AI Box PC Market Report Scope & Overview:

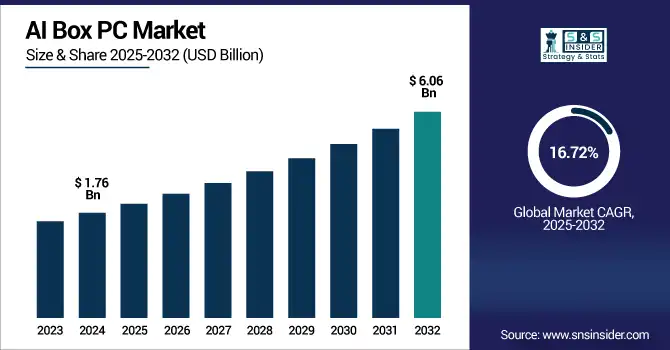

The AI Box PC Market size was valued at USD 1.76 billion in 2024 and is expected to reach USD 6.06 billion by 2032, expanding at a CAGR of 16.72% over the forecast period of 2025-2032.

To Get more information on AI Box PC Market - Request Free Sample Report

The AI Box PC Market is growing with the need for edge computing, and real-time AI processing in industries such as manufacturing, transportation, and smart cities, demanding a local, small footprint, rugged, avionics-level inference and decision making in the presence of low to no connectivity. These can be used for predictive maintenance, automated quality control, and intelligent surveillance. As processors evolve and become more integrated with AI frameworks, our performance is only becoming stronger and more efficient. Due to the facilitation of digitization in several industries, the Asia Pacific region holds the fastest market share. However, regions such as North America and Europe are also experiencing consistent growth, driven by investments in smart infrastructure and automation technologies.

According to research, AI adoption is being fueled by both government and industry initiatives, such as the U.S. DOE investing $70M in AI for energy efficiency, Germany’s BMWK investing €3B in Industry 4.0, and Intel driving edge AI on DL Boost-enabled processors.

The AI Box PC Market size was valued at USD 0.35 billion in 2024 and is expected to reach USD 1.15 billion by 2032, expanding at a CAGR of 15.82% over the forecast period of 2025-2032.

The U.S. AI Box PC Market is experiencing strong growth due to the increasing penetration of edge computing and AI technology in the healthcare, defense, manufacturing, and logistics sectors. As an industrial automation and smart infrastructure leader, the U.S. enjoys robust AI R&D investments, government backing, and significant tech players, including Intel and NVIDIA. The growing need for real-time data processing, data protection, and local computing is driving the adoption of AI Box PC in smart factories and autonomous systems. This is compounded by the nation’s dedication to Industry 4.0 and digitalisation projects.

Market Dynamics

Drivers:

-

Rapid Growth in Edge AI Applications Across Industrial, Automotive, Healthcare, and Smart Infrastructure Domains.

The demand for real-time, on-device AI processing is growing across sectors such as manufacturing, healthcare, and smart transportation. AI Box PCs enable fast and efficient real-time decisions in low-bandwidth settings. High-performance inference on the edge. Recent advances in embedded processors and neural accelerators are bringing high-performance inference to the edge. Furthermore, the evolution of 5G networks is driving uptake too, especially for use-cases involving autonomous operation and real-time processing of data at the edge.

Restraints:

-

High Initial Investment and System Integration Complexity Restrict Broader Adoption Among Small Enterprises.

AI Box PCs incorporate advanced hardware for edge AI workloads, resulting in higher upfront costs. Small enterprises often face financial limitations and integration issues with existing systems, especially in legacy industrial environments. A lack of skilled personnel and concerns around cybersecurity further hinder adoption. These barriers slow market penetration among cost-sensitive organizations despite long-term benefits offered by real-time data processing and automation capabilities.

Opportunities:

-

Increasing Industry-Specific AI Box PC Customization Creates Opportunities for Targeted Edge Computing Deployments.

There is growing interest in AI Box PCs tailored for specific AI box PC industries, such as healthcare imaging, industrial robotics, and smart transportation. Organizations are demanding modular and rugged designs optimized for sector-specific AI workloads. Governments and enterprises are supporting initiatives that promote customized AI edge deployments. This trend creates new opportunities for manufacturers to offer differentiated solutions, enabling seamless integration and performance optimization in high-demand verticals.

Challenge:

-

Shortage of Technical Expertise and Rising Edge Cybersecurity Threats Challenge AI Box PC Deployment.

Deploying AI Box PCs at the edge requires specialized expertise in AI inference, system integration, and data security. Many organizations lack the skilled workforce needed to manage these devices effectively, especially when integrating with complex legacy systems. Additionally, edge environments face increasing cybersecurity threats, making secure deployment challenging. These technical and operational gaps continue to limit widespread adoption, particularly in industries with constrained IT resources.

Segment Analysis

By Form Factor

The Mini PCs segment dominated the market with a 25.37% revenue share in 2024. The AI box PC market growth is mainly fueled by the demand for compact, energy-efficient AI computing solutions that can fit into confined spaces such as retail kiosks, digital signage displays, and point-of-sale systems. Mini PCs offer high-performance computing in a small footprint, making them ideal for edge AI deployment. Recent launches by companies such as Intel (NUC series) and ASUS (PN and PB series) have introduced AI-ready mini-PCs with GPU acceleration and multi-display support.

The Embedded PCs segment is projected to grow at the fastest CAGR of 17.46% over the forecast period due to their durability, modularity, and long lifecycle support, particularly in industrial and transportation sectors. These systems are designed for rugged environments and can operate under extreme conditions, making them ideal for 24/7 AI inference. AI box PC Market companies such as AAEON and Advantech have introduced embedded AI systems with NVIDIA Jetson modules and fanless architectures to support machine vision and predictive maintenance.

By Processor Type

Intel Processors accounted for the largest revenue share of 47.72% in 2024, driven by their widespread use in industrial computing and edge AI applications. Their robust architecture, AI acceleration features (e.g., Intel DL Boost), and compatibility with the OpenVINO toolkit make them ideal for demanding workloads. Intel's 13th Gen Core and Atom processors provide enhanced performance, power efficiency, and I/O integration.

The ARM Processors segment is anticipated to grow at the highest CAGR of 17.88% during the forecast period, supported by the growing demand for energy-efficient, low-power devices. Recent developments, such as NVIDIA’s Jetson Orin and Raspberry Pi CM4-based industrial boards, have revolutionized cost-effective AI edge computing. The growing adoption of agriculture, smart surveillance, and IoT makes ARM a key driver in the AI Box PC market’s expansion.

By Application

The Industrial Automation segment held the largest revenue share of 40.27% in 2024 due to the growing implementation of AI-driven automation across factories and production lines. AI box PCs are deployed for visual inspection, real-time monitoring, and predictive maintenance, reducing downtime and improving efficiency. As Industry 4.0 and smart factory initiatives gain traction, demand for AI-integrated hardware in industrial control systems continues to rise, solidifying this segment’s leadership within the market.

The IoT Gateways segment is expected to expand at the highest CAGR of 18.17% during the forecast period, driven by the growing demand for intelligent edge devices to process data from connected sensors and machines. AI box PCs used as IoT gateways enable local analytics, reducing latency and cloud dependence. Companies such as ADLINK and Dell have introduced rugged edge gateways with AI acceleration and 5G support.

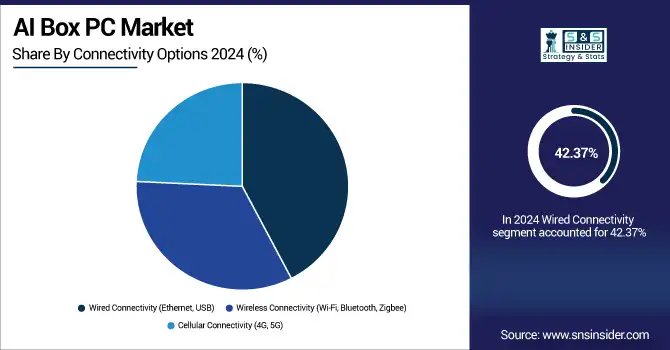

By Connectivity Options

The Wired Connectivity segment led with a 42.37% revenue share in 2024 due to its high reliability, low latency, and stable performance in industrial environments. Ethernet and USB ports are essential for interfacing with PLCs, cameras, and industrial sensors. The demand for secure and deterministic networking in factory floors, healthcare, and transportation applications continues to fuel the dominance of wired connectivity in the AI Box PC Market.

Wireless Connectivity is forecasted to grow at the highest CAGR of 17.53% during the forecast period due to rising use in mobile and remote installations. AI box PCs with wireless interfaces are ideal for applications such as smart retail, remote monitoring, and public transportation systems. Innovations from companies such as Nexcom and Axiomtek include the integration of Wi-Fi 6, Zigbee, and Bluetooth 5.2 in edge AI devices.

By Storage and Memory

SSD Storage dominated with 52.28% of revenue in 2024, attributed to its superior speed, reliability, and durability over traditional HDDs. AI workloads require fast access to training and inference data, making SSDs essential for responsive edge computing. Companies such as Transcend, Apacer, and Innodisk are offering high-endurance industrial SSDs optimized for AI edge systems. As data processing becomes increasingly localized, SSDs support quick boot times and robust data handling, playing a pivotal role in enhancing AI Box PC performance across various use cases.

The RAM Capacity segment is expanding at the fastest CAGR of 18.03% due to the rising complexity of AI models and multitasking requirements at the edge. AI box PCs now routinely require 16GB to 64GB of RAM to manage image processing, video analytics, and AI inference simultaneously. Recent product developments by Vecow and IEI Integration include AI PCs with DDR5 support and scalable memory architecture.

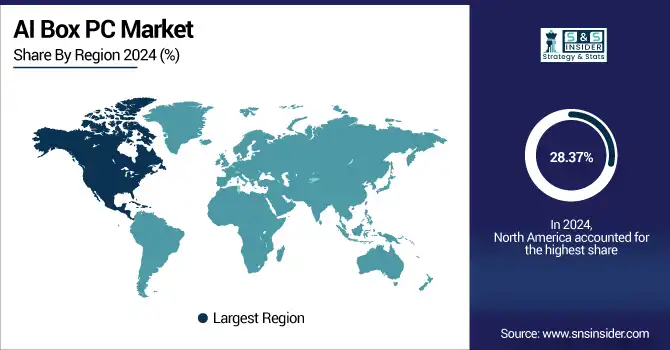

Regional Analysis

North America dominated in 2024 with a 28.37% of the AI box PC market share, driven by early adoption of edge AI, industrial automation, and smart city technologies. Strong presence of key players, robust digital infrastructure, and increasing deployment in healthcare, logistics, and manufacturing are fueling demand for AI box PCs across the region. The United States leads the regional market due to its advanced technological ecosystem, strong industrial base, and aggressive investments in AI-driven automation and edge computing projects.

Europe remains a vital market, benefiting from stringent industrial safety regulations, a growing focus on energy-efficient AI systems, and increasing use of AI in the automotive and manufacturing sectors. The region is witnessing the growing adoption of AI box PCs in predictive maintenance, intelligent surveillance, and robotics. Germany dominates the European market owing to its leadership in industrial automation, automotive manufacturing, and strong investments in Industry 4.0 and smart factory infrastructure.

Asia Pacific is the fastest-growing region in the AI Box PC Market, holding a 37.37% revenue share in 2024. This growth is fueled by rapid industrialization, widespread IoT adoption, and expanding investments in smart manufacturing and infrastructure. The region's large electronics ecosystem, rising AI start-up activity, and government support for AI-driven development initiatives are accelerating the deployment of AI box PCs across sectors. China leads the market due to its strong manufacturing base, aggressive 5G and AI policy rollouts, and massive deployment of smart city and industrial automation projects.

The Middle East & Africa and Latin America are witnessing steady adoption of AI Box PCs, driven by digital transformation in sectors such as oil & gas, security, mining, agriculture, and urban mobility. The UAE leads in MEA with smart city projects and early AI adoption, while Brazil dominates Latin America through industrial automation and smart infrastructure initiatives.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

The major key players of the Advantech, Siemens, AAEON Technology, Kontron, ADLINK, Axiomtek, Lanner Electronics, Neousys Technology, Aetina, IBASE, and others.

Key Developments

-

In January 2025, Siemens launched its “Industrial Copilot for Operations” at CES 2025, integrating it into its Industrial Edge platform. The solution enables seamless deployment of AI models locally for real-time decision-making in industrial environments.

-

In December 2024, AAEON launched the UP Xtreme i14 Edge, a compact AI PC powered by Intel Meteor Lake processors. Designed for edge AI applications, it offers enhanced performance, power efficiency, and advanced I/O capabilities in industrial settings.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.76 Billion |

| Market Size by 2032 | USD 6.06 Billion |

| CAGR | CAGR of 16.72% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Form Factor, (Mini PCs, Embedded PCs, Industrial PCs, Rugged PCs) •By Processor Type, (Intel Processors, AMD Processors, ARM Processors, Custom Processors) •By Application, (Industrial Automation, Digital Signage, IoT Gateways, Gaming, Artificial Intelligence, and Machine Learning) •By Connectivity Options, (Wired Connectivity (Ethernet, USB), Wireless Connectivity (Wi-Fi, Bluetooth, Zigbee), Cellular Connectivity (4G, 5G)) •By Storage and Memory, (SSD Storage, HDD Storage, Hybrid Storage Solutions, RAM Capacity (from 4GB to 64GB and beyond)) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Advantech, Siemens, AAEON Technology, Kontron, ADLINK, Axiomtek, Lanner Electronics, Neousys Technology, Aetina, IBASE |