Moreover, the focus of regulation on power reliability and sustainability drives hear the deployment of new-expensive equipment in switchgear and transfer switch initiatives for the U.S.-based data centers.

According to research, nearly 90% of Tier III and IV U.S. data centers have upgraded or are upgrading their UPS systems for higher energy efficiency and load flexibility.

Data Center Transfer Switches and Switchgears Market Dynamics

Key Drivers:

-

Increasing power demand and energy reliability needs in mission-critical data center environments

Continual power is crucial to data centers, which is one of the reasons facility managers are so concerned about having redundant systems in place. With the increasing speed of digital transformation, as organizations move their computing services off premise to cloud and edge computing services, load growth remains substantial. Transfer switches and switchgears are critical to providing an uninterrupted failover and power distribution. They require less down-time during outages or maintenance. The increasing occurrence of severe climate and grid instability drive the need for dependable backup systems, driving investments in modern, intelligent switchgear and automatic transfer systems to ensure resilient critical infrastructure, and operations.

Restrain:

-

Lack of standardization and interoperability challenges across electrical ecosystems

The lack of global switchgear and transfer switch standards results in mating and mounting compatibility challenges during installation and during connecting switchgear and transfer switches. Data center environments can be complex, and can comprise electrical components from various vendors, which to some extent inhibits successful integration of these components. Differences in voltage, frequency, and socket type between countries make global rollouts a nightmare. These differences result in delays for acquisition, engineering customisation and safety certification. The resulting waste and exposures may constrain growth or replacement activities, particularly in mission-critical environments where reliability and compliance cannot be sacrificed.

Opportunities:

-

Integration of smart monitoring and predictive maintenance features in next-gen equipment

The convergence of IoT-enabled sensors, AI and predictive analytics for switchgear and transfer switch systems provides disruptive value. Real-time tracking, fault identification, and predictive maintenance prolong the life of equipment, reduce loss of unplanned downtime, and provide for an efficient use of energy. While demand remains for only the latest and greatest when it comes to intelligent data center infrastructure, vendors with smart systems such as those that are remotely manageable are best-positioned to take it to market. These value-add features enhance ROI, minimise OPEX and contribute towards sustainability objectives, and offer significant scope for innovation and differentiation in a competitive market.

According to research, Predictive maintenance reduces equipment downtime by 30–50% and extends asset life by 20–40%.

Challenges:

-

Skilled workforce shortages hamper effective deployment and system maintenance

The installation and maintenance of transfer switches and switchgear systems that required specific skills in power engineering, automation, and safety procedures. The skills shortage in these areas is most profound in emerging markets and scaling hyper-scale datacentres. When you have no skilled technicians, having to repeatedly re-configure settings also means a delayed time to meet commissioning, while the system may not always be running at its best. Staffing’s shortage also slows preventive maintenance and problem troubleshooting, increasing risk of operation. Industry needs to spend on workforce development, certification programs, and digital training to ever get around this ongoing and increasing operational roadblock.

Data Center Transfer Switches and Switchgears Market Segment Analysis:

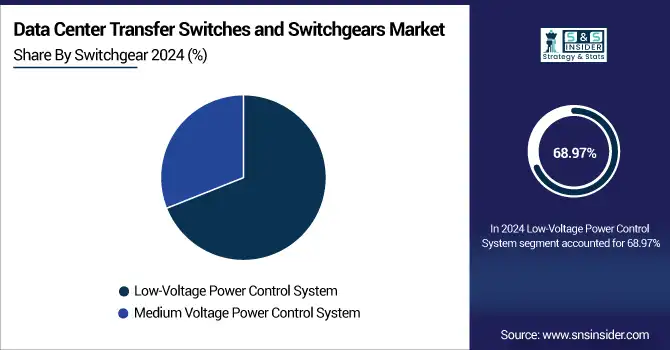

By Switchgear

Low-Voltage Power Control System segment dominated the data center transfer switches and switchgears market in 2024 with a 68.97% revenue share as it is widely used in modular, colocation and enterprise data centers. It Also have the advantage of being able to be used with low-to-medium power requirements and its cost- effective scalability, making it an attractive option. Easier integration to the intelligence automation and energy monitoring are also the benefits of these systems. Data center transfer switches and switchgears companies like ABB Ltd., which has capabilities in low-voltage, mission-critical type solutions. Their small size and energy density contribute to their preeminence, especially when retrofitting existing facilities.

Medium Voltage Power Control System segment is projected to witness the fastest CAGR of 10.41% from 2025–2032, because of the increasing use of hyperscale data centers which demand higher voltage tolerance. The latter are necessary for the efficient handling of high capacities over long distribution lines. Eaton Corporation, a provider of innovative medium-voltage switchgear solutions, is currently participating in the expansion of the segment. It is more demanding in the buildings that need to work with renewable energy systems and power plant as tier III and IV, so it also needs the medium-voltage systems to be more intelligent and reliable.

By Application

Colocation Data Centers segment dominated the highest data center transfer switches and switchgears market share of 39.00% in 2024, due to the increasing practices of enterprises to outsource for efficient, cheap and energy-conscious infrastructure. Uptime and redundancy-centric, these facilities push the requirement for advanced power management systems. Vertiv Group Corp., a leading provider of power, cooling and IT infrastructure to colocation companies, continues to provide modular electrical systems. Increasing trend of digitalization in industries such as finance, retail, and healthcare is bolstering growth of the global colocation market.

Hyperscale Data Centers segment is anticipated to register the fastest CAGR of 10.46% from 2025–2032 due to the surging investments from tech giants in AI, big data, and cloud infrastructure. Such data centers need to be supported by high-power, smart systems to ensure they continue to function. For hyperscale scalability and redundancy, Schneider Electric has custom-built switchgear and power distribution units. Also, the rise in demand for advanced and fault tolerant switchgear systems and increased in the adoption of smart grid integration and renewable generation will continue to drive the global market for hyperscale design.

By Transfer Switch

Automatic Transfer Switches segment dominated data center transfer switches and switchgears market largest revenue share of 41.17% in 2024, because they are an essential part of a system for seamless switching between a utility and a backup power source. These switches will help you maintain your data center's uptime requirements. Generac manufactures a strong lineup of commercial data center automatic transfer switches and is a major contributor to the segment’s growth. Smart functionality offering remote and status monitoring elevates the segment towards high-availability applications as well.

Service Entrance Transfer Switches segment is set to grow at the fastest CAGR of 10.25% from 2025–2032, due to increasing requirement for fault isolation and main-entry security in new data center constructions. These switches provide code-compliant electrical safety and quickly permit power systems to switch from utility to generator power. ASCO Power Technologies, a name synonymous with service entrance solutions, now meets the growing needs of hyperscale and regional data centers. Its attention to innovation and safety also help to drive the expanding deployment of those switches in newer digital hubs.

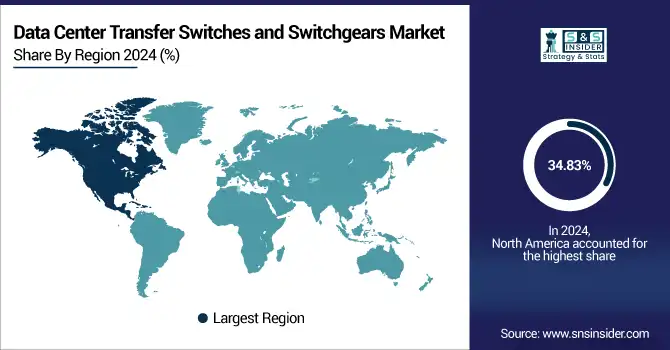

Data Center Transfer Switches and Switchgears Market Regional Outlook:

North America dominated the Data Center Transfer Switches and Switchgears Market with the highest revenue share of 34.83% in 2024 owing to its saturation of hyperscale data centers, tough regulations and heavy investment in digital transformation. The area boasts mature IT environment, early embracing of automation, and extensive roll out of cloud infrastructure. It also increases the demand for advanced switchgear and transfer systems in the United States and Canada Are there also increased requirements toward reliability of high energy and a move to sustainable power systems.

-

The U.S. dominates the North American market due to its extensive hyperscale data center presence, adoption of cloud computing at the early stage, and numerous regulations. Heavy investments in digital infrastructure and power continuity further establish its leadership in switchgear and transfer technology.

Asia Pacific is projected to grow at the fastest CAGR of 10.37% from 2025–2032, driven by urbanization, government digitization projects and a burgeoning cloud services industry. With few exceptions, countries including China, India and the countries in South-East Asia are experiencing significant investment in data centers by both international and local companies. Read more: Growing 5G deployment, IoT adoption, data sovereignty to fuel demand for robust power infrastructure in APAC: Analysts Consequently, efficient, scalable and intelligent transfer switch and switchgear solutions are increasingly sought after through the region.

-

Asia Pacific region is led by China owing to the growing rates of internet usage, construction of immense data centers, and digital initiatives supported by government. Its leadership is under pinned by a formidable home manufacturing and aggressive inculcation of cloud and AI infrastructure within sectors.

The data center transfer switches and switchgears market in Europe is growing on account of green data centers, energy efficiency and data sovereignty rules considerations. And with companies in Germany, the Netherlands and UK paving the way in moving toward more advanced, resilient power solutions to underpin their colocation and enterprise data infrastructure, particularly in financial services, telecom and research and development sectors.

-

Germany dominates the European market because of its robust data center market, especially in Frankfurt, which is fueled by high demand for cloud services, stringent data laws, as well as energy-efficient infrastructure. Demand for advanced switchgear and transfer solutions is also driven by government backing and large tech investments.

The Middle East & Africa and Latin America are emerging markets for data center transfer switches and switchgears. Leading in that region is the UAE, which is the most active in smart city projects and cloud expansion in the Middle East. In Latin America, Brazil and Mexico are growing due to rising investment in digital infrastructure and rising colocation datacenter deployments.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The Data Center Transfer Switches and Switchgears Companies are Schneider Electric, Eaton Corporation, ABB Ltd., Siemens AG, Vertiv, Caterpillar Inc., Cummins Inc., Delta Electronics, ASCO Power Technologies, Legrand and others.

Recent Development:

-

In March 2023, Cummins launched the PowerCommand B‑Series, a bypass‑isolation transfer switch line with high‑endurance tech and UL1008 compliance, designed for mission‑critical, high-load data centers

-

In March 2025, ASCO technicians reported successful deployment of multiple 7000 Series closed‑transition ATS units on a campus project, indicating continued trust in ASCO's modular ATS systems.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 3.49 Billion |

| Market Size by 2032 | USD 7.01 Billion |

| CAGR | CAGR of 9.22% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Switchgear (Low-Voltage Power Control System, Medium Voltage Power Control System) • By Application (Colocation Data Centers, Hyperscale Data Centers, Edge Data Centers, Others) • By Transfer Switch (Static Transfer Switches, Automatic Transfer Switches, Bypass Isolation Transfer Switches, Service Entrance Transfer Switches) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia,Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Schneider Electric, Eaton Corporation, ABB Ltd., Siemens AG, Vertiv, Caterpillar Inc., Cummins Inc., Delta Electronics, ASCO Power Technologies, Legrand |