IT Service Management Market Report Scope & Overview:

IT Service Management Market was valued at USD 14.77 billion in 2025E and is expected to reach USD 47.88 billion by 2032, growing at a CAGR of 15.94% from 2026-2033.

The IT Service Management Market is experiencing strong growth due to increasing digital transformation, cloud adoption, and the rising need for efficient IT operations across industries. Organizations are prioritizing automation, AI-driven service management, and self-service portals to enhance user experience and operational efficiency. Additionally, the growing reliance on hybrid and multi-cloud environments is driving demand for advanced ITSM solutions to ensure seamless infrastructure management and business continuity.

To Get More Information On IT Service Management Market - Request Free Sample Report

Market Size and Forecast

-

Market Size in 2025: USD 14.77 Billion

-

Market Size by 2033: USD 47.88 Billion

-

CAGR: 15.94% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

IT Service Management Market Trends

-

Rising demand for efficient IT operations and digital transformation is driving the IT service management (ITSM) market.

-

Growing adoption across enterprises to streamline workflows, improve service delivery, and enhance user experience is boosting growth.

-

Expansion of cloud computing, AI, and automation integration is enhancing operational efficiency and analytics.

-

Increasing focus on IT governance, compliance, and risk management is shaping market trends.

-

Advancements in self-service portals, incident management, and configuration management tools are improving productivity.

-

Growing use of ITSM in healthcare, BFSI, manufacturing, and telecom sectors is fueling adoption.

-

Collaborations between IT service providers, software vendors, and enterprises are accelerating innovation and deployment globally.

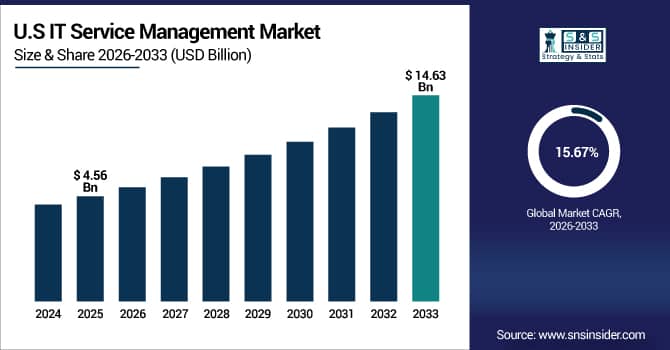

U.S. IT Service Management Market was valued at USD 4.56 billion in 2025E and is expected to reach USD 14.63 billion by 2032, growing at a CAGR of 15.67% from 2026-2033.

The U.S. IT Service Management Market is growing due to increasing enterprise digitization, widespread cloud adoption, and rising demand for AI-driven automation. Strong focus on IT governance, compliance, and improved service delivery further accelerates adoption across major industries.

IT Service Management Market Growth Drivers:

-

Integration of Artificial Intelligence and Automation Tools in IT Service Management is Enhancing Operational Efficiency

Organizations are integrating AI, machine learning, and automation into ITSM platforms to optimize workflows, predict incidents, and reduce response times. AI-driven analytics provide insights into IT performance, enabling proactive problem resolution and improved decision-making. Automation reduces repetitive manual tasks, minimizes human error, and improves productivity in service operations. Enterprises across sectors such as BFSI, healthcare, and IT are adopting intelligent ITSM solutions to enhance service quality and operational efficiency. This technological advancement and integration of AI in ITSM platforms are a key factor driving rapid market adoption and expansion globally.

IT Service Management Market Restraints:

-

High Implementation and Maintenance Costs of IT Service Management Solutions are Limiting Market Penetration

The deployment of ITSM solutions, particularly in large enterprises, involves significant investment in licensing, infrastructure, and training. Small and medium-sized enterprises often face budget constraints that limit adoption of advanced ITSM platforms. Continuous maintenance, updates, and integration with existing systems increase operational costs. Additionally, complex IT environments require expert personnel, adding to financial burdens. High costs associated with ITSM implementation restrict widespread adoption in cost-sensitive organizations, especially in emerging markets. Consequently, financial constraints and high total cost of ownership act as a major restraint, slowing the market’s overall growth potential globally.

IT Service Management Market Opportunities:

-

Growing Demand for Unified IT Service Management Platforms Across Industries is Creating Market Expansion Potential

Enterprises are seeking integrated ITSM platforms that combine incident management, asset tracking, change management, and reporting. A unified approach reduces operational silos, improves collaboration, and enhances service delivery efficiency. Increasing digital transformation initiatives across sectors like BFSI, healthcare, and retail drive demand for consolidated ITSM solutions. Vendors have opportunities to develop modular, customizable platforms catering to enterprise-specific requirements. Additionally, cloud and hybrid deployments allow easy scalability. The rising need for unified platforms represents a key opportunity for ITSM providers to expand market presence and capture emerging customer segments globally.

IT Service Management Market Segment Highlights

-

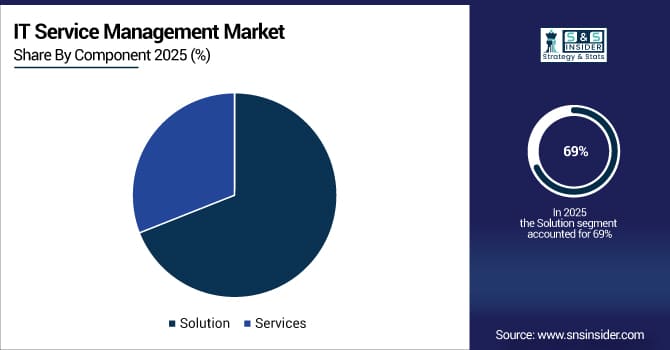

By Component, Solution dominated with ~69% share in 2025; Services fastest growing (CAGR).

-

By Enterprise Size, Large Enterprises dominated with ~68% share in 2025; SMEs fastest growing (CAGR).

-

By Technology, Network Management dominated with ~29% share in 2025; Performance Management fastest growing (CAGR).

-

By Vertical, IT & Telecom dominated with ~27% share in 2025; Healthcare fastest growing (CAGR).

-

By Deployment, Cloud dominated with ~63% share in 2025; Cloud fastest growing (CAGR).

IT Service Management Market Segment Analysis

By Component, Solution segment dominated in 2025; Services segment expected fastest growth 2026–2033

Solution segment dominated the IT Service Management Market in 2025 due to widespread enterprise adoption for incident management, asset tracking, and workflow automation. Solutions enable organizations to streamline IT operations, reduce downtime, and improve service delivery efficiency, making them the preferred choice for large-scale IT infrastructure management and strategic digital transformation initiatives globally.

Services segment is expected to grow at the fastest CAGR from 2026-2033 owing to increasing demand for managed ITSM services, consulting, integration, and support. Outsourcing IT service management helps organizations reduce operational complexity, improve system performance, and leverage expert guidance, driving rapid adoption of service-based ITSM offerings across diverse enterprise environments worldwide.

By Enterprise Size, Large Enterprises segment led in 2025; SMEs segment projected fastest growth 2026–2033

Large Enterprises segment dominated the IT Service Management Market in 2025 as these organizations have complex IT infrastructure, higher budgets, and stringent operational requirements. Large-scale adoption of ITSM solutions helps streamline multi-department workflows, enhance service quality, and ensure compliance, making large enterprises the primary revenue contributor in the market globally.

SMEs segment is expected to grow at the fastest CAGR from 2026-2033 due to increasing digital transformation initiatives and affordability of cloud-based ITSM solutions. SMEs are adopting scalable, cost-effective platforms to improve IT efficiency, automate workflows, and enhance service delivery, leading to accelerated market penetration and rapid growth in this segment globally.

By Technology, Network Management segment dominated in 2025; Performance Management segment anticipated fastest growth 2026–2033

Network Management segment dominated the IT Service Management Market in 2025 because enterprises require robust monitoring and management of IT networks to ensure uptime, performance, and reliability. High demand for network visibility, fault detection, and bandwidth optimization drove adoption, positioning network management as the leading technology segment in ITSM deployments globally.

Performance Management segment is expected to grow at the fastest CAGR from 2026-2033 due to rising focus on monitoring IT service efficiency, resource utilization, and service-level agreements. Organizations are increasingly adopting performance management tools to optimize IT operations, predict failures, and enhance overall productivity, driving rapid growth of this technology segment globally.

By Vertical, IT & Telecom segment led in 2025; Healthcare segment projected fastest growth 2026–2033

IT & Telecom segment dominated the IT Service Management Market in 2025 owing to extensive IT infrastructure, high service demand, and complex network environments in this sector. Adoption of ITSM solutions helps manage incidents, ensure uptime, and deliver seamless services, making IT & Telecom the primary revenue-generating vertical globally.

Healthcare segment is expected to grow at the fastest CAGR from 2026-2033 due to increasing adoption of ITSM for hospital IT management, patient data security, and workflow automation. Growing digitalization of healthcare operations and stringent compliance requirements are driving rapid deployment of ITSM solutions in hospitals, clinics, and healthcare enterprises worldwide.

By Deployment, Cloud segment dominated in 2025 and is expected fastest growth 2026–2033

Cloud segment dominated the IT Service Management Market in 2025 due to its scalability, flexibility, and cost-effectiveness, enabling organizations to manage IT services efficiently without heavy on-premises infrastructure. Cloud-based ITSM allows remote access, easy integration with existing systems, and faster deployment, making it highly preferred by enterprises. It is expected to grow at the fastest CAGR from 2026-2033 as organizations increasingly adopt cloud solutions for digital transformation, enhanced collaboration, real-time monitoring, and automated IT service management across diverse industries globally.

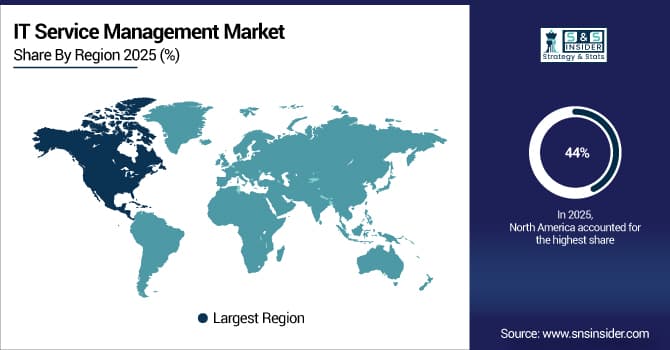

IT Service Management Market Regional Analysis

North America IT Service Management Market Insights

North America dominated the IT Service Management Market in 2025 with the highest revenue share of about 44% due to widespread adoption of advanced ITSM solutions, strong presence of key vendors, and well-established IT infrastructure. High demand for cloud-based platforms, digital transformation initiatives, and stringent compliance requirements in enterprises across BFSI, healthcare, and IT sectors further strengthened market dominance, driving consistent revenue generation and making North America the leading region in IT service management adoption globally.

Get Customized Report as Per Your Business Requirement - Enquiry Now

Asia Pacific IT Service Management Market Insights

Asia Pacific is expected to grow at the fastest CAGR of about 17.92% from 2026-2033 due to increasing digital transformation initiatives, rising cloud adoption, and expanding IT infrastructure in emerging economies such as India, China, and Japan. Growing demand for automated IT services, enhanced operational efficiency, and rising investments from global ITSM vendors are driving rapid adoption. Additionally, the expansion of SMEs and enterprise modernization efforts contributes significantly to the accelerated growth of the ITSM market in the region.

Europe IT Service Management Market Insights

Europe accounted for a significant share of the IT Service Management Market in 2025, driven by strong enterprise digitalization, data governance regulations, and the widespread shift toward cloud-based ITSM platforms. Organizations across BFSI, government, and manufacturing sectors are prioritizing automation, cybersecurity, and IT compliance. Moreover, increasing adoption of ITIL-based frameworks and integration of AI-driven service desk solutions are enhancing operational efficiency, supporting steady ITSM market growth across the region.

Middle East & Africa and Latin America IT Service Management Market Insights

The Middle East & Africa IT Service Management Market is expanding steadily due to increasing digital transformation initiatives, cloud adoption, and government-driven smart city projects. Enterprises are focusing on IT modernization to improve service delivery and compliance. In Latin America, growth is fueled by rising investment in IT infrastructure, expanding SME adoption of cloud-based ITSM solutions, and growing demand for cost-efficient, automated service management across sectors like BFSI, telecom, and retail.

IT Service Management Market Competitive Landscape:

IBM

IBM is a global technology and consulting company providing AI, cloud computing, and enterprise software solutions. Its IT service management offerings integrate AI, automation, and advanced analytics to optimize operations and decision-making. IBM focuses on embedding cutting-edge AI models into enterprise workflows, enhancing efficiency, accuracy, and business intelligence while supporting digital transformation across industries.

-

2025: Announced a strategic partnership with Anthropic to integrate its Claude AI models into IBM's enterprise software, aiming to enhance AI capabilities within ITSM solutions.

Atlassian

Atlassian is an Australian software company specializing in collaboration and IT service management tools such as Jira, Confluence, and Trello. Its platforms help organizations automate workflows, track issues, and improve team collaboration across IT and business operations. Atlassian integrates AI-driven automation to optimize incident response and operational efficiency, supporting scalable and agile service management.

-

2024: Introduced new functionalities in Jira Service Management to automate alert and issue remediation flows, enhancing operational efficiency.

BMC Software

BMC Software is a global leader in IT management solutions, providing IT service management, automation, and cloud infrastructure tools. Its AI-driven IT operations platform enables organizations to predict, detect, and resolve issues quickly while improving service quality. BMC focuses on integrating virtual assistants and generative AI to support IT teams and optimize operational processes.

-

2024: Launched the BMC Ask HelixGPT virtual assistant within BMC Helix AIOps, utilizing AI to assist IT operations teams in troubleshooting and incident resolution.

Microsoft

Microsoft is a global technology leader offering software, cloud services, and AI solutions. Its IT service management and developer tools, including Azure and GitHub, enable enterprises to build, deploy, and manage applications efficiently. Microsoft emphasizes cloud scalability, AI integration, and seamless workflow management to support enterprise digital transformation initiatives worldwide.

-

2024: Announced plans to move GitHub's infrastructure to its Azure cloud platform over the next 18 months, aiming to enhance scalability and integration with AI services.

Broadcom

Broadcom Inc. provides semiconductor and enterprise software solutions, including ITSM and cloud transformation tools. Its enterprise software offerings leverage AI and automation to optimize IT operations, reduce downtime, and accelerate digital transformation initiatives. Broadcom focuses on integrating cloud-native solutions and AI-driven analytics to enhance IT service delivery across global enterprises.

-

2024: Introduced new innovations at VMware Explore 2024, focusing on accelerating cloud transformations and harnessing AI in enterprise environments.

Key Players

Some of the IT Service Management Market Companies

-

ServiceNow

-

Atlassian

-

BMC Software

-

Ivanti

-

Microsoft

-

Broadcom

-

Kaseya + Datto

-

Freshworks

-

Zoho (ManageEngine)

-

SolarWinds

-

TeamDynamix

-

IBM

-

EasyVista

-

TOPdesk

-

SysAid

-

Cherwell (Ivanti)

-

InvGate

-

Alemba

-

Access Group

-

Aranda Software

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 14.77 Billion |

| Market Size by 2033 | USD 47.88 Billion |

| CAGR | CAGR of 15.94% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Solution, Services) • By Technology (Configuration Management, Performance Management, Network Management, Database Management System, Other Applications) • By Deployment (Cloud, On-Premises) • By Enterprise Size (SMEs, Large Enterprises) • By Vertical (BFSI, Healthcare, Retail & E-Commerce, IT & Telecom, Energy & Utilities, Government, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | ServiceNow, Atlassian, BMC Software, Ivanti, Microsoft, Broadcom, Kaseya + Datto, Freshworks, Zoho (ManageEngine), SolarWinds, TeamDynamix, IBM, EasyVista, TOPdesk, SysAid, Cherwell (Ivanti), InvGate, Alemba, Access Group, Aranda Software |