ISO Container Market Key Insights:

To get more information on ISO Container Market - Request Sample Report

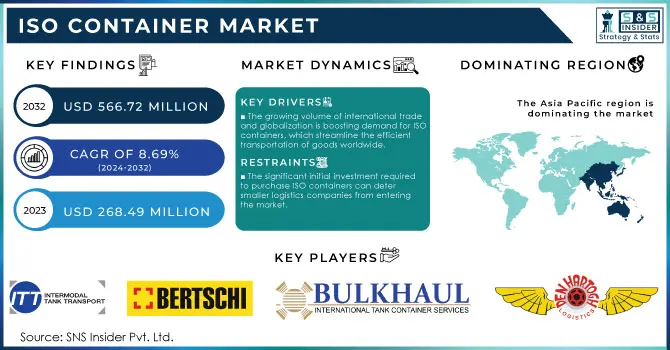

The ISO container Market size is expected to value at USD 268.49 Million in 2023 and is estimated to reach USD 566.72 Million by 2032 with a growing CAGR of 8.69% over the forecast period 2024-2032.

ISO containers are vital to the global supply chain, providing efficient transport and storage solutions across various industries. Standardized by the International Organization for Standardization (ISO), these containers typically come in two common sizes: 20 feet, with a volume of approximately 33.2 cubic meters, and 40 feet, which can hold about 67.7 cubic meters. With over 35 million ISO containers in circulation worldwide, their role in international trade logistics cannot be overstated. Constructed from robust materials like steel, ISO containers are designed to endure harsh environmental conditions and rough handling during transit. Their versatility allows them to accommodate a wide range of cargo, from perishables to hazardous materials, enabling businesses to optimize logistics operations without the need for repacking during intermodal transport. This adaptability is essential as the globalization of trade increases the demand for efficient and secure shipping solutions.

| Services | Description | Commercial Products |

|---|---|---|

| Standard ISO Containers | Intermodal containers adhering to ISO standards for international shipping and transport. | Maersk ISO Containers, Hapag-Lloyd Containers |

| Refrigerated ISO Containers | Temperature-controlled containers for transporting perishable goods. | Carrier Transicold, Daikin Reefer Containers |

| Tank ISO Containers | Containers designed for the transportation of liquids, gases, and chemicals. | Taree Global Tank Containers, TSI Tanks |

| Open Top ISO Containers | Containers with removable roofs for transporting heavy or oversized cargo. | Seaco Open Top Containers, Triton Open Top |

| Flat Rack ISO Containers | Flatbed containers used for heavy equipment and cargo that doesn’t fit in standard containers. | Textainer Flat Racks, Seaco Flat Racks |

| High Cube ISO Containers | Containers taller than standard height, offering more volume for cargo. | Maersk High Cube Containers, COSCO High Cube |

| ISO Logistics Services | Comprehensive services that include container leasing, transportation, and logistics management. | C.H. Robinson Logistics, Kuehne + Nagel Logistics |

| Container Tracking Solutions | Technologies that provide real-time tracking and monitoring of containers during transit. | ZIM Container Tracking, Maersk Remote Container |

| Custom ISO Container Solutions | Tailored containers designed to meet specific customer requirements or industry standards. | CIMC Custom Containers, Singamas Custom Solutions |

Moreover, advancements in technology are enhancing the functionality of ISO containers. A growing number are being equipped with IoT technology, with projections indicating that around 30% of all shipping containers will be smart containers by 2025. These innovations enable real-time tracking and monitoring, improving supply chain visibility and reducing the risk of cargo loss or damage. Sustainability is becoming increasingly significant in the ISO container market, as companies aim to minimize their environmental impact. This shift has sparked interest in eco-friendly materials and practices, with many exploring recyclable container options that reduce carbon emissions during production and transport. Currently, over 60% of companies involved in international shipping utilize ISO containers due to their reliability and versatility, especially in sectors like agriculture, electronics, and automotive.

MARKET DYNAMICS

DRIVERS

- The growing volume of international trade and globalization is boosting demand for ISO containers, which streamline the efficient transportation of goods worldwide.

The surge in global trade growth and the interconnectedness of economies are significantly influencing the demand for ISO containers. As international trade expands, businesses seek efficient methods to transport goods across borders, making ISO containers essential for global logistics. These containers are standardized, durable, and versatile, allowing for seamless movement of various types of cargo, including perishables, textiles, machinery, and hazardous materials. The use of ISO containers not only enhances efficiency but also reduces shipping costs and transit times, which are critical in today’s fast-paced market.

In 2022, approximately 1.8 billion twenty-foot equivalent units (TEUs) were transported worldwide, reflecting the increasing reliance on container shipping. Over 90% of global trade by volume is carried by shipping containers, underscoring their pivotal role in the logistics industry. The rise of e-commerce further fuels the demand for ISO containers, as retailers and suppliers need reliable shipping solutions to meet consumer expectations for quick and efficient delivery. Additionally, advancements in logistics technology, such as digital tracking and automated handling systems, are improving the overall efficiency of container shipping, making it an attractive option for businesses. As trade agreements continue to evolve and new markets emerge, the demand for ISO containers is expected to grow, further solidifying their importance in global trade dynamics.

- The expansion of e-commerce has significantly increased the demand for shipping containers, particularly ISO containers, to efficiently transport goods in logistics and supply chain management.

The expansion of e-commerce has fundamentally transformed the logistics and supply chain landscape, driving an unprecedented demand for efficient transportation solutions. As consumers increasingly favor online shopping, the volume of goods requiring swift and reliable delivery has surged. This shift necessitates a robust infrastructure capable of supporting the rapid movement of products from manufacturers to consumers, prominently featuring ISO containers. These standardized containers facilitate the efficient handling, storage, and transportation of goods across various modes of transport, including ships, trucks, and trains.

The adoption of e-commerce platforms has encouraged businesses to streamline their supply chains, leading to an increase in inventory turnover rates. As a result, companies are optimizing their logistics operations to ensure quicker fulfillment of customer orders. In this context, ISO containers serve as a vital tool, enabling retailers and wholesalers to efficiently manage their inventory while minimizing shipping costs and transit times. The versatility and reliability of ISO containers not only support e-commerce businesses in meeting consumer expectations for fast delivery but also enhance overall supply chain resilience. Thus, the interplay between the growth of e-commerce and the demand for ISO containers is a key driver in the logistics industry, shaping the future of global trade and transportation.

RESTRAIN

- The significant initial investment required to purchase ISO containers can deter smaller logistics companies from entering the market.

The logistics industry increasingly relies on ISO containers for efficient and standardized transportation of goods. However, one of the major barriers to entry for smaller logistics companies is the high initial costs associated with purchasing these containers. For smaller firms, this substantial investment can strain budgets, especially when coupled with other startup expenses like transportation vehicles, warehousing, and operational costs. Furthermore, the expenses extend beyond the initial purchase; companies must also consider maintenance, storage, and insurance costs, which can accumulate over time.

According to the research indicates that approximately 50% of small logistics companies struggle to manage the upfront capital required to enter the ISO container market. As a result, many opt for leasing options, which can also be financially burdensome, leading to long-term commitments without ownership benefits. The reluctance to invest in ISO containers can limit smaller firms' ability to compete with larger, established companies that have the financial flexibility to absorb such costs. This situation creates a barrier to market entry, restricting innovation and service diversification in the logistics sector. To foster a more inclusive market environment, potential solutions could include financing programs or partnerships with container suppliers, enabling smaller companies to access the necessary resources without incurring overwhelming financial pressure.

KEY SEGMENTATION ANALYSIS

By Transport Mode

The marine transport segment dominated the market share over 38.42% in 2023. Approximately 90% of global trade by volume is carried out via shipping, making marine transport indispensable for the movement of ISO containers. The efficiency and cost-effectiveness of transporting large volumes of goods over long distances by sea bolster its prominence in international logistics. In fact, around 60% of ISO containers are utilized in maritime shipping operations.

By Capacity

The 20,000 to 35,000 liters segment dominated the market share over 44.08% in 2023. These containers are particularly beneficial for the logistics industry, facilitating the movement of perishable items like food and pharmaceuticals, as well as non-perishable goods such as industrial chemicals and agricultural products. Their design allows for easy loading and unloading, optimizing operational efficiency. Furthermore, the growing trend toward globalization and increased demand for reliable supply chains are driving the adoption of these containers. Additionally, the food and beverage sector is projected to account for around 30% of containerized trade, underscoring the critical role of ISO containers in modern logistics and supply chain management.

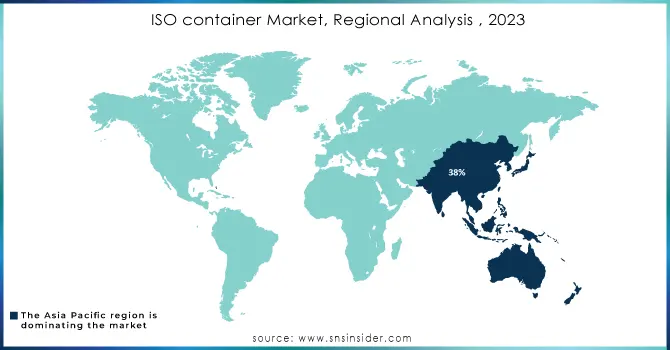

KEY REGIONAL ANALYSIS

The Asia Pacific region dominated the market share over 38 % in 2023, primarily due to its strategic position as a global manufacturing hub and a key player in international trade. Countries like China, Singapore, and South Korea serve as significant container terminals, facilitating a high volume of shipping activities. The Port of Shanghai is consistently ranked as one of the busiest ports in the world, handling over 40 million TEUs (Twenty-foot Equivalent Units) annually. China's robust industrial base, characterized by rapid urbanization and economic development, drives the demand for ISO containers, which are essential for transporting goods across borders. Notably, China dominates global container production, accounting for over 80% of the total output. This impressive production capability translates to approximately 2 million containers produced each year, ensuring a steady supply to meet both domestic and international needs.

The European market for ISO containers is poised for significant growth, fueled by a resurgence in maritime trade activities across the continent. Europe boasts approximately 1,000 commercial ports, with major hubs like Rotterdam, Antwerp, and Hamburg leading the way in container throughput. Furthermore, around 70% of Europe's freight transport is conducted via maritime routes, highlighting the importance of shipping in the region’s supply chain. The container shipping sector employs nearly 600,000 individuals across various functions, from logistics to manufacturing, showcasing the industry’s contribution to job creation. In terms of sustainability, more than 50% of European shipping companies are adopting eco-friendly practices, including the use of energy-efficient ISO containers, in response to strict environmental regulations.

Do You Need any Customization Research on ISO Container Market - Inquire Now

KEY PLAYERS

Some of the major key players of ISO Container Market

-

Intermodal Tank Transport (Specialized tank containers)

-

Bertschi AG (Chemical tank containers)

-

Bulkhaul Limited (Chemical and gas tank containers)

-

Royal Den Hartogh Logistics (Chemical ISO tank containers)

-

HOYER GmbH (Liquid bulk containers)

-

Interflow TCS Ltd. (Gas and chemical ISO tanks)

-

New Port Tank (ISO tank containers)

-

Sinochain Logistics Co., Ltd. (ISO liquid tank containers)

-

Stolt-Nielsen Limited (Tank containers for bulk liquids)

-

CIMC (China International Marine Containers) (Standard dry cargo and tank containers)

-

Singamas Container Holdings Ltd. (Dry freight containers, refrigerated containers)

-

W&K Containers, Inc. (Dry and specialty containers)

-

TLS Offshore Containers International (Offshore DNV containers)

-

Danteco Industries BV (Tank containers for liquid chemicals)

-

Container Corporation of India Ltd. (CONCOR) (Freight containers)

-

Seaco Global Ltd. (Dry freight containers, tank containers)

-

UBE Industries, Ltd. (Chemical tank containers)

-

Trifleet Leasing (Leased tank containers)

-

VTG Tanktainer GmbH (Liquid chemical tank containers)

-

Eurotainer SA (Bulk liquid ISO tank containers)

Suppliers for Specializes in refrigerated containers, ideal for cold chain logistics and temperature-sensitive goods of ISO Container Market:

-

CIMC (China International Marine Containers)

-

Singamas Container Holdings Ltd.

-

Maersk Container Industry (MCI)

-

TLS Offshore Containers

-

BSL Containers

-

Florens Container Services

-

Sea Box, Inc.

-

Container Technology, Inc.

-

W&K Containers, Inc.

-

Hoover Ferguson

RECENT DEVELOPMENTS

-

In 2024: Dana is set to open a new ISO tank container depot in Kansas City, Kansas, adjacent to a Union Pacific location, with operations expected to begin in mid-July. The facility aims to centralize tank fleets and enhance transloading capabilities, expanding Dana's existing network.

-

In March 2024: H&S Group, one of Europe's leading food and liquid transport companies, Royal Den Hartogh Logistics is broadening its services to offer global transportation of chemicals, gases, and foodstuffs.

-

In 2024: Airbus Defence and Space unveiled the first serial model of the protected casualty transport container for the Bundeswehr, enhancing capabilities for overland patient transport.

-

In December 2023: Stolt Tankers became the first shipping company globally to apply an advanced, durable coating to the hull of one of its chemical tankers.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 268.49 Million |

| Market Size by 2032 | USD 566.72 Million |

| CAGR | CAGR of 8.69% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Transport Mode (Road, Rail, Marine) •By Capacity (Below 20,000 Liters, 20,000 - 35,000 Liters, Above 35,000 Liters) •By Container Type (Multi-Compartment Tank, Lined Tank, Reefer Tank, Cryogenic & Gas Tanks, Swap Body Tank) •By End-use Industry, (Chemicals, Petrochemicals, Food & Beverage, Pharmaceuticals, Industrial Gas, Others (Paints) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Intermodal tank transport, Bertschi AG, Bulkhaul Limited, Royal Den Hartogh Logistics, HOYER GmbH, Interflow TCS Ltd., New Port Tank, Sinochain Logistics Co., Ltd., Stolt-Nielsen Limited, CIMC, Singamas Container Holdings Ltd., W&K Containers, Inc., TLS Offshore Containers International, Danteco Industries BV, Container Corporation of India Ltd. (CONCOR), Seaco Global Ltd., UBE Industries, Ltd., Trifleet Leasing, VTG Tanktainer GmbH, and Eurotainer SA. |

| Key Drivers | • The growing volume of international trade and globalization is boosting demand for ISO containers, which streamline the efficient transportation of goods worldwide. • The expansion of e-commerce has significantly increased the demand for shipping containers, particularly ISO containers, to efficiently transport goods in logistics and supply chain management. |

| RESTRAINTS | • The significant initial investment required to purchase ISO containers can deter smaller logistics companies from entering the market. |