IoT Connectivity Market Report Insights:

Get More Information on IoT Connectivity Market - Request Sample Report

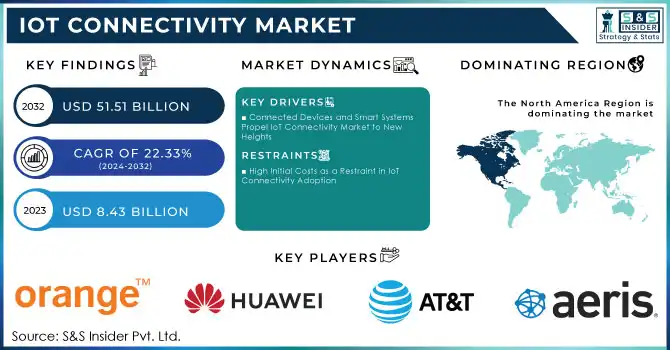

The IoT Connectivity Market Size was valued at USD 8.43 billion in 2023 and is expected to reach USD 51.51 billion by 2032, growing at a CAGR of 22.33% from 2024-2032.

The increasing requirement for connected devices across industries is catalyzing the growth of the IoT connectivity market, facilitated by rapid expansion in the number of IoT devices worldwide. Projections indicate that by 2025, there will be more than 75 billion in use, IoT-connected devices clear surge in smart device uptake. This is true in the manufacturing, healthcare, and transport industries where the application of IoT has been optimized to make operations safer and enhanced on real-time analytics. Then the automation and smart application requirements are hence dramatically increasing the exponential need for reliable and scalable devices that rely on such support. Already in 2023 more than 15.4 billion IoT devices were in use, highlighting the fast growth that the market has made for itself in this sector.

The adoption of 5G networks has come to further uplift the demand for IoT connectivity as it promises to provide high speed and low latency connectivity necessary for continuous usage of IoT applications. This is expected to amount to USD 4.6 trillion in global economic value through 2025 and change this industry in various sectors, such as smart cities, autonomous vehicles, and remote healthcare. Moreover, AI and machine learning have engineered major advancements in the ability of IoT devices to handle large amounts of data, creating predictive analytics, automation, and optimization in decision-making. This has assisted various industries in leveraging big data to achieve operational efficiency and the enhancement of service provisions that in turn positively enhance the growth of IoT.

Digital transformation is another prominent driver of the IoT connectivity market. It has been emerging in different industries such as agriculture, retail, and energy for the improvement of IoT adoption in such industries to better and positively manage their supply chains, offer customers better experiences as well as optimize energy efficiency. Also, this worth-of-efficiency period has pushed all businesses toward an IoT possibility for tracking wastage and environmental impact. Governments would be investing USD 124 billion in the smart city initiative, which could speed up IoT connectivity. This can have huge implications on the economy as well as on the environment.

IoT Connectivity Market Dynamics

DRIVERS

-

Connected Devices and Smart Systems Propel IoT Connectivity Market to New Heights

Several key sectors that generate major revenues by interconnecting devices have been driving the growth of the IoT connectivity market. Connected vehicles also substantially contributed to the market, while payment terminals significantly contributed to the value of the market, with USD 39.4 billion. Collectively, these three segments together generate revenues of more than 10% compared to that of consumer media and internet devices on their own. This trend underscores increasing dependence upon IoT connectivity to make consumer experiences richer, enhance safety within cars, and make payment systems much more efficient.

RESTRAINTS

-

High Initial Costs as a Restraint in IoT Connectivity Adoption

IoT infrastructure is expensive to deploy and involves upfront costs like the price of sensors, connectivity hardware, and base software. Among small-to-medium enterprises, the costs can become downright prohibitive: setting up even basic IoT systems starts at around USD 50,000 for some simple integrations—and goes well over USD 1 million for more complex networks. SMEs Are Timorous Due to a Burden of Proof to Purchase: The upfront financial commitment is higher which deters their adoption rate for IOT compared to larger enterprises who can bear the cost due to the benefits in the long-term. Therefore, most businesses are unable to invest in tools that can provide accurate data and offload failures so they may continue effectively implementing IoT for efficiency and technology advancement.

IoT Connectivity Market Segments Analysis

BY ENTERPRISES

Large companies dominate the IoT connectivity market in 2023, capturing 56% of revenue. This can be attributed to the enormous financial capabilities and advanced infrastructure they possess which allows them to implement large-scale IoT deployments. The companies can invest deeply into diversified industries such as manufacturing, logistics, and supply chain. Their size ensures that their investment can bring significant returns and thus follows an upward curve.

The fastest growth will be witnessed in small and medium-sized enterprises that are expected to account for 23.13% CAGR from 2024-2032. This growth will be due to the increased adoption of low-cost, scalable IoT solutions available to smaller businesses. The technology only gets cheaper, and subsequently, SMEs are increasingly embracing IoT to improve efficiency at operations as well as enhance customer experiences. Cloud-based IoT solutions specifically help cut upfront investment costs, making SMEs able to compete with larger enterprises even more effectively.

BY COMPONENT

Solutions lead the way in IoT connectivity, claiming 57% of revenue in 2023. It is mainly because interest in integrated systems-including IoT platforms and sensors, as well as connectivity hardware continues to push forward the adoption of solutions that can automate operations, gather real-time data, and thus make informed decisions. As industries scale their applications, this market share continues to be pushed by robust and comprehensive solutions.

Services are anticipated to increase at the fastest CAGR of 22.92% from the forecast period from 2024 to 2032. The demand is growing because businesses need specialized services like network management, data analytics, and cybersecurity. Organizations become more IoT-driven and tend to ask for constant support in a bid to optimize and secure the system. This is why the market is growing to be so extensively large in terms of services needed to integrate, maintain, and scale up IoT systems.

BY APPLICATION

Smart manufacturing is the largest market share of IoT connectivity market at 35%, where automation and real-time monitoring help with predictive maintenance. The technologies will streamline the operations, reducing downtime, and resource management optimization. Manufacturers now rely on IoT not only for productivity improvement but also for reducing supply chain complexity. The trend will not escape because companies embrace digital transformation.

Hence, smart retail is expected to grow at a CAGR of 23.75% between 2024 and 2032 with the growing demand for experience personalization and the need for supply chain optimization. The inbuilt capability of IoT technologies allows retail businesses to track inventory in real time and optimize customer interaction. This trend is developing due to consumers' increased desire for convenience and a frictionless shopping experience. Retailers are investing heavily in smart technologies to help satisfy these changing needs.

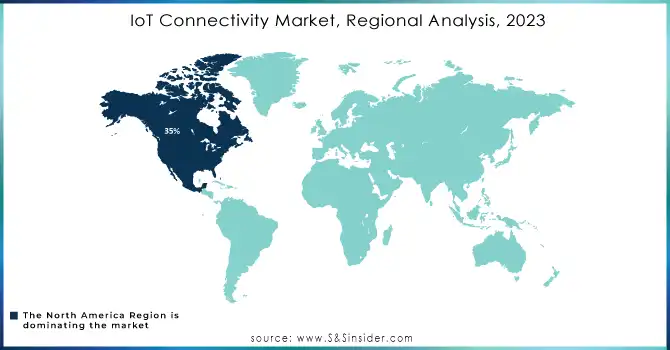

IoT Connectivity Market Regional Overview

North America leads the IoT connectivity market with a market share of 35% in 2023 due to huge technological advancement, early adoption, and strong infrastructure. In the United States, IoT solutions are witnessing high demand, particularly across industries such as healthcare, retail, and automotive industries. Smart city projects and investments in 5G technology by the government have further fueled the growth of IoT in the region. Also, high disposable incomes and good industry support are helping the region gain a strong position in this market as well.

Asia Pacific is expected to hold the fastest CAGR at 23.29% from 2024 to 2032. This can be attributed to the high adoption of IoT technologies throughout China and India, wherein these technologies become key drivers for smart cities, industrial automation, and digital transformation initiatives. Much greater investments in the infrastructure, more government policies, and the spread of mobile networks will encourage further IoT adoption. The focus on efficiency and innovation, coupled with business continuities in the Asia Pacific, makes this region set to lead in both aspects, market share, and technological advancements.

Need Any Customization Research On IoT Connectivity Market - Inquiry Now

LATEST NEWS-

-

InfraX, a Digital Dewa subsidiary, signed an agreement with Zoho Corp, bringing innovative IoT solutions toward driving digital transformation for the UAE. The partnership was announced at Gitex Global 2024.

-

Microsoft plans to invest in Vodafone's managed IoT connectivity platform, which will be spun off as a standalone business by April 2024. The new business would operate with a zeal to onboard more partners and customers that would propel the growth of IoT applications and also the rise in device connectivity.

Key Players in IoT Connectivity Market

-

Aeris Communications India Pvt. Ltd. (Aeris IoT Platform, Aeris Mobility)

-

AT&T Inc. (AT&T IoT Services, AT&T Control Center)

-

Cisco Systems Inc. (Cisco IoT Solutions, Cisco Jasper)

-

Huawei Technologies Co. Ltd. (Huawei IoT Cloud, Huawei 5G IoT Solutions)

-

Orange (Orange Business Services, Orange IoT Solutions)

-

Sierra Wireless (AirLink Routers, Octave IoT Platform)

-

Sigfox (Sigfox IoT Network, Sigfox Backend Services)

-

Telefonaktiebolaget LM Ericsson (Ericsson IoT Accelerator, Ericsson Device Connection Platform)

-

Telefónica S.A. (IoT Global Platform, Telefónica IoT Connectivity)

-

Telit IoT Platforms, LLC (Telit IoT Modules, Telit Connectivity Platform)

-

Verizon Communications Inc. (Verizon IoT Solutions, Verizon ThingSpace)

-

Vodafone Group Plc (Vodafone IoT Platform, Vodafone Automotive)

-

Hologram (Hologram IoT SIM Cards, Hologram Data Plans)

-

Particle (Particle IoT Devices, Particle Cloud Platform)

-

EMnify (EMnify IoT Platform, EMnify Cellular IoT Solutions)

-

Moeco (Moeco IoT Network, Moeco Data Management)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 8.43 Billion |

| Market Size by 2032 | USD 51.51 Billion |

| CAGR | CAGR of 22.33% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Buildings and Home Automation, Smart Energy and Utility, Smart Manufacturing, Smart Retail, Smart Transportation, Others) • By Enterprise Size (Small and Medium-sized Enterprises, Large Enterprises) • By Component (Solutions, Services) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Aeris Communications India Pvt. Ltd., AT&T Inc., Cisco Systems Inc., Huawei Technologies Co. Ltd., Orange, Sierra Wireless, Sigfox, Telefonaktiebolaget LM Ericsson, Telefónica S.A., Telit IoT Platforms, LLC, Verizon Communications Inc., Vodafone Group Plc, Hologram, Particle, EMnify, Moeco. |

| Key Drivers | • AI Integration in IoT Drives Cost Savings and Revenue Growth Across Industries • Connected Devices and Smart Systems Propel IoT Connectivity Market to New Heights |

| Restraints | • High Initial Costs as a Restraint in IoT Connectivity Adoption |