CNC Machine Tools Market Report Scope & Overview:

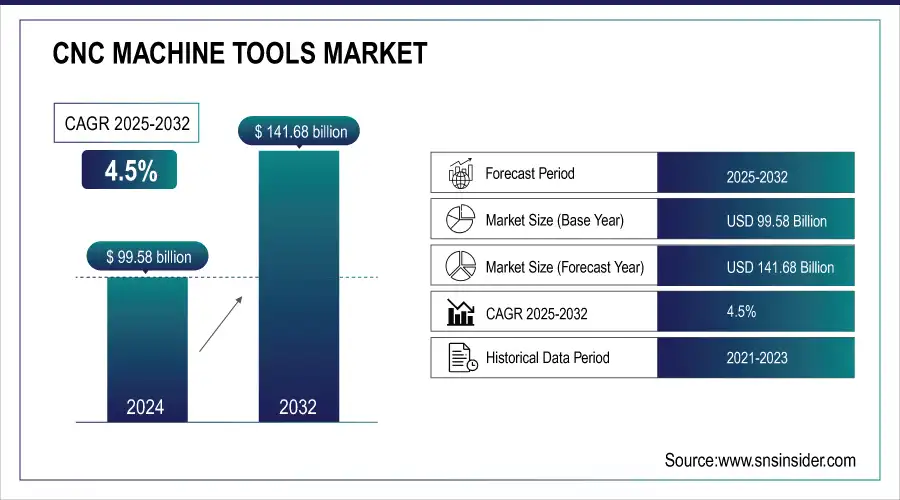

The CNC Machine Tools Market was valued at USD 99.58 billion in 2024 and is expected to reach USD 141.68 billion by 2032, growing at a CAGR of 4.5% from 2025-2032.

The global demand for milling machines is rising due to the growth of metalworking industries. These machines offer versatile functions, including filleting, turning, chamfering, drilling, and gear cutting, and can perform multiple cuts with various cutters. Key sectors benefiting include automotive, aerospace, defense, and railways. CNC machines dominate the machine tools market, driven by manufacturers seeking higher productivity, innovation, and precision. Advanced CNC technology enables automation, reduces human error, and improves operational efficiency and time management. Increasing adoption of CNC solutions is expected to further expand the global milling machine market in the coming years.

To get more information on CNC Machine Tools Market - Request Free Sample Report

In May 2023, DMG MORI launched the LASERTEC SLM 30 US, featuring contactless recoating, adjustable laser control, hybrid toolpaths, and cost-effective production for complex parts with an 11.8-inch cubic workspace.

CNC Machine Tools Market Trends

-

Rising demand for precision manufacturing and automation is driving CNC machine tool adoption.

-

Integration with IoT, AI, and advanced sensors is enhancing productivity, accuracy, and predictive maintenance.

-

Growing use in automotive, aerospace, and electronics industries is boosting market growth.

-

Adoption of multi-axis and high-speed CNC machines is improving operational efficiency.

-

Expansion of smart factories and Industry 4.0 initiatives is accelerating technology deployment.

-

Increasing focus on energy-efficient and environmentally friendly machining solutions is shaping market trends.

-

Collaborations between machine tool manufacturers, software providers, and industrial firms are fostering innovation and advanced applications.

CNC Machine Tools Market Growth Drivers:

-

The growing shift towards automated manufacturing processes is boosting demand for CNC machine tools.

the growing usage of automated manufacturing processes is fuelling demand for Computer Numerical Control (CNC) machine tools. As we progressively move into the era of high productivity and construction levels, CNC machines are a necessity as they can automate intricate tasks, minimize manual errors and accelerate production. It is a very flexible tool which can produce complex structures with high quality every time of the same shape and it makes them perfect for automotive, aerospace or electronic industry. Automation is becoming more pervasive as high-volume production, cost reduction and critical adaptation to rapidly changing market demands are key drivers of this change. Further, the rising integration of multi-axis machining along with AI in CNC technology is adding to their allure and ultimately boosting demand among several industries. They will do so to keep pace with competition in an industrial environment that is becoming increasingly automated and digitalized.

-

Government policies promoting manufacturing and industrial growth drive CNC machine tool demand.

Government initiatives that support the expansion of manufacturing and industry greatly increase the need for CNC (Computer Numerical Control) machine tools. Many times, these policies offer rewards such as tax benefits, financial aid, and funding to promote the utilization of cutting-edge manufacturing technologies, motivating businesses to put their money into up-to-date CNC machinery. By creating a favorable setting for industrial growth, these measures result in higher manufacturing capabilities and a demand for precise, effective equipment. Additionally, efforts such as "Make in India" and other worldwide campaigns highlight the importance of local manufacturing, prompting industries to invest in CNC machines to enhance production capabilities and meet quality requirements and competitive timelines. Moreover, the government's funding for infrastructure development and defense industries generates significant need for CNC machine tools due to their requirement for precision components. Emphasis on training programs and skill development results in a proficient workforce that can operate advanced machinery, speeding up the adoption of CNC machines. In general, these initiatives by the government not only improve manufacturing capabilities but also result in increased demand for CNC machine tools as industries aim to boost efficiency, accuracy, and competitiveness in the international market.

CNC Machine Tools Market Restraints:

-

High upfront costs for CNC machines hinder adoption by small and medium-sized businesses.

The considerable initial expenses of CNC machines greatly impede their acceptance among small and medium-sized businesses (SMBs). These machines, crucial for accurate manufacturing, demand a significant amount of money to purchase, sometimes exceeding hundreds of thousands of dollars. For small and medium-sized businesses, this expense may be too high, particularly when considering extra costs like software, training, maintenance, and possible operational disruptions while implementing the system. Smaller businesses struggle to justify spending because they have less financial flexibility compared to bigger companies. This financial obstacle may restrict their capacity to participate in competitive markets that require accuracy and effectiveness, possibly hindering progress and creativity. As a result, numerous small and medium-sized businesses choose to postpone implementing CNC technology or select cheaper alternatives, leading to potential compromises in their competitive advantage and overall production abilities.

CNC Machine Tools Market Segment Analysis

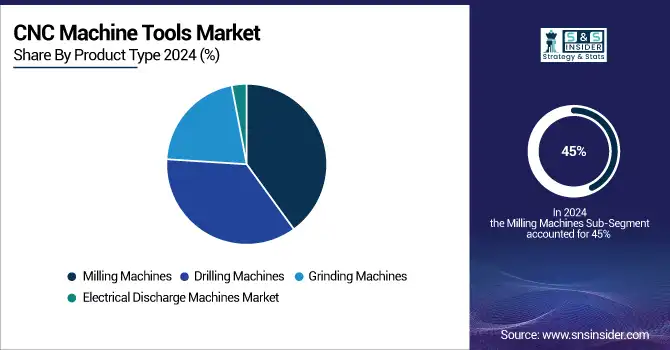

By Product Type, Milling machines dominated in 2024 with a 45% market share.

In 2024, milling machines held the largest market share of 45%, primarily utilized for metal cutting across various industries. The increasing growth of metalworking industries globally has caused a need for milling machines to rise. Milling machines have great versatility and can carry out various tasks like filleting, turning, chamfering, drilling, gear cutting, and more. They are also capable of making numerous cuts with multiple cutters. The benefits of milling machines make them well-suited for the automotive, aerospace, defense, and railway sectors.

By Industry, Automotive and transportation sector held the largest share in 2024 at 42.02%.

In 2024, the automotive and transportation sector held a majority market share of 42.02% due to the increased need for quicker production of more effective components in the automotive industry. These machines can manufacture various components such as suspension parts, car combustion engines, exhaust systems, lights, bushings, fluid system parts, and valve retainers. The automotive industry demands accuracy, precision, efficiency, and consistency in tasks, resulting in the growing use of CNC machines in this field.

CNC Machine Tools Market Regional Analysis

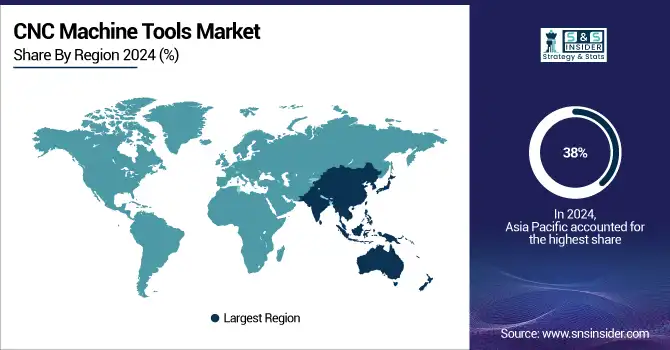

Asia Pacific CNC Machine Tools Market Insights

In 2024, Asia Pacific dominated the market with a share of 38%. The area plays a crucial role in the expansion of the worldwide CNC Machine industry, in terms of both manufacturing and distribution. The increasing number of elderly individuals in China and Japan has caused labor expenses to increase, prompting a rise in the utilization of automation. The growing population in the Asia Pacific region is also luring companies to make investments there.

Need any customization research on CNC Machine Tools Market - Enquiry Now

North America CNC Machine Tools Market Insights

North America holds a significant share in the CNC machine tools market, driven by advanced manufacturing, automotive, aerospace, and defense sectors. The region benefits from technological innovation, automation adoption, and high demand for precision machining. Growing investment in smart factories, Industry 4.0 initiatives, and government support for advanced manufacturing further boost CNC machine adoption. Rising emphasis on productivity, efficiency, and product quality continues to propel market growth across the United States and Canada.

Europe CNC Machine Tools Market Insights

Europe represents a key market for CNC machine tools, supported by strong automotive, aerospace, and precision engineering industries. High adoption of advanced manufacturing technologies, automation, and Industry 4.0 solutions drives demand. Germany, Italy, and France lead in production and usage, focusing on efficiency, accuracy, and sustainable manufacturing. Government incentives, skilled labor, and investments in R&D further strengthen Europe’s position, fostering continued growth in CNC machine tool adoption across the region.

Middle East & Africa and Latin America CNC Machine Tools Market Insights

The Middle East & Africa and Latin America CNC machine tools markets are witnessing steady growth, driven by industrialization, infrastructure development, and the expansion of automotive and aerospace sectors. Rising demand for precision machining, labor efficiency, and modernization of manufacturing facilities supports adoption. Additionally, increasing investments in smart factories, government initiatives, and awareness of advanced manufacturing technologies are encouraging the uptake of CNC machine tools across these regions.

CNC Machine Tools Market Competitive Landscape:

Mazak Corporation

Mazak Corporation is a leading player in the CNC machine tools market, offering innovative multi-tasking, turning, and milling solutions. Its machines are recognized for high precision, reliability, and efficiency, serving automotive, aerospace, and industrial sectors. Mazak’s focus on automation, smart factory integration, and user-friendly controls enhances productivity and reduces operational costs, driving adoption worldwide.

-

2024: At IMTS 2024, Mazak expanded its NEO Series with HQR 200/3 NEO and HQR 250/3 NEO, multi-tasking turning centers featuring two spindles, three turrets, and the MAZATROL SmoothG³ control.

Okuma Corporation

Okuma Corporation is a prominent player in the CNC machine tools market, providing advanced solutions for turning, milling, and multitasking applications. Its machines are renowned for precision, durability, and energy efficiency, catering to automotive, aerospace, and industrial sectors. Okuma emphasizes digital integration, smart operation, and sustainability, enhancing productivity and reducing operational costs for manufacturers globally.

-

2024: Okuma Corporation unveiled the OSP-P500 CNC control featuring Digital Twin on-machine simulation, Smart OSP Operation for ease-of-use, and Eco Suite Plus for energy efficiency implemented across its 5-axis and Multus series.

-

2023: Began shipping its Green-Smart Machine in Japan, integrating next-gen OSP-P500, energy-saving technologies, high precision, and DX capabilities in 5-axis and multitasking centers.

Key Players

Some of the CNC Machine Tools Market Companies

-

Fanuc Corporation

-

Datron AG

-

DMG Mori

-

Dalian Machine Tool Group (DMTG) Corporation

-

Mazak Corporation

-

Doosan Machine Tools

-

Makino Milling Machine Co., Ltd.

-

Hyundai WIA Corporation

-

Mori Seiki Co., Ltd.

-

Cincinnati Incorporated

-

EMCO Group

-

Victor Taichung Machinery Works Co., Ltd.

-

Hurco Inc.

-

Brother Industries, Ltd.

-

Shenyang Machine Tool Co. Ltd. (SMTCL)

-

Hurco Companies Inc.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | US$ 99.58 Billion |

| Market Size by 2032 | US$ 141.68 Billion |

| CAGR | CAGR of 4.5% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Milling Machines, Drilling Machines, Grinding Machines, Electrical Discharge Machines Market) • By Industry Segment (Automotive and Transportation, Sheet Metals, Capital Goods, Energy Market) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Amada Co. Ltd, Amera Seiki, Fanuc Corporation, Datron AG, DMG Mori, Dalian Machine Tool Group (DMTG) Corporation, Mazak Corporation, Doosan Machine Tools, Makino Milling Machine Co., Ltd., Hyundai WIA Corporation, Mori Seiki Co., Ltd., Cincinnati Incorporated, EMCO Group, Victor Taichung Machinery Works Co., Ltd., Hurco Inc., Brother Industries, Ltd., Haas Automation Inc., Okuma Corporation, Shenyang Machine Tool Co. Ltd. (SMTCL), Hurco Companies Inc. |