Lawn & Garden Equipment Market Report Scope & Overview:

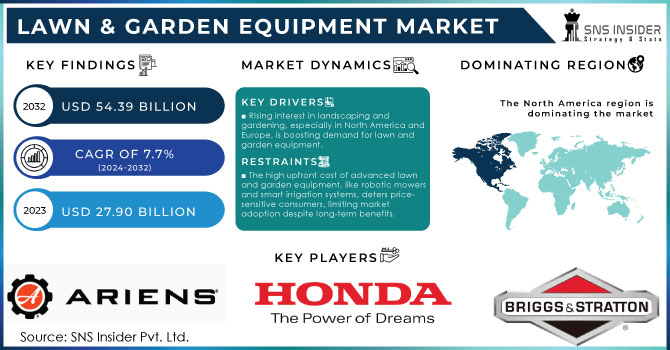

The Lawn & Garden Equipment Market size was valued at USD 27.90 Billion in 2023 and is projected to reach USD 54.39 Billion by 2032, displaying a compound annual growth rate (CAGR) of 7.7% during the forecast period of 2024 - 2032.

Get More Information on Lawn & Garden Equipment Market - Request Sample Report

The lawn & garden equipment market, particularly in machinery, has seen significant activity recently due to several key factors. These include rise in urban and suburban gardening and landscaping has driven demand for advanced equipment that offers efficiency and ease of use. Innovations in technology including robotic lawn mowers and smart irrigation systems, are meeting the growing consumer preference for automation and precision.

Moreover, surged focus on sustainable practices has led to a rise in eco-friendly and energy-efficient machinery. Increasing disposable incomes and the trend of enhancing residential outdoor spaces also propel the lawn & garden equipment market growth. As homeowners and businesses seek to improve aesthetics and functionality, the lawn & garden equipment market continues to expand, driven by technological advancements and evolving consumer needs. Some of the lawn and garden equipment are techniques including GPS system, auto braking system, which drives along the stems to cut the grass in a uniform style.

Apart from technological shifts, environmental regulations in the U.S. have also had a critical influence on the market. It was reported that California will ban gasoline-powered small off-road engines in 2024, which is expected to be driving the shift to electric lawn mowers and other battery-powered equipment across the nation. At the same time, the growing popularity of organic gardening can also be expected to stimulate demand for eco-friendly, low-emission tools, creating a lawn & garden equipment market trend projected to ensure 20% growth in sales of electric and battery-powered equipment by 2027 compared to gas-powered alternatives.

Currently, the most significant obstacles are the high prices of advanced electric tools and, especially, robotic equipment, which exclude them from the budget of most customers. In addition, the price of raw materials has seen significant fluctuations, with the experts noting 8%-10% increases in the cost of steel and aluminum in 2023. Thus, many manufacturers find themselves torn between increasing prices and degrading their profitability, forcing them to seek compromise solutions.

In 2024: Husqvarna has unveiled its latest robotic mower model, the Husqvarna Automower 535 AWD. This state-of-the-art device boasts advanced navigation systems and all-wheel drive capabilities, designed to tackle even the most challenging terrains with ease. This innovation represents a significant leap forward in autonomous garden care technology.

Lawn & Garden Equipment Market Dynamics:

Drivers:

-

Rising Interest in Landscaping and Gardening, Especially in North America and Europe, is Boosting Demand for Lawn and Garden Equipment

The landscaping and gardening boom seen in residential, commercial, and public spaces has been a significant driver for the increased demand for this type of equipment. Not only does urbanization and disposability of income push homeowners to invest in creating visually pleasing outdoor segments surrounding their properties, but it also influences commercial companies to show the same interest. Undeniably America and Europe are at the forefront of this development: the former’s cultural obsession with perfect lawns together can be the perfect explanation for its leading role, with many parts of Europe following in this influence.

Homeowners view their gardens not only as a greener extension of their home space but also as a place for entertainment and social interaction. Therefore, an increasing number of households are inclined to buy lawnmowers, hedge trimmers, leaf blowers, and other equipment to keep their gardens neat and visually appealing. An industry survey indicated that this type of equipment is sold in increasing amounts every year. The same could be said about commercial companies fighting for customers and reputation by improving not only the inside but also the outside of their establishments.

Hotels, shopping centers, and office parks see a value in professionals’ continuous effort and application of gardening and lawn equipment to keep their surroundings lovely. The governments of different levels are vying to make public green spaces accessible and pleasant, and purchases of special equipment facilitate this development. The rollout accumulatively explains the investment seen in the lawn and garden equipment sphere over recent years, which corresponds with the overall tendency of people becoming more value-oriented in the area of aesthetics maintenance.

-

Technological Innovations in Robotic Mowers, Battery Tools, and Smart Irrigation Systems are Boosting Lawn Maintenance Efficiency, Driving Market Growth

Innovations of robotic mowers, battery-operated tools, and smart irrigation systems are defined as the true transformation of lawns maintenance due to the high efficiency of these pieces of equipment and the attraction of eco-conscious customers. Robotic mowers take advantage of their advanced sensors and usage of AI technologies to ensure precision and automation of this process. Lasers, sensors of objects, and cameras are expected to be used by this machinery to define the field for mowing. The current system allows robotic mowers to learn to cut when the grass reaches a specific height, not according to the initial field form. This type of mowers returns to the charging station and continues mowing after its battery is ready or even some problem with a blade is noticed.

These characteristics are significant when customers look for reliable companies to help with essay writing. Battery-operated tools for grass including trimmers or blowers have become essential due to the possibility of avoiding gasoline use. Moreover, battery-operated blowers of leaves become more popular than gas-powered equipment because they are quieter and cleaner. Smart irrigation systems also have the right to be called one of the significant changes. Gardeners use weather data and soil moisture sensors to determine when and where this water will be needed. Mistakes of over-irrigation are minimized, and, as a result, the water bill is decreased.

Restraints:

-

High Upfront Cost of Advanced Lawn and Garden Equipment Including Robotic Mowers and Smart Irrigation Systems, Hamper Market Growth

The most prominent barrier preventing a wider adoption of smart technologies among price-sensitive consumers is the high upfront cost of advanced lawn and garden equipment. Both robotic mowers and smart irrigation systems offer a range of benefits, such as reduced labor, higher efficiency, and lower maintenance cost in the long run. While golden customers can easily commit to the systems for their savings and environmental advantages, price-sensitive consumers are more hesitant, as they cannot easily opt for more costly technologies, hoping to benefit more in the future. Until the prices of these technologies decrease, or the financing options become more accessible, the high cost of advanced production systems will remain a formidable barrier.

Lawn & Garden Equipment Market Outlook:

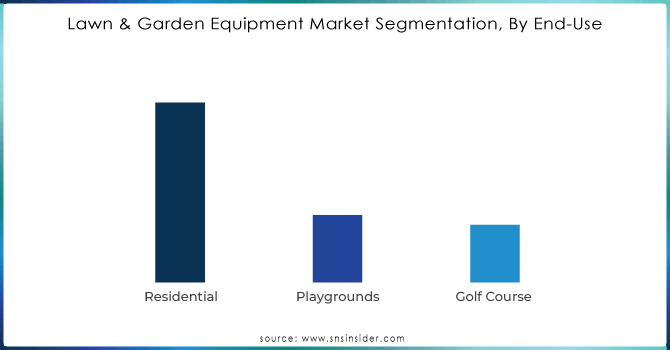

By End-Use

The Residential segment is dominating the market with the share of around 59.04% in 2023. This dominance is due to increase in the single-family households and the anticipate increase in online sales of lawn & garden equipment will boost the demand. With the increasing trend of Do-It-Yourself, garden equipment OEMs are introducing a new product lineup which is inexpensive and user-friendly for household use for outdoor lawn & garden activations which are growing are thereby helping in the market expansion.

Ask For Customized Report as per Your Business Requirement - Enquiry Now

By Power

The Electric segment is dominating the market with a lawn & garden equipment market share of around 46.4% in 2023. The segment’s growth is driven by the growing worries toward global warming and fuel emission, and green energy, acting as the market dampener. As customers are looking for eco-friendly solutions, the electric segment is promising thus is driving the overall market’s expansion.

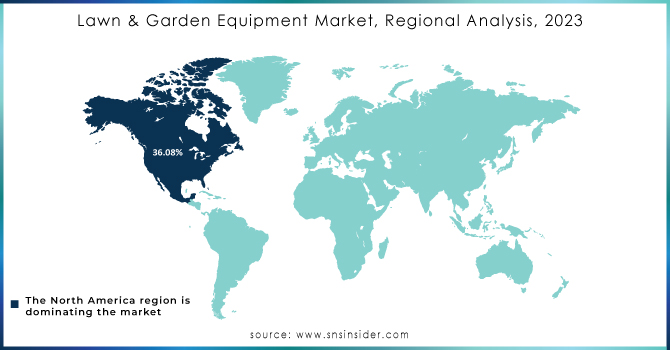

Lawn & Garden Equipment Market Regional Analysis:

North America is dominating the market with a share of around 36.08% in 2023, attributable to the rising disposable income of consumers and improved standard of living. The market of this region is expanding due to the increasing automation and accessibility of raw materials. Due to high durability and high availability of the materials including aluminum, steel, and iron are now widely used in the production of lawn and garden equipment.

Key Players in the Lawn & Garden Equipment Market are:

The major key players are Ariens Company, American Honda Motor Co. Inc., Briggs Stratton, Deere & Company, Falcon Garden Tools, Fiskars, Husqvarna Group, Robert Bosch GmbH, Robomow Friendly House, The Toro Company and others

Recent Development

In October 2023: Honda debuts its first-ever electric autonomous zero-turn riding lawn Rider called the Honda Autonomous Work Rider (AWM).

In June 2023: John Deere announces a new partnership with EGO enabling John Deere to sell EGO-branded battery products through John Deere dealers.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 27.90 Billion |

| Market Size by 2031 | US$ 54.39 Billion |

| CAGR | CAGR of 7.7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Lawn Rider, Lawn ZTR, Walk Behind, Snow Throwers, Trimmers And Edgers) • By End Use (Residential, Playgrounds, Golf Course) • By Power (Manual, Electric, Gas) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Ariens Company, American Honda Motor Co. Inc., Briggs Stratton, Deere & Company, Falcon Garden Tools, Fiskars, Husqvarna Group, Robert Bosch GmbH, Robomow Friendly House, The Toro Company |

| Key Drivers | • Rising interest in landscaping and gardening, especially in North America and Europe, is boosting demand for lawn and garden equipment. • Technological innovations in robotic mowers, battery tools, and smart irrigation systems are boosting lawn maintenance efficiency and attracting eco-conscious consumers. |

| Restraints | • The high upfront cost of advanced lawn and garden equipment, like robotic mowers and smart irrigation systems, deters price-sensitive consumers, limiting market adoption despite long-term benefits |