Keratin Market Report Scope & Overview:

Get More Information on Keratin Market - Request Sample Report

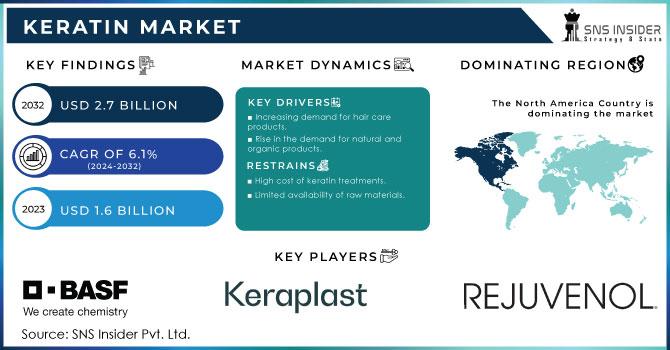

The Keratin Market Size was valued at USD 1.6 billion in 2023, and is expected to reach USD 2.7 billion by 2032, and grow at a CAGR of 6.1% over the forecast period 2024-2032.

The global keratin market has grown significantly over the last few years, with more awareness among consumers related to personal care and grooming products, besides the increasing demand for natural and sustainable products. Keratin is a hard protein made by cells to help give strength and to repair cells that suffer from disease, injury, and wear and tear. It exists in human hair, nails, and skin, as well as in animal feathers, horns, and wool. It is widely used in hair care products, skin care lotions, and various cosmetic formulations. Besides that, keratin has enormous applications in the pharmaceutical, nutrition, and biomedical materials sectors, indicating its great versatility and wide applications in the market.

Advancement of technology has expanded the dimensions of the keratin industry, especially in recycling and putting to sustainable use wastes that are rich in keratin. The ICT Mumbai has come up with a new technique to convert these wastages of keratin, like human hair, wool, and poultry feathers into items that can be useful as animal feed and fertilizers. This latest technology addresses both ecological impacts of keratin waste and the rising demand for sustainable agricultural practices. The technology contributes to decreasing the environmental impact but opens new opportunities for keratin: by conversion of waste into beneficial products, the technology expands the market for this protein.

The modern consumer trend related to natural and organic products stimulates the demand for keratin. People become more aware of hazards related to the synthetics, and they prefer using exclusively natural ingredients in their personal care applications. Therefore, keratin is a naturally existing product properly fitting the current tendency. Moreover, keratin supplements are highly demanded in the health and well-being sector as they are effectively improving hair, skin, and nails. This trend is also being assisted through an increase in the emphasis on beauty and health, especially in developing nations as a result of improved incomes and lifestyles which spur the demand for high-quality personal care products.

Ongoing innovation and expansion of uses will continue to drive growth in the keratin market. The global keratin market is expected to grow owing to the R&D investments by companies. This is leading to the development of more effective products and expanding its application in biomedical materials, food additives, etc. The increasing saturation in the keratin market will result in higher number of strategic alliances such as mergers and acquisitions by companies to increase their presence in the market and moreover, to diversify their products further. The keratin market will continue to grow owing to favourable legislations by governments and investments in greener technologies. The global economy is heading towards environmental sustainability and this development will also increase the demand for keratin.

Keratin Market Dynamics:

Drivers

-

Rising Consumer Demand for Keratin-Infused Hair Care Products Drives Market Growth and Innovation

The keratin industry is experiencing significant growth as consumer interest in premium hair care products rises, indicating a changing preference towards specialized and high-quality personal grooming options. Procter & Gamble launched a fresh collection of hair care items containing keratin under the Pantene label in March 2023, in reaction to rising consumer desires for products ensuring stronger and healthier hair. This choice capitalized on the rising customer demand for products with potent ingredients like keratin, renowned for enhancing hair strength and reducing damage. In July 2023, L'Oréal also launched an innovative keratin treatment for their professional hair care line, catering to salon customers seeking effective solutions. The rise in consumer knowledge on the advantages of keratin, along with the growing accessibility of these items in multiple retail outlets, highlights the important influence of consumer preferences on market expansion. The growing emphasis on hair care, particularly on products that offer repair and strengthening advantages, is evident through the notable increase in advertising efforts and introduction of new products in the market, reflecting a close relationship with evolving consumer preferences and decisions.

-

Growing Preference for Natural and Organic Ingredients Boosts Demand for Keratin-Based Hair Care Products

The increasing demand for natural and organic products on the back of growing demand for clean beauty and sustainable ingredients is driving a remarkable growth impetus in the keratin market. Briogeo, an organic beauty company, introduced shampoo and conditioner with infusions of keratin in April 2024 using organic ingredients owing to the surge in demand emanating from consumers for hair care products free of chemicals. The launching of such a product is very well aligned with the emerging trend of consumers towards efficient yet eco-friendly products. Aveda launched a plant-based keratin treatment in February 2024 by incorporating the working of natural keratin sourced from plant proteins to attract green consumers who are efficient yet seek effective hair care solutions in an ecologically friendly manner. In organic and nature-oriented products, concern over potential harm from synthetic chemicals and preference for commodities to harmonize with sustainable and ethical considerations stimulate their demand. Incorporation of natural keratin in hair care items accommodates the consumers' concerns about safety and reflects the increasingly important emphasis on environmental accountability, which plays an influential role in determining market trends and extends the growth of the keratin industry.

Restrain

-

High Cost of Keratin Treatments Limits Market Growth and Consumer Accessibility

The high costs of the treatments have been among the major market-entry barriers for the product to reach a wider base of customers. As an example, there are some challenges that the luxury hair care company Oribe is finding with its latest keratin treatment; its products are extremely expensive, at $150 per bottle. This would be a very high price for stingy consumers, and the treatment would only be able to be used by a small number of people. Furthermore, in March 2024, demand for keratin services started to fall for the chain of salons called Paul Mitchell, and it pinpointed part of the culprit as being the premium-priced keratin treatments that they offer, which are way more expensive than regular haircare. This financial barrier underlines the bigger picture of affordability that is currently characterizing the keratin market, since the consumer purchase decisions and growth in the industry depend largely on that very factor.

Opportunities

-

Rising Demand for Keratin Products in Emerging Markets Offers Significant Growth Opportunities

The prospects of the keratin market are brighter with the rise in demand for the product in developing countries. In June 2024, one of the most popular beauty companies globally, Schwarzkopf, expanded its sales in India with the launch of an affordable range of keratin treatments to satisfy the burgeoning demand for quality hair care products in the burgeoning Indian market. In a similar way, in September 2024, the South Korea-based company Amorepacific launched a line of hair care products containing keratin, targeting the rapid market expansion in Southeast Asia. This demonstrates a strategic decision to meet the increasing demand for high-quality beauty items in these areas. The keratin industry has a great chance for growth through expansion into emerging markets, thanks to higher disposable incomes, a rise in beauty awareness, and a growing demand for advanced hair care products in these areas.

Challenges

-

Intense Competition from Alternative Hair Care Solutions Challenges Growth in the Keratin Market

Intense competition from alternative hair care solutions poses a significant challenge for the keratin market, potentially affecting its market share and growth. In February 2024, Olaplex launched a new bond-building treatment that rivals traditional keratin treatments, providing comparable advantages at a potentially reduced price. This new development has caught the attention of a large number of customers seeking cost-effective yet efficient options. Furthermore, in April 2024, Nutrafol's introduction of biotin-enriched hair care items heightened rivalry by offering a desirable option to keratin therapies, highlighting organic components and wellness advantages. These advancements emphasize the competitive stress that the keratin market encounters from both new and existing hair care products, disrupting its dominance and impacting consumer preferences in a market that is becoming more varied.

Keratin Market Segments

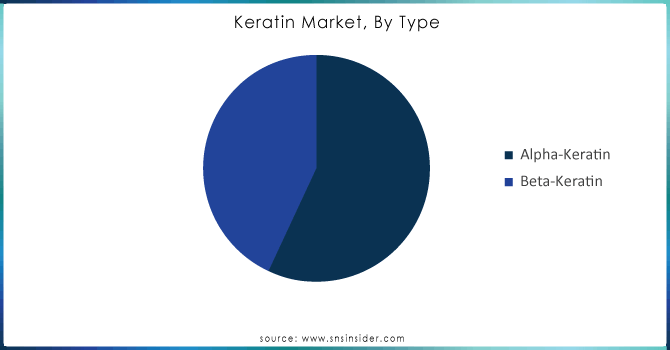

By Type

The Alpha-keratin segment dominated the keratin market in 2023, capturing 65% of the market share. Alpha-keratin, which is famous for its strong ability to strengthen and repair hair, was commonly chosen because of its excellent advantages in hair care products. For example, in July 2023, the popular hair care company Kerastase launched a new line of products infused with alpha-keratin, which attracted a significant number of consumers, demonstrating the appeal of the market. Alpha-keratin's strong market position is due to its proven ability to improve hair health and strength.

Get Customised Report as per Your Business Requirement - Enquiry Now

By Product

In 2023, the hydrolyzed segment dominated the market, holding a 70% share of the keratin market. Hydrolyzed keratin is clinically proven to improve and repair hair. The keratin that has gone through breaking down the molecules of it produce allows for higher absorption and effectivity, allowing more penetration into the skin or scalp. The new launch is L’Oréal’s hydrolyzed keratin infuse in shampoo and conditioner, which they launched last March – 2023. All users and customer reviews gave an excellent result for the hair repair. The segment shows appeal to consumers. This significant market share showcases the extensive use and success of hydrolyzed keratin in satisfying consumer needs for advanced hair care options.

By Application

In 2023, the personal care and cosmetics segmented dominated in the keratin market, capturing approximately 80% of the market share. The was a success because of the increasing demand for keratin-containing products for hair and skin care. Keratin is known to be very effective in improving the health of hair and skin. In August 2023, Pantene launched a new product line of hair care products with keratin, which was extremely popular among the customers. This significant market share showcases the segment's important role in fuelling the overall growth of the keratin market.

Keratin Market Regional Analysis

In 2023, North America dominated the keratin market, with a marked share of around 38% of the total revenue. The major factor contributing to the rising demand for keratin in North America is that more and more individuals are becoming interested in hair and skin care products. The presence of small- and large-scale manufacturers across the region has also enhanced awareness and generated a higher need for personal care products. Furthermore, the different manufacturers in North America have adopted a single strategy of health and cosmetic products. The regional manufacturers seem to have finally understood how the different sectors in cosmetic and personal care are intertwined. This has facilitated the expansion of the market in different ways. In addition, $1.7 billion worth of hair products were exported in 2022 by the United States, which is also the largest exporter of them in North America. I would assume that the primary reason is that the demand for personal care products within the region has been steadily increasing. In addition, the need to protect the skin and hair of people from dust and pollution has increased due to the growing retail sector and awareness among the people. It seems to me that these factors are pivotal in determining the demand for keratin in North America throughout the entire forecast period.

Moreover, Asia Pacific emerged as fastest growing region with the highest Compound Annual Growth Rate (CAGR) of approximately of 6.5% and become the largest market for keratin in the region. The increase is due to the rising need for products to care for and style hair, as well as the growing trend of keratin treatments and other methods to straighten hair in countries such as China, India, Japan, and South Korea. Furthermore, the existence of international corporations in this area, along with the high demand from various industries like personal care & beauty, healthcare & medicine, and food & drinks, also drives the keratin market. Moreover, the growing use of personal care and cosmetic items offering improved nutrition for the skin and hair is projected to boost the need for keratin in the upcoming years. Therefore, it is expected that the keratin market in the Asia Pacific region will experience significant growth.

Key Players

The major key players are BASF SE, Keraplast, Proteina, Rejuvenol, MakingCosmetics Inc., Hefei TNJ Chemical Industry Co. Ltd., Greentech, Keratin Express, Clariant, Kerline Srl, Roxlor, NutriScience Innovations LLC, and other key players are mentioned in the final report.

Recent Developments

-

January 2023: Vestige Marketing Pvt. Ltd. introduced Assure Anti-Hairfall Bounce Restore and Assure Keratin Smoothening Shampoos for professional care at home.

-

January 2023: SUNATORIA launched three hydrolyzed keratin hair masks that improve softness, shine, and volume, without containing sodium, sulfates, or parabens.

-

August 2022: Godrej Professional introduced Kerasmooth, a keratin treatment for protein reconstruction

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.6 Billion |

| Market Size by 2032 | USD 2.7 Billion |

| CAGR | CAGR of 6.1% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Alpha-Keratin, Beta-Keratin) •By Product (Hydrolyzed, Others) •By Application (Personal Care & Cosmetics, Food & Beverages, Healthcare & Pharmaceuticals, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BASF SE, Keraplast, Proteina, Rejuvenol, MakingCosmetics Inc., Hefei TNJ Chemical Industry Co. Ltd., Greentech, Keratin Express, Clariant, Kerline Srl, Roxlor, NutriScience Innovations LLC and other key players |

| Key Drivers | • Rising Consumer Demand for Keratin-Infused Hair Care Products Drives Market Growth and Innovation • Growing Preference for Natural and Organic Ingredients Boosts Demand for Keratin-Based Hair Care Products |

| Restraints | • High Cost of Keratin Treatments Limits Market Growth and Consumer Accessibility |