Kidney Stone Management Market Size Analysis:

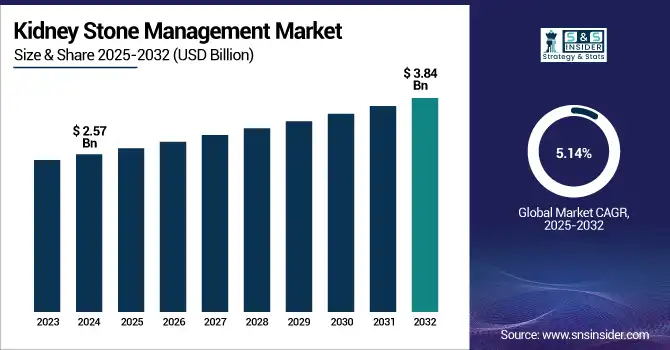

The Kidney Stone Management Market size was valued at USD 2.57 billion in 2024 and is expected to reach USD 3.84 billion by 2032, growing at a CAGR of 5.14% over the forecast period of 2025-2032.

To Get more information on Kidney Stone Management Market - Request Free Sample Report

The global kidney stone management market is driven by the increasing incidence and high recurrence rate of kidney stones across the globe. According to the Journal of the American Society of Nephrology, Nephrolithiasis currently affects nearly 7% of adults globally, with over 30% experiencing a recurrence in under 10 years. Nationally, over 10% of the United States had kidney stones, a rise from 8.8% in the late 2000s, between 2013 and 2014. In the U.S., the healthcare bill for stone disease is substantial, exceeding USD 1.24 billion in annual medical management costs as reported by the National Center for Biotechnology Information.

The U.S. kidney stone management market size was valued at USD 0.75 billion in the year 2024 and is expected to reach USD 1.11 billion by the year 2032 at a CAGR of 5.02% over the forecast period. These drivers are further supported by advances in technology surrounding miniaturized surgeries, holmium laser technologies, and disposable ureteroscopes that are enhancing outcomes and minimizing complications in this market. The prevalence of kidney stones is reported to be greater than 10% (UK) and 12% of the population (India) by government health agencies, notifying the global burden of disease and the need for implementation of effective kidney stone treatment market.

Kidney Stone Management Market Dynamics

Drivers

-

Growing Incidence of Kidney Stones Globally and Lifestyle-Associated Risk Factors Are Increasing Demand for New Therapies

New paradigms in the lifestyle/dietary correlation with stone disease are driving the rapid worldwide increase in kidney stone burden, and this, in turn, is driving demand for a new era of kidney stone management. The U.S. National Health and Nutrition Examination Survey (NHANES) has shown that the prevalence of kidney stones in the United States increased from 9.0% in 2013–2014 to 10.1% in 2015–2016, with a combined age-standardized prevalence of 9.3% from 2007 to 2016. Trends of incidence rising in a similar trajectory as that observed in the ASR have been documented globally; for example, an increase in incidence from 1979 to 2001 of 4.0% to 4.7% in Germany, and an explosive rise in other countries such as India and Malaysia, with incidence rates that were less than 40/100,000 in the 1960s increasing to 930/100,000 and 442.7/100,000 accordingly thirty years later.

Such increases may be related to an increasing prevalence of modifiable risk factors such as unhealthy eating, inactivity, and obesity, and an increasing contribution of chronic kidney disease (CKD), arising from a recent report by the Australian Institute of Health and Welfare of CKD-related mortality. Introduction Increasing prevalence of kidney stone disease is driving healthcare systems towards the implementation of new, less invasive, delivery systems for more cost-effective, patient-centric therapies, exemplified by the recent FDA-approved clinical trial of Avvio Medical's Enhanced Lithotripsy System to enhance, expedite, and optimize outpatient treatment regimens to improve clinical outcomes when affected patients receive treatment at a designated treatment site.

Restraints

-

High Cost and Limited Accessibility of Advanced Kidney Stone Treatments Remain Major Barriers to Widespread Adoption

Kidney stone management market growth and equitable access to patient care will continue to be hindered by the cost and access barriers of advanced kidney stone management technologies. Although new devices such as Avvio Medical's Enhanced Lithotripsy System are changing the possibility for fast, effective, outpatient, and minimally invasive procedures, the immediate cost of the latest application, teaching, and facilities will still be high for a lot of healthcare providers, particularly in low- and middle-income regions.

Moreover, sophisticated procedures often necessitate specialty devices and knowledge that vary by geography and are not necessarily widely available. This also means that in developing countries, the differences in funding and provision of healthcare, and who has insurance, worsen these problems, and sometimes treatment cannot be given to a patient soon enough, or is never given. Even in developed countries, uninsured communities may face out-of-pocket costs for diagnostics, surgery, and follow-up care that are unaffordable. Consequently, the relatively expensive and limited access to recent therapies still proves to be one of the key impediments to large-scale implementation of kidney stone management technologies, even in the face of continued technological advancement and a rise in the incidence of the disease.

Kidney Stone Management Market Segmentation Analysis

By Type

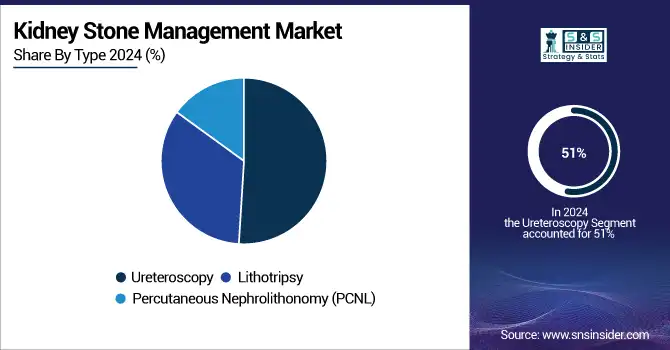

The ureteroscopy segment dominated the market with 51% of kidney stone management market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This section is dominated by increased usage of minimally invasive urology surgeries, which result in fewer complications and a quick recovery period, and a low recurrence rate of kidney stones. Recent technological advances in lithotripsy and high-resolution imaging have made ureteroscopy the treatment of choice for both patients and providers.

The European Association of Urology and other regulatory bodies recognize these innovations by recommending flexible ureteroscopic lithotripsy as a first-line treatment for stones less than 2cm, and an alternative for larger stones. Whereas ureteroscopes themselves were previously reusable, the advent of disposable ureteroscopes and advanced laser technologies such as holmium and MOSES lasers has increased the precision and safety of the removal of kidney stones even further. Such as the MOSES technology from Lumenis, which in March 2020 was able to highlight the use of highly energized lasers to fragment stones with minimal tissue damage, improving patient outcomes and thereby reducing the recurrence rate of kidney stones. Since ureteroscopy is most commonly used for calcium oxalate stones and uric acid stones, the segment also benefited from the rising incidence of these stones.

By end users

The hospitals led the kidney stones management market in 2024, Use in-hospital setting to dominate as only hospitals have comprehensive capabilities to provide all levels care, they have extensive diagnostic imaging capacities, and can treat complicated cases, surgical intervention for kidney stones, for instance, extracorporeal shock wave lithotripsy (ESWL), percutaneous nephrolithotomy (PCNL), and endourology market. Hospitals also have the benefit of reimbursement policies and large investments in technologies around kidney stone management companies. According to the CDC, over 1 million people visit U.S. hospital emergency rooms a year for kidney stones, and around 20% require admission for subsequent surgical treatment.

Meanwhile, the specialty clinics are expected to show the fastest kidney stone management market growth over the forecast period. specialty clinics with an emphasis on minimally invasive urology procedures, shorter waiting lists, and faster adoption of new technologies for kidney stone removal (i.e., single-use ureteroscopes; novel ESWL systems) are establishing themselves with increasing speed. The specialty clinics segment is driven by the transition from inpatient-based procedures to outpatient-based procedures and the increasing number of ambulatory surgical centers providing urinary stone management. The NHS in the UK has witnessed a growing interest in ureteroscopy procedures, reporting a 12% increase from the same period in 2023 to 2024 in exploratory evaluations of renal and ureteric calculi.

Regional Insights

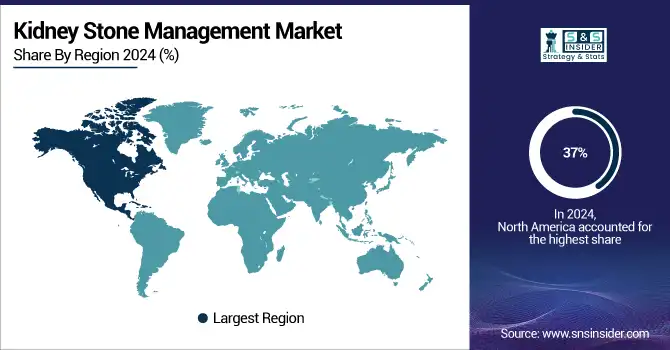

In 2024, North America will dominate the kidney stone management market, capturing nearly 37% of the global market as a single regional market. Several structural and demographic considerations underlie this leadership. Based on estimates of 10% of the adult population in the United States, the high frequency of kidney stones in the area fuels significant demand for both therapeutic and diagnostic approaches. The U.S. kidney stone management market was estimated at USD 0.75 billion in 2024, and landmarks approximately USD 1.11 billion by 2034, growing at a CAGR of 5.02%.

The advanced healthcare infrastructure and increased healthcare spending in North America make it easier to adopt novel technologies for removing kidney stones as ESWL, flexible ureteroscopy, and robotic-assisted procedures. This dominance can be attributed to favourable reimbursement policies, the significant presence of the major kidney stone management companies, and a culture of early adoption of minimally invasive urology procedures in the region. The end user segment is further divided into hospitals, ambulatory surgical centers, and specialty clinics. Hospitals are the leading end users, as they are capable of handling complex cases and can provide an entire range of options in the nephrolithiasis treatment market; however, ambulatory surgical centers offer the necessary convenience and patient-centric health care, but on an increasingly broader basis.

Europe is the second-largest region in the global kidney stone management market, and the region is gaining from increasing incidences, high acceptability of advanced medical solutions, and government initiatives towards healthcare. Germany, France, and the UK lead in this category, with established reimbursement structures that allow for advanced treatments to treat a larger proportion of the eligible population and a trend toward minimally invasive procedures. The European market is further defined by the high amount of investment into research and development to improve the efficacy of diagnostic imaging for kidney stones while new technologies for kidney stones removal are also entering the market. Market drivers are an aging population in the region, as well as increasing lifestyle-induced risk factors for kidney stones, such as obesity and food habits.

The Asia-Pacific kidney stones management market is poised to become the fastest-growing regional market in the global kidney stones management market. Major drivers of the rapid development of the region include a huge and aging population, a higher incidence of kidney stones, and broader healthcare access. Rising awareness, an increase in disposable income, and government initiatives for the modernization of healthcare infrastructure are the factors for increasing demand for urinary stone management in regions such as China, India, and Japan. The underpenetration of advanced kidney stone removal technologies in Asia-Pacific is also creating lucrative opportunities for key kidney stone management companies to define their presence in the region. Supported by extensive educational efforts and the availability of cost-effective alternatives, the adoption of minimally invasive urology for procedures including ESWL, ureteroscopy for kidney stones, and percutaneous nephrolithotomy (PCNL) is being rapidly advanced.

Get Customized Report as per Your Business Requirement - Enquiry Now

Kidney Stone Management Market Key Players

The key Kidney stone management Companies are Olympus Corp., Storz Medical AG, Medi spec Ltd., Cook Medical Inc., Richard Wolf GmbH, Lumenis, EDAP TMS, DirexGroup, Elmed Electronics & Medical Industry & Trade Inc., Convergent Laser Technologies, E.M.S. Electro Medical Systems S.A., C.R. Bard Inc., and others

Recent Developments in the Kidney Stone Management Market

-

PubMed released a study on technological developments in percutaneous nephrolithotomy (PCNL) in April 2025, stressing integrated navigation, robotics, and artificial intelligence as revolutionary for the market for nephrolithiasis treatment.

-

Emphasizing early detection and minimally invasive urological operations, The U.S. National Institutes of Health (NIH) published revised recommendations on the treatment of urinary stone management in October 2024 (NIH.gov, 2024).

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 2.57 Billion |

| Market Size by 2032 | USD 3.84 Billion |

| CAGR | CAGR of 5.14% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Lithotripsy, Ureteroscopy, and Percutaneous Nephrolithotomy (PCNL)) • By End User (Hospitals, Specialty Clinics, and Ambulatory Surgical Centers) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Olympus Corp., Storz Medical AG, Medi spec Ltd., Cook Medical Inc., Richard Wolf GmbH, Lumenis, EDAP TMS, DirexGroup, Elmed Electronics & Medical Industry & Trade Inc., Convergent Laser Technologies, E.M.S. Electro Medical Systems S.A., C.R. Bard Inc., and others |