Agentic AI in Prevention & Fraud Detection Market Report Scope & Overview:

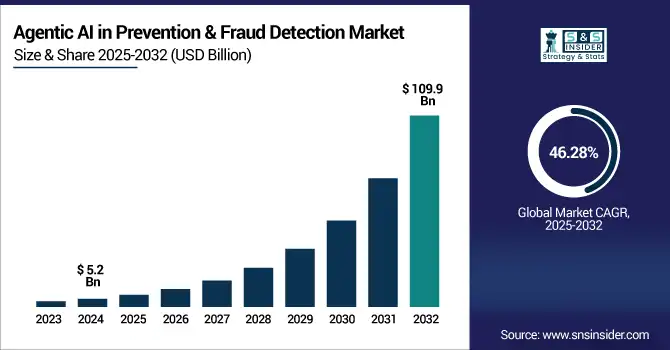

The Agentic AI in Prevention & Fraud Detection Market size was valued at USD 5.2 billion in 2024 and is expected to reach USD 109.9 billion by 2032, growing at a CAGR of 46.28% during 2025-2032.

To Get more information on Agentic AI in Prevention & Fraud Detection Market - Request Free Sample Report

The agentic AI in prevention & fraud detection market growth is driven by the rise of digital transactions, increasingly complex cyber threats, and growing regulatory demands for compliance. Agentic AI is being adopted by companies in BFSI, retail, healthcare, and government to create real-time autonomous agents for fraud detection and risk mitigation. The machine learning technology is driving the market and is expected to set the stage for significant growth with the decreasing 3D static nature of reports, which drives real-time analytics along with a growing need for integration of machines and systems for AI with legacy systems for fraud analytics and identity authentication.

The agentic AI in the prevention & fraud detection market analysis points towards the rise in the tendency to use self-learning and predictive systems to mitigate the changing fraud patterns. As digital ecosystems expand, the agentic AI in prevention & fraud detection market analysis trends some trends predicting a strong growth trajectory for the Agentic AI in Prevention & Fraud Detection Market by deployment, scalable and explainable AI in cloud solution

The U.S. agent AI in the prevention & fraud detection market is estimated to be valued at approximately USD 1.56 billion in 2024 and is anticipated to reach a market value of USD 32.0 billion by 2032, growing at a CAGR of 45.9% over the forecast period. The rising sophistication of cyber threats, increasing adoption of AI-driven security solutions, and the need for real-time threat detection and response are some of the key driving factors for market growth. Some of the major drivers of the market are increased sophistication of cyber threats, increasing penetration of cloud-based security solutions, and growing demand for automated threat detection.

Market Dynamics:

Drivers:

-

Surge in Real-Time Digital Transactions Drives Need for Instant Fraud Detection

As digital payments and online services continue to explode, there is an ever-growing need for sophisticated fraud detection systems. Traditional Fraud Prevention Lags Risk/Reward Balance Real-time financial services become the norm, and traditional fraud methods fall short when it comes to speed and accuracy. Agentic AI solutions that can learn and make decisions on their build in the proactive threat identification and the instant identification of any anomaly. Fraud detection systems dig through huge amounts of data from various channels like banking, e-commerce, and health care to find trends among behaviors that will likely lead to fraud with a high degree of accuracy. This growing appetite has prompted investment in AI-enabled platforms that combine fraud analytics, biometric authentication, and risk governance. In particular, the U.S. is witnessing mass adoption across banking and insurance.

For instance, A 2024 report revealed that 94% of global fraud executives observed a rise in real-time payments, with 80% reporting an uptick in mule activity associated with these transactions.

Restraints:

-

High Implementation and Integration Costs Limit Adoption Among Smaller Enterprises

Despite strong fraud prevention abilities, the agentic AI needs a high initial investment in its deployment, which can be difficult for SMEs. Implementing these systems requires more than just the transaction of advanced software, but heavy integration with current IT infrastructures, data migration, employee training, and maintenance in the long term. Ensuring interoperability with legacy systems is still a big challenge for traditional institutions. Or, some organizations may experience regulatory and compliance complexities that drive total deployment costs up. The combination of these financial and technical constraints not only ensnares adoption, especially in developing markets and industries operating with scant IT budgets, but also limits the sizeable market opportunity for promising technology.

For instance, a 2024 survey by Builder.ai revealed that 27% of the U.S. small and medium-sized businesses (SMBs) identified high costs as a primary concern when considering AI adoption.

Opportunities:

-

Rise of Explainable AI Creates Opportunities for Regulatory Compliance and Trust

As more governments and regulators get into the game, they are pushing for transparency in the output of AI-based decision-making, especially in sectors where sensitive data is being exchanged, like finance, insurance, and healthcare. This presents an enormous market opportunity for agentic AI platforms with explainable AI functionalities that include audit trails, justifications for fraud alerts, and compliance documentation.

It has also enabled organizations to not only better detect fraud but also provide proof of compliance with regulations, such as Global Data Protection Regulation, California Consumer Privacy Act, and anti-money laundering laws. There is already a growing impetus for AI systems that provide both real-time prevention and ex post regulatory accountability, and that is accelerating adoption. In this rapidly evolving market, vendors who emphasize ethical AI and explainability can find themselves with a competitive edge.

For Instance, A 2024 Forrester report indicates that 55% of business and technology professionals have implemented XAI in their organizations, with an additional 13% planning adoption within the next 12 months.

Challenges:

-

Data Privacy and Ethical Concerns Challenge AI Adoption and Public Trust

Using agentic AI for fraud detection calls for deep access to troves of personal and financial data, which raises serious privacy, data security, and ethical AI deployment issues. The abuse or mismanagement of data may result in a regulatory fine and loss of customer confidence. AI algorithms can thus be biased and yield false positives, unfairly targeting some user or transaction types. Developers and institutions find it tough to maintain fairness, transparency, and security of AI models.

With growing regulatory scrutiny on the ungoverned application of AI with bad data, driven by the widespread misinformation and disinformation, the challenge of low trust on the efficacy of data-driven decisions will make the cost of current avoidance strategies higher. Instead, application of responsible AI frameworks, data governance principles, and privacy-preserving technologies is imperative for companies to address these disruptive risks and sustain credibility.

For instance, according to the Pew Research Center, 70% of the U.S. adults express little to no trust in companies to make responsible decisions about AI usage, underscoring a significant trust gap.

Segmentation Analysis:

By Component:

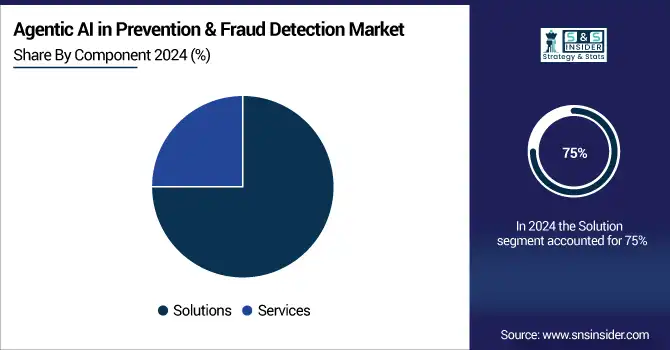

The Solution segment dominated the market in 2024 and accounted for 75% of the agentic AI in prevention & fraud detection market share, owing to the growing demand for real-time fraud analytics, authentication systems, and compliance tools in banking, financial services, and insurance (BFSI) and retail sectors. Organizations move toward autonomous, AI-driven solutions for detecting and blocking sophisticated fraud patterns. Explainable AI and decision intelligence, showing growing adoption of all the sub-categories in the segment.

The Services segment is expected to record the fastest CAGR, driven by increasing demand for specialized implementation, integration, and continuous support of agentic AI systems. While enterprises are looking at more sophisticated fraud detection platforms, they are increasingly depending on professional and managed services to ensure seamless deployment. The growing momentum of this trend will be further strengthened by 2032.

By Application:

The identity theft segment dominated the agentic for prevention and fraud detection market and accounted for a significant revenue share in 2024, owing to the rise in online banking, digital onboarding, and remote or contactless transactions, which increase the risk of identity-related threats. As synthetic identity fraud and phishing cases rise, agentic AI is more widely used for biometric verification and behavioral analysis. And it is likely to remain so as ID protection moves to the core of digital trust frameworks.

The Payment Fraud segment is estimated to grow at the fastest rate, due to the rapid growth of e-commerce, mobile wallets, and real-time payment systems. Such channels are regular victims of transaction spoofing and card-not-present fraud. This segment is set to grow quickly through 2032 across banking, retail, and fintech ecosystems, as Agentic AI allows for dynamic fraud detection over high-speed payment environments.

By Enterprise Size:

The Large Enterprises segment dominated the agentic AI in prevention & fraud detection market and accounted for 79% of revenue share in 2024, owing to the presence of large budgets, mature IT infrastructure, and immediate regulatory requirements. Such organizations look to exceed comprehensive agentic AI systems to protect huge databases of transactions and customer networks. Ongoing innovation in scalable fraud analytics, compliance automation, and internal threat detection will enable their sustained dominance across BFSI, telecom, and healthcare sectors until 2032.

Cloud-based and cost-effective agentic AI solutions will become more accessible, enabling the fastest CAGR for the SMEs segment. Demand is driven by increasing cyber threats and the rapid adoption of digital channels, where lower footprint fraud prevention solutions are needed. The managed services help in reducing the entry barriers, and therefore, the investment in AI-powered protection is going to be higher among the SMEs through the year 2032, owing to the higher cost efficiencies that can be obtained, especially in the retail, fintech, and logistics verticals.

By End-Use:

The BFSI segment dominated the agentic AI in prevention & fraud detection market in 2024 and accounted for a significant revenue share, due to higher exposure to financial fraud, stringent regulatory mandates, and the early adoption of AI-driven risk management strategy solutions. Transaction monitoring, anti-money laundering, and identity verification are all heavily deployed areas for agentic AI. The BFSI (banking, financial services, and insurance) sector will maintain its leadership position until 2032, in both developed and emerging markets, with ongoing investment in AI compliance and fraud prevention.

The Retail and E-commerce segment is expected to register the fastest CAGR during the forecast period, as the digital payments ecosystem has exploded in recent years with omnichannel transactions, while promo abuse, fake returns, and account takeover cases have also increased. Agentic AI provides a real-time protective layer that spans checkout, payment, and loyalty systems. As consumer activity has surged online, the adoption of fraud detection AI for retail will continue growing rapidly through 2032.

Regional Analysis:

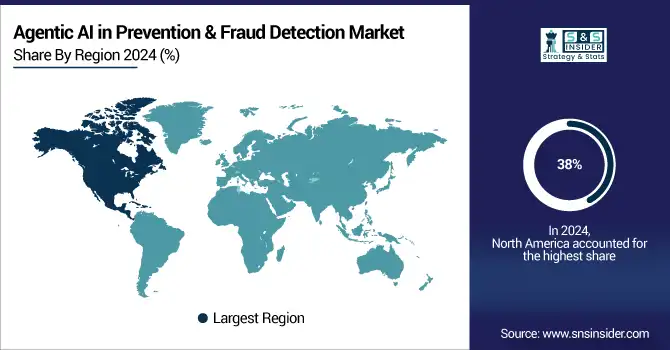

North America leads the agentic for prevention and fraud detection market in 2024 and accounted for 38% of revenue share. Due to the presence of advanced digital infrastructure, early technology adoption, and stringent regulatory frameworks covering fraud-related activities, including Guidelines on the Security of Processing and Payment Card Industry Data Security Standard. Agentic AI investment trends in BFSI, e-commerce, and healthcare due to higher fraud risk exposure growth through 2032 will be driven by continually broadening cybersecurity mandates and the most recent wave of AI adoption throughout the enterprise.

Asia Pacific is projected to grow at the fastest CAGR during the forecast period, attributed to growing digitalization, real-time payments, and a boom in online fraud cases. Everyone with a stake in payment is building fraud prevention infrastructure at unprecedented speed. Due to increased adoption of AI in fintech, telecom, and retail, the region will see the most significant deployment of agentic AI solutions, particularly in developing economies, till 2032.

Banking on the booming UPI transactions, strides in digital banking & frequent frauds, India dominated the Asia Pacific agentic for prevention and fraud detection market. Government-driven initiatives and regulatory backing are propelling the adoption. India is predicted to be a leader in regional growth by 2032, primarily due to its burgeoning fintech innovation, scalable AI adoption, and a broader SME digital coverage infrastructure.

Agentic AI in Europe is experiencing robust growth in the Agentic AI in Prevention & Fraud Detection Market based on rising regulatory pressure (GDPR and the EU AI Act, focusing on transparency, data protection, and ethical AI use). Through 2032, the rapid expansion of digital banking, the growth of cross-border e-commerce, and the threat of cybercrime will push widespread adoption of AI across all industries.

The European battle for AI dominance relied on the U.K., which led the European track toward AI, complementing its step ahead in financial markets, and the prevalence of online fraud rates among its citizens was balanced out by its advanced regulatory alignment with AI ethics at a very early stage. Ongoing investments in the fintech and cybersecurity framework allow for the rapid integration of AI and will make the U.K. a domestic leader in fraud detection technology over the same period (2032).

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The Major agentic AI in prevention & fraud detection market Companies are IBM Corporation, FICO (Fair Isaac Corporation), SAS Institute Inc., ACI Worldwide, BAE Systems, Experian Information Solutions, Inc., Oracle Corporation, SAP SE, NICE Ltd., Dell Inc. and others

Recent Developments:

-

In March 2025, Oracle introduced AI agents into its Investigation Hub Cloud Service to combat financial crime. These agents automate investigative processes, generate narratives, and recommend actions, enhancing the efficiency of financial crime investigations

-

In May 2025, At SAS Innovate 2025, SAS unveiled AI agents within its Viya platform, enhancing analytics and decision intelligence capabilities. These agents support responsible AI deployment and have applications in fraud prevention across various industries.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | US$ 5.2 Billion |

| Market Size by 2032 | US$ 109.91 Billion |

| CAGR | CAGR of 46.28% From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2024-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Solution and Services) • By Application (Identity Theft, Money Laundering, Payment Fraud, and Others) • By Organization Size (SMEs and Large Enterprises), • By Vertical (BFSI, Government and Defense, Healthcare, IT and Telecom, Industrial and Manufacturing, Retail and E-commerce, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | IBM Corporation, FICO (Fair Isaac Corporation), SAS Institute Inc., ACI Worldwide, BAE Systems, Experian Information Solutions, Inc., Oracle Corporation, SAP SE, NICE Ltd., Dell Inc. and others in the report |