Cognitive Process Automation Market Report Scope & Overview:

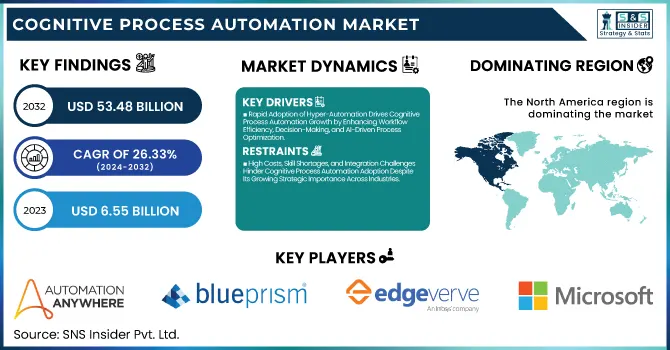

The Cognitive Process Automation Market was valued at USD 6.55 billion in 2023 and is expected to reach USD 53.48 billion by 2032, growing at a CAGR of 26.33% from 2024-2032. This report includes insights into adoption rates, investment & funding trends, cost reduction metrics, and productivity improvements. The market is witnessing rapid adoption as enterprises seek AI-driven automation to enhance decision-making and operational efficiency. Increased funding and strategic investments are fueling innovation, while advancements in AI and machine learning contribute to cost reductions. Businesses are leveraging automation to streamline workflows, optimize resource utilization, and improve productivity, making cognitive process automation a key enabler of digital transformation across industries.

To Get more information on Cognitive Process Automation Market - Request Free Sample Report

Cognitive Process Automation Market Dynamics

Drivers

- Rapid Adoption of Hyper-Automation Drives Cognitive Process Automation Growth by Enhancing Workflow Efficiency, Decision-Making, and AI-Driven Process Optimization

Enterprises are increasingly focusing on hyper-automation, integrating AI-driven solutions to enhance efficiency and decision-making. Cognitive Process Automation (CPA) is at the core of this transformation, enabling businesses to streamline complex workflows, reduce manual intervention, and optimize operational efficiency. Organizations are leveraging CPA to augment Robotic Process Automation (RPA), allowing systems to handle unstructured data, adapt to dynamic scenarios, and execute intelligent decision-making. This shift is particularly evident in industries such as finance, IT, and customer service, where automation of cognitive tasks improves accuracy and scalability. As companies seek to drive digital transformation, the convergence of AI, machine learning (ML), and natural language processing (NLP) with automation is becoming a strategic priority across various sectors.

Restraints

-

High Costs, Skill Shortages, and Integration Challenges Hinder Cognitive Process Automation Adoption Despite Its Growing Strategic Importance Across Industries.

The integration of AI, machine learning (ML), and natural language processing (NLP) into automated systems requires a lot of infrastructure, software, and expert professionals. Most organizations are financially strapped to implement Cognitive Process Automation (CPA) at scale due to the high costs of customization, training, and maintenance adding to the overall cost. Second, the lack of AI and automation professionals is a major hurdle, slowing down adoption and effective usage. Companies also grapple with integrating legacy systems, which means extra resources are needed to upgrade aging IT systems. Third, data security, privacy, and regulatory compliance concerns act as brakes in sectors that deal with sensitive data. These elements together act as impediments to the seamless adoption of CPA in different sectors, even as its strategic relevance continues to rise.

Opportunities

- AI-Driven Decision-Making Fuels Cognitive Process Automation Growth by Enhancing Real-Time Analytics, Operational Efficiency, and Business Process Optimization.

Businesses are shifting their focus towards hyper-automation, which includes AI-based solutions to make decisions and optimize efficiency. The focal point of this transformation lies in Cognitive Process Automation (CPA), as it enables firms to automate complex workflows, reduce human intervention, and optimize the efficiency of operations. Organizations implement CPA to extend Robotic Process Automation (RPA) with the capability of processing unstructured data, gaining insights from ever-changing situations, and making wise decisions. This transformation is most evident in industries such as finance, IT, and customer service, where automation of cognitive functions increases accuracy and scalability. With companies looking to power digital transformation, the convergence of AI, ML, and NLP technologies with automation is becoming a strategic imperative across various sectors.

Challenges

- Data Privacy and Security Risks Hinder Cognitive Process Automation Adoption as Businesses Face Cyber Threats, Compliance Challenges, and Regulatory Pressures.

Processing massive volumes of sensitive business and customer information through Cognitive Process Automation (CPA) has major implications for cybersecurity, regulatory compliance, and data breach risks. With automation systems handling sensitive information, organizations need to have robust data encryption, access controls, and adherence to changing regulations like GDPR and HIPAA. The rising incidence of cyber attacks only adds to the complexity of deploying CPA on a large scale, and companies are wary of embracing AI-powered automation at scale. Besides, sectors like finance, healthcare, and telecommunications, which handle highly sensitive information, are subject to more stringent compliance norms, further complicating CPA implementation. Absent robust security architectures and risk management practices, organizations would be unable to entirely exploit CPA's capabilities while ensuring trust and compliance.

Cognitive Process Automation Market Segment Analysis

By Type

The Robotic Process Automation (RPA) segment dominated the Cognitive Process Automation Market in 2023, holding the highest revenue share of 66%. This dominance is driven by its widespread adoption across industries for automating rule-based, repetitive tasks, reducing operational costs, and enhancing efficiency. RPA’s seamless integration with existing enterprise systems, combined with its ability to work alongside AI-driven cognitive automation tools, has made it the preferred choice for businesses. Additionally, its proven return on investment and ease of deployment have further solidified its leadership position.

The Intelligent Process Automation (IPA) segment is projected to grow at the fastest CAGR of 28.03% from 2024 to 2032, fueled by the increasing demand for AI-driven automation that enhances decision-making and operational agility. Unlike RPA, IPA combines machine learning, natural language processing, and analytics, enabling automation of complex, unstructured processes. Organizations are rapidly adopting IPA to improve business intelligence, predictive analytics, and real-time adaptability, making it a key driver of hyper-automation strategies. The shift towards end-to-end intelligent automation across industries further accelerates IPA’s rapid growth.

By Industry Vertical

The BFSI segment dominated the Cognitive Process Automation Market in 2023, holding the highest revenue share of 27%. This leadership is attributed to the industry's heavy reliance on automation for fraud detection, risk management, compliance, and customer service. CPA enables banks and financial institutions to streamline operations, enhance regulatory adherence, and improve real-time decision-making. Additionally, the sector’s increasing adoption of AI-driven chatbots, automated loan processing, and intelligent document processing has further reinforced its dominance in the market.

The Healthcare & Life Sciences segment is expected to grow at the fastest CAGR of 30.45% from 2024 to 2032, driven by the rising need for automation in medical data management, patient care, and drug discovery. CPA is being widely adopted to optimize clinical workflows, reduce administrative burdens, and enhance diagnostics with AI-driven insights. Additionally, advancements in telemedicine, personalized treatment plans, and regulatory compliance automation are accelerating CPA adoption in healthcare, making it the most rapidly expanding segment in the market.

By Services

The Finance segment dominated the Cognitive Process Automation Market in 2023, holding the highest revenue share of 37%. This dominance is driven by the sector’s reliance on AI-powered automation for financial reporting, fraud detection, risk assessment, and transaction processing. CPA enhances accuracy, ensures compliance with regulatory frameworks, and improves operational efficiency by automating repetitive, high-volume tasks. Additionally, the increasing adoption of predictive analytics, intelligent invoicing, and real-time financial monitoring has solidified the Finance segment’s leadership in the market.

The HR segment is expected to grow at the fastest CAGR of 29.07% from 2024 to 2032, fueled by the need for automation in talent acquisition, payroll processing, employee engagement, and compliance management. CPA streamlines HR functions by utilizing AI-driven chatbots, automated resume screening, and predictive workforce analytics, reducing manual workloads and improving decision-making. With businesses prioritizing employee experience, workforce planning, and efficiency, the demand for CPA in HR operations is rapidly increasing, driving its strong growth trajectory.

By Application

The Machine Learning (ML) segment dominated the Cognitive Process Automation Market in 2023, holding the highest revenue share of 34%. Its dominance is driven by ML’s ability to enable self-learning automation, predictive analytics, and intelligent decision-making. Businesses across industries leverage ML-powered CPA solutions to analyze vast datasets, detect patterns, and optimize workflows with minimal human intervention. The increasing adoption of ML in finance, healthcare, and IT for fraud detection, diagnostics, and operational efficiency has further reinforced its market leadership.

The Natural Language Processing (NLP) segment is expected to grow at the fastest CAGR of 28.39% from 2024 to 2032, driven by the rising demand for AI-powered chatbots, voice assistants, and sentiment analysis tools. NLP enhances CPA by enabling systems to understand, interpret, and generate human language, improving customer service automation, document processing, and real-time insights. With increasing adoption in BFSI, healthcare, and e-commerce, NLP-driven CPA is rapidly expanding, making it the fastest-growing segment in the market.

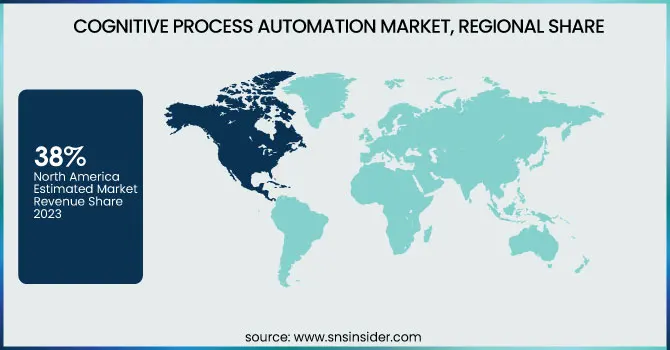

Regional Analysis

The North America region dominated the Cognitive Process Automation Market in 2023, holding the highest revenue share of 38%. This dominance is driven by early adoption of AI-driven automation, strong investments in digital transformation, and the presence of leading technology providers. Industries such as BFSI, healthcare, and IT & telecommunications extensively utilize CPA for process optimization, regulatory compliance, and customer experience enhancement. Additionally, the region's focus on hyper-automation and AI-driven business intelligence has further reinforced its leadership in the market.

The Asia Pacific region is expected to grow at the fastest CAGR of 28.75% from 2024 to 2032, driven by rapid industrialization, increasing digital transformation, and rising investments in AI and automation technologies. Expanding economies, particularly in China, India, and Japan, are witnessing accelerated CPA adoption in finance, healthcare, and manufacturing. Additionally, the growing demand for cost-effective automation solutions, skilled workforce availability, and government initiatives supporting AI-driven technologies is fueling Asia Pacific’s rapid market growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Automation Anywhere (Automation 360, Bot Insight)

-

Blue Prism (Blue Prism Cloud, Decipher IDP)

-

EdgeVerve Systems Ltd. (AssistEdge RPA, XtractEdge)

-

International Business Machines Corporation (IBM Robotic Process Automation, IBM Watson Assistant)

-

Microsoft Corporation (Power Automate, Azure Cognitive Services)

-

NICE (NICE Robotic Process Automation, NEVA)

-

NTT Advanced Technology Corp. (WinActor, WinDirector)

-

Pegasystems (Pega Robotic Process Automation, Pega Customer Decision Hub)

-

UiPath (UiPath Studio, UiPath Orchestrator)

-

WorkFusion, Inc. (Intelligent Automation Cloud, Smart Process Automation)

-

Celonis (Process Mining, Execution Management System)

-

Contextor (Contextor RPA, Contextor Studio)

-

Kofax (Kofax RPA, Kofax TotalAgility)

-

SAP (SAP Intelligent RPA, SAP Conversational AI)

-

Oracle (Oracle Intelligent Process Automation, Oracle Digital Assistant)

-

Google (Google Cloud AI, Google Dialogflow)

-

Appian (Appian RPA, Appian AI)

-

SAS Institute, Inc. (SAS Viya, SAS Intelligent Decisioning)

-

TIBCO Software Inc. (TIBCO Spotfire, TIBCO Data Science)

-

Teradata Corporation (Teradata Vantage, Teradata IntelliCloud)

-

Datameer, Inc. (Datameer Spectrum, Datameer X)

-

DataRobot, Inc. (DataRobot AI Cloud, DataRobot AutoML)

Recent Developments:

-

In June 2024, Automation Anywhere unveiled its new AI + Automation Enterprise System, integrating second-generation GenAI Process Models to accelerate the discovery, development, and deployment of AI-driven process automations.

-

In January 2024, SAP released updates to SAP Build Process Automation, enhancing workflow management, RPA, decision management, process visibility, and AI capabilities to streamline business processes.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 6.55 Billion |

| Market Size by 2032 | USD 53.48 Billion |

| CAGR | CAGR of 26.33% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Robotic Process Automation, Intelligent Process Automation) • By Services (Finance, Procurement, HR, IT Operations) • By Application (Machine Learning, Natural Language Processing, Pattern Identification, Biometrics, Optical Character Recognition, Others) • By Industry Vertical (BFSI, IT & Telecommunication, Transportation & Logistics, Retail & E-commerce, Media & Entertainment, Manufacturing, Healthcare & Life Sciences, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Automation Anywhere, Blue Prism, EdgeVerve Systems Ltd., International Business Machines Corporation, Microsoft Corporation, NICE, NTT Advanced Technology Corp., Pegasystems, UiPath, WorkFusion, Inc., Celonis, Contextor, Kofax, SAP, Oracle, Google, Appian, SAS Institute, Inc., TIBCO Software Inc., Teradata Corporation, Datameer, Inc., DataRobot, Inc. |