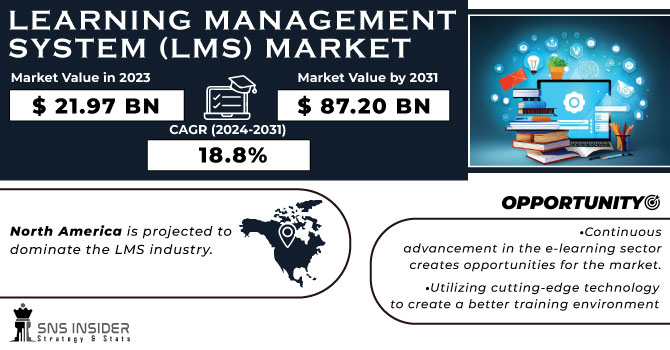

Learning Management System (LMS) Market Size Analysis:

The Learning Management System (LMS) Market Size was valued at USD 20.9 Billion in 2023 and is expected to reach USD 95.4 Billion by 2032, growing at a CAGR of 18.4% over the forecast period 2024-2032. The Learning Management System (LMS) market is rapidly evolving, with the growing need for digital education solutions and technological advancement driving growth across the globe. The outbreak of the COVID-19 pandemic across the globe has made it very essential for every government to include digital learning platforms in order to move towards an accessible mode of education. In the recent report of the U.S Department of Education, states that approximately 70% of public schools in the U.S. have incorporated some type of online or blended learning into their course curriculum this development greatly impacted the LMS market. Furthermore, both initiatives such as the "Digital India" campaign in India and others by other nations have also significantly accelerated the penetration of digital learning tools and platforms, thus driving even more demand for these LMS solutions.

Get more information on Learning Management System Market - Request Free Sample Report

Governments are also investing heavily in upskilling and reskilling programs, which further contribute to the growth of the LMS market. This, in turn, influences the expansion of the LMS market as the U.S. government recently announced a USD 3.5 billion investment in 2023 for workforce development and digital skills training. The increasing reliance on online education combined with digitization pressure within the education ecosystem is driving the adoption of Learning Management Systems (LMS) by educational institutes to facilitate better learning outcomes, enhance monitoring, and provide greater flexibility. In addition, the COVID-19 pandemic increased the transition to remote learning by commanding organizations and educational bodies to adopt LMS platforms on an accelerated basis. LMS global market is anticipated to experience consistent growth as ongoing investments from public & private sector educational technologies are still the key cause in gaining a sustainable position amongst worldwide nations with an enhanced focus on fathoming the need for availability & standards of education.

Market Dynamics

Drivers

-

The growing adoption of e-learning tools across various sectors is driving the demand for LMS. With organizations emphasizing employee training and development, LMS platforms are crucial for enhancing productivity through digital learning solutions.

-

The increasing shift to cloud-based LMS solutions is fueling market growth. Cloud platforms offer flexibility, scalability, and cost-effectiveness, making them more appealing to organizations looking for efficient learning solutions.

The growth of the Learning Management System (LMS) market is largely driven by the rise of e-learning. With the growing focus on digital solutions by businesses, educational institutions, and governments LMS has become a crucial tool for online education and training. Online learning refers to a flexible method of studying that is gaining popularity due in large part to the COVID-19 pandemic which has forced many institutions out of imparting lessons face-to-face and into virtual classrooms.

According to a report by the International Association for K-12 Online Learning (iNACOL), more than 90% of higher education institutions globally are now using some form of online learning. This shift has mainly been attributed to the fact that LMS platforms give learners flexibility and accessibility to access your content, anytime anywhere. Also, Fortune 500 companies are using LMS to train employees in an efficient and scalable way. Accenture, a global consulting organisation is an example of this: it has implemented cloud LMS to provide employees continuous learning programmes to its 500,000 human resources functioning within 120 countries. In the education space, Moodle and Canvas have emerged as staples for blended learning capabilities that mesh face-to-face teaching with online units. This increasing uptake of LMS in improving workforce productivity and student engagement is anticipated to continue fueling the market growth.

Restraints:

-

Many educators and trainers are still accustomed to traditional teaching methods, and there is a significant need for technical training to adapt to LMS platforms effectively

-

With the rise of cloud-based systems, concerns over data privacy and security are restraining the full-scale adoption of LMS solutions. Organizations are cautious about protecting sensitive learner data from cyber threats

A major constraint for the Learning Management System (LMS) market is technical skill shortages among teachers. Even though more and more institutions are embracing LMS platforms, many educators continue to teach the same way they have always taught and do not have the level of technical skill needed to build effective online or digital courses. This gap in skills can create challenges in course creation, assessment administration, and overall engagement in the digital classroom. Consequently, the phenomenon of resistance to full use of such systems may be seen in educational and corporate organizations which may cause inefficiencies and under-utilization of the features provided by LMS. This barrier can be overcome by training and upskilling instructors on using the LMS platform effectively, but such programs require much effort and time which many organizations may perceive as a challenge. Such a challenge may slow down the adoption of LMS in some places and impact the effectiveness across regions with low digital literacy.

Segment Analysis

By Component

In 2023, the solution segment held about 66% of the global revenue share of the Learning Management System (LMS) market. This is mostly because of their increasing demand for an LMS as a whole type of software that delivers one or more features related to content management, learning administration, assessments, and tracking. Thus, governments and educational institutions are investing in advanced LMS solutions that enable varied forms of learning synchronous to asynchronous and also technologies like artificial intelligence and machine learning for personalized learning experiences. As per U.S. Department of Education, over 50% of K-12 students in the U.S. adopted online learning in 2023 alone leading to a rapid increase in LMS usage. This software helps educational establishments efficiently and effectively administer courses, track the progress of learners, and enhance the learning experience. The corporate sector is also giving importance to LMS for conducting employee training programs and uplifting their workforce. Moreover, in 2023, employee training and onboarding would remain the largest stake in the LMS market due to increasing emphasis on building a skilled workforce through employee development programs and digital transformation across industries.

By Enterprise Size

In 2023, the large enterprises segment held the highest revenue share in the Learning Management System (LMS) market at around 70%. The main reason for this is to do with the large corporations spending a great amount of money on their employees' training and development programs. Scalability, flexibility, and customization are key for large enterprises that need to manage a high volume of users while tracking detailed insights on learner progress. Enterprises have also often a global workforce so they need an LMS that supports multi-language capabilities and can be connected with many different corporative systems. In addition, statistics from the U.S. Bureau of Labor Statistics indicate that more than 55% of U.S. companies with an employee strength of over 500 implemented formal training programs in the year 2023 further catalyzing the transition towards LMS solutions. With a changing job landscape, big organizations are trying to give their employees the proper guidance and upskill them this makes LMS platforms critical as they consistently provide automated training modules with minimal costs. As governments continue promoting skills development programs to their citizens as evidenced by the European Union's Digital Skills and Jobs Coalition, large enterprises are anticipated to drive market growth over the forecast period as they increasingly invest in advanced LMS solutions for up-skilling and re-skilling of its workforce.

By Deployment

The Learning Management System (LMS) Market was dominated by the cloud segment which held the largest revenue share 65% in 2023. Cloud-based LMS solutions are gaining more traction than on-premise solutions owing to their scalability, cost-effectiveness, and flexibility. Cloud deployment enables educational institutions and enterprises to access learning management tools from anywhere in the world, giving students and employees the opportunity to learn from their location. Recently, a report from the U.S. National Center for Education Statistics revealed that in 2023, more than 75% of all higher education institutions in the U.S. used cloud-based LMS solutions. This shows how even educational organizations are shifting towards using cloud technology to gain more benefits from it. In addition to these benefits, the SaaS model offers continuous software updates, data backup, and improved coordination with other cloud-based tools which are important for businesses looking to simplify learning management. Furthermore, the governments themselves have played a very important part in driving cloud technology by pushing cloud even deeper into public sector institutions. For example, in 2023, the General Services Administration (GSA) of the U.S. government issued guidelines to federal agencies on how migration to cloud-based systems could lead to more efficient and cost-effective operations, which is likely to further drive the growth of the cloud segment in the LMS market.

By End User

Based on End-User, the academic segment dominated the Learning Management System (LMS) market in 2023 with a revenue share of 38%, owing to the growing acceptance of digital learning platforms in schools, colleges and universities. LMS solutions serve the academic segment owing to higher demand for remote and hybrid learning environments due to lockdown scenarios following the COVID-19 crisis. Over 90% of tertiary institutions in North America and Europe had adopted LMS platforms in 2023 according to the UNESCO Institute for Statistics, while comparable trends are evident in other regions such as Asia-Pacific. Such platforms, enable institutions to offer flexible learning while also improving student engagement and administrative processes. Governments have also been heavily investing in the education sector, funding initiatives that promote digital learning and the use of LMS platforms.

On the other hand, the corporate segment is anticipated to grow at the highest CAGR during the forecast period. This is driven by growth in corporate training budgets and the need for enterprises to reskill. A report from the European Union stated that 72% of enterprises in Europe intended to deploy corporate LMS solutions by 2025, and anticipated significant growth in the LMS market within the corporate sector.

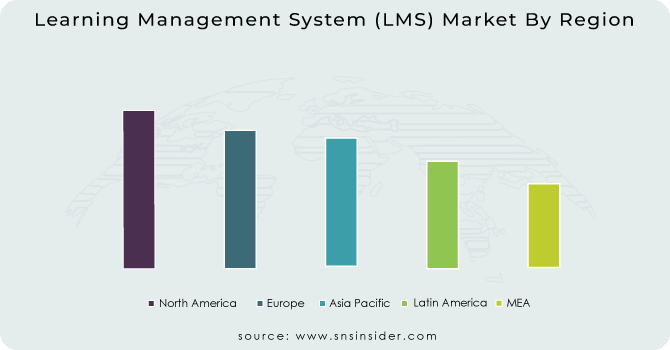

Regional Analysis

The global Learning Management System (LMS) market was led by North America with the largest revenue share of 36% in 2023 because e-learning technologies are adopted earliest in this region and contribute significantly towards implementation of LMS for both academic as well as corporate learning & Development (L&D). Many of the largest educational institutions and enterprises in North America rely on LMS solutions to help deliver schooling, as well as employee training for many organizations in both the U.S. and Canada. Additionally, government programs like the funding for online learning infrastructure and training initiatives provided by the U.S. Department of Education have certainly helped to increase LMS adoption. Moreover, the presence of prominent key LMS vendors contributes to North America being the leading region in the market.

On the contrary, Asia-Pacific is expected to maintain the highest growth rate throughout the forecast period owing to increasing investments in digital education technologies as well as government initiatives towards skill development. LMS adoption is also a priority for countries such, as India, China, and Japan; all focused on making upward mobility investments. The “Digital India” campaign in India has driven massive uptake of LMS from education institutes and government training programs. A report released by the Indian Ministry of Education reports that over 60% of universities in India had adopted LMS platforms by the end of 2023. The demand for LMS solutions is set to increase rapidly over the next few years as governments throughout the region accelerate digital learning strategies and workforce development initiatives.

Need any customization research on Learning Management System Market - Enquiry Now

Key Players

Key Service Providers/Manufacturers in the Learning Management System (LMS) Market:

-

Blackboard Inc. (Blackboard Learn, Blackboard Collaborate)

-

Cornerstone OnDemand, Inc. (Cornerstone Learning, Cornerstone Performance)

-

SAP SE (SAP SuccessFactors Learning, SAP Litmos)

-

Instructure, Inc. (Canvas, Bridge)

-

Adobe Inc. (Adobe Captivate, Adobe Captivate Prime)

-

Docebo Inc. (Docebo Learn, Docebo Shape)

-

D2L Corporation (Brightspace, Degree Compass)

-

IBM Corporation (IBM Talent Management, IBM Skills Gateway)

-

Oracle Corporation (Oracle Learning Cloud, Taleo Learn)

-

Moodle Pty Ltd (Moodle LMS, Moodle Workplace)

Key Users of LMS Products/Services:

-

University of Phoenix

-

Amazon

-

Deloitte

-

Walmart

-

Accenture

-

Google

-

University of California

-

General Electric

-

PwC (PricewaterhouseCoopers)

-

Coca-Cola

Recent Developments

-

Cornerstone announced in April 2023 that it would be making Opportunity Marketplace, its offering promoting career development and talent exchange, generally available as part of its Talent Experience Platform. Aims to drive employee engagement, retention, agile work and internal mobilization by merging AI with human-centered design.

-

In February 2023, GSoft acquired corporate LMS provider Didacte to strengthen its existing portfolio of employee experience solutions and further address customer experience.

| Report Attributes | Details |

| Market Size in 2023 | USD 20.9 Billion |

| Market Size by 2032 | USD 95.4 Billion |

| CAGR | CAGR of 18.4% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Solution, Services) • By Enterprise Size (Small & Medium Enterprises, Large Enterprises) • By Deployment (Cloud, On-premise) • By Delivery Mode (Distance learning, Instructor-led training, Blended learning) • By End-user (Academic, Corporate) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles |

Blackboard Inc., Cornerstone OnDemand Inc., SAP SE, Instructure Inc., Adobe Inc., Docebo Inc., D2L Corporation, IBM Corporation, Oracle Corporation, Moodle Pty Ltd. |

| Key Drivers | •The growing adoption of e-learning tools across various sectors is driving the demand for LMS. With organizations emphasizing employee training and development, LMS platforms are crucial for enhancing productivity through digital learning solutions •The increasing shift to cloud-based LMS solutions is fueling market growth. Cloud platforms offer flexibility, scalability, and cost-effectiveness, making them more appealing to organizations looking for efficient learning solutions |

| Market Restraints | •Many educators and trainers are still accustomed to traditional teaching methods, and there is a significant need for technical training to adapt to LMS platforms effectively •With the rise of cloud-based systems, concerns over data privacy and security are restraining the full-scale adoption of LMS solutions. Organizations are cautious about protecting sensitive learner data from cyber threats |