Intumescent Coatings Market Report Scope & Overview:

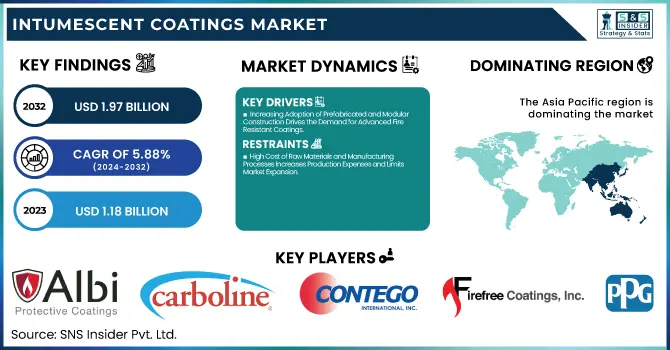

The Intumescent Coatings Market Size was valued at USD 1.18 Billion in 2023 and is expected to reach USD 1.97 Billion by 2032, growing at a CAGR of 5.88% over the forecast period of 2024-2032.

Get E-PDF Sample Report on Intumescent Coatings Market - Request Sample Report

The intumescent coatings market is evolving rapidly, driven by stringent fire safety regulations and technological advancements. Our report explores key factors shaping the industry, including investment feasibility and return on investment analysis, guiding businesses on profitability and market entry strategies. With sustainability at the forefront, the study examines the environmental and sustainability impact, highlighting eco-friendly innovations and regulatory shifts. A comprehensive supply chain and distribution channel analysis reveals sourcing efficiencies and global distribution trends. Additionally, investments and funding trends shed light on mergers, acquisitions, and R&D advancements fueling competition. A detailed raw material analysis uncovers cost structures and supply dynamics affecting production. These insights offer a strategic perspective for businesses navigating the evolving market landscape.

Market Dynamics

Drivers

-

Increasing Adoption of Prefabricated and Modular Construction Drives the Demand for Advanced Fire-Resistant Coatings

The intumescent coatings market is experiencing heightened demand due to the rising trend of prefabricated and modular construction. As developers seek faster, cost-effective, and eco-friendly construction solutions, prefabricated structures are becoming mainstream in residential, commercial, and industrial projects. However, prefabrication requires stringent fire safety measures to ensure compliance with building codes and regulations. Intumescent coatings play a crucial role in protecting prefabricated steel, wood, and composite materials from fire hazards, making them an essential component in modular construction. The increasing shift toward sustainable and energy-efficient building techniques further boosts the need for fire-resistant coatings with minimal environmental impact. Manufacturers are responding to this demand by developing innovative, fast-curing intumescent coatings tailored for off-site construction processes. This trend not only enhances fire safety but also contributes to faster project completion, making intumescent coatings a vital element in the evolving construction landscape.

Restraints

-

High Cost of Raw Materials and Manufacturing Processes Increases Production Expenses and Limits Market Expansion

The intumescent coatings market faces a significant restraint due to the high cost of raw materials and complex manufacturing processes. Essential components such as epoxy resins, flame-retardant additives, and specialized curing agents contribute to elevated production expenses. The fluctuating prices of raw materials, driven by supply chain disruptions and geopolitical uncertainties, further impact manufacturing costs. Additionally, the intricate production process of intumescent coatings requires specialized equipment and expertise, increasing operational expenditures for manufacturers. These cost constraints often lead to higher product prices, limiting adoption, particularly in cost-sensitive industries and developing economies. Small and medium-sized enterprises face challenges in competing with large-scale manufacturers, further restricting market penetration. Addressing these cost concerns through sustainable material sourcing, innovative formulations, and efficient production techniques is crucial for enhancing market accessibility and long-term growth.

Opportunities

-

Expansion of Green Building Initiatives and Sustainable Construction Creates Demand for Low-VOC and Eco-Friendly Intumescent Coatings

The increasing emphasis on green building initiatives and sustainable construction presents a significant opportunity for the intumescent coatings market. Governments and regulatory bodies worldwide are implementing strict environmental policies to reduce carbon footprints in construction materials, prompting manufacturers to develop low-VOC and eco-friendly intumescent coatings. These coatings provide fire protection while minimizing environmental impact, making them ideal for green-certified buildings. The demand for water-based and bio-based intumescent coatings is rising as architects and developers seek sustainable solutions without compromising on fire safety. Additionally, certification programs such as LEED (Leadership in Energy and Environmental Design) and BREEAM (Building Research Establishment Environmental Assessment Method) are encouraging the adoption of environmentally friendly coatings. Manufacturers investing in research and innovation to create high-performance, non-toxic intumescent coatings stand to gain a competitive advantage in this expanding segment.

Challenge

-

Balancing Fire Protection Efficiency with Aesthetic and Design Requirements in Modern Architectural Applications

A major challenge in the intumescent coatings market is balancing fire protection efficiency with aesthetic and design requirements, particularly in modern architectural applications. While these coatings provide critical fire resistance, they often result in thick layers that may alter the appearance of structural elements. Architects and designers seek coatings that maintain fire safety standards without compromising aesthetics, especially in exposed steel structures and high-end commercial buildings. The challenge lies in developing thin-film coatings that offer superior fire resistance while maintaining a sleek, smooth finish. Additionally, color-matching and surface texture considerations further complicate the adoption of traditional intumescent coatings in decorative applications. Advancements in nanotechnology and transparent fire-resistant coatings are emerging solutions, but widespread implementation requires continuous innovation and cost-effective production methods.

Segmental Analysis

By Type

Thin-film coatings dominated the intumescent coatings market in 2023 with a 54.8% market share. These coatings are widely used in the construction industry due to their lightweight nature, aesthetic appeal, and excellent fire protection properties. Thin-film intumescent coatings expand significantly when exposed to heat, forming an insulating char that protects structural elements like steel beams from extreme temperatures. Their superior adhesion and compatibility with architectural finishes make them a preferred choice in high-rise buildings, commercial spaces, and industrial applications. Regulatory authorities such as the International Code Council (ICC) and the National Fire Protection Association (NFPA) have implemented stringent fire safety norms, driving the adoption of these coatings. Additionally, the European Union’s EN 13381 standards for fire protection coatings further reinforce the demand for thin-film solutions. Companies like Sherwin-Williams, AkzoNobel, and Jotun have been actively developing advanced thin-film intumescent coatings that align with sustainability goals, ensuring long-term growth in this segment.

By Technology

Epoxy-based coatings dominated the intumescent coatings market in 2023 with a 45.1% market share. These coatings offer superior durability, excellent moisture resistance, and high chemical stability, making them highly suitable for demanding environments such as offshore oil rigs, petrochemical plants, and industrial structures. Epoxy-based intumescent coatings are particularly favored for their ability to withstand harsh conditions while maintaining their fire-resistant properties over extended periods. Regulatory frameworks like the U.S. Occupational Safety and Health Administration (OSHA) and the European Chemicals Agency (ECHA) impose strict fire protection standards, accelerating the adoption of epoxy-based coatings. Additionally, industry leaders such as PPG Industries and Jotun have focused on developing high-performance epoxy formulations tailored to hydrocarbon fire protection in oil & gas and marine applications. With increasing investments in industrial safety and fireproofing, this segment continues to dominate the market.

By Substrate

Structural Steel & Cast Iron dominated the intumescent coatings market in 2023 with a 70.5% market share. These materials are widely used in commercial buildings, bridges, energy infrastructure, and industrial facilities, all of which require fire protection to meet regulatory safety standards. Organizations such as the American Institute of Steel Construction (AISC) and the International Fire Safety Standards (IFSS) Coalition emphasize the importance of fireproofing structural steel to prevent catastrophic failures in fire incidents. Government initiatives such as the U.S. Infrastructure Investment and Jobs Act (IIJA) and China’s Five-Year Plan for Sustainable Infrastructure Development have increased investments in fire-resistant construction materials. Additionally, in the oil & gas sector, offshore drilling platforms and refineries utilize steel structures that require high-performance intumescent coatings to ensure compliance with safety norms. These factors have significantly driven the demand for fire-resistant coatings for structural steel and cast iron.

By Application Technique

Brush/Roller application dominated the intumescent coatings market in 2023 with a 51.7% market share. This method is preferred for its cost-effectiveness, ease of application, and ability to provide uniform coverage, particularly in small-scale construction projects and renovation work. Unlike spray applications, which require specialized equipment and controlled environments, brush/roller application allows flexibility in on-site fireproofing, reducing material waste and overspray concerns. Many European and Asian construction companies opt for brush/roller application due to its compliance with environmental regulations and minimal impact on workers’ health. Regulations such as the European Union’s REACH framework emphasize reducing airborne pollutants from coating applications, making brush/roller techniques an attractive choice. Furthermore, in regions with labor-intensive construction practices, such as India and Southeast Asia, manually applied coatings continue to dominate, ensuring steady growth in this segment.

By Application

Cellulosic fire protection dominated the intumescent coatings market in 2023 with a 58.4% market share. This segment is primarily driven by the demand for fire-resistant coatings in commercial buildings, residential high-rises, and stadiums. Cellulosic fires, which originate from materials like wood, paper, and textiles, spread rapidly, necessitating the use of intumescent coatings to enhance fire safety. Regulatory bodies such as the National Fire Protection Association (NFPA) and the International Building Code (IBC) have mandated stringent fireproofing measures in urban infrastructure. Additionally, urbanization and high-rise construction projects worldwide are accelerating the adoption of cellulosic intumescent coatings. Companies such as Hempel and Carboline have introduced advanced fireproofing coatings that comply with international safety standards, ensuring long-term dominance of this segment.

By End-use Industry

The building & construction industry dominated the intumescent coatings market in 2023 with a 42.7% market share. The growing emphasis on fire safety in residential, commercial, and industrial buildings has driven the demand for intumescent coatings. Governments worldwide have introduced stringent building codes, requiring the application of fire-resistant coatings on structural components. Programs such as China’s New Infrastructure Plan, India’s Smart Cities Mission, and the European Green Deal’s sustainable construction initiatives highlight the importance of fireproofing materials in modern urban development. Additionally, the increasing frequency of fire-related accidents has prompted stricter enforcement of fire protection laws. Leading manufacturers such as Sika AG, Promat International, and GCP Applied Technologies continue to invest in innovative fireproofing solutions tailored for the construction sector, reinforcing this segment’s market dominance.

Regional Analysis

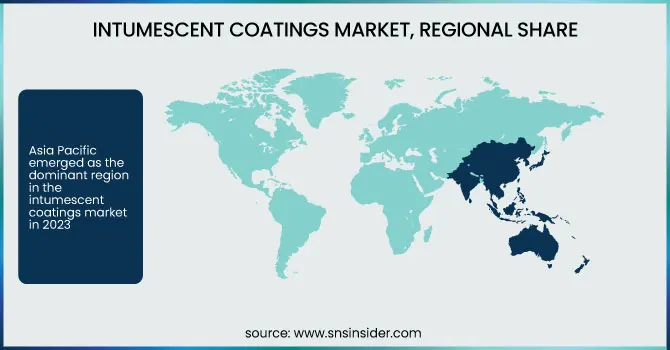

Asia Pacific emerged as the dominant region in the intumescent coatings market in 2023, primarily driven by rapid urbanization, industrialization, and stringent fire safety regulations across major economies. The construction boom in China, India, and Southeast Asia has significantly increased the demand for fire-resistant coatings, particularly for high-rise buildings, infrastructure projects, and industrial facilities. China, the largest market in the region, fueled by the government's 14th Five-Year Plan, which emphasizes fire safety and infrastructure resilience. India follows with a fast-growing construction sector, with initiatives like Smart Cities Mission and Pradhan Mantri Awas Yojana (PMAY) boosting the adoption of intumescent coatings. Meanwhile, Japan and South Korea, known for their stringent fire safety laws and advanced manufacturing industries, have also contributed to the region’s dominance. Major players like Nippon Paint, Jotun, and AkzoNobel have increased their investments in the region, further solidifying its leading position.

North America projected to be the fastest-growing region in the intumescent coatings market, driven by increasing fire safety awareness, stringent building regulations, and growing industrial investments. The U.S. dominates the region, due to strict fire protection codes set by the National Fire Protection Association (NFPA) and the Occupational Safety and Health Administration (OSHA). The Biden administration’s Infrastructure Investment and Jobs Act (IIJA) has also led to substantial investments in commercial and industrial buildings, further accelerating demand for intumescent coatings. Canada follows as the second-largest market, with rising urban infrastructure projects and growing adoption of fireproofing solutions in energy and transportation sectors. Mexico is witnessing steady growth, especially in the oil & gas industry, where safety regulations mandate the use of fire-resistant coatings in refineries and offshore platforms. Increasing innovation from companies like PPG Industries, Sherwin-Williams, and Carboline is further driving market expansion in the region.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

Key Players

-

Albi Protective Coatings (Albi Clad TF, Albi Clad 800, Albi Clad 900)

-

Carboline (Thermo-Lag 3000, Pyrocrete 241, Firefilm III)

-

Contego International Inc. (Contego High-Performance Coating, Contego Passive Fire Barrier)

-

Firefree Coatings, Inc. (Firefree 88, Firefree Class A)

-

Flame Control Coatings, LLC (Flame Control 60-60A, Flame Control 10-10)

-

GCP Applied Technologies Inc. (MONOKOTE Z-146, MONOKOTE MK-6 HY, MONOKOTE MK-1000 HB)

-

Hempel A/S (Hempacore One, Hempacore One FD, Hempafire Optima 500)

-

Isolatek International (CAFCO SprayFilm WB3, CAFCO BlazeShield II, CAFCO FENDOLITE M-II)

-

Jotun (SteelMaster 1200WF, SteelMaster 600WF, SteelMaster 60WB)

-

No-Burn Inc. (No-Burn Original, No-Burn Plus XD, No-Burn Plus ThB)

-

Nullifire (SC801, SC802, SC902)

-

PPG Industries, Inc. (PPG Steelguard 651, PPG Steelguard 701, PPG Steelguard 951)

-

Promat International (Promapaint SC3, Promapaint SC4, Promapaint SC1)

-

Rudolf Hensel GmbH (HENSOTHERM 421 KS, HENSOTHERM 820 KS, HENSOTHERM 910 KS)

-

Sika AG (Sika Unitherm Platinum, Sika Pyroplast Wood P, Sika Unitherm Steel W 60)

-

Teknos Group Oy (Teknosafe 2467-00, Teknos Teknocoat Aqua 2577-22)

-

The Sherwin-Williams Company (Firetex FX1002, Firetex FX6002, Firetex FX5120)

-

Tor Coatings (Pyroshield Durable Matt, Pyroshield Durable Eggshell)

-

Warren Paint & Color Co. (Fireshell F10E, Fireshell F1)

Recent Developments

-

January 2025: Isolatek International launched FireSolve SB, a solvent-based intumescent fireproofing with industry-leading durability, efficiency, and low VOC levels. It offers up to four hours of fire protection per ASTM and UL standards.

-

August 2024: Hexion Inc. and Clariant partnered to enhance intumescent coatings by combining VeoVa vinyl ester-based binders with advanced intumescent additives for superior fire protection.

-

May 2023: Akzo Nivel NV introduced a bisphenol-free internal coating as an alternative solution for coil coaters and can makers. This coating is designed to meet the growing demand for sustainable and safe intumescent coatings, providing a more environmentally friendly option.

-

April 2023: Nullifire unveiled its latest product, the Nullifire FZ100 Fire Safe Zone. This innovative intumescent coating is specifically designed to provide fire protection at off-site construction sites. When exposed to high temperatures, the coating expands, creating a protective barrier for both the building structure and its occupants.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.18 Billion |

| Market Size by 2032 | USD 1.97 Billion |

| CAGR | CAGR of 5.88% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Thick-film, Thin-film) •By Technology (Solvent-based, Epoxy-based, Water-based) •By Substrate (Wood, Structural Steel & Cast Iron, Others) •By Application Technique (Spray, Brush/Roller) •By Application (Cellulosic, Hydrocarbon) •By End-use Industry (Building & Construction, Oil & Gas, Transportation, Consumer Electronics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Jotun, The Sherwin-Williams Company, PPG Industries, Inc., Hempel A/S, Carboline, Sika AG, Isolatek International, Nullifire, Rudolf Hensel GmbH, Contego International Inc. and other key players |