Maritime Cybersecurity Market Report Scope & Overview:

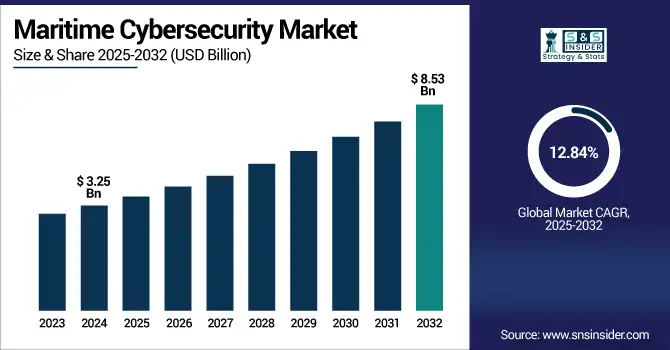

The Maritime Cybersecurity Market size was valued at USD 3.25 billion in 2024 and is expected to reach USD 8.53 billion by 2032, growing at a CAGR of 12.84% during 2025-2032.

Maritime Cybersecurity Market growth is being driven by the increase in digitization of port operations, deployment of smart shipping technologies, and automated and connected maritime systems. with the expansion of integrated navigation, cargo tracking, and communications systems comes an increasing risk of cyber threats, including ransomware, GPS spoofing, and data breaches.

In the U.S., the Maritime Cybersecurity Market trend is shaped by rising federal mandates, port digitization, and the rising national security concerns for maritime infrastructure protection. The market was valued at USD 0.77 billion in 2024 and is projected to reach USD 1.99 billion by 2032, growing at a CAGR of 12.62%.

To Get more information on Maritime Cybersecurity Market- Request Free Sample Report

Key Trends Shaping the Maritime Cybersecurity Market

-

Data Security & Regulatory Compliance: Rising cyber threats and stringent maritime regulations drive adoption of secure network and shipboard systems.

-

Integration of Advanced Technologies: AI, machine learning, and blockchain are increasingly used for threat detection, predictive analytics, and secure data sharing.

-

IoT & Smart Shipping Impact: Expansion of connected vessels and port operations increases vulnerability, accelerating demand for robust cybersecurity solutions.

-

Cloud & Remote Monitoring Solutions: Adoption of cloud-based monitoring enables real-time threat detection and operational efficiency across global maritime networks.

-

Industry Collaboration & Partnerships: Shipowners, port authorities, and technology providers collaborate to strengthen maritime cybersecurity frameworks.

Maritime Cybersecurity Market Drivers:

-

As Maritime Operations Become More Digitized, the Attack Surface Expands, Driving Demand for Advanced Cybersecurity Solutions

Automation of navigation, value chain-oriented cargo-centric tracking systems, remote fleet management, and IoT-based port infrastructure are rapidly digitalizing the maritime sector. In this interconnected ecosystem, the attack surface is also big though making it prone to Cyberattacks, including ransomware, spoofing, hijack of a system, and many others. While trying to make ships and ports more efficient and operationally safe using digital tools, we are exposing more entries to cyber predators. Operators are also compelled to upscale their cybersecurity infrastructure based upon various government mandates such as cybersecurity guidelines from IMO. the global maritime industry continues to become increasingly digital, connected, and interwoven across maritime supply chains, which is one of the key factors accelerating demand for comprehensive maritime cybersecurity solutions worldwide, including in several regions that have critical maritime trade routes and port infrastructure.

Over 1,800 vessels were targeted by cyberattacks in just the first half of 2024, demonstrating a sharp rise in maritime digitization-linked intrusions

Maritime Cybersecurity Market Restraints:

-

The Absence of Uniform Cybersecurity Protocols Across Countries Results in Fragmented Defenses and Inconsistent Implementation

In spite of its increasing significance, the lack of congruity of the cybersecurity regulations in the world continues to be one of the key restraints in the maritime cybersecurity market. Although organizations issuing guidelines, like the International Maritime Organization (IMO), have had some success, full implementation has varied widely among individual flag states and maritime operators. The gaps in the approach mean that not every port and shipping line has the same level of security in place, leading to a patchwork of measures in which some companies have robust defenses while many others have little protection at all. The absence of uniform standards and the lack of enforcement mechanisms render it difficult to cooperate and share data to manage emerging threats proactively. due to limited resources, small or mid-sized maritime businesses do not comply with changing standards, therefore, it increases the cyber gap and slows market growth further.

Maritime Cybersecurity Market Opportunities:

-

The Adoption of AI and Analytics Allows for Real-Time Threat Monitoring, Creating New Opportunities for Cybersecurity Innovation

AI Machine Learning and Predictive analytics are the key factors driving demand for the maritime cybersecurity market. They allow for real-time anomaly detection, behavioral analysis, and automatic response to threats for increasingly complex maritime networks. AI-driven platforms enable remote investigation of unusual occurrences and behaviours across ship logs and maritime systems, satellite communications, and port control interfaces to recognize threats at an early stage. AI can be vigilant and adapt to new techniques used to attack its primary target, making it an asset for enhancing maritime cyber defense. With increasing connectedness & data-driven ship operations, the case for investing in intelligent cybersecurity platforms is increasingly a strategic necessity. This presents great opportunities for AI-integrated maritime security solution vendors.

Maritime Cybersecurity Market Challenges:

-

The Complexity and Expense of Upgrading Outdated Maritime Systems Limit the Adoption of Modern Cybersecurity Infrastructure

High costs and legacy system constraints make it hard to implement modern cybersecurity frameworks in maritime environments. Countless vessels and port facilities rely on legacy software and hardware architectures that were never conceived with cybersecurity in mind, making them difficult and expensive to connect to current defense assets. A huge investment in technology and workforce retraining is often needed to upgrade these legacy systems. Moreover, the world of maritime trade is global, requiring stakeholders to collaborate across countries, networks, and legacy IT systems. This level of complexity prevents small and mid-sized operators from taking on integrated solutions, which creates a barrier for overall market penetration and poses a major growth challenge.

Maritime Cybersecurity Market Segmentation Analysis:

-

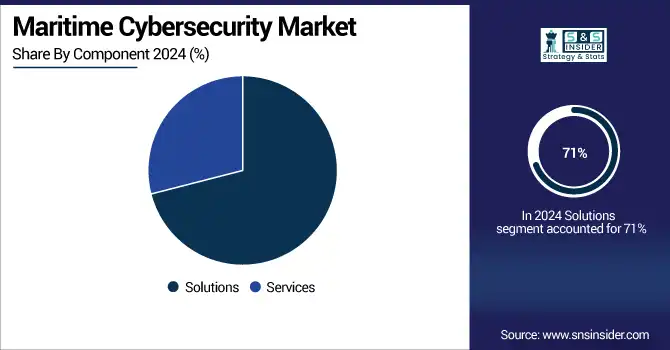

By Component, Solutions Segment Leads Maritime Cybersecurity Market; Services Segment Registers Fastest Growth

In 2024, the Solutions segment dominated the Maritime Cybersecurity Market and accounted for a significant revenue share due to the increasing deployment of integrated cybersecurity platforms, such as risk management, intrusion detection, and encryption tools across ships and ports. The need for real-time threat detection and regulatory compliance is driving widespread adoption. This segment will maintain steady growth through 2032.

The Services segment is expected to register the fastest CAGR in the Maritime Cybersecurity Market, driven by rising demand for managed security services, consulting, vulnerability assessments, and continuous system monitoring. As maritime companies face evolving cyber threats and a lack of in-house expertise, reliance on third-party cybersecurity providers is increasing. This shift is accelerating growth in service-based offerings across global maritime ecosystems.

-

By Security Type, Network Security Dominates Market; Operational Technology Security Shows Rapid Adoption

In 2024, the Network Security segment dominated the Maritime Cybersecurity Market and accounted for a significant revenue share owing to increasing threats targeting shipboard communication systems, port networks, and satellite connections. The widespread use of interconnected systems across fleets necessitates robust firewalls, intrusion detection systems, and secure protocols, ensuring continued investment in this segment throughout the forecast period.

The Operational Technology (OT) Security segment is expected to register the fastest CAGR in the Maritime Cybersecurity Market as shipping operators prioritize securing critical systems like navigation, propulsion, and cargo handling. The growing risk of cyberattacks disrupting physical maritime operations is pushing stakeholders to adopt advanced OT security frameworks, especially with rising automation in vessels and port infrastructure.

-

By Deployment, On-Premise Solutions Hold Major Share; Cloud-Based Deployment Exhibits Strong Growth

In 2024, the On-premise segment dominated the Maritime Cybersecurity Market and accounted for a significant revenue share due to strong demand for customized, high-control security environments in critical maritime infrastructure. Many ports and fleet operators prefer on-premise solutions for sensitive data handling, regulatory compliance, and system autonomy, especially in regions with limited cloud connectivity or strict national security requirements.

The Cloud segment is expected to register the fastest CAGR in the Maritime Cybersecurity Market, driven by increasing adoption of scalable, remote-access cybersecurity solutions. Cloud-based platforms enable centralized monitoring, threat intelligence sharing, and rapid updates across global fleets. As maritime operators seek cost-effective, flexible options for managing distributed assets, cloud deployment is gaining momentum across commercial shipping and port operations.

-

By Organization Size, Large Enterprises Lead Market; SMEs Experience Fastest Growth in Maritime Cybersecurity Adoption

In 2024, the Large Enterprises segment dominated the Maritime Cybersecurity Market and accounted for a significant revenue share owing to their expansive fleet sizes, complex port operations, and higher budgets for implementing comprehensive cybersecurity frameworks. These enterprises prioritize risk mitigation, compliance with international standards, and real-time monitoring, leading to sustained investments in advanced maritime cybersecurity infrastructure and services globally.

The Small and Medium-sized Enterprises (SMEs) segment is expected to register the fastest CAGR in the Maritime Cybersecurity Market as rising cyber threats push smaller operators to adopt affordable, scalable security solutions. Cloud-based and managed security services are making cybersecurity more accessible for SMEs. Government grants, industry partnerships, and regulatory pressures are also encouraging cybersecurity adoption among these cost-sensitive players.

Maritime Cybersecurity Market Regional Analysis:

-

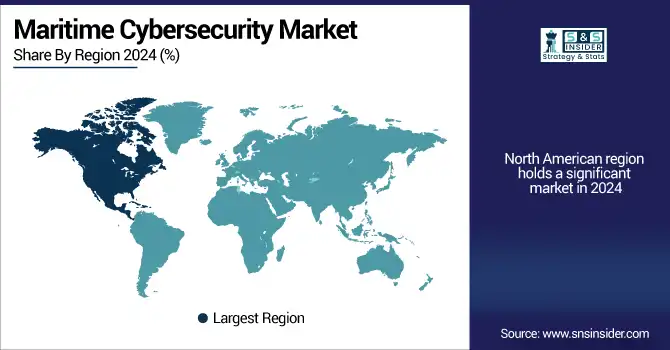

North America Leads the Market with Strong Regulatory Compliance and Advanced Maritime Infrastructure

In 2024, North America dominated the Maritime Cybersecurity Market and accounted for a significant revenue share due to strong regulatory enforcement, early adoption of maritime digitalization, and high investment in cybersecurity infrastructure. The presence of major shipping companies and technologically advanced ports in the U.S. and Canada continues to drive demand for comprehensive cybersecurity solutions across commercial and military maritime domains.

-

Asia-Pacific Emerges as Fastest-Growing Region Driven by Digitalization and Expanding Port Infrastructure

According to the maritime cybersecurity market analysis, Asia-Pacific is expected to register the fastest CAGR in the Maritime Cybersecurity Market fueled by rapid growth in seaborne trade, expanding port infrastructure, and increasing digital transformation in countries like China, Japan, and Singapore. Rising cyber threats, government-led modernization initiatives, and regional maritime disputes are compelling stakeholders to prioritize cybersecurity, creating strong growth momentum across both public and private sectors.

-

Europe Sees Steady Growth Fueled by Cybersecurity Regulations and Port Digitalization Initiatives

Europe’s growth is driven by increasing maritime trade regulations, rising cyberattack incidents on ports, and EU-mandated cybersecurity directives. Enhanced investment in port digitalization and cross-border data security will continue to drive market growth steadily through 2032 across major shipping and logistics hubs.

-

UK Dominates Europe with Advanced Naval Infrastructure and AI-Driven Threat Detection Adoption

The United Kingdom dominated Europe’s Maritime Cybersecurity Market due to its advanced naval infrastructure, strict cybersecurity compliance policies, and high maritime trade volume. Continued modernization of port systems and growing adoption of AI-driven threat detection will fuel strong growth in the UK through 2032.

Get Customized Report as per Your Business Requirement - Enquiry Now

Competitive Landscape Maritime Cybersecurity Market:

Northrop Grumman:

Northrop Grumman is a leading global aerospace and defense company providing innovative solutions for national security, space, and maritime domains. In the maritime cybersecurity sector, the company focuses on protecting naval and commercial fleets from cyber threats by integrating advanced risk assessment, intrusion detection, and secure communication systems. Its solutions enable real-time monitoring, threat mitigation, and compliance with international cybersecurity standards, ensuring operational resilience across complex maritime operations. By combining cutting-edge technology with defense expertise, Northrop Grumman helps shipping companies, ports, and naval forces safeguard critical assets, data, and infrastructure against evolving cyberattacks.

-

In March 2025, Northrop Grumman was awarded a $24.9 million contract by the U.S. Navy to advance the development of its next-generation Full Spectrum Undersea Warfare prototype, aimed at enhancing autonomous maritime sensing and cybersecurity resilience in high-risk environments.

Kongsberg Gruppen:

Kongsberg Gruppen, a Norwegian defense and maritime technology company, specializes in advanced systems for naval defense, commercial shipping, and offshore operations. In maritime cybersecurity, the company delivers integrated solutions to protect ships, ports, and offshore facilities from cyber threats. Kongsberg Gruppen’s offerings include secure communication systems, intrusion detection, and real-time threat monitoring tailored to maritime operations. By combining digital security with operational technology expertise, the company ensures safe navigation, compliance with international cybersecurity regulations, and resilience against cyberattacks. Its solutions support both military and commercial stakeholders in safeguarding critical maritime infrastructure globally.

-

In August 2024, Kongsberg Gruppen completed DNV Type Approval cybersecurity testing (IEC 62443/DNV Cyber Security Profile 1) for its digital maritime products, reinforcing trust in its integrated automation and dynamic positioning systems amid increasing cybersecurity risks in shipboard operations.

Maritime Cybersecurity Market Companies:

-

Northrop Grumman

-

Honeywell

-

Cisco Systems

-

Siemens

-

BAE Systems

-

Raytheon Technologies

-

Kongsberg Gruppen

-

Thales Group

-

ABS Group

-

Naval Dome

-

CyberOwl

-

Darktrace

-

Maritime Cyber Solutions

-

StormGeo

-

Booz Allen Hamilton

-

Leonardo S.p.A.

-

Wärtsilä

-

IBM

-

Airbus CyberSecurity

-

Dell Technologies

|

Report Attributes |

Details |

|

Market Size in 2024 |

US$ 3.25 Billion |

|

Market Size by 2032 |

US$ 8.53 Billion |

|

CAGR |

CAGR of 12.84 % From 2025 to 2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Data |

2021-2023 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Component (Solutions [Risk and Compliance Management, Identity and Access Management, Firewall and Intrusion Detection Systems, Encryption, Incident Response], Services [Professional Services, Managed Services]) |

|

Regional Analysis/Coverage |

North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, ASEAN Countries, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar,Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America) |

|

Company Profiles |

Northrop Grumman, Honeywell, Cisco Systems, Siemens, BAE Systems, Raytheon Technologies, Kongsberg Gruppen, Thales Group, ABS Group, Naval Dome, CyberOwl, Darktrace, Maritime Cyber Solutions, StormGeo, Booz Allen Hamilton, Leonardo S.p.A., Wärtsilä, IBM, Airbus CyberSecurity, Dell Technologies and others in the report |