Crop Protection Chemicals Market Report Scope & Overview:

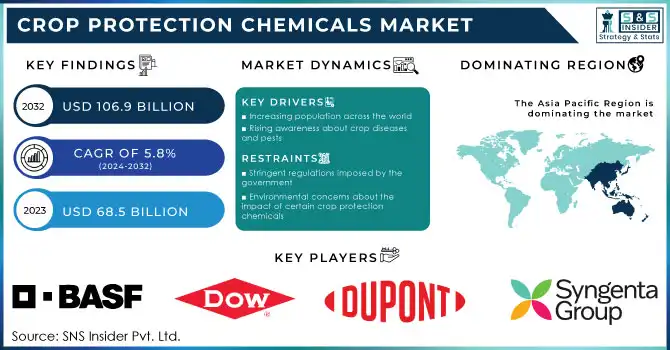

The Crop Protection Chemicals Market Size was valued at USD 64.57 Billion in 2023 and is expected to reach USD 102.31 Billion by 2032, growing at a CAGR of 5.30% over the forecast period of 2024-2032.

Get More Information on Crop Protection Chemicals Market - Request Sample Report

The Crop Protection Chemicals Market is evolving with shifting agricultural demands, regulatory policies, and sustainability concerns. Our report examines pricing trends across regions, highlighting cost variations and market competitiveness. The role of raw material suppliers is crucial, influencing production costs and supply chains. With growing emphasis on environmental sustainability, the market is adapting to eco-friendly solutions and stricter regulations. Trade dynamics are explored, identifying key exporting and importing countries shaping global supply. Investment trends reveal strategic expansions, research innovations, and emerging players. Additionally, chemical waste management regulations are tightening, impacting production and disposal practices. This report provides a comprehensive outlook on industry trends, challenges, and growth opportunities defining the future of crop protection chemicals.

Crop Protection Chemicals Market Dynamics

Drivers

-

Adoption of Integrated Pest Management (IPM) Strategies to Enhance Sustainable Crop Protection Chemical Usage

The increasing adoption of Integrated Pest Management (IPM) strategies is significantly influencing the growth of the Crop Protection Chemicals Market. IPM focuses on a holistic approach to pest control, combining biological, cultural, mechanical, and chemical methods to minimize environmental impact while ensuring effective pest management. Farmers and agricultural organizations are shifting toward IPM due to its ability to reduce excessive chemical usage, improve soil health, and enhance crop resilience against pests and diseases. Governments and regulatory bodies worldwide are also promoting IPM through subsidies, awareness programs, and policy reforms, driving the demand for advanced crop protection chemicals that align with these principles. Manufacturers are increasingly developing products compatible with IPM strategies, such as biopesticides, targeted herbicides, and precision application technologies. The growing preference for IPM is reshaping the market by encouraging innovations that balance productivity with sustainability. As farmers seek efficient yet eco-friendly solutions, the demand for modern crop protection chemicals is set to rise, fostering market expansion in the coming years.

Restraints

-

Rising Resistance of Pests and Weeds to Conventional Crop Protection Chemicals Reducing Effectiveness and Hampering Market Growth

The increasing resistance of pests and weeds to conventional crop protection chemicals is emerging as a critical restraint in the Crop Protection Chemicals Market. Over time, repeated exposure to the same chemical compounds has led to genetic adaptations in pest populations, reducing the efficacy of insecticides, herbicides, and fungicides. This phenomenon has particularly affected key crops such as wheat, corn, and soybeans, where resistance issues are escalating. As a result, farmers are required to use higher doses or multiple chemicals, leading to increased costs and potential environmental risks. The agrochemical industry faces continuous pressure to develop novel active ingredients and integrated management strategies to counteract resistance. However, the research and development cycle for new crop protection chemicals is long and costly, further hindering market growth. The industry must address this challenge through innovation, but resistance management remains a persistent concern for sustainable agricultural productivity.

Opportunities

-

Surging Demand for Bio-Based Crop Protection Chemicals to Reduce Environmental and Health Risks

The rising consumer preference for organic food and sustainable farming practices is creating lucrative opportunities in the Crop Protection Chemicals Market for bio-based solutions. Biopesticides, bioherbicides, and microbial fungicides are gaining traction as effective alternatives to synthetic chemicals, driven by their lower toxicity, biodegradability, and eco-friendly nature. Governments are actively supporting the adoption of bio-based crop protection chemicals through incentives, research grants, and favorable regulatory policies. Key industry players are investing in biological formulations to cater to the growing demand for residue-free agricultural products. The increasing awareness of soil health preservation and biodiversity conservation further accelerates the shift toward bio-based solutions. As agricultural sustainability becomes a global priority, companies focusing on innovative biological crop protection chemicals are expected to witness substantial market growth.

Challenge

-

Balancing Cost-Effectiveness with Sustainability in Crop Protection Chemical Formulations

The challenge of balancing cost-effectiveness with sustainability is a key concern for manufacturers in the Crop Protection Chemicals Market. While the demand for environmentally friendly products is rising, developing sustainable alternatives that are both effective and affordable remains a hurdle. Bio-based pesticides and advanced formulations often come with higher production costs, making them less accessible to small-scale farmers in emerging economies. Additionally, meeting stringent sustainability standards while maintaining profitability requires significant research investment. Companies must innovate cost-efficient solutions without compromising environmental integrity. The industry’s ability to bridge this gap will determine the long-term success of sustainable crop protection technologies.

Crop Protection Chemicals Market Segmental Analysis

By Source

In 2023, the synthetic segment dominated the Crop Protection Chemicals Market, accounting for a 78.5% of the market share. Synthetic chemicals have long been the cornerstone of agricultural pest management due to their immediate and potent effects against a wide spectrum of pests and diseases. Their consistent performance, ease of application, and cost-effectiveness make them the preferred choice for large-scale farming operations. For instance, the U.S. Department of Agriculture (USDA) continues to support the use of approved synthetic pesticides to ensure crop yields meet the nation's food security demands. Similarly, in developing countries like Brazil, the adoption of synthetic herbicides has been instrumental in managing invasive weed species, thereby enhancing crop productivity. Despite the growing interest in bio-based alternatives, the scalability and proven efficacy of synthetic crop protection chemicals solidify their dominance in the market.

By Product Type

Herbicides dominated the Crop Protection Chemicals Market in 2023, capturing approximately 39.6% of the market share. The prevalence of herbicides is largely due to the global challenge of weed management, which significantly impacts crop yields. Weeds compete with crops for essential resources such as nutrients, water, and sunlight, necessitating effective control measures. The U.S. Environmental Protection Agency (EPA) has approved various herbicides that are widely utilized to manage weed proliferation in major crops like corn and soybeans. In regions such as North America, the extensive cultivation of herbicide-tolerant genetically modified crops has further propelled herbicide usage. Additionally, the development of advanced herbicidal formulations by agrochemical companies has enhanced application efficiency and broadened the spectrum of controllable weed species, reinforcing the segment's market leadership.

By Crop Type

Cereals and grains dominated the Crop Protection Chemicals Market in 2023, holding a 45.2% market share. Staple crops like wheat, rice, and maize are fundamental to global food security, leading to extensive cultivation worldwide. The high susceptibility of these crops to various pests and diseases necessitates the substantial use of crop protection chemicals to safeguard yields. Organizations such as the Food and Agriculture Organization (FAO) emphasize the importance of protecting cereal crops to meet the nutritional needs of the growing global population. For example, in India, government initiatives have been implemented to provide farmers with access to effective pesticides and fungicides, aiming to enhance the productivity of rice and wheat. The critical role of cereals and grains in daily diets ensures that this segment remains a primary focus for crop protection efforts.

By Form

The liquid form segment dominated the Crop Protection Chemicals Market in 2023, comprising about 63.1% of the market share. Liquid formulations, including emulsifiable concentrates and solutions, are favored for their ease of handling, mixing, and application. They offer uniform distribution and better adherence to plant surfaces, enhancing the efficacy of the active ingredients. Agricultural extension services often recommend liquid formulations for their versatility and effectiveness across various application methods, such as foliar sprays and soil treatments. In countries like Australia, the widespread use of liquid herbicides has been pivotal in large-scale weed management programs. The adaptability of liquid crop protection chemicals to different spraying equipment and their suitability for tank-mixing with fertilizers or other pesticides contribute to their predominant market position.

By Mode of Application

Foliar spray was the dominant mode of application in the Crop Protection Chemicals Market in 2023, accounting for approximately 54.2% of the market share. This method involves the direct application of chemicals to plant leaves, allowing for rapid absorption and immediate action against pests and diseases. Foliar spraying is particularly effective for addressing above-ground infestations and nutrient deficiencies. The method's efficiency is recognized by agricultural organizations, leading to its widespread adoption in both developed and developing regions. For instance, the Indian Council of Agricultural Research (ICAR) advocates foliar application of micronutrients and pesticides to enhance crop health and yield. The ability to quickly mitigate pest outbreaks and the convenience of combining pest control with nutrient supplementation make foliar spray a preferred choice among farmers, solidifying its leading position in the market.

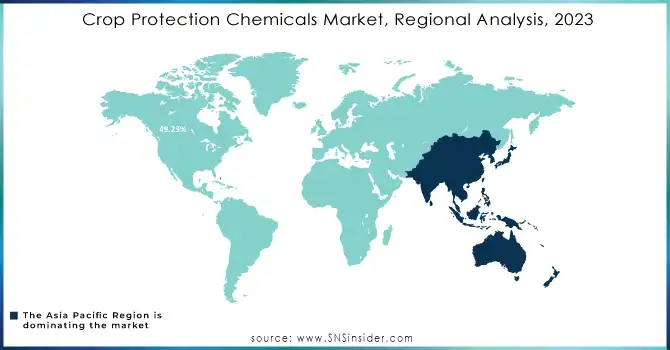

Crop Protection Chemicals Market Regional Outlook

In 2023, the Asia Pacific region dominated the Crop Protection Chemicals Market, securing a 38.7% market share, driven by its vast agricultural landscape, high population density, and increasing food demand. Countries such as China, India, and Japan play a crucial role in this dominance. China, the largest producer and consumer of crop protection chemicals, benefits from government-backed agricultural initiatives and a well-established agrochemical industry. According to the National Bureau of Statistics of China, pesticide production reached approximately 2.1 million metric tons in 2023, showcasing its dominance. India, with its heavy reliance on agriculture, has also seen significant demand for insecticides and herbicides, fueled by initiatives like the “Paramparagat Krishi Vikas Yojana,” promoting modernized farming. The Indian agrochemical sector was valued at around $6.3 billion in 2023, as per the Federation of Indian Chambers of Commerce and Industry (FICCI). Additionally, Japan's advanced R&D in biopesticides and stringent agricultural safety regulations further contribute to regional market leadership.

However, North America emerged as the fastest-growing region in the Crop Protection Chemicals Market, with a significant growth rate during the forecast period. The growth is driven by technological advancements, precision agriculture, and increasing demand for sustainable crop protection solutions. The United States dominates the regional market, backed by a strong regulatory framework from agencies like the Environmental Protection Agency (EPA) and the U.S. Department of Agriculture (USDA), which encourage innovation in biopesticides and integrated pest management. In 2023, U.S. farmers spent approximately $14 billion on crop protection chemicals, with a significant rise in bio-based product adoption. Canada also plays a crucial role, with its government supporting sustainable agriculture practices under the "Canadian Agricultural Partnership," which has allocated over CAD 3 billion to improve farm productivity. Additionally, Mexico’s expanding agribusiness sector and increasing exports of fruits and vegetables to the U.S. further fuel market growth in the region.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Key Players

-

BASF SE (Headline, Kixor, Engenia)

-

Bayer AG (Bayer CropScience) (Delaro, Propulse, Luna)

-

Corteva Agriscience (Rinskor, Arylex, Transform)

-

FMC Corporation (Cyazypyr, Diamide, Talstar)

-

Ishihara Sangyo Kaisha Ltd. (Flonicamid, Cyflumetofen, Bixafen)

-

Jiangsu Yangnong Chemical Co. Ltd. (Lambda-cyhalothrin, Bifenthrin, Cypermethrin)

-

Kumiai Chemical Industry Co., Ltd. (Pyriftalid, Cyflufenamid, Benzobicyclon)

-

Mitsui Chemicals Agro, Inc. (Dinotefuran, Ortho-dichlorobenzene, Cyflufenamid)

-

Nippon Soda Co., Ltd. (Topsin-M, Nabu, Flutolanil)

-

Nufarm Ltd. (Weedmaster, Panther, Credit Xtreme)

-

PI Industries (Osheen, Biovita, Nominee Gold)

-

Rotam CropScience Ltd. (Rango, Rufast, Tezuma)

-

Sipcam-Oxon Group (Oxonil, Sipstar, Sipgran)

-

Sumitomo Chemical Co., Ltd. (Pyriproxyfen, Esfenvalerate, Fenitrothion)

-

Tagros Chemicals India Ltd. (Lambda-cyhalothrin, Deltamethrin, Cypermethrin)

-

UPL Limited (Manzate, Lifeline, Saaf)

-

Arysta LifeScience Corporation (Evito, Kasumin, Rancona)

-

Isagro S.p.A (Tetraconazole, Kiralaxyl, Copper Oxychloride)

-

Albaugh LLC (Atrazine, Simazine, 2,4-D)

-

Gowan Company (Permit, Sandea, Trellis)

Recent Developments

-

February 2025: Syngenta acquired a genetic repository from Novartis to enhance its biologic crop protection portfolio. The deal aimed to accelerate Syngenta’s research in sustainable agricultural solutions by leveraging Novartis’ genetic data. This acquisition aligned with Syngenta’s strategy to develop innovative and eco-friendly alternatives to conventional pesticides.

-

February 2025: Albaugh introduced a new Etiprole-based alternative formulation that offered twice the market concentration of existing products. The launch aimed to provide farmers with a more efficient crop protection solution, addressing pest resistance and improving overall yield. The formulation was developed to meet the growing demand for advanced insecticides with lower environmental impact.

-

January 2025: Sumitomo Chemical announced a partnership with a European agricultural firm to develop sustainable crop protection solutions. The collaboration focused on enhancing biological pest control methods and reducing reliance on synthetic chemicals. The initiative aligned with global sustainability goals and regulatory requirements for greener agricultural practices.

-

December 2024: Industry leaders at the Agrochem Summit 2024 called for supportive policies to drive growth in the crop protection sector. Discussions emphasized the need for streamlined regulations, increased R&D investments, and incentives for bio-based pesticides. Experts highlighted the role of policy reforms in boosting the agrochemical market amid rising global food demand.

-

January 2024: U.S. farmers faced increasing challenges as herbicide-resistant weeds spread rapidly, reducing the effectiveness of conventional chemical treatments. Scientists warned that resistance to widely used herbicides, including glyphosate, was worsening, leading to higher production costs and yield losses. Experts urged for integrated weed management strategies to counter the growing threat.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 64.57 Billion |

| Market Size by 2032 | USD 102.31 Billion |

| CAGR | CAGR of 5.30% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Source (Synthetic, Bio-based) •By Product Type (Insecticide, Fungicide & Bactericides, Herbicide, Others) •By Crop Type (Cereals & Grains, Fruits & Vegetables, Oilseeds & Pulses, Others) •By Form (Liquid, Dry) •By Mode of Application (Seed Treatment, Soil Treatment, Foliar Spray, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BASF SE, Bayer AG (Bayer CropScience), Syngenta Group, Corteva Agriscience, FMC Corporation, UPL Limited, Sumitomo Chemical Co., Ltd., Nufarm Ltd., American Vanguard Corporation, ADAMA Agricultural Solutions Ltd. and other key players |