Insulating Glass Window Market Report Scope & Overview:

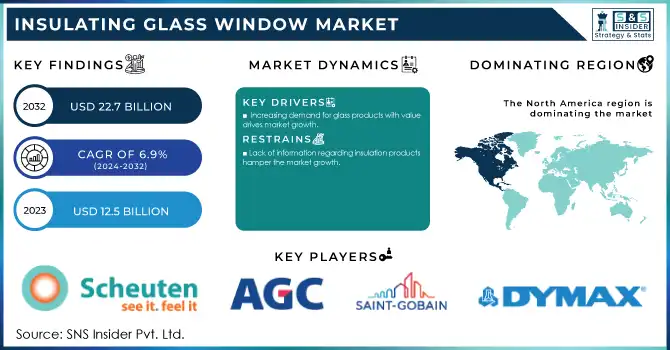

The Insulating Glass Window Market Size was valued at USD 12.5 Billion in 2023 and is expected to reach USD 22.7 Billion by 2032 and grow at a CAGR of 6.9% over the forecast period 2024-2032.

Get E-PDF Sample Report on Insulating Glass Window Market - Request Sample Report

The insulating glass windows demand for energy efficiency has been substantially boosted in the past few years, owing to increasing residential and commercial construction, predominantly across emerging economies. In countries like India, China, and Brazil, urbanization rates have been rising rapidly, leading to substantial investments in the development of relevant infrastructure.

Moreover, in turn, China’s Ministry of Housing and Urban-Rural Development has established drastic measures to minimize the level of energy use in new buildings, setting a 50% energy savings goal. The development of low-emissivity coatings and multi-pane glass technology applications introduced a further increase in the efficiency of insulating glass windows. Finally, increasing energy-efficient construction projects across Europe and the United States, accompanied by substantial legislative pressure, specifically the EPBD requiring NZEBs by 2028, can be deemed as the driving force of the rapid expansion of the target market.

For instance, Saint-Gobain launched a new range of insulating glass windows under the Planitherm series, featuring advanced Low-E coatings. These windows provide improved thermal insulation and enhanced light transmission, catering to the demand for energy-efficient solutions in both residential and commercial construction. The company has been actively expanding its product portfolio to align with the growing global emphasis on green building standards.

Governments have also implemented rules to lower household carbon footprints due to a rise in sustainability awareness due to the recognition of climate change. Governments frequently provide various incentives for the replacement of obsolete windows and furnaces, which result in energy waste, to execute such measures. These subsidies fuel the demand for insulating glass windows. Additionally, throughout the forecast period, there are anticipated to be lucrative potential prospects for the expansion of the insulating glass window market due to the rise in government programs for energy-efficient buildings.

For instance, NSG Group expanded its insulating glass portfolio with the introduction of Pilkington Spacia, a vacuum-insulated glass product. This product targets residential and commercial markets in Europe and Asia, where governments offer subsidies and incentives for replacing outdated, inefficient windows. For instance, the UK Green Homes Grant and Japan’s energy efficiency subsidies have driven demand for NSG’s energy-efficient window solutions.

Insulating glass windows have become a trend in the present residential and commercial building industry as there is a growing emphasis on acoustic insulation. This has been particularly exciting for the builders who work in urban areas like city centers or metropolis areas as the noise formed from various activities has been a problem for both residential buildings and office applications. Indeed, the increased traffic, continuing construction, or industrial activities generate noise which has a great impact on the living and working environment.

Insulating Glass Window Market Dynamics:

Drivers

-

Increasing demand for glass products with value drives market growth.

The insulating glass windows demand is increasing at a remarkable rate, owing to the rapid rise in the demand for high-value glass products. This growth is mainly characterized by the ongoing need for improved safety and features among households and other businesses, which contributes to the increasing demand for insulating glass windows. In addition, the escalating demand is driven by the accelerating implementation of stringent energy efficiency policies which calls for the use of insulating glass windows.

For example, the U.S. Energy Star policy and the EU’s energy performance of buildings directive are urging the near zero-energy buildings by the year 2028. The surge in demand for high-value glass products is driving the growth of the market. High-performance insulating glass windows are the favorite for many residential and commercial users as they solve various potential benefits associated with their use. Notably, the key players have made various developments, which are in line with the central theme of market growth and development.

For example, Saint-Gobain released its Ecovision+ in 2023, a line of insulating glass windows, which advances energy savings and acoustic insulation by accentuating the advanced glasses and the airspace. Likewise, Guardian Glass SunGuard SNX 62/27 2022, controls the solar natural light transmission and is widely accepted by many due to the rising environmental concerns and the increasingly frequent applications. Similarly, that rapid growth is due to the market’s response to the various

Government initiatives aimed at reducing energy usage and enhancing sustainability. For example, the European Commission affirms that the building contributes to forty percent of their energy consumption in the EU, hence, the government’s approval of the energy-efficient materials. Given these factors, insulating glass windows will continue to enjoy massive popularity and use.

-

Maximum Efficiency in Energy Saving

-

Smart Building Energy Efficiency Demand Is Influenced by COVID-19

Restrain

- Lack of information regarding insulation products hamper the market growth.

Insufficient information and awareness of insulation products, specifically insulating glass windows impact market growth significantly. Many end-consumers in both developed and developing regions remain uninformed about high-performance insulation products and their increased energy savings and cost efficiency and hgh fuel use in Glass Manufacturing. Unfortunately, buyers often opt for more affordable and less efficient alternatives for short-term use, not realizing the lower cost of operation in the long term. Insulation technology is relatively complex and involves thermal performance ratings known as U-values, low-emissivity coatings, which help reduce heat loss from buildings, and different gas fillings such as argon. Frequently, a lack of proper guidance and education about these factors overwhelms the buyers.

Insulating Glass Window Market Segmentation

By Product Type

Gas filled insulating glass held the largest market share 43.34% in 2023. This is because This type of insulating glass, typically filled with inert gases like argon or krypton, offers superior thermal insulation compared to air-filled alternatives. The gas significantly reduces heat transfer between the glass panes, making it highly effective in maintaining indoor temperatures and improving energy efficiency. As a result, gas-filled insulating glass has become the preferred choice in both residential and commercial buildings, especially in regions with stringent energy efficiency regulations such as the European Union, North America, and parts of Asia. Key players in the market, such as Saint-Gobain and Guardian Glass, have focused on expanding their gas-filled insulating glass product lines, which align with rising demand for energy-efficient buildings

By Glazing Type

The double-glazed insulating glass market share is around 48.23% in 2023. It is predominantly used in both residential and commercial buildings as it delivers the best combination of cost and energy performance. Double-glazed windows are manufactured by layering two sheets of glass with a layer of air or gas in between. They provide excellent thermal insulation and are more cost-efficient compared to triple-glazed glass. As a result, this product is used the most frequently as places with moderate climates require only double-glazed glass, which meets the necessary thermal performance building energy standards.

By Spacer Type

The warm edge spacer is currently leading the insulating glass window market by spacer type. Warm edge spacers are made from materials with lower thermal conductivity compared to traditional aluminum or metal-based cold edge spacers, helping to reduce heat transfer around the edges of the glass panes. This results in better overall thermal performance, contributing to significant energy savings by minimizing heat loss and condensation at the window edges. As energy efficiency becomes a critical focus for building design, warm edge spacers have gained widespread adoption in both residential and commercial construction.

By Sealant Type

Silicone sealants led the insulating glass windows market by the sealant type. There is a considerable preference for silicone sealants over other types of sealants, which can be justified by their extremely high flexibility, enhanced durability, and resistance to temperature variation, moisture, and UV. Moreover, these sealants remain strong over time, which implies that silicone sealants enable a reliable bond, which helps to preserve the integrity of the insulated glazing unit for a longer period. The fact that silicone sealants are perfectly suitable for withstanding rough environmental conditions and stick to glass very well could also contribute to their commercial use.

By End-Use Industry

The residential segment held the largest market share around 68.34% in 2023. This is because all around the world, people who live in houses and apartments increasingly want to conserve as much energy and gain as much comfort from their dwellings as they can afford. Residential end-users demand high-performance insulating glass windows to achieve lower energy consumption, reduced costs, more considerable comfort in homes, and better noise insulation. Increased demand occurs mainly in the regions with harsh climates and the regions implementing energy emissions regulations, particularly in North America and Europe. Apart from that, in some cases, state programs and support, such as the U.S. Energy Star program and the EU Energy Performance of Buildings Directive, encourage residential end-users to switch to more energy-efficient windows.

Insulating Glass Window Market Regional Analysis

North America held the largest market share around 42.23% in 2023. North America has the largest market share for insulating glass windows because of several, linked factors. To begin with, the region, especially the United States and Canada, has implemented stringent building codes. There are numerous regulations and standards in the United States already in place or proposed to raise energy efficiency in buildings. Examples include the U.S. Energy Star program and Canada’s Energy Code for Buildings which continuously raise the bar on insulating glass windows as a critical element in meeting the new standards. The large residential renovation market in North America cannot be overlooked as it accounts for the largest portion of sales. Homeowners in the region increasingly install insulating glass windows to save on energy costs and to make their homes more comfortable. Lastly, some of the more contemporary market drivers include policies and competitions, such as the 2023 update from the U.S. Department of Energy that brought new stringent standards. Such factors working in combination suggest that North America is in the lead because of the restrictive regulations that are accompanied by high demand on the consumer side and considerable investments on the part of the industry.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players:

- Saint-Gobain (Planitherm, , Saint-Gobain Glass)

- Guardian Glass (ClimaGuard, Guardian Low-E)

- AGC Inc. (Thermobel Advanced, AGC Solar Control Glass)

- NSG Group (Pilkington K Glass™, Pilkington Optiwhite)

- Schüco International (AWS, ASE 60, Schüco FWS 35 PD)

- Scheuten

- Dymax

- Central Glass Co., Ltd.

- Marvin Windows and Doors (Infinity, Integrity, Elevate)

- Jeld-Wen (Siteline EX, W-2500, V-2500)

- Kolbe Windows & Doors (VistaLuxe, Ultra Series, Heritage Series)

- Milgard Windows & Doors (Ultra Series, Tuscany Series, Style Line Series)

- Henkel AG & Co. KGaA

- Rehau Group (Brillant-Design, Euro-Design 70)

- 3M

- Viracon

- FENSA (Fensa Glass Units, Fensa Performance Windows, Fensa Energy-Efficient)

- H.B. Fuller Company

- Sika AG

- Internorm

Recent Development:

-

In 2023, Schüco International introduced Schüco FWS 35 PD, a new façade system offering enhanced thermal insulation and acoustic performance.

-

In 2023, YKK AP Inc. released YKK AP Thermal Windows with improved energy efficiency and enhanced weather resistance.

-

In 2023, Marvin Infinity, a new line of windows with enhanced thermal performance and sustainability features.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 12.5 Billion |

| Market Size by 2032 | US$ 22.7 Billion |

| CAGR | CAGR of 6.9% From 2023 to 2032 |

| Base Year | 2022 |

| Forecast Period | 2023-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Vacuum insulating glass (VIG), Gas filled insulating glass, Air filled insulating glass) • By Glazing Type (Double glazed, Triple glazed, Others) • By Spacer Type (Cold edge spacer, Warm edge spacer) • By Sealant Type (Silicone, Polysulfide, Hot melt butyl, Polyurethane, Others) • By End-Use Industry (Residential, Commercial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Scheuten, AGC Inc.,Compagnie de Saint-Gobain SA, Dymax, Guardian Glass, H.B. Fuller Company, Nippon Sheet Glass Co., Ltd., Henkel AG & Co. KGaA, Central Glass Co., Ltd., Internorm, Viracon, Sika AG, 3M, and other players. |

| Drivers | • Maximum Efficiency in Energy Savings • Increasing Demand for Glass Products with Value drives market growth. • Building Energy Efficiency Demand Is Influenced by COVID-19 |

| Restraints | • Lack of Information Regarding Insulation Products hamper the market growth. |