Forklift Truck Market Report Size:

Get More Information on Forklift Truck Market - Request Sample Report

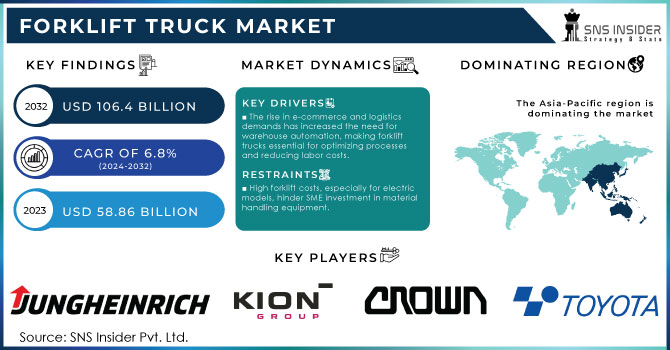

The Forklift Truck Market Size was valued at USD 58.86 Billion in 2023 and is now anticipated to grow to USD 106.4 Billion by 2032, displaying a compound annual growth rate (CAGR) of 6.8% during the forecast Period 2024-2032.

The forklift truck market is experiencing significant growth driven by several interrelated factors. A major contributor is the expansion of warehouses and logistics services, particularly spurred by the rising e-commerce sector. As online shopping continues to flourish, the demand for fast and efficient material handling within warehouses has surged, enhancing the role of forklift trucks in optimizing supply chain operations. Additionally, various industries, including manufacturing, food and beverage, and construction, rely heavily on forklift trucks for lifting and transporting heavy materials, underscoring their essential role in operations of all sizes.

Another notable trend is the increasing adoption of automation in forklifts. This shift not only reduces the risk of accidents and fatalities but also enhances operational efficiency. According to the Occupational Safety and Health Administration (OSHA), forklift-related incidents lead to approximately 85 deaths and 34,900 serious injuries annually. This alarming statistic emphasizes the urgent need for integrating automation to improve safety, streamline operations, and enable better data-driven decision-making within the workforce. Furthermore, the forklift truck market is characterized by its flexibility and cost-effectiveness, offering a wide range of applications tailored to diverse industries. This adaptability is crucial as businesses seek to optimize their operations and reduce overhead costs. The combination of these factors warehouse expansion, rising e-commerce, automation adoption, and the inherent flexibility of forklift trucks position the market for sustained growth. As companies continue to invest in advanced material handling solutions to meet evolving operational demands, the forklift truck market is expected to thrive, contributing significantly to enhanced productivity and safety across various sectors.

MARKET DYNAMICS

DRIVERS

- The surge in e-commerce and the need for efficient logistics have escalated the demand for warehouse automation, making forklift trucks crucial for optimizing storage and retrieval processes while lowering labor costs.

The increasing demand for warehouse automation is primarily fueled by the rapid growth of e-commerce and the necessity for efficient logistics solutions to meet consumer expectations. As online shopping continues to rise, businesses are under pressure to streamline their operations and ensure faster delivery times. In this context, automated warehouses equipped with advanced technologies, including forklift trucks, have become crucial for maintaining competitive advantage. Forklift trucks play an essential role in automating the storage and retrieval processes, allowing for the efficient movement of goods within warehouses. These vehicles help optimize space utilization by enabling high-density storage systems and minimizing the time taken to retrieve items. Consequently, operational efficiency is significantly enhanced, leading to quicker order fulfilment and reduced lead times.

Moreover, the automation of warehousing processes contributes to substantial labor cost savings, as fewer personnel are needed to manage manual handling tasks. This is particularly important in an era where labor shortages are common in logistics and warehousing sectors. Automated forklifts equipped with advanced features, such as sensors and navigation systems, can operate with minimal human intervention, further reducing the risk of accidents and increasing safety in the workplace. Additionally, as businesses seek to scale their operations to accommodate growing inventory levels, the integration of automated solutions, including forklifts, becomes indispensable. Overall, the demand for warehouse automation, driven by the e-commerce boom and the need for efficient logistics, is propelling the forklift truck market into a period of significant growth and transformation.

- Technological advancements in forklift trucks, including automation, telematics, and enhanced safety features, significantly boost efficiency and safety, reducing workplace accidents and increasing their attractiveness to businesses.

Technological advancements in forklift technology are revolutionizing the material handling industry by enhancing the functionality, safety, and efficiency of forklift trucks. Automation is a significant innovation, allowing forklifts to perform tasks with minimal human intervention. Automated guided vehicles (AGVs) and autonomous mobile robots (AMRs) can navigate warehouses and distribution centers, improving inventory management and reducing labor costs. This shift not only increases operational efficiency but also frees up human resources for more complex tasks.

Telematics is another critical advancement, enabling real-time monitoring of forklift performance and usage. This technology collects data on various metrics, such as operating hours, maintenance needs, and fuel consumption. Businesses can leverage this information to optimize fleet management, schedule maintenance proactively, and reduce downtime, ultimately leading to cost savings and enhanced productivity. Moreover, advanced safety features, such as collision avoidance systems, improved visibility, and stability controls, significantly reduce the risk of workplace accidents. By minimizing hazards, these innovations contribute to safer working environments, which is a priority for many organizations. With safety regulations becoming increasingly stringent, forklifts equipped with the latest safety technologies are more appealing to businesses looking to comply with regulations and enhance worker safety.

RESTRAIN

- The high purchase cost of forklift trucks, especially electric models, poses a significant financial barrier for small and medium-sized enterprises (SMEs), restricting their investment in essential material handling equipment.

The high initial investment required for purchasing forklift trucks, especially electric models, represents a substantial financial barrier for small and medium-sized enterprises (SMEs), potentially restricting their access to essential material handling equipment necessary for efficient operations. This cost challenge is particularly acute in a landscape where SMEs often operate with tighter budgets and limited capital.

While electric forklifts offer long-term savings through lower operating and maintenance costs, the upfront costs can be daunting. For many SMEs, allocating a significant portion of their budget to a single piece of equipment may detract from other critical investments, such as inventory, technology upgrades, or workforce training. Furthermore, the rapid pace of technological advancements in the forklift industry means that companies may hesitate to invest in new models for fear of them becoming outdated quickly. Additionally, the financial burden is compounded by the need for specialized operator training and ongoing maintenance, which adds to the overall expenditure. The reluctance to incur such high initial costs can lead SMEs to rely on older, less efficient equipment, which may not only increase their operational inefficiencies but also impact safety and productivity in the long run. Consequently, many SMEs may find themselves at a competitive disadvantage, unable to leverage the latest advancements in material handling technology that could streamline operations, reduce costs, and improve service delivery. Addressing this financial constraint through financing options, leasing agreements, or government incentives could help empower SMEs to invest in modern forklift solutions, ultimately enhancing their operational capabilities and market competitiveness.

KEY SEGMENTATION ANALYSIS

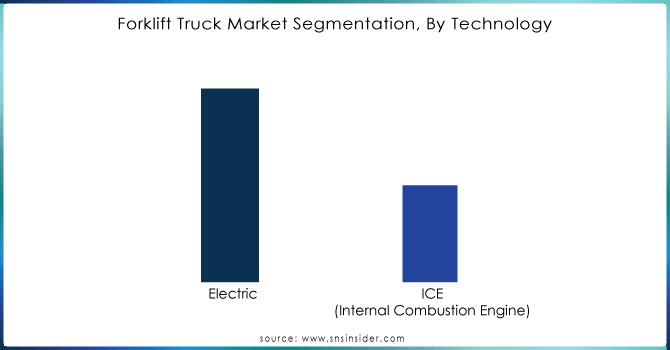

By Technology

The Electric is dominated the market with a share of around 67.12% in 2023. They are eco-friendly alternatives compared to ICE. Battery technology is evolving continuously with higher safety of lithium-ion batteries than lead-acid batteries are making Li-ion batteries popular in electric forklifts. Moreover, electric vehicles require lower maintenance than ICE. Countries around the world started to discontinue the sale of ICE forklifts seeking in mind over environmental sustainability.

Need any customization research on Keyword Market - Enquiry Now

By Capacity

The above 5 tons capacity is dominated the market with a share of around 63.06% in 2023. The increasing demand for material handling & heavy lifting in industries like such as manufacturing, logistics & construction is the reason for the dominance. With the expansion of businesses & growing trade, the need for a heavy lifting forklift is a must. Moreover, increasing automation in warehouses is creating demand for high-capacity forklifts.

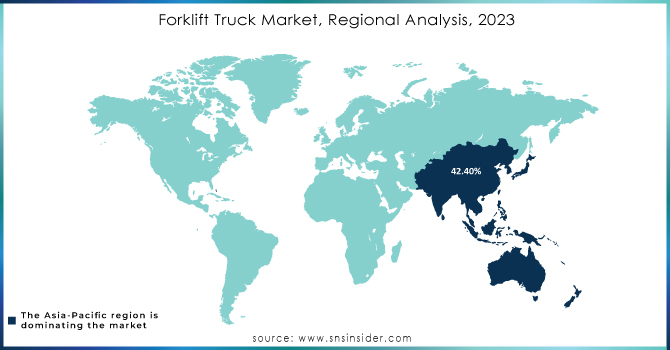

REGIONAL ANALYSIS

The Asia-Pacific region dominated the Forklift Truck Market, holding market share approximately 42.4% in 2023, driven by several key factors. The rapid adoption of automation in manufacturing and warehousing enhances operational efficiency and optimizes supply chain processes, with countries like China, Japan, and South Korea leading in implementing advanced solutions. Additionally, the surge in e-commerce activities compels warehouses to improve material handling efficiency, thereby increasing the demand for sophisticated forklifts. Rising industrial activity, particularly in sectors such as automotive, metal, and machinery manufacturing, further fuels this demand as new establishments require reliable material handling solutions.

KEY PLAYERS

Some of the major key players of Forklift Truck Market

- Toyota Industries Corporation: (Toyota 8FG Series)

- Crown Equipment Corporation: (Crown FC Series)

- Kion Group AG: (Linde H80-H150)

- Hyster-Yale Materials Handling Inc.: (Hyster H50FT)

- Hyundai Heavy Industries: (Hyundai 25B-9)

- Mitsubishi Nichiyu Forklift Co., Ltd: (Mitsubishi FBC20-25N)

- Jungheinrich AG: (Jungheinrich EFG 430)

- Doosan Industrial Vehicle: (Doosan D25S-7)

- Hangcha Group: (Hangcha CPD30)

- Komatsu Ltd.: (Komatsu FG25T-16)

- Godrej & Boyce Manufacturing: (Godrej GBL 70)

- Clark Material Handling Company: (Clark C40-60 Series)

- Yale Materials Handling Corporation: (Yale GP050-070VX)

- Linde Material Handling: (Linde E35-E50)

- Nissan Forklift Corporation: (Nissan G25)

- Baoli Forklift: (Baoli KBG 20)

- Linde AG: (Linde R14 - R20)

- Manitou Group: (Manitou M Series)

- TCM Corporation: (TCM FHG Series)

- Caterpillar Inc.: (Cat GC Series)

RECENT DEVELOPMENTS

In May 2023: Toyota launched a new electric forklift designed for versatile outdoor use in diverse terrains. Ranging from 3,000 to 7,000 lb., these models prioritize safety with advanced stability systems, embodying Toyota's commitment to continuous improvement.

In February 2023: Doosan launched two new ranges of high-capacity electric counterbalance forklift trucks within the NXE Series, providing industrial users with a wide range including low-noise level, zero-emission, and environmentally friendly. The trucks are capable of tackling heavy-duty task.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 58.86 Billion |

| Market Size by 2032 | USD 106.4 Billion |

| CAGR | CAGR of 6.8%% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Electric, ICE) • By Capacity (Below 5 tons, above 5 tons) • By Application (Manufacturing. Logistic, Retail & Wholesale, Others) • By Product (Warehouse, Counterbalance) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Toyota Industries Corporation, Crown Equipment Corporation, Kion Group AG, Hyster-Yale Materials Handling Inc., Hyundai Heavy Industries, Mitsubishi Nichiyu Forklift Co., Ltd, Jungheinrich AG, Doosan Industrial Vehicle, Hangcha Group, Komatsu Ltd., Godrej & Boyce Manufacturing, Clark Material Handling Company, Yale Materials Handling Corporation , Linde Material Handling, Nissan Forklift Corporation, Baoli Forklift, Linde AG, Manitou Group, TCM Corporation,Caterpillar Inc |

| Key Drivers | • The surge in e-commerce and the need for efficient logistics have escalated the demand for warehouse automation, making forklift trucks crucial for optimizing storage and retrieval processes while lowering labor costs. •Technological advancements in forklift trucks, including automation, telematics, and enhanced safety features, significantly boost efficiency and safety, reducing workplace accidents and increasing their attractiveness to businesses. |

| RESTRAINTS | • The high purchase cost of forklift trucks, especially electric models, poses a significant financial barrier for small and medium-sized enterprises (SMEs), restricting their investment in essential material handling equipment. |