Personalized Medicine Biomarkers Market Size Analysis

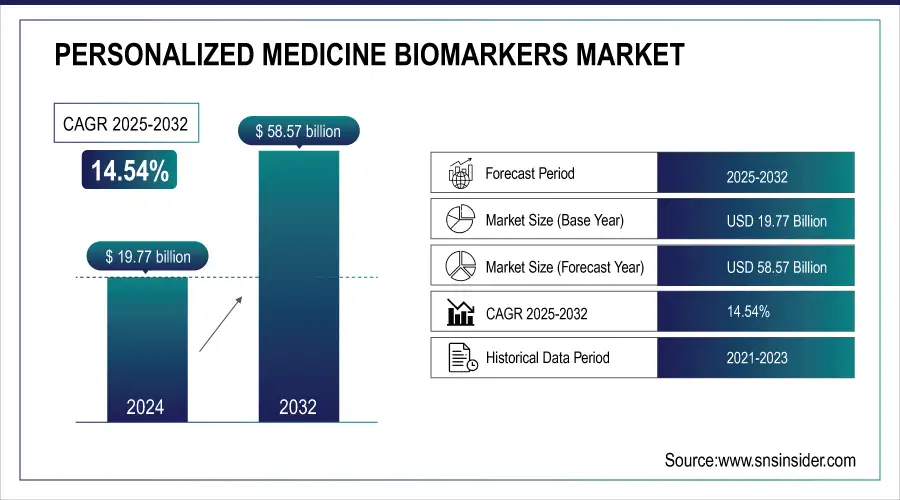

The Personalized Medicine Biomarkers Market was valued at USD 19.77 billion in 2024 and is expected to reach USD 58.57 billion by 2032, growing at a CAGR of 14.54% from 2025-2032.

Get More Information on Personalized Medicine Biomarkers Market - Request Sample Report

The Personalized Medicine Biomarkers Market is rapidly advancing, driven by precision medicine and the demand for targeted therapies. Biomarkers enable tailored treatments by identifying patients likely to respond to specific therapies, improving outcomes and reducing side effects. Oncology leads the market, with PD-L1, BRCA1/2, and EGFR biomarkers guiding diagnostics and therapy, while liquid biopsies enable early, minimally invasive detection. Neurology and pharmacogenomics are expanding applications, enhancing early disease detection and individualized drug responses. Regulatory support, AI-driven biomarker discovery, and industry investments from companies like IBM Watson Health and Roche are accelerating growth, transforming healthcare toward precise, patient-specific care.

Personalized Medicine Biomarkers Market Trends

-

Rising demand for targeted therapies and precision medicine is driving biomarker adoption.

-

Advances in genomics, proteomics, and metabolomics are enabling identification of novel biomarkers.

-

Integration with AI and big data analytics is enhancing patient stratification and treatment optimization.

-

Growing prevalence of chronic and genetic diseases is boosting market growth.

-

Expansion of companion diagnostics and targeted drug development is increasing biomarker utilization.

-

Collaborations between pharma companies, biotech firms, and research institutions are accelerating innovation.

-

Supportive regulatory frameworks and increased funding for personalized medicine are fostering market adoption.

Personalized Medicine Biomarkers Market Growth Drivers

-

Increasing Demand for Targeted Therapies in Oncology

A key factor propelling the Personalized Medicine Biomarkers market is the rising need for targeted treatments, particularly in cancer care. Personalized medicine utilizes biomarkers to pinpoint particular molecular targets, allowing for more efficient treatment alternatives by concentrating on the unique attributes of a patient's tumor. In oncology, biomarkers play a vital role in detecting mutations, choosing the appropriate medication, and assessing treatment efficacy, resulting in better patient outcomes.

Furthermore, the U.S. Food and Drug Administration (FDA) has authorized over 20 targeted cancer therapies in the last ten years, highlighting the growing acknowledgment of the importance of personalized treatment. The capability to provide customized therapies to patients according to their distinct genetic characteristics has generated significant interest in personalized biomarkers for cancer treatment.

-

Advancements in Genomic Technologies and Diagnostics

Improvements in genomic technologies, such as next-generation sequencing (NGS), have greatly advanced the personalized medicine biomarkers industry. NGS facilitates high-throughput sequencing of DNA and RNA, making it possible to identify genetic variations and biomarkers linked to diseases. This technology has transformed how healthcare professionals identify conditions and tailor treatments, especially in intricate diseases such as cancer, cardiovascular issues, and neurological disorders.

These technological innovations are improving the precision of biomarker identification and the creation of diagnostic tests, fueling the need for personalized medicine. Furthermore, numerous firms, including Illumina and Thermo Fisher Scientific, have introduced new sequencing technologies that offer quicker and more cost-effective biomarker analysis, thereby boosting the expansion of this market.

Personalized Medicine Biomarkers Market Restraints:

-

High Costs of Biomarker Discovery and Implementation

A major constraint for the Personalized Medicine Biomarkers market is the substantial expenses linked to biomarker discovery, validation, and application. Creating customized biomarkers necessitates significant research and clinical testing, which are both resource-demanding and time-intensive. The expenses associated with carrying out genomic research, securing regulatory approvals, and producing diagnostic tests based on biomarkers can be excessive, especially for smaller biotech companies and healthcare practitioners.

Additionally, although genomic sequencing technologies have progressed significantly, they still necessitate specialized infrastructure and trained professionals, which can increase the total expense. This might restrict the uptake of personalized medicine, particularly in low-resource areas or developing markets where healthcare funding is limited. Moreover, reimbursement challenges for biomarker-based assessments in certain areas also hinder market expansion. Although personalized medicine holds great potential, the financial obstacles linked to these technologies may hinder their widespread use and restrict access for a larger patient demographic.

Personalized Medicine Biomarkers Market Segmentation Analysis

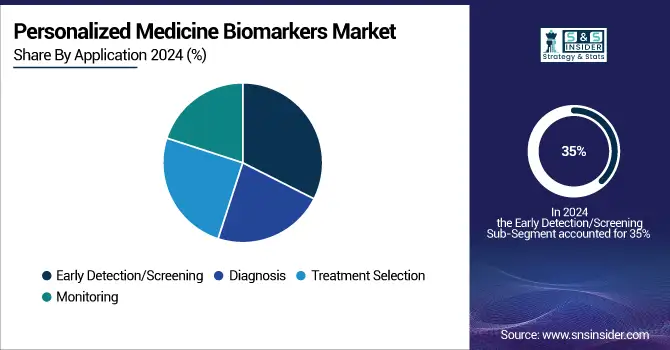

By Application: Early detection/screening dominated the personalized medicine biomarkers market, while Treatment Selection is projected to grow fastest.

The early detection/screening segment dominated the market holding the highest market share of 35% in 2023. The expansion of the segment can be linked to the demand for early intervention. For patients exhibiting the biomarker associated with a therapy's response, the likelihood of survival relies on the treatment pathway. For example, the presence of the HER2/neu protein serves as a prognostic indicator for breast cancer. Additionally, KRAS is a commonly mutated oncogene in colorectal cancer and serves as a biomarker indicating resistance to anti-EGFR monoclonal antibody treatment. Additionally, the advancement of new technologies for the early identification of different conditions is also driving the market's growth.

The treatment Selection segment is to expand at a notable CAGR of 13% during the forecast period, Personalized medicine biomarkers aid in selecting the most appropriate patients for early-phase clinical trials, based on the tumor's molecular features. They likewise offer details about the action mechanism of a specific medication. The emphasis in oncology drug development has transitioned from developing non-specific cytotoxic chemotherapies to creating molecularly targeted therapies due to the discovery of specific mutations that effectively predict a drug's efficacy in a molecularly defined patient population. Furthermore, an improved range of treatments boosts the chances of addressing the condition, which in turn drives the need for personalized medicine biomarkers.

By Indication: Oncology led the market in 2023, with Diabetes expected to expand at the fastest rate.

In 2023, oncology held the most significant market share at 41%, fueled by the rising incidence of cancer globally. The World Health Organization estimates that by 2040, cancer cases could increase to 29.5 million, requiring improved diagnostic and treatment methods. Personalized medicine customizes treatment according to individual genetic and molecular characteristics, improving the effectiveness of cancer therapies while reducing side effects. GLOBOCAN reported that there were 18,741,966 cancer instances worldwide in 2022. Of these, there were 9,566,825 cases reported in men, whereas 9,175,141 cases were noted in women. The need for biomarkers that can forecast patient reactions to targeted therapies and immunotherapies is swiftly growing, enabling earlier diagnosis and enhancing overall patient results in oncology, thereby driving market expansion in this area.

The diabetes segment is the fastest-growing sector and is anticipated to expand at a CAGR of % throughout the forecast duration. The diabetes sector is seeing significant expansion in the personalized medicine biomarkers market, propelled by the increasing worldwide incidence of diabetes. As per the IDF Diabetes Atlas, the worldwide count of people with diabetes is increasing and is projected to rise by 46% between 2020 and 2045, whereas the global population is expected to grow by only 20%. Personalized medicine, concentrating on customizing treatments according to specific biomarkers, is vital in diabetes management as it helps identify patients at risk for complications and enhances therapeutic approaches. The need for biomarkers that can forecast glycemic control, insulin sensitivity, and various metabolic reactions is growing, promoting progress in targeted treatments and enhancing patient results in diabetes management.

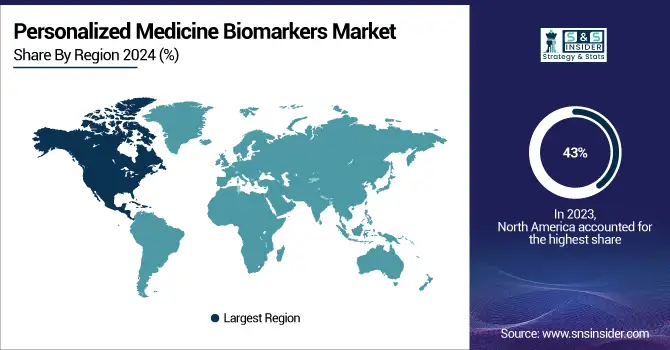

Regional Analysis

North America Personalized Medicine Biomarkers Market

The North American region dominated the Personalized Medicine Biomarkers market with 43% in 2023, mainly fueled by the presence of top biotechnology firms, sophisticated healthcare systems, and substantial funding in research and development. The U.S., especially, is notable for its strong healthcare system, significant need for customized treatments, and supportive government initiatives, like the 21st Century Cures Act, which streamlines the approval process for new medications and medical devices, including biomarkers. Moreover, the rising incidence of chronic illnesses and the heightened emphasis on precision medicine have also bolstered the market's robustness in North America. The presence of sophisticated sequencing technologies, along with robust reimbursement policies, has further enhanced the use of personalized medicine biomarkers in this area.

Need Any Customization Research On Personalized Medicine Biomarkers Market - Inquiry Now

Asia Pacific Personalized Medicine Biomarkers Market

The Asia Pacific area is the fastest growing personalized medicine biomarkers market, fueled by swift improvements in healthcare systems, a rising prevalence of chronic illnesses, and an escalating emphasis on personalized healthcare options. Nations such as China and India are at the forefront of clinical research and precision medicine adoption, backed by government programs focused on enhancing healthcare accessibility and affordability. As these countries allocate resources to genomics research and biotechnological advancements, the need for personalized medicine biomarkers is projected to grow, driven by expanding healthcare industries and a rising number of biotech startups concentrating on biomarker identification and confirmation.

Europe Personalized Medicine Biomarkers Market

Europe is a key region in the Personalized Medicine Biomarkers Market, driven by advanced healthcare infrastructure, strong R&D, and supportive regulatory frameworks. Widespread adoption of precision medicine, especially in oncology and neurology, fuels demand for biomarkers like BRCA1/2 and PD-L1. Government initiatives, public-private collaborations, and investments in AI-based biomarker platforms enhance innovation. Europe’s focus on early disease detection, personalized therapies, and pharmacogenomics positions it as a leading hub for biomarker research and application.

Middle East & Africa and Latin America Market

The Middle East & Africa and Latin America are emerging markets in Personalized Medicine Biomarkers, driven by growing awareness of precision medicine and increasing healthcare investments. Expansion in oncology and neurology applications, along with government initiatives to improve diagnostics and treatment, is fueling growth. Challenges like limited infrastructure are being addressed through collaborations and technology adoption. Rising interest in pharmacogenomics and AI-based biomarker platforms is creating new opportunities across these regions.

Competitive Landscape:

Thermo Fisher Scientific

Thermo Fisher Scientific is a leading player in the Personalized Medicine Biomarkers Market, offering advanced solutions like the Oncomine Tumor Mutation Load Assay and Ion AmpliSeq Cancer Hotspot Panel. The company focuses on enabling precision oncology through comprehensive genomic profiling, supporting targeted therapies and early disease detection. Continuous innovation, strong R&D, and collaborations with healthcare providers position Thermo Fisher Scientific as a key contributor to the growth of personalized medicine and biomarker-driven treatments.

-

In 2025, Thermo Fisher Scientific’s newly launched Olink Explore Platform will be deployed in the UK Biobank Pharma Proteomics Project to analyze over 5,400 proteins from 600,000 samples, facilitating large-scale discovery of proteomic biomarkers and advancing precision medicine initiatives.

Illumina

Illumina is a prominent leader in the Personalized Medicine Biomarkers Market, providing advanced genomic sequencing solutions such as the TruSight Oncology 500 and NovaSeq 6000 Sequencing System. These technologies enable comprehensive biomarker discovery, precise cancer profiling, and targeted therapy development. With strong R&D, innovative sequencing platforms, and collaborations with healthcare and research institutions, Illumina plays a pivotal role in advancing precision medicine, enhancing early disease detection, and supporting personalized treatment strategies globally.

-

2024: Illumina’s TruSight Oncology Comprehensive (TSO Comprehensive) test received FDA approval as the first distributable pan-cancer genomic profiling IVD kit, analyzing over 500 genes and providing companion diagnostics for targeted therapies.

-

2025: Illumina launched TruSight Oncology 500 v2, enhancing tumor profiling with HRD biomarker detection, faster turnaround, and reduced tissue requirements, supporting broader precision oncology research.

-

2025: Illumina partnered with Tempus to accelerate clinical adoption of NGS molecular profiling across major disease categories, leveraging AI and multimodal data to advance precision medicine.

Key Players in the Personalized Medicine Biomarkers Market

-

Thermo Fisher Scientific (Oncomine Tumor Mutation Load Assay, Ion AmpliSeq Cancer Hotspot Panel)

-

Roche Diagnostics (cobas EGFR Mutation Test v2, Elecsys BRAHMS PCT)

-

Illumina (TruSight Oncology 500, NovaSeq 6000 Sequencing System)

-

AbbVie (Venclexta (venetoclax), AndroGel (testosterone gel))

-

Qiagen (QIAamp DNA Blood Mini Kit, Therascreen EGFR RGQ PCR Kit)

-

Agilent Technologies (SureSelect Clinical Research Exome Kit, Dako PD-L1 IHC 22C3 pharmDx)

-

Merck & Co. (Keytruda (pembrolizumab), FoundationOne CDx)

-

Bristol Myers Squibb (Opdivo (nivolumab), Empliciti (elotuzumab))

-

Bio-Rad Laboratories (Droplet Digital PCR (ddPCR) System, Bio-Plex Pro Human Cytokine 27-Plex Assay)

-

PerkinElmer (AlphaLISA Human Biomarker Kits, LabChip GX GXII Touch System)

-

GE Healthcare (PET/CT Scanner Discovery MI, MRI Scanner SIGNA Premier)

-

Novartis (Kymriah (tisagenlecleucel), Cosentyx (secukinumab))

-

Thermo Fisher Scientific (Oncomine Comprehensive Assay, Ion Proton System)

-

Abbott Laboratories (Alinity m, ARCHITECT i2000SR)

-

Beckman Coulter (Access 2 Immunoassay System, UniCel DxC 600 Pro)

-

Cardiff Oncology (ONCOS-102, ONCOS-103)

-

Myriad Genetics (myRisk Hereditary Cancer Test, EndoPredict Test)

-

Gilead Sciences (KTE-X19 (KTE-C19), Yescarta (axicabtagene ciloleucel))

-

Hologic (Aptima HPV Assay, ThinPrep Pap Test)

-

Guardant Health (Guardant360 Liquid Biopsy Test, GuardantOMNI Genomic Profiling Test)

Personalized Medicine Biomarkers Market Suppliers

These suppliers provide essential tools and technologies that support personalized medicine biomarkers, ranging from diagnostic assays to sequencing systems and imaging solutions.

-

Thermo Fisher Scientific

-

Roche Diagnostics

-

Illumina

-

Qiagen

-

Agilent Technologies

-

PerkinElmer

-

Bio-Rad Laboratories

-

GE Healthcare

-

Guardant Health

-

Abbott Laboratories

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | US$ 17.26 Billion |

| Market Size by 2032 | US$ 58.39 Billion |

| CAGR | CAGR of 14.54% From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Application (Early Detection/Screening, Diagnosis, Treatment Selection, Monitoring) •By Indication (Oncology, Neurology, Diabetes, Autoimmune Diseases, Cardiology, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Becton, Dickinson and Company, Novo Nordisk, Thermo Fisher Scientific, F. Hoffmann-La Roche Ltd., Illumina, Agilent Technologies, Bio-Rad Laboratories, Abbott Laboratories, Qiagen, Myriad Genetics, Siemens Healthineers, PerkinElmer, Danaher Corporation, Genomic Health, Quest Diagnostics, Foundation Medicine, Exact Sciences, NanoString Technologies, Caris Life Sciences, Guardant Health, and other players. |