IoT Monetization Market Report Scope & Overview:

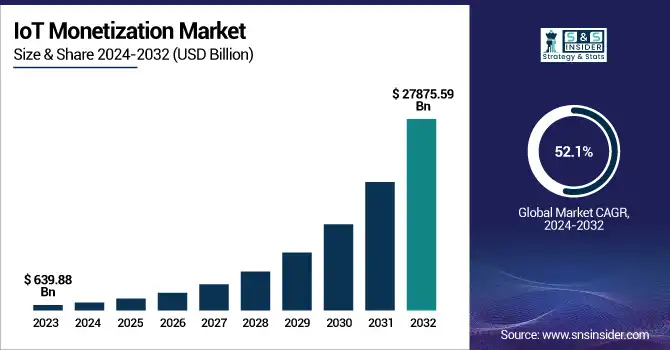

The IoT Monetization Market was valued at USD 639.88 billion in 2023 and is expected to reach USD 27875.59 billion by 2032, growing at a CAGR of 52.1% from 2024-2032.

To Get more information on IoT Monetization Market - Request Free Sample Report

This report includes a comprehensive analysis of key market segments, trends, and growth drivers, providing in-depth insights into revenue and pricing strategies. It explores technology and feature adoption across various industries, shedding light on the emerging tools and platforms enhancing IoT monetization. Additionally, consumer and user insights highlight evolving preferences and demand patterns, while security and compliance statistics address the challenges of safeguarding data and maintaining regulatory adherence in an increasingly connected world. With an emphasis on market dynamics, this report serves as a valuable resource for stakeholders seeking to capitalize on the IoT monetization opportunities.

The U.S. IoT Monetization Market was valued at USD 199.06 billion in 2023 and is projected to reach USD 7,611.49 billion by 2032, expanding at a CAGR of 49.95% from 2024 to 2032.

This remarkable growth is primarily driven by the rapid expansion of connected devices across industries such as healthcare, manufacturing, automotive, and smart cities. The increasing adoption of data-driven business models, edge computing, and 5G connectivity is enhancing real-time data analysis and enabling new revenue streams. Additionally, the growing demand for personalized services and subscription-based platforms is reshaping monetization strategies. Supportive regulatory frameworks, strong technological infrastructure, and a robust innovation ecosystem further position the U.S. as a key market for IoT monetization over the forecast period.

IoT Monetization Market Dynamics

Drivers

-

Growing adoption of connected devices across industries boosts demand for scalable IoT monetization frameworks and data-driven revenue models.

The rapid expansion of connected devices in industries such as manufacturing, healthcare, automotive, and home automation has escalated the need for strong IoT monetization. Companies are using data from these devices to create new revenue streams and enhance service offerings. Real-time analytics, device usage tracking, and predictive maintenance are becoming essential tools to generate value from IoT ecosystems. Monetization strategies now include subscription-based services, pay-per-use models, and usage-based billing, increasing profitability. As digital transformation accelerates globally, businesses are prioritizing scalable and secure monetization platforms to maximize returns on IoT investments. This is supported by the development of smart cities, autonomous vehicles, and industrial automation, where there is an ongoing need for innovation in monetizing connected infrastructure and services.

Restraints

-

Lack of standardized protocols and interoperability issues limit seamless integration and hinder large-scale IoT monetization across diverse ecosystems.

The lack of common standards for communication and data exchange across IoT platforms poses a major hindrance to monetization initiatives. Products across various vendors are usually not interoperable, leading to fragmented ecosystems that make it difficult to aggregate data, manage, and analyze. This absence of standardization hinders scalability and reduces the efficiency of monetization models like cross-platform services or single billing models. Enterprises are hindered in deploying end-to-end solutions, adding complexity to operations and integration costs. Incompatibility also prevents vendors from collaborating, slowing down innovation in service creation. Without harmonized protocols and streamlined connectivity, companies are unable to maximize the revenue potential of IoT networks. This fragmentation remains a significant hurdle even with advancements in other aspects of the IoT ecosystem.

Opportunities

-

Emergence of subscription and outcome-based models encourages recurring revenue streams and drives innovation in IoT service monetization.

As companies transition away from conventional ownership to outcome-based and subscription services, IoT monetization is going through a revolution. Companies are increasingly embracing models where customers pay for outcomes or services instead of hardware, allowing ongoing interaction and recurring revenue. This is seen in industries such as industrial IoT, healthcare, and smart homes, where customers value flexibility and value based on performance. These models enable providers to package services such as analytics, maintenance, and device management, improving customer loyalty and lifetime value. They further promote scalability with the ability to update automatically and price adaptability. This enablement drives innovation in billing technology, customer experience solutions, and service design and brings long-term monetization opportunities to the entire IoT value chain.

Challenges

-

High initial investment and infrastructure complexity create barriers for small and mid-sized enterprises entering the IoT monetization ecosystem.

Establishing and deploying IoT solutions that are efficiently monetizable requires a huge initial investment in infrastructure, hardware, software, and data analytics platforms. Small and medium-sized enterprises do not have the technical capabilities and capital to deploy scalable IoT models. Moreover, integrating sensors, edge devices, connectivity solutions, and data platforms is a complex process that involves a high learning curve. These issues restrict access to sophisticated monetization models such as dynamic pricing, real-time analytics, or AI-based automation. The expense of maintaining cybersecurity, compliance, and interoperability further increases the entry barrier. Without considerable financial assistance or easy-to-use platforms, most businesses cannot access the complete revenue potential of IoT, hindering wider market growth and competition.

IoT Monetization Market Segment Analysis

By Application

Consumer Electronics dominated the IoT Monetization Market with the largest revenue share of approximately 71% in 2023 as a result of widespread adoption of smart devices, wearables, and networked home appliances. Increased consumer demand for convenience, automation, and real-time control has spurred the use of IoT-enabled solutions. The incorporation of sophisticated features such as voice assistants, AI, and real-time data analytics has opened up many monetization avenues through subscriptions, premium services, and usage-based pricing models, making this segment a major revenue driver.

Healthcare segment is expected to grow at the fastest CAGR of around 55.46% from 2024 to 2032 led by growing usage of remote patient monitoring, telehealth, and connected medical devices. Demand for access to real-time data, patient tracking, and predictive healthcare analytics is compelling healthcare providers to invest in IoT. Monetization opportunities are growing through outcome-based models, subscription platforms, and sophisticated diagnostics, providing strong growth in clinical and consumer health applications.

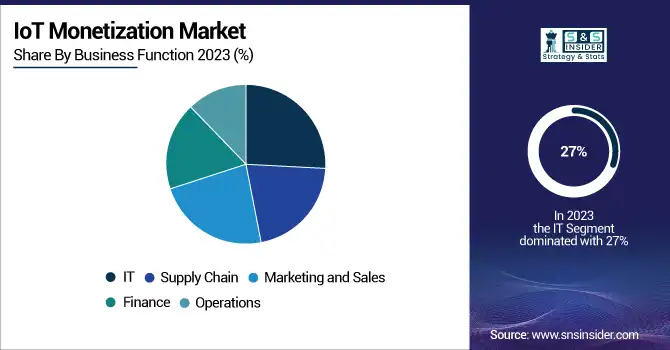

By Business Function

IT segment led the IoT Monetization Market with the largest revenue share of around 27% in 2023 because of its core contribution to facilitating infrastructure, connectivity, and data management for IoT ecosystems. Cloud computing, edge processing, and cybersecurity services provided by IT firms are essential to enabling large-scale deployments. These companies are also primary enablers of analytics, platform-as-a-service (PaaS), and AI integration, developing strong monetization frameworks across industries and perpetuating long-term dominance in the overall market landscape.

Supply Chain segment is expected to expand at the fastest CAGR of around 53.53% between 2024 and 2032 owing to rising adoption of IoT for real-time tracking, asset monitoring, and logistics optimization. Companies are using IoT to improve transparency, decrease delays, and minimize operational risk. Increased demands for predictive maintenance, automated inventory, and connected fleets are also establishing new streams of monetization via data-as-a-service, smart contracts, and performance-based logistics models, driving fast growth in this space.

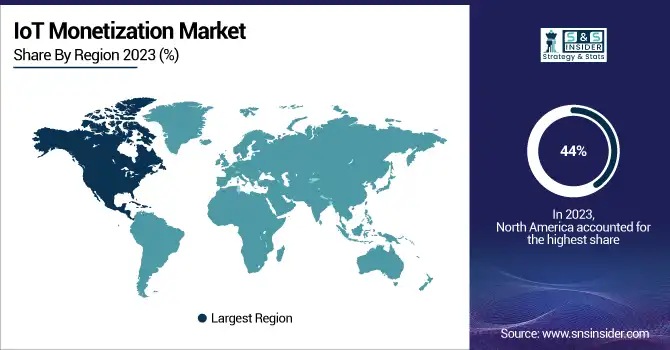

Regional Analysis

North America dominated the IoT Monetization Market with the highest revenue share of about 44% in 2023 due to its advanced digital infrastructure, high IoT adoption across industries, and strong presence of leading technology firms. The region benefits from early deployment of 5G, widespread use of smart devices, and significant investments in AI, edge computing, and cloud platforms. Supportive regulatory frameworks and a mature consumer base further enable innovative monetization strategies such as subscription models and usage-based billing.

Asia Pacific segment is expected to grow at the fastest CAGR of about 54.39% from 2024 to 2032 driven by rapid industrialization, expanding smart city projects, and increasing penetration of smartphones and connected devices. Governments across the region are heavily investing in IoT infrastructure, especially in countries like China, India, and Japan. The growth of e-commerce, manufacturing automation, and digital transformation initiatives across sectors presents vast monetization potential, propelling accelerated market expansion.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

SAP SE (SAP Leonardo IoT, SAP Edge Services)

-

General Electric Co. (Predix Platform, Asset Performance Management)

-

Telefonaktiebolaget LM Ericsson (Ericsson IoT Accelerator, Ericsson Device Connection Platform)

-

Intel Corporation (Intel IoT Platform, Intel Edge Insights)

-

Microsoft Corporation (Azure IoT Hub, Azure Digital Twins)

-

Oracle Corporation (Oracle IoT Cloud, Oracle Autonomous Database for IoT)

-

IBM Corporation (Watson IoT Platform, IBM Maximo)

-

Amdocs Ltd. (Amdocs IoT Monetization Platform, Amdocs Digital Commerce Suite)

-

Thales Group (Thales IoT Security Solutions, Thales Sentinel Licensing)

-

Cisco Systems, Inc. (Cisco IoT Control Center, Cisco Kinetic for Cities)

Recent Developments:

-

January 2024: SAP announced a company-wide transformation program aimed at enhancing its cloud and IoT offerings. This initiative is part of SAP's updated Ambition 2025 strategy, reflecting strong performance and anticipated benefits from the new program.

-

January 2025: GE Appliances, a Haier company, was honored with the "Smart Appliance Company of the Year" award at the 9th annual IoT Breakthrough Awards. This recognition highlights GE's advancements in integrating IoT technologies into their appliance offerings, contributing to the monetization of IoT solutions.

-

November 2024: Ericsson's Mobility Report indicated that the total number of cellular IoT connections reached 3.4 billion at the end of 2023 and is forecasted to approach 4 billion by the end of 2024. This growth underscores the expanding market for IoT monetization opportunities.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 639.88 Billion |

| Market Size by 2032 | US$ 27875.59 Billion |

| CAGR | CAGR of 52.1% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application Type (Retail, Healthcare, Automotive & Transportation, Industrial, Building & Home Automation, Agriculture, Energy, Consumer Electronics, Others) • By Business Function (Marketing and Sales, IT, Finance, Supply Chain, Operations) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | SAP SE, General Electric Co., Telefonaktiebolaget LM Ericsson, Intel Corporation, Microsoft Corporation, Oracle Corporation, IBM Corporation, Amdocs Ltd., Thales Group, Cisco Systems, Inc., PTC, Inc., Google Inc. |