Intraoral Cameras Market Report Scope & Overview:

Get More Information on Intraoral Cameras Market - Request Sample Report

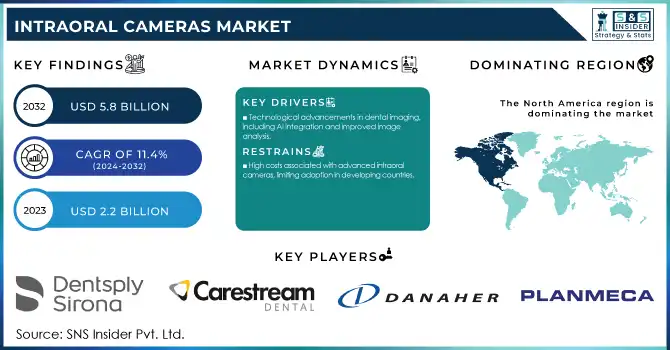

The Intraoral Cameras Market size was valued at USD 2.2 billion in 2023 and is expected to reach USD 5.8 billion by 2032 and grow at a CAGR of 11.4% over the forecast period 2024-2032.

The demand for intraoral cameras is rising drastically across the globe, which is primarily fueled by improving awareness regarding oral health, advancements in imaging technologies in dentistry, and a surge in the incidence of dental disorders. Oral diseases are regarded to be the most widespread diseases in the world, affecting nearly 3.5 billion people worldwide with untreated dental caries the most prevalent condition according to the World Health Organization (WHO). According to the CDC, over 1 in 4 (26%) adults in the United States have untreated tooth decay. As these statistics highlight, this could cause an increasing demand for complicated dental diagnostic tools like intraoral cameras. Government programs for oral healthcare awareness and the effects of digital technologies in dentistry also propel the demand in the market. An excellent example of this through public health is the U.S. Department of Health and Human Services Healthy People 2030 initiative, which seeks to address oral health through access to dental care and reducing barriers to dental care provision by promoting preventive services. The European Union's Horizon Europe program also supports research and innovation in dental technologies.

The importance of oral health and the intraoral camera market continues to be emphasized by government statistics and initiatives. In India, the National Oral Health Programme (NOHP) was launched to provide integrated, comprehensive oral health care in existing healthcare facilities. Considering the high treatment burden of oro-dental diseases in India, wherein only about 27.4% of the population receives professional dental care, the proposed program seeks to provide relief from the agonies of oro-dental diseases as more than 72.6% of the population remains deprived of oral health care facilities. According to the National Health Service (NHS) in the United Kingdom, there are roughly 10 million people waiting for routine dental treatment. This backlog in dental care services underscores the need for efficient diagnostic tools like intraoral cameras to streamline dental procedures and reduce waiting times.

The U.S. HRSA (Health Resources and Services Administration) offers grants designed to support the expansion of dental services in underserved areas, which may lead to the adoption of advanced dental technologies such as intraoral cameras. In addition, NIDCR of the U.S. has also funded several research projects on intraoral cameras through its grant funding program. The Healthy China 2030 plan issued by the government set goals for oral health at the national level, which may spur the demand for high-end dental technology in the world's most populous country. Similarly, in Japan, the government has been promoting preventive dental care through its national health insurance system, potentially creating opportunities for the intraoral camera market.

Market Dynamics

Drivers

-

Increasing prevalence of dental disorders and growing awareness related to oral health.

-

Technological advancements in dental imaging, including AI integration and improved image analysis.

-

Growing adoption of teledentistry, especially post-COVID-19 pandemic and Integration with digital dentistry and electronic health records (EHR) systems.

-

Increasing focus on patient-centered care models and enhanced diagnostic precision

The intraoral camera market is primarily driven by the increasing prevalence of dental disorders and growing awareness about oral health. Oral diseases impact approximately 3.5 billion people globally, making untreated dental caries the most prevalent condition according to the World Health Organization (WHO). In the United States, nearly 3 percent of children 6 to 11 years old had untreated decay in one or more permanent teeth, and about 10 percent of adolescents 12 to 19 years old were affected. The overall prevalence of dental caries was found to be 60% in participants when a study was conducted in India in 2024 and it was revealed that girls had a slightly higher prevalence than boys. A cross-sectional study done in Tamil Nadu-India reported that the overall prevalence of dental caries was 64.8% in both rural (73.39%) and urban (56.59%) areas. The high prevalence of dental disorders along with the growing awareness regarding oral health is increasing the adoption of intraoral cameras as advanced diagnostics tools. These devices allow for early diagnosis and enhanced communication between the patient and the dentist, ensuring better oral health outcomes, and the growing need for preventive dental care.

Restraints:

-

High costs associated with advanced intraoral cameras, limiting adoption in developing countries.

-

Shortage of skilled dental professionals to operate sophisticated imaging devices.

-

Technical challenges in integrating intraoral camera images with existing dental systems.

The lack of skilled dental professionals who know how to operate complex imaging devices is a key restraint in the market for intraoral cameras. In less developed parts of the world including countryside places, this is a major challenge. The recent data from the World Health Organization (WHO) states that shortage of dentists worldwide, with a ratio as low as 1:150,000 in some African countries compared to 1:2,000 in most industrialized nations.

Today, Intraoral cameras are very complex as they are often coupled to AI and sophisticated imaging software which requires specialized training. Older dentists or those in geographical areas with limited access to continuing education may be slower to incorporate these new technologies into their practices. Such resistance is often due to unfamiliarity with digital systems or apprehension of the learning curve required for new technologies. Furthermore, dental schools in many countries are struggling to keep pace with rapidly evolving dental technologies, resulting in newly graduated dentists lacking the necessary skills to operate advanced intraoral cameras effectively.

Intraoral Cameras Market Segment analysis

By Product

The intraoral wand segment held the majority share of 70% of revenue in 2023. The reasons behind this dominance include better imaging resolution, ease of usage, and flexibility offered by intraoral wands. Over 90 percent of dental practices in the U.S. already use some form of digital imaging technologies, including intraoral cameras, according to the American Dental Association (ADA). Thanks to its high-definition capturing of difficult-to-reach parts of the oral cavity, the intraoral wand has become central to any accurate diagnosis and treatment strategies. The U.S. Food and Drug Administration (FDA) has approved numerous intraoral wand devices, recognizing their importance in dental care. Additionally, growing segment growth is due to governmental efforts promoting the adoption of digital dental technologies. Examples include funded research projects at the National Institute of Dental and Craniofacial Research (NIDCR) in the U.S. which have worked to develop advanced dental imaging technologies such as intraoral cameras. In its guidelines for modern dentistry, the European Dental Association (EDA) has also stressed the use of digital imaging. Compatibility with dental practice management software as well as the importance of intraoral wand in patient education have reaffirmed its position in the market.

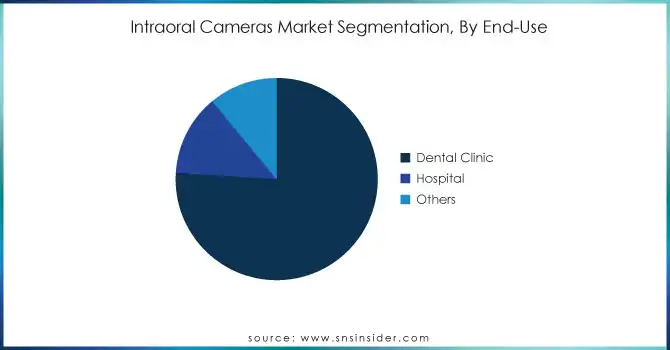

By End-use

In 2023, the dental clinics segment dominated the intraoral cameras market and held the largest revenue share of 76% in 2023. The number of dental clinics across the globe is increasing and the adoption of advanced dental technologies in these workstations is on the rise which is why the market share is majorly held by this segment. As of 2023, according to the American Dental Association (ADA), there were about 200,000 practicing dentists in the United States, and most of them around 83 percent worked in private practice. According to the Bureau of Labor Statistics, employment for dentists is expected to grow 6% from 2021 to 2031, which is faster than average for all occupations. This increase in dental professionals has also aroused a demand for advanced dental equipment such as intraoral cameras. According to the Council of European Dentists, Europe has more than 340,000 active dentists within EU member states and a general movement towards digitalization in dental practices. The expansion of clinics has also been helped by government campaigns to promote oral health and improve access to dental services. For instance, The U.S. Health Resources and Services Administration (HRSA) awards grants to assist in the expansion of dental services to areas lacking service capacity. Intraoral cameras allow effective communication between dentists and patients, treatment acceptance, and overall patient satisfaction, further driving their adoption in this end-use segment.

By Technology

The fiber optic camera segment dominated the market with the largest revenue share of 38% in 2023. The reason behind such domination is due to better image quality, durability, and reliability of the fiber optic technology over the other imaging modalities. According to data from the National Institute of Dental and Craniofacial Research (NIDCR) on trends over the past few decades, the use of fiber optic in dentistry has gradually increased since the introduction of fiber optic technology in the 1990s, More than 50 percent of U.S. dental practices had fiber optic intraoral cameras as part of their arsenal of diagnostic tools in 2010. The U.S. FDA has approved rubber optic intraoral cameras with consistent safety and efficacy in dental diagnostics. The standards of periodontal examination from the European Federation of Periodontology (EFP), have been a great stimulus to adopt fiber optic cameras as high-quality imaging is mandatory. This has made the technology especially useful in dental applications due to its power transmission of light, allowing for high-resolution imaging with more clarity at lower light levels. And, this progress has been indirectly facilitated by more government-funded research programs like the National Science Foundation (NSF) which has helped in the advancements of fiber optics as well as the dental imaging systems.

Intraoral Cameras Market Regional Insights

In 2023, the intraoral cameras market has been dominated by North America with a market share of 35%. The dominance of North America is due to advanced healthcare infrastructure in this region, and the high adoption rate of dental technologies, along with significant investment in research and development. Over 90% of dental practices in the US utilize digital imaging technologies, including intraoral cameras, as per the American Dental Association (ADA). According to the U.S. Centers for Medicare & Medicaid Services (CMS), dental services spending totaled $142.4 billion in 2020, indicating a large market for the dental technologies.

On the other hand, the Asia-Pacific region is witnessing the highest CAGR during the forecast period of 2024–2032. The rapid growth is due to growing consciousness of oral health, increasing disposable income, and government initiatives to provide better access to dental care. For example, the National Health Commission of the People's Republic of China has adopted the Healthy China 2030 plan with oral health goals throughout the country. Integrated, comprehensive oral health care is provided by the National Oral Health Program, India. Similarly, the Japanese government has been working to promote preventive dental care with its national health insurance coverage. The willingness to adopt advanced dental technologies like intraoral cameras, supported by the large population base and burgeoning middle class in the region, is driving the growth of the intraoral camera market across the Asia Pacific.

Get Customized Report as per Your Business Requirement - Enquiry Now

Recent developments

-

In February 2023, Sirona Dental Systems introduced the CEREC Omnicam, an intraoral camera featuring a laser scanner for creating digital teeth models.

-

In May 2024, Danaher partnered with Johns Hopkins University to advance diagnostic methods for mild traumatic brain injuries (TBI).

Key Players

Manufacturers/Service Providers:

-

Dentsply Sirona (CEREC Primescan, Schick USBCam4)

-

Carestream Dental (CS 1500, CS 1200)

-

Danaher Corporation (Gendex GXDP-700, Gendex GXC-700)

-

KaVo Dental (KaVo ProXam iCam, KaVo DIAGNOcam Vision Full HD)

-

Planmeca (Planmeca Somia, Planmeca Emerald S)

-

Acteon Group (Soprocare, Sopro 617)

-

MouthWatch (MouthWatch Intraoral Camera, MouthWatch Plus+ HD Intraoral Camera)

-

Digital Doc LLC (IRIS X90, PXL)

-

Air Techniques (CamX Elara Intraoral Camera, CamX Triton HD)

-

Durr Dental (VistaCam iX HD Smart, VistaCam iX)

-

Gendex Corp. (GXC-300, GXS-700)

-

Owandy Radiology (Owandy-Cam HD, OPTEO)

-

Polaroid Corporation (Polaroid P31, Polaroid P1080)

-

Flight Dental Systems (Whicam Story 3 Intraoral Camera)

-

Rolence Enterprise Inc. (ZoomCam LD-10X)

-

Shofu Dental Corporation (EyeSpecial C-II, EyeSpecial C-IV)

-

Midmark Corporation (Midmark Intraoral Digital Sensor System, Vivid Intraoral Video Camera)

-

Yoshida Dental Mfg. Co. Ltd. (Mielscope, Pict Cam)

-

ASAHI ROENTGEN INDUSTRIES Co. Ltd.

-

ProDent

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.2 Billion |

| Market Size by 2032 | USD 5.8 Billion |

| CAGR | CAGR of 11.4% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Intraoral Wand, Single Lens Reflex) • By Technology (USB Camera, Fiber Optic Camera, Wireless Cameras, Others) • By End Use (Hospital, Dental Clinic, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Dentsply Sirona, Carestream Dental, Danaher Corporation, KaVo Dental, Planmeca, Acteon Group, MouthWatch, Digital Doc LLC, Air Techniques, Durr Dental, Gendex Corp., Owandy Radiology, Polaroid Corporation, Flight Dental Systems, Rolence Enterprise Inc., Shofu Dental Corporation, Midmark Corporation, Yoshida Dental Mfg. Co. Ltd., ASAHI ROENTGEN INDUSTRIES Co. Ltd., ProDent |

| Key Drivers | • Increasing prevalence of dental disorders and growing awareness related to oral health. • Technological advancements in dental imaging, including AI integration and improved image analysis. |

| Restraints | • High costs associated with advanced intraoral cameras, limiting adoption in developing countries. • Shortage of skilled dental professionals to operate sophisticated imaging devices. |